-

you are in Research

For Individuals

Personal BankingWealth BankingPrivilege BankingPrivilege ReservePrivate BankingFor Companies

GROUP WHOLESALE BANKINGForeign direct investmentUOB Asean insightsIndustry insightsSUSTAINABLE SOLUTIONSAbout UOB

UOB GroupBranches & ATMsSustainabilityTech Start-Up EcosystemUOB Group Subsidiaries

UOB asset managementUnited overseas insuranceUOB travel plannersUOB venture managementUOB global capital

Video and Audiocast

Impact of escalating global volatility on ASEAN

04 July 2025

Missed our recent webinar? With tariffs, shifting supply chains and global uncertainties shaping the outlook for ASEAN and beyond, staying informed is more important than ever.

Watch the full recording online to hear our economists and strategists share timely perspectives on trade dynamics, monetary policy, the US dollar outlook and strategies to navigate the months ahead.

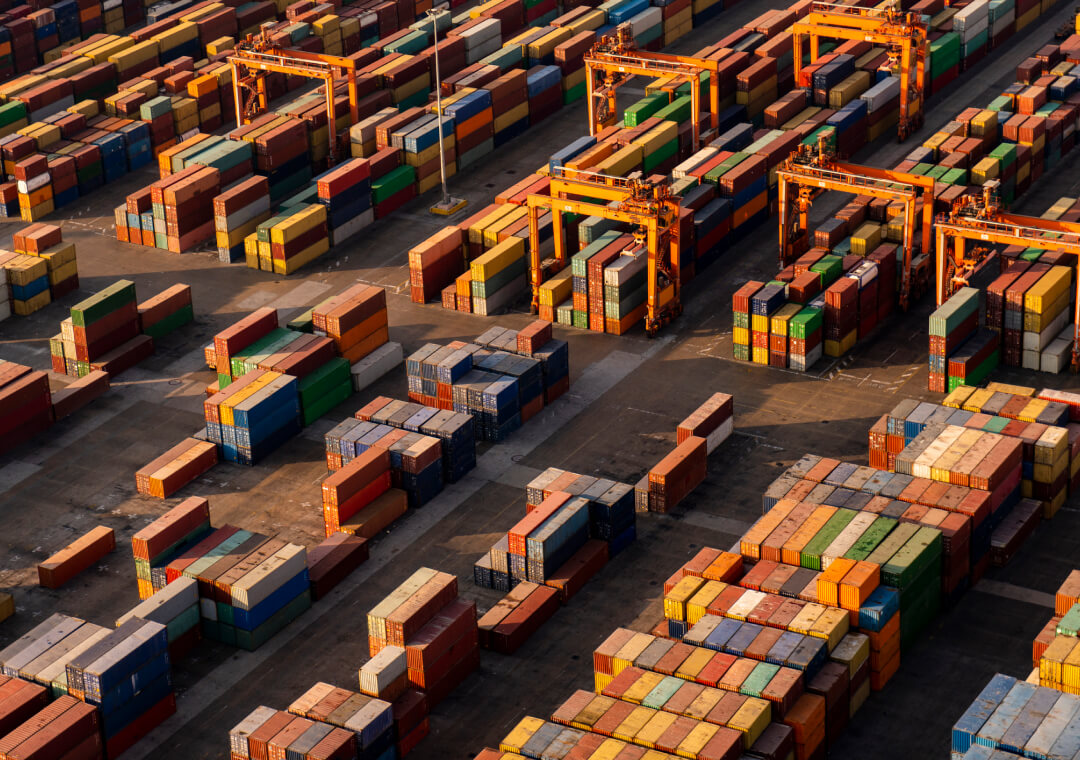

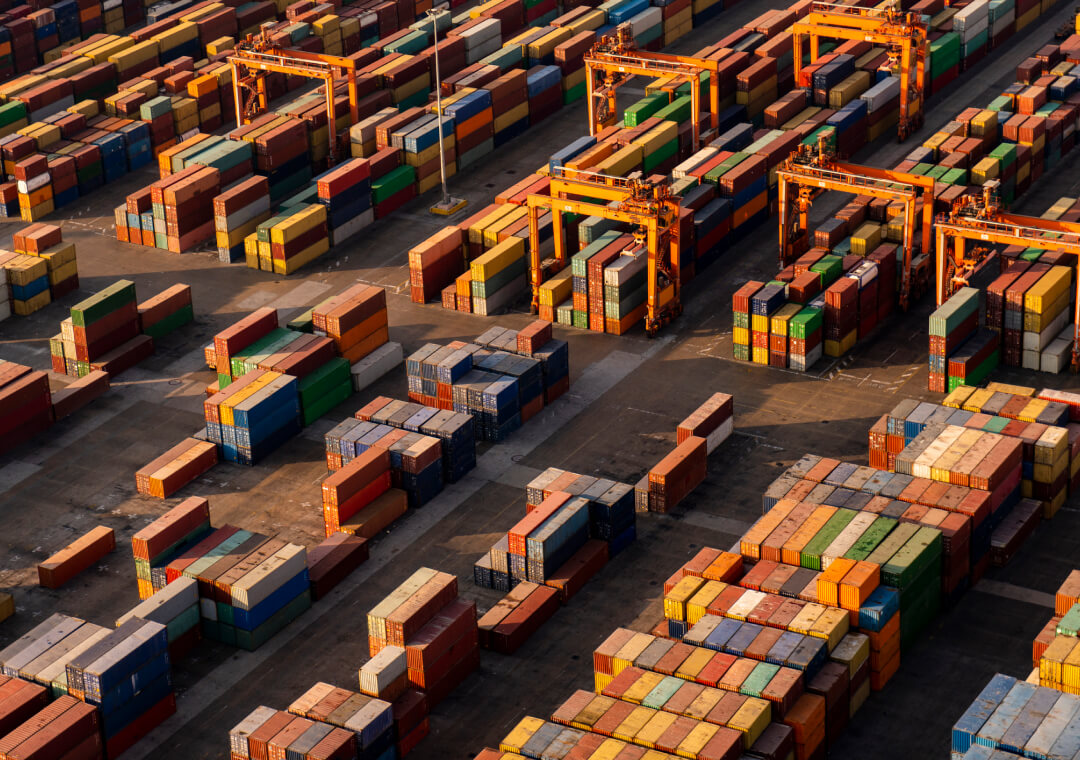

Impact of Liberation Day Tariffs on Asia

08 April 2025

In an unprecedented move to impose both universal and reciprocal tariffs, President Trump’s sweeping tariffs of up to 50% on imports will impact more than 180 countries globally.

As the global trade war involving trillions of trades escalates, what impact will it have on global economies and monetary policies, particularly in Asia?

Join our Global Economics and Markets Research team as they discuss how the region will be impacted by the biggest trade war in recent decades.

- Global and US Economic Outlook

- ASEAN and China Economic Outlook

- FX Market Outlook

- Commodities Outlook

Global Markets Economic Forum 2025

14 January 2025

This year, the attention is squarely on Trump 2.0 and its broad impact on the economy. This is the result of the potential inflationary impact of not just the incoming trade tariffs, but the overall expansionary mix of Trump 2.0 policies as well. We have lowered our forecast of upcoming Fed rate cut