1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

An interest rate swap is a financial contract in which two parties agree to exchange floating rate payments for fixed rate payments (or vice versa) over the contracted period of time.

Key uses

Companies who borrow on a floating rate basis are exposed to interest rate risks. Using an Interest Rate Swap as an overlay, companies can synthetically transform their floating interest rate liability into a fixed interest rate liability. This allows companies to effectively hedge their interest rate risks.

Simple and cost-effective method to manage interest rate risks.

Stabilise cash flow for the contracted period of the swap.

Flexible terms that match your desired hedging requirements.

Ability to forward hedge an upcoming asset/liability.

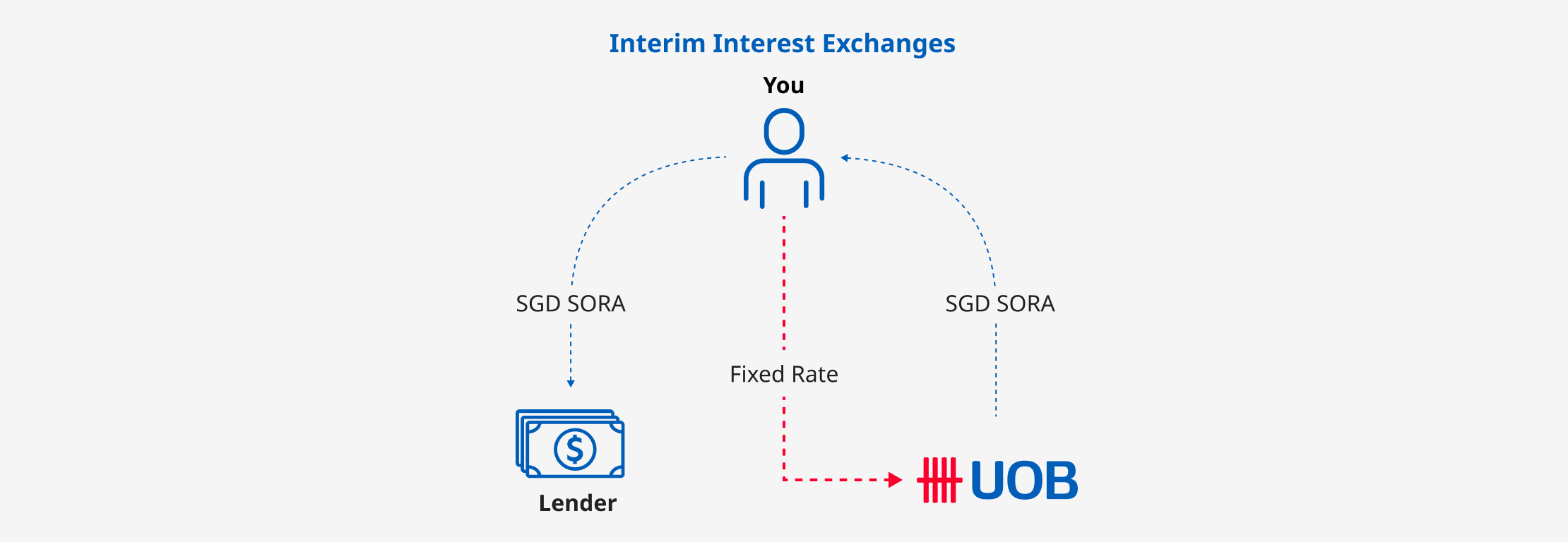

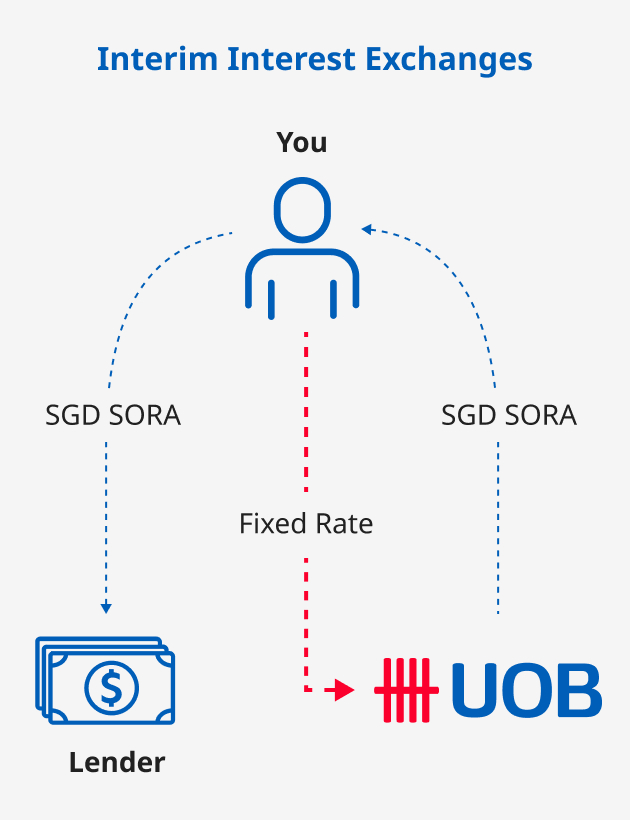

Your company has a loan of SGD 50 million on a floating interest rate (i.e. SGD SORA). To protect your loan against rising interest rates, your company would like to enter into an Interest Rate Swap to exchange its floating rate payments for fixed rate payments.

How it works: In this Interest Rate Swap, you will pay a fixed interest rate to UOB. At the same time, you will receive SGD SORA floating interest rate from UOB to service your loan's floating interest payments. This transforms your floating rate loan synthetically into a fixed rate loan.

Disclaimer: This is only an illustration, it does not constitute an offer or an invitation to offer or a solicitation or recommendation to enter into or conclude any transaction. Please contact UOB for more information.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.