You are now reading:

China: Export jumped in March ahead of more tariff uncertainty

you are in Research

You are now reading:

China: Export jumped in March ahead of more tariff uncertainty

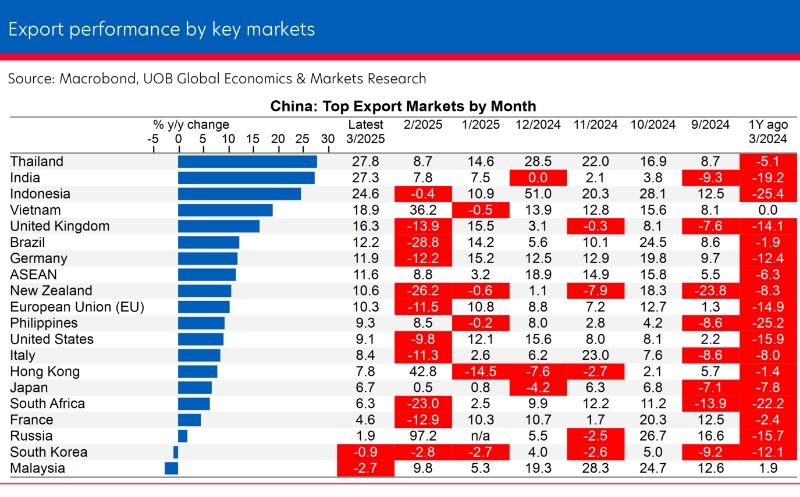

The tariff uncertainty has driven more frontloading activities in March. In USD terms, exports surged by 12.4% y/y (Bloomberg est: 4.6%, Feb: -3.0%) while it rose 13.5% y/y in CNY-terms (Feb: -1.9%). Exports to its key markets were higher, including to ASEAN (+11.6% y/y), EU (+10.3% y/y) and the US (+9.1% y/y). Shipments of mechanical & electrical products, LCD panels, automotive parts, garments and semiconductors registered strong growth in March.

However, the larger-than-expected drop in imports by -4.3% y/y (Bloomberg est: -2.1%, Feb: 1.5%) in USD-terms and by -3.5% y/y (Feb: 2.5%) in CNY-terms continued to indicate a weak domestic demand in China. China’s imports from Taiwan (+34.5% y/y) and ASEAN (+9.8% y/y) rose but its imports from sources such as the US (-9.5% y/y) and EU (-7.5% y/y) contracted. While imports of aircrafts and computers soared ahead of more tariffs, weak demand for other consumer goods suggested a more cautious outlook. In volume terms, imports of commodities were weaker for soya beans, iron ore, coal, LPG and refined petroleum products in March compared to the same period last year.

As such, China’s trade surplus widened sharply to US$102.64 bn in March from a monthly average of US$85.26 bn in the first two months of this year. Overall, China recorded a trade surplus of US$272.97 bn in 1Q25, of which US accounted for US$76.63 bn.

Overall in 1Q25, China’s exports rose 5.8% y/y while imports contracted by - 7.0% y/y. Export gains were seen across its key markets including to ASEAN (+8.1% y/y), US (+4.5% y/y) and EU (+3.7% y/y). However, China imported less from EU (-6.3% y/y) and US (-1.4% y/y) while registering a modest gain for ASEAN (+2.8% y/y) in 1Q25.

The temporary exemption of smartphones, computers and some other electronic devices from "reciprocal" tariffs (at 125% for Chinese goods) that was announced on 11 April may see further room for some frontloading of tech exports before Trump unveils sector specific tariffs on semiconductors and critical technology products from China. Trump’s latest exemptions apply to around a fifth (US$100 bn) of US’ imports from China, providing some cushion against products hit by the hefty “reciprocal” tariffs. The decoupling of US-China trade will have a significant impact on China’s export outlook. Despite the strong export growth in 1Q25, the momentum is expected to reverse as more tariffs set in and until US and China can arrive at a resolution to prevent further escalation in trade tensions.

We previously factored in marginal growth of around 1.0% for both China’s export and import in 2025 compared to growth of 5.9% and 1.1% respectively in 2024. However, downside risks have increased with a full-year contraction likely especially for imports.

Ho Woei Chen

Economist

Follow Woei Chen on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.