trajectory and reiterated our bullish USD expectation. Do watch the recording of the presentations by our economists and market strategists for more details of our forecasts. We are also very privileged to have Ambassador Chan Heng Chee to share her informed thoughts and views on US-China relationship, how that impacts our ASEAN and Singapore economies. Finally, in the industry discussion, we have assembled a high powered CEO panel of leading thought leaders to discuss innovations next in AI data center, capital markets as well as sustainable urbanization.

Global Markets Economic Forum 2024

01 February 2024

In 2024, the main theme would revolve around the Federal Reserve which is likely to start to ease interest rates in mid-2024. This is set against the backdrop of slowing US growth as inflation stabilises further. Other major central banks are likely to follow suit with differing timelines. While recent data points to improvement, China’s situation remains challenging with growth likely to stay soft this year. ASEAN economic growth is expected to remain resilient with external trade cycle bottoming for the region but the recovery may be lacklustre due to China’s slowdown. Find out more in the following videos from the forum hosted by our Global Markets and Group Wholesale Bank on 01 February.

Impact of escalating global volatility on ASEAN

04 July 2025

Missed our recent webinar? With tariffs, shifting supply chains and global uncertainties shaping the outlook for ASEAN and beyond, staying informed is more important than ever.

Watch the full recording online to hear our economists and strategists share timely perspectives on trade dynamics, monetary policy, the US dollar outlook and strategies to navigate the months ahead.

Impact of Liberation Day Tariffs on Asia

08 April 2025

In an unprecedented move to impose both universal and reciprocal tariffs, President Trump’s sweeping tariffs of up to 50% on imports will impact more than 180 countries globally.

