Accelerate your rewards as you save

Earn up to 25X UNI$ (10 miles per S$1) when you pair your UOB Lady’s Savings Account with UOB Lady’s Credit Card.

Flexibility to choose your preferred rewards categories

• Choose the rewards category(ies) that earns you the most – Fashion, Dining, Travel, Beauty and Wellness, Family, Transport or Entertainment. And feel free to change it every quarter, as your lifestyle and interests evolve – because it’s time to live the life you want.

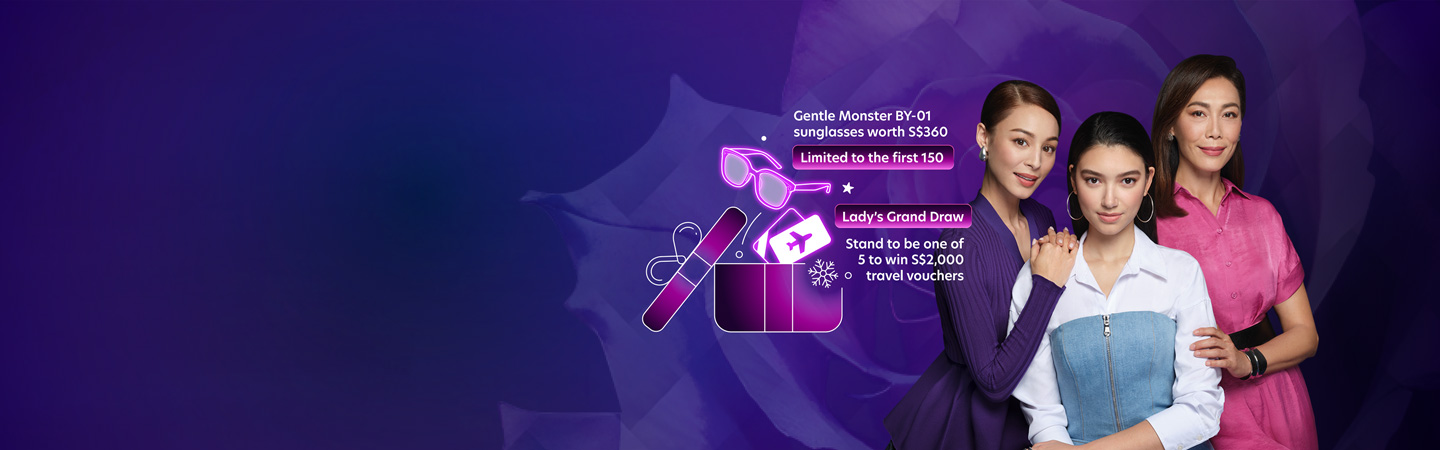

UOB Lady’s Savings Year End Festive Promotion

This holiday season, we celebrate you! Here’s to always lifting those around you, providing for the ones you love while continuing to live your life with passion.

Be amongst the first 150 customers to receive a pair of Gentle Monster sunglasses when you save with UOB Lady’s Savings Account. Plus, stand to be one of 5 lucky winners to walk away with S$2,000 worth of travel vouchers in the Lady’s Grand Draw!

Here’s how:

Step 1: Register your participation here.

Step 2: Deposit S$50,000 in new funds to your UOB Lady’s Savings Account and hold the funds for approximately 4 months.![]()

Promotion ends 31 December 2025. Subject to qualifying criteria. Subject to qualifying criteria. T&Cs apply.![]()

The UOB Lady’s Unstoppable Pairing that gives you up to 25X UNI$ is here to stay!

