About

By incentivising the achievement of corporate sustainability performance targets, sustainability-linked instruments facilitate and support environmentally and socially sustainable economic activities and growth.

Sustainability-linked loans are a key form of environmental, social, and governance (ESG) linked financing that reward companies for meeting specific sustainability performance targets. By integrating sustainability performance measurement into the loan structure, these loans encourage transparent tracking and reporting of ESG metrics. This form of financing supports sustainable growth by aligning financial incentives with improved ESG outcomes, helping businesses contribute meaningfully to sustainable economy.

What is Sustainability-linked Financing?

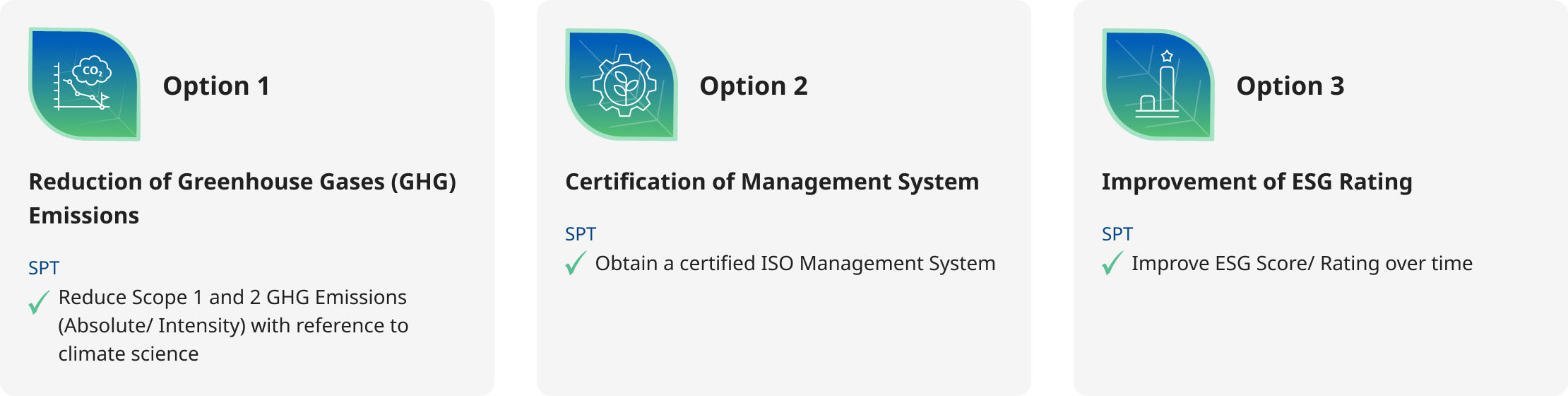

Sustainability linked financing ties interest margins to a borrower's achievement of ambitious sustainability performance targets (SPTs).

Note: These components are aligned with the principles established by the Asia Pacific Loan Market Association (APLMA), Loan Market Authority (LMA), Loan Syndications and Trading Association (LSTA) and the International Capital Market Association (ICMA). Borrowers are recommended to obtain a Second Party Opinion (SPO) to opine on the materiality and ambitiousness of the KPI-SPT(s).

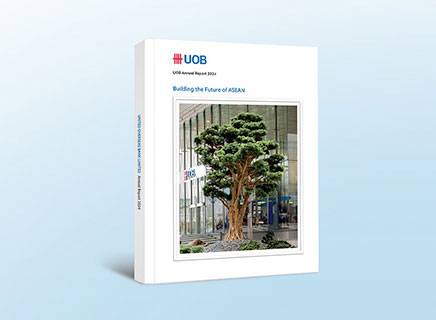

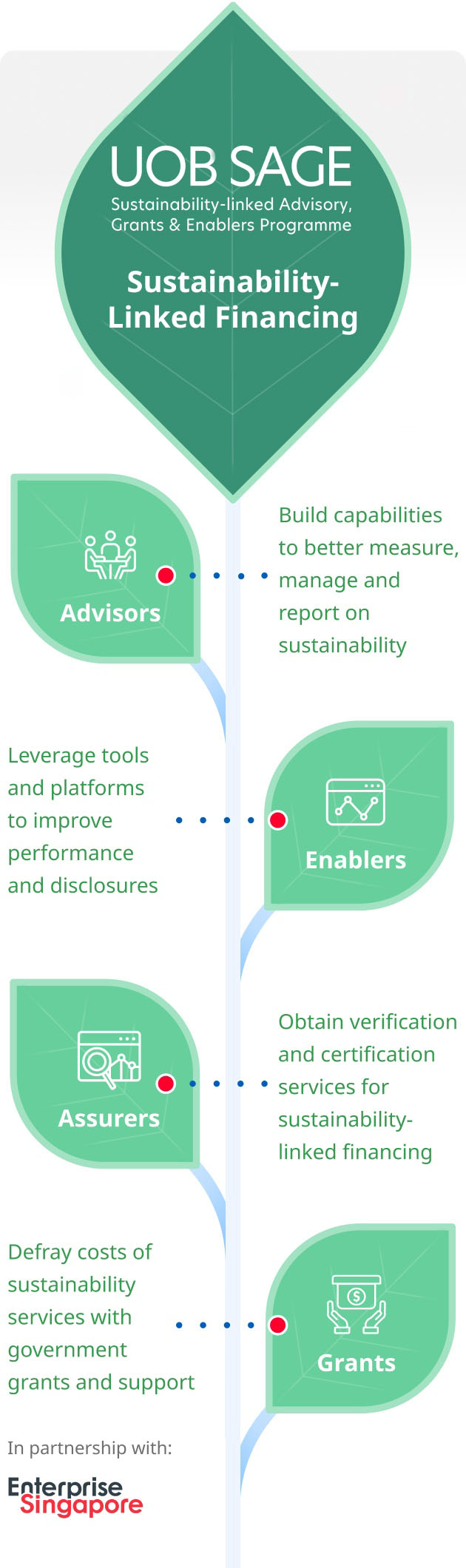

Supporting SMEs through the UOB SAGE Programme

UOB SAGE simplifies sustainability-linked financing for SMEs, encouraging them to meet pre-agreed SPTs. Through partnership with Enterprise Singapore and our network of sustainability experts, we assist SMEs in enhancing sustainability practices efficiently, saving time and resources.

*Validated by independent Second Party Opinion (SPO) provider  to be in alignment with the APLMA/LMA/LSTA Sustainability-Linked Loan Principles

to be in alignment with the APLMA/LMA/LSTA Sustainability-Linked Loan Principles

Award winning SAGE Programme

You may also like

Green Finance

Businesses can tap on green finance to reduce emissions and progress to a low-carbon economy.

Transition Finance

Supports companies in the energy intensive, fossil fuels-based, and hard-to-abate sectors through the transition journey.

Sustainable Trade

Supports the enhancement of sustainable supply chains.