As the global trade war involving trillions of trades escalates, what impact will it have on global economies and monetary policies, particularly in Asia?

Join our Global Economics and Markets Research team as they discuss how the region will be impacted by the biggest trade war in recent decades.

- Global and US Economic Outlook

- ASEAN and China Economic Outlook

- FX Market Outlook

- Commodities Outlook

Global Markets Economic Forum 2025

14 January 2025

This year, the attention is squarely on Trump 2.0 and its broad impact on the economy. This is the result of the potential inflationary impact of not just the incoming trade tariffs, but the overall expansionary mix of Trump 2.0 policies as well. We have lowered our forecast of upcoming Fed rate cut trajectory and reiterated our bullish USD expectation. Do watch the recording of the presentations by our economists and market strategists for more details of our forecasts. We are also very privileged to have Ambassador Chan Heng Chee to share her informed thoughts and views on US-China relationship, how that impacts our ASEAN and Singapore economies. Finally, in the industry discussion, we have assembled a high powered CEO panel of leading thought leaders to discuss innovations next in AI data center, capital markets as well as sustainable urbanization.

Global Markets Economic Forum 2024

01 February 2024

In 2024, the main theme would revolve around the Federal Reserve which is likely to start to ease interest rates in mid-2024. This is set against the backdrop of slowing US growth as inflation stabilises further. Other major central banks are likely to follow suit with differing timelines. While recent data points to improvement, China’s situation remains challenging with growth likely to stay soft this year. ASEAN economic growth is expected to remain resilient with external trade cycle bottoming for the region but the recovery may be lacklustre due to China’s slowdown. Find out more in the following videos from the forum hosted by our Global Markets and Group Wholesale Bank on 01 February.

More videos

05 JAN 2025

Global Markets Economic Forum 2023

With failing Asian currencies and other risks, what will be the regional outlook for 2023? How can businesses be flexible and resilient enough to turn these risks into opportunities?

We are sharing the clips here for those who missed the forum hosted by our Global Markets and Group Wholesale Bank on 11 January.

12 JANUARY 2022

2022 start of year webinar series

Our Global Markets and Group Wholesale Bank hosted a webinar on 12 January titled: 2022 Start of Year Macro and Markets – What do Omicron, rate hikes and innovation have in common?

We are sharing the clips here for those who missed it.

23 JANUARY 2020

Economic and market outlook 2020 (Part 2)

This is part 2 of our Economic & Market Outlook 2020. In part 1, we discussed that though uncertainties still linger, economic outlook is stabilizing.

What does this imply for our FX, interest rates and commodities outlook? Watch the video as our Market Strategists outline their thoughts for 2020.

For more insights on what to watch out for 2020, and how you can navigate in this challenging environment, download our 1Q2020 Quarterly Global Outlook report.

20 JANUARY 2020

Economic and market outlook 2020 (Part 1)

This is part 1 of our 2-part Economic & Market Outlook 2020 video series.

Hear from our team of Economists as they share their insights on the trade issues between US and China, Brexit outcomes and closer to home, Singapore’s economic performance this year.

Stay tune for part 2 of our video which focuses on our FX, interest rates and commodities views.

07 JANUARY 2020

Economic and market outlook 2020 (Introduction)

In 2019, major economies as well as Asian central banks have responded to the weaker growth and uncertain trade environment by easing monetary policies.

Heading into 2020, what are the central themes and key risks? Watch our introduction video to find out more.

Subsequently, we will be releasing our Economic & Market Outlook 2020 video in 2-parts in the next 2 weeks, stay tune!

08 OCTOBER 2019

Slower growth, lower rates and its implications

Many key economies across the world are facing the negative impact of growth slowdown and export contraction amidst a lower interest rates environment.

Hear from Mr Alvin Liew, Senior Economist and Mr Victor Yong, Interest Rates Strategist, on how you can diversify in this challenging environment. For further insights do read our 4Q2019 Quarterly Global Outlook report.

06 JUNE 2019

US-China: China's retaliation intensifies trade tension

On 1 June, China has increased its tariff rate on US$60bn of its imports from the US, in response to US imposing higher additional tariffs on US$200bn of Chinese goods in May.

In this video, we take a closer look at the US-China trade tensions and its implications. Our Strategists Mr Heng Koon How, Mr Peter Chia together with Economist Ms Ho Woei Chen, will endeavour to answer some of the key questions.