Spend on UOB Lady’s Credit Card

Earn 10X UNI$ for every S$5 spent

(equivalent to 4 miles per S$1) on your preferred rewards category(ies)

+

Save with UOB Lady’s Savings Account

Earn up to additional 15X Lady’s Savings Bonus UNI$ for every S$5 spent

(equivalent to 6 miles per S$1) on your preferred rewards category(ies)

How your UNI$ adds up with UOB Lady's Savings Account and UOB Lady's Credit Card

The total Bonus UNI$ earned is based on your UOB Lady’s Savings Account Monthly Average Balance (MAB)  in each calendar month. The more you save, the more UNI$ earned!

in each calendar month. The more you save, the more UNI$ earned!

| When you spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card with no min. spend | When you save with Lady’s Savings Account and spend on your Preferred Rewards Category(ies) with your Lady’s Credit Card | Total UNI$ earned for every S$5 spend in a calendar month | |

| Lady’s Savings Account Monthly Average Balance (MAB) | Lady’s Savings Bonus UNI$ earned [for every S$5 spend] |

||

| Base + Bonus UNI$: 10X For every S$5 spend |

< S$10,000 | - | 10X UNI$ (4 miles per S$1) |

| S$10,000 to S$49,999 | 5X UNI$ | 15X UNI$ (6 miles per S$1) |

|

| S$50,000 to S$99,999 | 10X UNI$ | 20X UNI$ (8 miles per S$1) |

|

| S$100,000 & above | 15X UNI$ | 25X UNI$ (10 miIes per S$1) |

|

Illustration:

Jasmine maintains S$50,000 MAB in her UOB Lady's Savings Account and spends S$800 on her preferred rewards category with her UOB Lady’s World Credit Card in a calendar month.

She'll be able to accumulate 3,200 UNI$![]() in a month. Here’s the breakdown:

in a month. Here’s the breakdown:

Base UNI$: S$800 / every S$5 spent X 1X UNI$ = 160 UNI$

Bonus UNI$: S$800 / every S$5 spent X 9X UNI$ = 1,440 UNI$

Lady’s Savings Bonus UNI$: S$800 / every S$5 spent X 10X UNI$ = 1,600 UNI$

If she maintains the MAB and spending for 12 months, she’ll be able to earn 38,400 UNI$ in a year!

She can choose to convert the UNI$ into 76,800 KrisFlyer miles![]() .

.

With this, she could redeem a round-trip business class ticket to Hong Kong![]() within a year!

within a year!

Alternatively, she can also choose to redeem her UNI$ for rewards across the wide selection of dine, shop and travel merchants on Rewards+.

Important Notice:

Starting 1 August 2025, the maximum Bonus UNI$ you can earn each calendar month with your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card) will be revised to:

New monthly cap: 2,700 UNI$ (equivalent to S$1,500 spending)

Previously: 3,600 UNI$ which is equivalent to S$2,000 spending

New rewards category cap: 1,350 UNI$ per category (equivalent to S$750 spending)

The Bonus UNI$ earned on the UOB Lady’s Account will also be capped based on S$1,500 in spending (previously S$2,000) and capped at S$750 spend per rewards category when you save with the UOB Lady’s Savings Account and spend on your UOB Lady’s Solitaire Card (excluding UOB Lady’s Solitaire Metal Card).

Refer to the UOB Lady’s Card Terms and Conditions and the UOB Lady’s Savings Account Reward Program Terms and Conditions for more details.

Subject to qualifying criteria. T&Cs apply.

Lady’s Card and Lady’s Savings Account Calculator

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards category | 1,800 |

| Lady's Card Base 1X UNI$ on all purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards category | 1,000 |

| Total UNI$ earned monthly | 3,040 |

Details

| Lady’s Card Bonus 9X UNI$ on preferred rewards category 1 | 1,800 |

| Lady’s Card Bonus 9X UNI$ on preferred rewards category 2 | 1,800 |

| Lady's Card Base 1X UNI$ on all purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards categories | 1,000 |

| Total UNI$ earned monthly | 3,040 |

Details

| Lady's Card Bonus 9X UNI$ on preferred rewards categories | 1,800 |

| Lady's Card Base 1X UNI$ on all purchases | 240 |

| Lady's Savings Bonus up to 15X UNI$ on preferred rewards categories | 1,000 |

| Total UNI$ earned monthly | 3,040 |

Pair your UOB Lady’s Savings Account with the UOB Lady's Card

UOB Lady’s Savings Account with UOB Lady’s Card

Up to 25X UNI$ for every S$5 spent (10 miles per S$1) on your preferred rewards category

- 10X UNI$ per S$5 spent (4 miles per S$1) with no min. spend on your UOB Lady’s Credit Card

- Up to additional 15X UNI$ per S$5 spent (6 miles per S$1) when you save with UOB Lady’s Savings Account

- Choose from Travel, Dining, Fashion, Beauty & Wellness, Family, Entertainment and Transport

- UNI$1 per S$5 spent (0.4 miles per S$1) on other purchases

- 0% LuxePay

Interest Free Payment Plan over 6 or 12 months - e-Commerce Protection on online purchases

T&Cs apply.

