Latest advisory

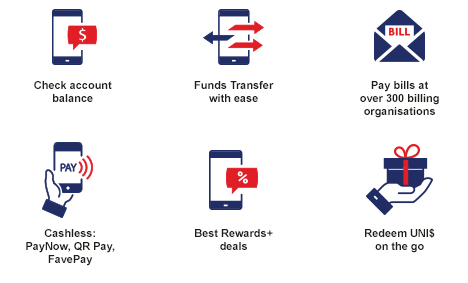

- As we stay home and stay safe, we encourage you to use our digital banking services such as UOB TMRW and Personal Internet Banking or our phone and self-service banking services wherever possible.

- Keep safe against cybercrimes. Online and phone scams are on the rise. Never disclose your Personal Internet Banking username, password, One-Time Password (OTP), banking account or credit/debit card details to anyone. More on staying safe online.