You are now reading:

Indonesia: Macro Impact from US Reciprocal Tariffs

you are in Research

You are now reading:

Indonesia: Macro Impact from US Reciprocal Tariffs

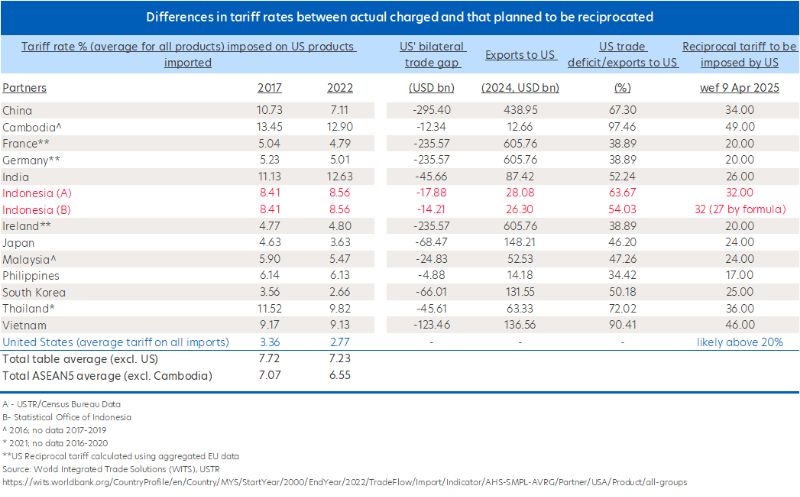

Indonesia’s trade surplus with the US almost quadrupled since 2010, reaching its peak of USD16.6bn in 2022 and has since narrowed to USD14.2bn in 2024. Last year, Indonesia exported a total of USD26.3bn worth of goods to the US.

Pragmatically, we are of the view that the sweeping tariff treatment globally by the US is to bring countries to the negotiation table to improve US’ terms-of-trade positions. This stands out in the case of Indonesia who only has less than 10% of its total exports to the US and Indonesia ranked close to the bottom of relative trading partner to the US but was charged a whopping 32% reciprocal tariff rate.

However, we are cognizant of the adverse ramifications that US reciprocal tariffs can bring about to Indonesia’s already dimming near-term growth prospects. Palm oil and derivatives, footwear products, low-value electrical apparatus, apparel, and furniture (altogether account for 51% of total surplus with the US) are sectors that will bear significant downside risks of lower exports revenue. These top 10 exports product accounted for a mere 3.4% of Indonesia’s total exports to the world.

In conclusion, though data suggests a relatively manageable exposure of Indonesia’s exports with respect to the US reciprocal tariff, the ripple effects from other larger and export-oriented trading economies subjected to such tariffs, especially China, would likely have some bearings on Indonesia’s economic growth prospects (current forecast of 5.2% will be reviewed after 1Q25 GDP data is released in May). This will also affect our forecast for BI to lower its benchmark rate by a greater extent (will be reviewed post 23 Apr MPC).

Read full article

Enrico Tanuwidjaja

Economist

Follow Enrico on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.