UOB Lady’s Savings Account with UOB Lady's Solitaire Card

Up to 25X UNI$ for every S$5 spent (10 miles per S$1) on two of your preferred rewards categories

- 10X UNI$ per S$5 spent (4 miles per S$1) with no min. spend on your UOB Lady’s Credit Card

- Up to additional 15X UNI$ per S$5 spent (6 miles per S$1) when you save with UOB Lady’s Savings Account

- Choose from Travel, Dining, Fashion, Beauty & Wellness, Family, Entertainment and Transport

- UNI$1 per S$5 spent (0.4 miles per S$1) on other purchases

- 0% LuxePay

Interest Free Payment Plan over 6 or 12 months - e-Commerce Protection on online purchases

For existing UOB Cardmembers, kindly ensure that your annual income as per the bank’s record has been updated to S$120k p.a. and above before proceeding with your application. If you have not done so, please click here to update your income.

Promotion

UOB Season of Gold Savings Promotion

The season of gold is here!

Get up to S$600 cash![]() when you save with UOB. Plus, stand a chance to win a 20-gram 999.9 gold bar (PAMP® Rosa Gold Minted Bar) in our festive lucky draw! The more you save, the more chances you earn to win.

when you save with UOB. Plus, stand a chance to win a 20-gram 999.9 gold bar (PAMP® Rosa Gold Minted Bar) in our festive lucky draw! The more you save, the more chances you earn to win.

Here’s how to participate and earn up to S$340![]() in cash:

in cash:

Step 1: Register your participation here or via Rewards+ on UOB TMRW by 31 December 2025.

Step 2: Deposit a minimum of S$20,000 in new funds![]() into your UOB One Account, UOB Stash Account, UOB Lady’s Savings Account, UOB Uniplus Account or UOB Passbook Savings account. The new funds deposited cannot be withdrawn for approx. 7 months.

into your UOB One Account, UOB Stash Account, UOB Lady’s Savings Account, UOB Uniplus Account or UOB Passbook Savings account. The new funds deposited cannot be withdrawn for approx. 7 months.

That’s it! If you are eligible for the cash credit, you will also be auto-enrolled into a lucky draw where you could be one of 12 lucky winners to walk away with a 20-gram 999.9 gold bar (PAMP® Rosa Gold Minted Bar)!

Don’t have a UOB savings account? Apply online now and receive up to an additional S$260 bonus cash reward.

Promotion ends 31 Dec 2025.

T&Cs apply.

Activate Money Lock to protect your savings from digital scams

Scammers are becoming increasingly sophisticated, which is why it’s more important than ever to safeguard your money. By enhancing anti-scam measures that give you peace of mind, we continue our fight against digital scams with diligence and innovation.

Set a Money Lock amount in your existing UOB accounts to prevent unauthorised withdrawals. Rest assured, your money continues to earn the same interest and/or rewards. Simply use the UOB TMRW app, UOB Personal Internet Banking or visit any UOB ATM in Singapore to lock any amount, anytime. You can unlock your funds at any UOB ATM in Singapore.

Requirements and fees

Account eligibility

Age

16 years old and aboveEarly Account Closure Fee

S$30Within 6 months from opening

Fall-below Fee

S$2 if average balance for the month is below S$1,000Waived for first 6 months for accounts opened online

Min. Initial Deposit

S$1,000Statement Type

eStatementLearn more about account fees and charges.

UOB Lady’s Card eligibility and fees

Eligibility

Age: 21 years and above

Singaporean/PR:

- Minimum annual income of S$30,000 OR

- Fixed Deposit collateral of at least S$10,000#

For Foreigners:

- Minimum annual income of S$40,000 OR

- Fixed Deposit collateral of at least S$10,000#

Documents required: Click here

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$196.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first card

- S$98.10^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a UOB Lady's Card, your existing Lady's Solitaire Card, if any, will be automatically downgraded upon approval of your application. T&Cs apply.

