1 of 3

What do you need help with?

1 of 3

you are in GROUP WHOLESALE BANKING

A Cross Currency Swap (CCS) is an instrument which allows two parties to exchange a series of cashflows from one currency to another based on contracted rates. Using a CCS, you can synthetically swap a currency exposure of your asset or liability to another effectively.

Key uses

The primary use of a Cross Currency Swap is the ability to synthetically swap one currency exposure to another. For example, if a company is only able to borrow SGD but requires a loan in USD, he can use a CCS to swap the SGD loan into a USD loan. The ability of a Cross Currency Swap to synthetically transform the currency exposure of an underlying asset or liability provides an effective way to hedge currency risk, as well as to access foreign currency funding sources if favourable.

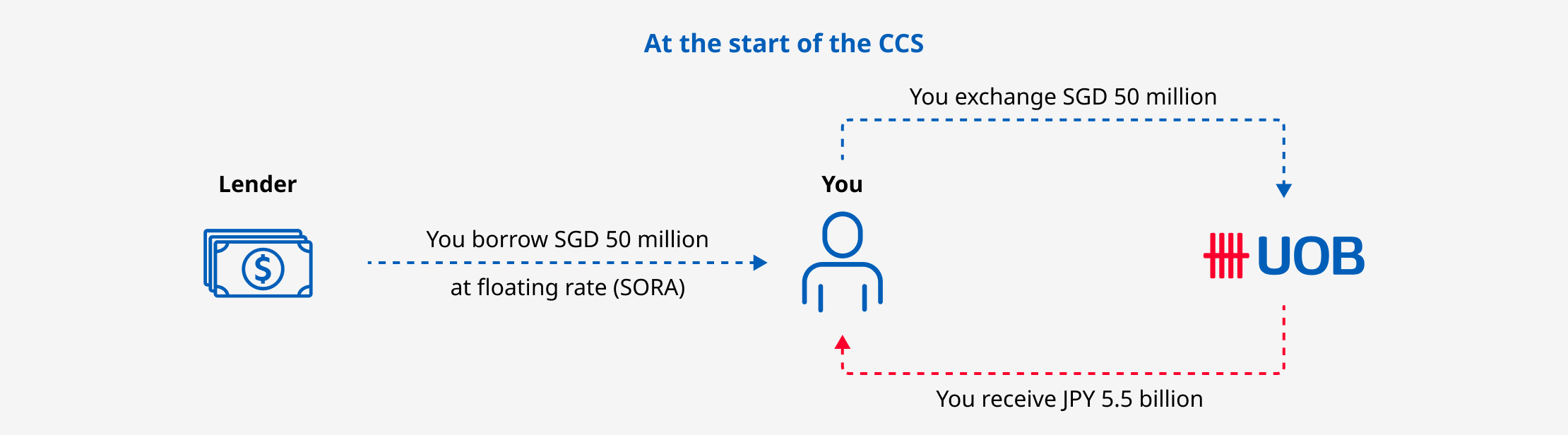

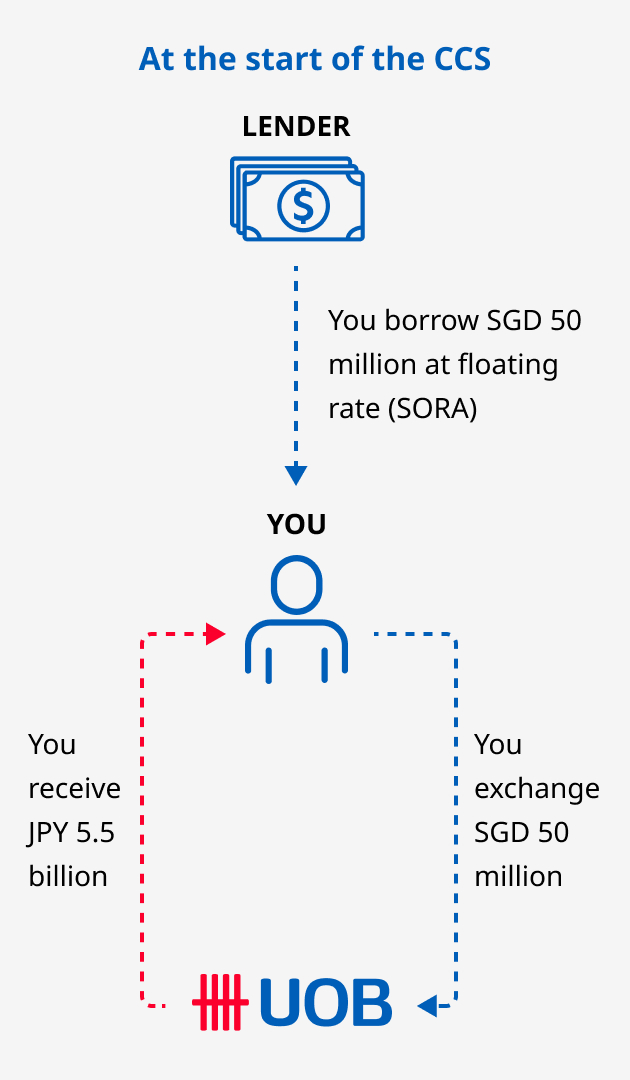

Your company has a loan of SGD 50 million on a floating interest rate (i.e. SGD SORA). You would like to execute a Cross Currency Swap to transform your loan into a Japanese Yen denominated fixed interest rate loan.

How it works: On the start date, your company will receive SGD 50 million from your lender. Your company can then exchange the SGD 50 million into Japanese Yen at a predetermined foreign exchange rate using a CCS.

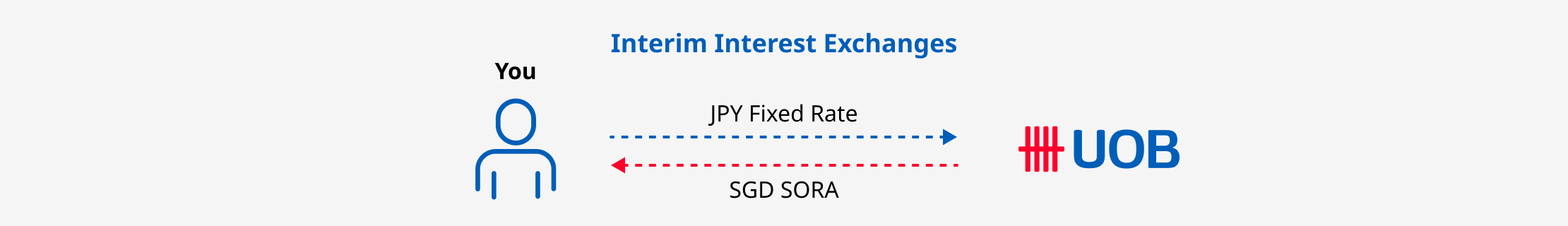

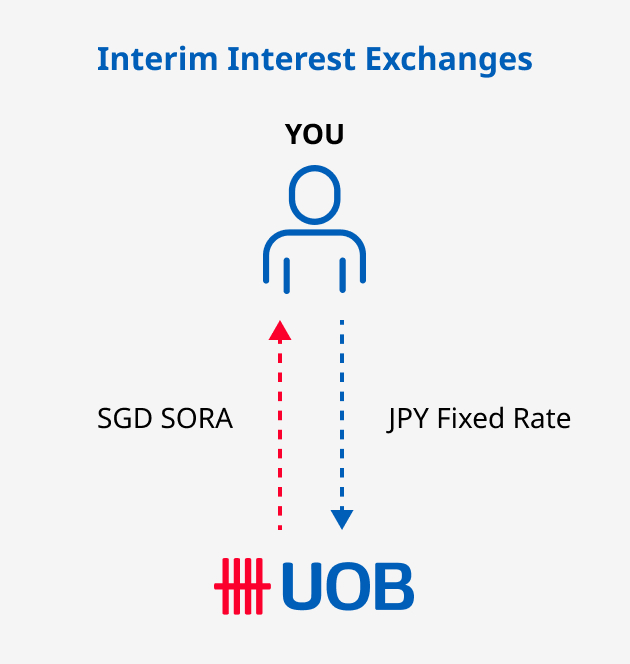

How it works: During the interim, your company will receive SGD SORA floating interest rate which will match your loan’s interest rate payments. In exchange, your company will pay JPY fixed rate to UOB.

