Save

Find an account that meets all your banking needs and goals. We believe saving should be simple and rewarding. Take a look at our range of award-winning accounts and you will find one that suits your saving goal.

What have you got in mind?

Compare accounts

Can’t decide which account to apply for? Here’s an easy way to find the one for you.

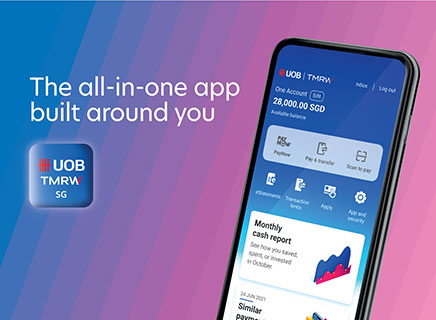

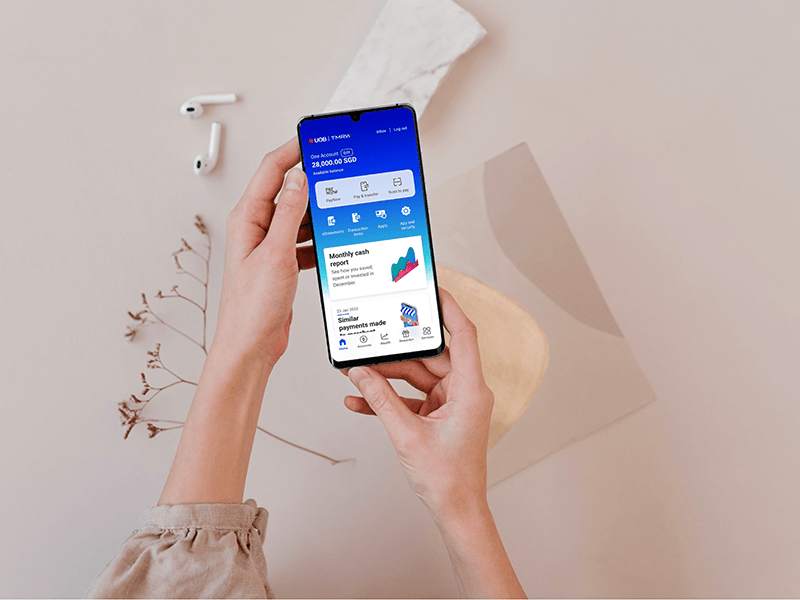

UOB TMRW

The all-in-one app for all your financial needs. It’s banking made simple, easy and personal for you

Personalised money insights – Bank smarter with personalised alerts, reminders, and spending and saving recommendations.

Withdraw cash using your phone to enjoy cardless withdrawals at selected UOB ATMs

Simple and effortless payments with FavePay QR, NETS QR, PayNow, Bill payments

Find personalised, exclusive UOB Cards deals on dining, shopping, travel and more, and track and use your cashback and reward points

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.