UOB Lady’s Solitaire Card eligibility and fees

Eligibility:

Age: 21 years and aboveSingaporean/PR/Foreigners:

- Minimum annual income of S$120,000 is required OR

- Fixed Deposit collateral of at least S$30,000#.

Documents required: Click here.

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$414.20^ yearly

- First year card fee waiver

Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Card.

Supplementary card

- FREE for first 2 cards

- S$196.20^ for subsequent card

Terms and conditions:

^Inclusive of Singapore's prevailing Goods and Services Tax (GST).

#Terms and conditions apply. Please visit UOB Branches for more information on secured card applications. Supporting documents (NRIC or passport) will be required.

Note: By applying for a Lady's Solitaire Card, your existing UOB Lady's Card, if any, will be automatically upgraded upon approval of your application. T&Cs apply.

For existing UOB Cardmembers, kindly ensure that your annual income as per the bank’s record has been updated to S$120k p.a. and above before proceeding with your application. If you have not done so, please click here to update your income.

UOB Lady’s Debit Card eligibility and fees

Eligibility:

Age: 16 years and aboveSingaporean/PR/ Foreigners:

- Hold a UOB Savings or Current account

- No minimum income requirement

For existing UOB Lady's Debit Cardmembers, you can adjust your Debit Card Mastercard spending limit. If you wish to adjust, click here to find out more.

Annual fees:

-

With effect from 1 January 2024:

- Principal card: S$18.34* yearly

- First 3 years card fee waiver

-

Thereafter, annual fee waiver with at least 12 Mastercard transactions per calendar year.

- Annual Fee Waiver shall not apply to applicants who have cancelled and reapplied for the same principal UOB Lady's Debit Card.

*Inclusive of Singapore's prevailing Goods and Services Tax (GST).

Terms and conditions:

- View full UOB Lady's Debit Card Terms and conditions here.

Actions or Documents required

You can open a savings account online, get approval within minutes and start transacting instantly (where applicable).![]()

How to apply:

- Retrieve with Myinfo using Singpass login – applicable to new to UOB customers, existing to UOB customers and joint applicants

- Personal Internet Banking login details – applicable to existing to UOB customers

- Credit/Debit card number and PIN – applicable to existing to UOB customers applying for single-named account application

For Foreigners and U.S Persons

Please proceed to any UOB Branch for application. You will need to bring along original copies of:

- Your Physical Passport (Min 6 months validity is required)

- Proof of Residential Address (E.g. Utilities or Telecommunication bills)

- Employment Pass/S Pass/Dependent Pass

Please note that photocopied or digital copies of the above documents will not be accepted for processing.

Frequently asked questions (FAQs)

Refer to the detailed FAQs below to have your questions answered.

All promotions subject to qualifying criteria. Terms and conditions

- All promotions subject to qualifying criteria. Terms and Conditions Governing Accounts & Services

- All promotions subject to qualifying criteria. Terms and Conditions governing UOB Lady’s Savings Account Rewards Program

- All promotions subject to qualifying criteria. Terms and Conditions for the UOB Lady’s Cards

Make banking simpler with these services

Withdraw cash via your phone

With Contactless Cash Withdrawals, you can now travel light and withdraw cash with a quick tap on your phone.

Make payments simpler

Register for PayNow with your mobile number to send and receive money instantly. Use Scan to Pay at more than 25,000 merchant outlets, including hawkers and shops.

Maximise your rewards

Check your UNI$ balance on UOB TMRW app and redeem your favourite deals. You can use your UNI$ to offset bills and purchases instantly at key utility and e-commerce platforms such as Kris+, SP Utilities App and UOB Apple Rewards store.

Here’s something else you may like

UOB FX+ Debit Card

Now with no FX fees, it all adds up!

- No FX fees when you spend worldwide

- No mark-ups when you convert currencies

- Auto-convert currencies at your preferred rate

- S$5 cashback on overseas ATM withdrawals

T&Cs apply.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.