Advice for what matters to you

Everyone experiences life's milestones differently. This is why you need advice for what matters to you.

Experience the UOB Privilege Banking difference, with tailored advice from a dedicated Client Advisor and our team of specialists to help protect and grow your wealth. We also understand the bigger purpose behind your wealth – the people and pursuits closest to your heart. As our client, enjoy concierge services for your loved ones’ health, overseas education and more.

The Privilege Banking Difference

Tailored wealth advice

Protect and grow your wealth across the different stages in your life with our carefully tailored wealth advice.

Concierge services

As our client, you have access to concierge services for your loved ones’ health, overseas education, lifestyle and travel needs.

Bespoke lifestyle privileges

Indulge in special treats during your birthday month and enjoy specially curated offers all year long.

Our network

Attend to your banking needs in the comfort and privacy of our dedicated Privilege Banking Centres islandwide, and access our network of Privilege Banking Centres across the region.

Our Network

As a Privilege Banking client, you have access to:

Dedicated Privilege Banking Centres across the island

Attend to your banking needs in the comfort and privacy of our dedicated Privilege Banking Centres islandwide.

Preferential services at UOB Group branches

Enjoy priority queues, as well as preferential services and pricing on products such as Telegraphic Transfers, FX rates, demand drafts and cheque fees at any of our branches islandwide.

Privilege Banking Centres across the region

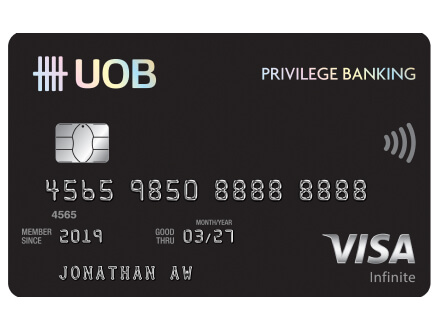

Your wealth does not reside within borders. Visit our Privilege Banking Centres across the region by simply presenting your Privilege Banking Card or Privilege Banking e-card on the UOB TMRW app.

ATMs around the region

Enjoy the convenience of fee-free cash withdrawals at UOB’s network of ATMs around the region.

Get in Touch

Get in Touch

Call our 24-hour UOB Privilege Concierge at 1800 222 9889 (Singapore) or +65 6222 9889 (overseas).

For existing Privilege Banking clients

Tap on the Privilege Banking icon on your home page on the UOB TMRW app for your Client Advisor's name and contact details.

Start a Privilege Banking relationship with us

Sign up as a Privilege Banking client with a minimum of S$350,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Client Advisor will contact you.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.