Three in five funding deals went to Singapore-based FinTech firms

Despite disruptions brought about by the COVID-19 pandemic, four in five financial technology (FinTech) firms in ASEAN will push ahead with their expansion plans in the next two years. According to the FinTech in ASEAN: Get up, Reset, Go! report1 by UOB, PwC Singapore and the Singapore FinTech Association (SFA), ASEAN is the top choice for market expansion for these firms (78 per cent). The region is also a top destination for expansion by FinTech firms based outside of ASEAN (69 per cent).

The optimism comes on the back of the accelerated trend in digital adoption across ASEAN amid the pandemic, with more than 40 million new internet users this year.2 Seventy per cent of the ASEAN population today use the internet3 and this is expected to continue to increase in the next decade as digital services such as online marketplaces become commonplace.4

This macro trend provides FinTech firms in the region an opportunity to provide the growing digitally-connected population with digital financial solutions in areas such as payments and alternative lending. One way in which FinTech firms can extend their services in ASEAN is through working with banks to combine the respective strengths of each, including the customer touchpoints that banks offer and the technology capabilities of FinTech firms.

Ms Janet Young, Head of Group Channels and Digitalisation, UOB, said, “As FinTech firms in ASEAN continue to eye expansion in the region, partnerships will remain integral to driving sustainable growth in a landscape with diverse regulatory and operating requirements. Tapping the complementary strengths of a partnership also enables FinTech firms to reach a wider network of customers and to enhance the way in which customers work, live, play and bank. For example, the increasing collaboration between banks and FinTech firms in ASEAN has brought together the best of technology and industry capabilities. This has led to the development of innovative solutions that make banking simpler and more accessible across ASEAN.”

Three in five funding deals went to Singapore-based FinTech firms

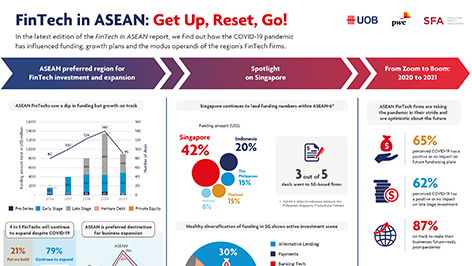

Of the total 95 completed deals that took place in the first three quarters of 2020, almost two-thirds of these deals went to FinTech firms in Singapore.

Investor interest in Singapore-based FinTech firms also remained strong, with these firms continuing to attract the highest funding amount (42 per cent) in the region. This could be as investors place faith in Singapore’s favourable regulatory and business environment and its good track record of mitigating the impact of crises such as the COVID-19 pandemic.

With Singapore being the most mature FinTech market in ASEAN, funding in Singapore-based FinTech firms remains diversified across every category, with alternative lending, payments and banking technology taking the lead. In the other ASEAN markets, funding in the payments space continues to dominate in expectation of the unabated adoption and usage of digital payments.

Ms Wong Wanyi, FinTech Leader, PwC Singapore, said, “In the last year, Singapore continued to attract the most funding within ASEAN and has been maintaining its established position as a leader in ASEAN’s FinTech landscape. A key contributor to the strong performance in Singapore is the conducive, collaborative and supportive ecosystem. For example, incentives coming from regulators and key industry associations like the SFA and the strong start-up culture of knowledge sharing helps to accelerate the industry's growth. The industry players are also playing a key role in developing and growing our talent pool. This coming together of government, businesses and talent is key to a successful FinTech hub.”

FinTech firms in ASEAN remain optimistic about the future despite the pandemic

According to the report, FinTech firms in ASEAN continue to have a positive outlook on the future as they take the pandemic in stride. Around two in three FinTech firms stated that the pandemic has either no impact or a positive one on their future fundraising plans (65 per cent) and late stage investment (62 per cent). The majority of FinTech firms in ASEAN (87 per cent) also said they are on track to ensuring their businesses can last post-pandemic, with a focus on product innovation and driving revenue growth in the next year.

Mr Chia Hock Lai, President, SFA, said, “There are good reasons for FinTech firms in ASEAN to be optimistic about the future as COVID-19 has accelerated adoption of digital finance by consumers and businesses. In order to capture the growth opportunities in the region, FinTech firms need to remain agile in adapting their products and revenue models to compete effectively, including collaborating with traditional financial institutions, in order to thrive in the exciting yet fragmented environment in the ASEAN region.”

The FinTech in ASEAN: Get up, Reset, Go! report can be downloaded by visiting: https://www.uobgroup.com/techecosystem/news-insights-fintech-in-asean-2020.html. Findings of the report will also be presented to attendees of the Singapore FinTech Festival 2020 via a Green Shoots Session at the Impact Summit on Wednesday, 9 December, 19:40 – 20:00 SGT.

1 The survey was conducted by UOB, PwC and SFA in September 2020 among 109 FinTech firms across six ASEAN markets including Indonesia, Malaysia, Singapore, the Philippines, Thailand and Vietnam.

2 According to the Google, Temasek Holdings and Bain & Company’s e-Conomy SEA 2020 report published in November 2020.

3 Ibid.

4 According to the World Economic Forum’s Future of Consumption in Fast-Growth Consumer Markets: ASEAN report published in November 2020.