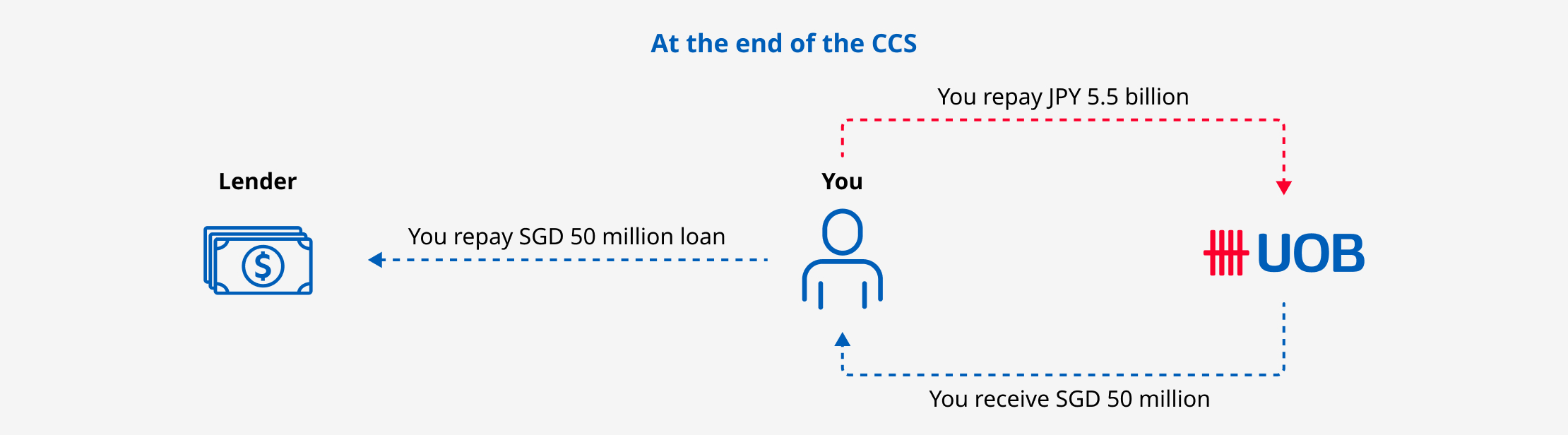

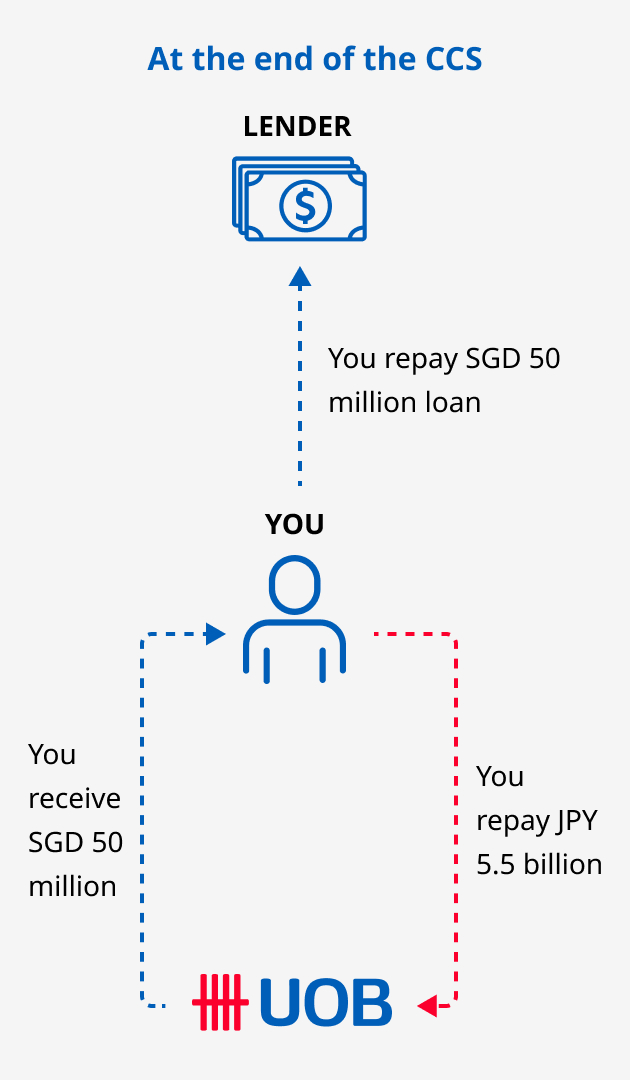

How it works: At maturity, your company will exchange the JPY 5.5 billion back into Singapore dollars at the same exchange rate used at the start of the CCS. With the SGD 50 million received from UOB, your company will use it to repay its existing loan.

Disclaimer: This is only an illustration, it does not constitute an offer or an invitation to offer or a solicitation or recommendation to enter into or conclude any transaction. Please contact UOB for more information.

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.