Small businesses want more government initiatives to build digital infrastructure such as national business databases and networks

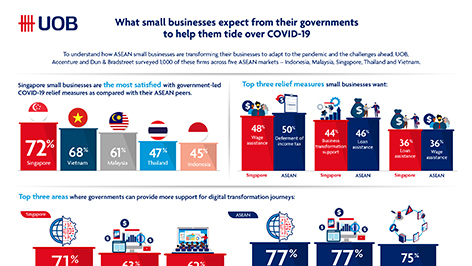

Small businesses in Singapore are the most satisfied within ASEAN with the relief measures provided by their government to cushion the impact of COVID-19 according to a recent survey conducted by United Overseas Bank (UOB), Accenture and Dun & Bradstreet1. Close to three in four (72 per cent) Singapore-based firms surveyed expressed this sentiment, higher than the ASEAN average of 58 per cent.

Across the region, Vietnamese small businesses (68 per cent) were the second most satisfied with their government’s relief measures, followed by those in Malaysia (61 per cent), Thailand (47 per cent) and Indonesia (45 per cent).

Given that one in two small businesses across ASEAN are facing cash flow challenges (48 per cent) as a result of the pandemic, the majority of respondents indicated a preference for cash flow-related support from their governments. In Singapore, small businesses felt that wage assistance was the most important government measure (48 per cent) to help them tide over the COVID-19 situation. Next on their list was support for business transformation initiatives (44 per cent) followed by loan assistance (36 per cent). Within ASEAN, small businesses preferred measures that deferred the payment of income tax (50 per cent) and provided loan (46 per cent) and wage assistance (36 per cent).

Mr Lawrence Loh, Head of Group Business Banking, UOB, said that as small businesses tap cash flow-focused relief measures to ease their immediate challenges, other forms of government assistance could be used to help them emerge stronger post-COVID-19.

“In supporting our small business clients, we found that many of them are not only concerned with immediate challenges but also with exploring enterprising ways to protect the long term viability of their business. To help our small business clients achieve their goals, we have been working closely with them, drawing on the Bank’s entrepreneurial roots to help them determine how best to use the funds from the relief measures to improve their resilience,” Mr Loh said.

A small business that has been able to enhance its business model through UOB’s funding support is SCT Auto Services Pte Ltd. The Singaporean company, which offers vehicle repair services, used funds from a Temporary Bridging Loan2 provided by the Bank to take up the UOB BizSmart3 solution to digitalise its operations. By implementing the solution, the company has reduced the time taken to complete administrative tasks such as their human resource processes by 50 per cent and can now generate real-time insights to improve its business operations. This in turn has enabled the company to make business decisions with more certainty and agility. To date, more than 31,000 small businesses in ASEAN have signed up for UOB BizSmart to digitalise their operations.

Mr Marcus Soh, Business Development Manager at SCT Auto Services Pte Ltd said, “Like many other companies, we were also affected by COVID-19 with sales dropping by more than 30 per cent. We decided to use the time we had to digitalise our operations through the UOB BizSmart solution as this would not only give us the ability to manage our processes remotely, but also helps us improve our efficiency. The Bank also helped us to understand the government grants that we could apply for when taking up the solution, enabling us to take up the solution without causing a strain on our cash flow.”

Small businesses want more digital infrastructure to support their innovation efforts

To support their efforts to strengthen their capabilities, particularly in the area of digitalisation, small businesses in Singapore said more investment in digital infrastructure to support innovation (71 per cent) is vital. Examples of digital infrastructure include national business databases for electronic know-your-customer processes and nation-wide networks for electronic invoicing processes. The need for more digital infrastructure was also ranked as the top area of support needed among small businesses across ASEAN (77 per cent).

Other government initiatives that Singapore-based small businesses said would help in the current business environment include funding support (63 per cent) and more education and training programmes to upskill employees, especially older workers (62 per cent).

Ms Audrey Chia, Chief Executive Officer, Dun & Bradstreet Singapore said, “While majority of the current government support measures are aimed at helping businesses with their immediate cash flow challenges amid COVID-19, the desire for non-cash flow support by small businesses across ASEAN highlights the increasing importance that they place in adapting to the new normal. Firms that use technology to strengthen their capabilities and resiliency will be able to seize business opportunities as they arise, whether during or post-COVID-19.”

Mr Divyesh Vithlani, who leads Accenture’s financial services practice in Southeast Asia, said, “Small businesses in the region are dealing with many challenges right now and it is very encouraging to see many of them looking beyond the immediate difficulties and focusing on how best to revamp and future-proof their operations. Financial services firms with the right digital tools and next-generation services will play a key role in the broader economic recovery in Southeast Asia, particularly as they streamline different government relief programs and partner with SMEs to help them navigate the current instability.”

The ASEAN SME Transformation Study 2020 aims to help ASEAN small businesses understand how they can transform their businesses to adapt to the changes ahead and to participate in the region’s long-term growth.

To view the full report, please visit: www.uobgroup.com/aseansme.

1 The survey was conducted among 1,000 small businesses with annual turnover of $20 million and below before and during the COVID-19 pandemic, in the third quarter of 2019 and May 2020 respectively. Small businesses across five ASEAN markets – Indonesia, Malaysia, Singapore, Thailand and Vietnam – were surveyed.

2 The Temporary Bridging Loan programme, administered by Enterprise Singapore, provides access to working capital for business needs. https://www.enterprisesg.gov.sg/financial-assistance/loans-and-insurance/loans-and-insurance/temporary-bridging-loan-programme/overview

3 UOB BizSmart is a suite of cloud-based integrated solutions that helps small businesses to digitalise their operations.