Complete your car loan application

Complete your Car Loan Application (Hirer)

Complete your Car Loan Application (Guarantor)

Promotions

Petrol privileges with UOB Cards

Enjoy petrol privileges with UOB Cards at Shell and SPC.

Pay your car instalments with ease

Plus, get a one-time S$30 cash![]() when you make loan repayments for your UOB car loan via GIRO from your UOB savings Account*. Subject to qualifying criteria. T&Cs apply.

when you make loan repayments for your UOB car loan via GIRO from your UOB savings Account*. Subject to qualifying criteria. T&Cs apply.

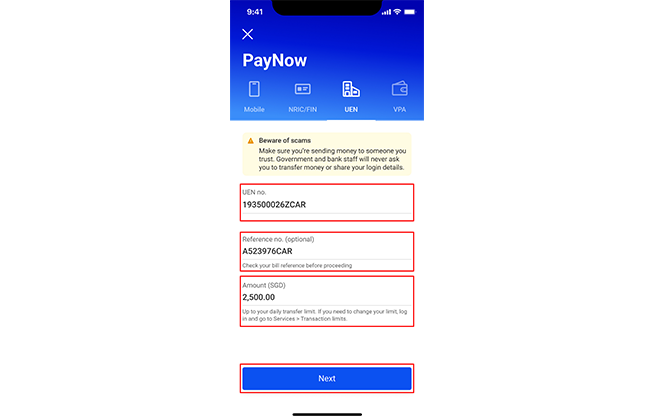

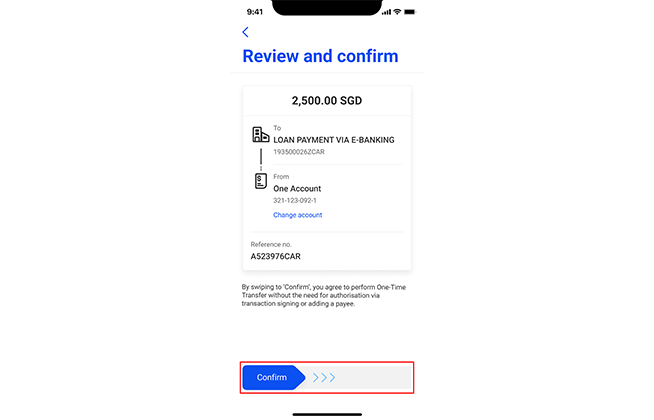

Here’s how:

1. You’ll need a UOB Savings Account

Don’t have a UOB Savings Account? Apply now and get up to S$68 cash for New-to-UOB Deposits customers

2. Register your participation here

3. Log in to UOB Personal Internet Banking and apply for GIRO Arrangement

* Insured up to S$100k by SDIC

Driver privileges

Petrol privileges with UOB Cards

Enjoy petrol privileges with UOB Cards at Shell and SPC.

CashCard for cash-free convenience

No more worrying if your Cashcard has enough stored value, or looking for a NETS Top Up Machine – just get a vCashCard!

Worry-free rides begin with InsureDrive

InsureDrive is a car insurance plan that gives you the flexibility to decide on the coverage you need as well as complimentary 24-hour emergency on-site assistance in the unfortunate event of an accident.

With you at every life moment

Getting Married

Marriage marks the start of a new adventure with your partner. It is never too early to start planning ahead for one of the most important milestones in your life.

Starting a Family

At UOB, we believe all children are smart. Start by building a plan now to nurture your child’s unique combination of smarts.