The Travel Insider

Southeast Asia's first one-stop travel portal designed for UOB Cardmembers. Inspire, plan, and book your next adventure with UOB Cards.

Find out moreFeatured

Apply for UOB One Account online and get up to S$260 cash

Skip to higher interest of up to 3.4% p.a. interest in just two steps. T&Cs apply. Insured up to S$100k by SDIC.

Find out moreCard Privileges

Cross over to your favorite deals in JB with UOB Cards

Tap your way to 0% FX fees, cashback on MYR spend and instant savings with UNI$ redemption.

Find out moreFeatured

Borrow services

Balance Transfer

Get instant cash at 0% interest and low processing fees. Choose from 3, 6 and 12-months tenor.

Find out moreFeatured Solutions

Your access to Private Bank CIO’s expertise

Invest in funds powered by Private Bank CIO – United CIO Income Fund and United CIO Growth Fund.

Learn more

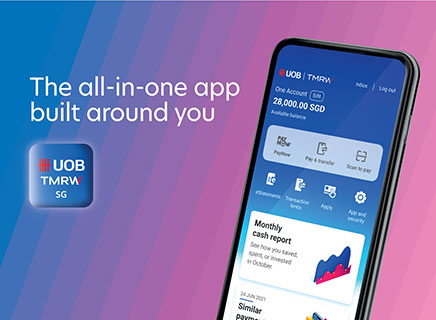

UOB TMRW

Meet UOB TMRW, the all-in-one banking app built around you and your needs.

Bank. Invest. Reward. Make TMRW yours.

-

you are in Personal Banking

For Individuals

Wealth BankingPrivilege BankingPrivilege ReservePrivate BankingFor Companies

GROUP WHOLESALE BANKINGForeign direct investmentUOB Asean insightsIndustry insightsSUSTAINABLE SOLUTIONSAbout UOB

UOB GroupBranches & ATMsSustainabilityTech Start-Up EcosystemUOB WorldUOB Subsidiaries

UOB asset managementUnited overseas InsuranceUOB travel plannersUOB Venture managementUOB Global capital - SUSTAINABILITY

- Financial Literacy

UOB Banker’s Guarantee

Learn more about Banker's Guarantees (BG), and the documents required to apply for a UOB Banker's Guarantee.

UOB Banker’s Guarantee

What is a Banker's Guarantee?

A Banker's Guarantee is a definite undertaking by a bank (as guarantor) to pay the beneficiary of the BG, a certain sum of money within a specified period, if the applicant of the BG (as principal) fails to fulfil his/her obligations under the underlying transaction of the BG (contractual or otherwise).

As issuing bank of the UOB Banker’s Guarantee, UOB undertakes to pay your beneficiary upon receipt of a demand from them which is compliant with the terms of the UOB Banker’s Guarantee.

How to apply?

You and the joint applicant (if any) will need to physically present all the required documents for a UOB Banker’s Guarantee application at any UOB branch.

List of Documents Required & Requirements

- A copy of your and the joint applicant’s (if any) NRIC

- A physical copy of the duly completed Banker’s Guarantee Application Form

- A copy of a banker’s guarantee format

- A Singapore Dollar Fixed Deposit of the same amount as the UOB Banker’s Guarantee applied for, to be placed with UOB Singapore for the required period with an auto-renewal maturity instruction.

- For details on the placement of a Fixed Deposit with UOB Singapore, please refer to Singapore Dollar Fixed Deposit

- The amount of the Banker’s Guarantee applied for, must be at least S$5,000.

- Approval of the issuance of the Banker’s Guarantee (including but not limited to the acceptability of the banker’s guarantee format submitted) will be subject to UOB’s discretion.

Rates & fees

Please refer to https://www.uob.com.sg/business/help-support/rates-fees/trade-finance-services.page for the fees & charges1 payable in relation to the Banker’s Guarantee.

1A minimum charge of S$150 applies. Other applicable charges may also apply.

We use cookies to improve and customise your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.