07 MARCH 2019

Singapore Budget 2019: Supporting SMEs and emphasis on healthcare

Overall, this is a comprehensive budget that providessupport to the businesses, helping them to scale-up and addressing healthcare concerns to cater for the ageing population.

Watch our video as our Economists, Alvin and Woei Chen highlight some of the key measures and discuss the impact on businesses and individuals.

31 JANUARY 2019

Will there be even more volatility ahead for FX and rates in 2019?

2019 began on a very interesting note for financial markets, with a strong equity rally as well as a sharp rebound in Asian currencies. However, investors remain concerned over the uncertain US-China trade talks as well as the global and China growth slowdown. Will the Fed stop hiking interest rates?

Our Head of Markets Strategy, Heng Koon How, will answer the above and other pertinent questions in his video.

More videos

05 JAN 2025

Global Markets Economic Forum 2023

With failing Asian currencies and other risks, what will be the regional outlook for 2023? How can businesses be flexible and resilient enough to turn these risks into opportunities?

We are sharing the clips here for those who missed the forum hosted by our Global Markets and Group Wholesale Bank on 11 January.

12 JANUARY 2022

2022 start of year webinar series

Our Global Markets and Group Wholesale Bank hosted a webinar on 12 January titled: 2022 Start of Year Macro and Markets – What do Omicron, rate hikes and innovation have in common?

We are sharing the clips here for those who missed it.

23 JANUARY 2020

Economic and market outlook 2020 (Part 2)

This is part 2 of our Economic & Market Outlook 2020. In part 1, we discussed that though uncertainties still linger, economic outlook is stabilizing.

What does this imply for our FX, interest rates and commodities outlook? Watch the video as our Market Strategists outline their thoughts for 2020.

For more insights on what to watch out for 2020, and how you can navigate in this challenging environment, download our 1Q2020 Quarterly Global Outlook report.

20 JANUARY 2020

Economic and market outlook 2020 (Part 1)

This is part 1 of our 2-part Economic & Market Outlook 2020 video series.

Hear from our team of Economists as they share their insights on the trade issues between US and China, Brexit outcomes and closer to home, Singapore’s economic performance this year.

Stay tune for part 2 of our video which focuses on our FX, interest rates and commodities views.

07 JANUARY 2020

Economic and market outlook 2020 (Introduction)

In 2019, major economies as well as Asian central banks have responded to the weaker growth and uncertain trade environment by easing monetary policies.

Heading into 2020, what are the central themes and key risks? Watch our introduction video to find out more.

Subsequently, we will be releasing our Economic & Market Outlook 2020 video in 2-parts in the next 2 weeks, stay tune!

08 OCTOBER 2019

Slower growth, lower rates and its implications

Many key economies across the world are facing the negative impact of growth slowdown and export contraction amidst a lower interest rates environment.

Hear from Mr Alvin Liew, Senior Economist and Mr Victor Yong, Interest Rates Strategist, on how you can diversify in this challenging environment. For further insights do read our 4Q2019 Quarterly Global Outlook report.

06 JUNE 2019

US-China: China's retaliation intensifies trade tension

On 1 June, China has increased its tariff rate on US$60bn of its imports from the US, in response to US imposing higher additional tariffs on US$200bn of Chinese goods in May.

In this video, we take a closer look at the US-China trade tensions and its implications. Our Strategists Mr Heng Koon How, Mr Peter Chia together with Economist Ms Ho Woei Chen, will endeavour to answer some of the key questions.

07 MARCH 2019

Singapore Budget 2019: Supporting SMEs and emphasis on healthcare

Overall, this is a comprehensive budget that providessupport to the businesses, helping them to scale-up and addressing healthcare concerns to cater for the ageing population.

Watch our video as our Economists, Alvin and Woei Chen highlight some of the key measures and discuss the impact on businesses and individuals.

31 JANUARY 2019

Will there be even more volatility ahead for FX and rates in 2019?

2019 began on a very interesting note for financial markets, with a strong equity rally as well as a sharp rebound in Asian currencies. However, investors remain concerned over the uncertain US-China trade talks as well as the global and China growth slowdown. Will the Fed stop hiking interest rates?

Our Head of Markets Strategy, Heng Koon How, will answer the above and other pertinent questions in his video.

Audiocast

- Date

- Title

| Date | Title | |

| 04 September 2020 | Australia has entered into recession, what are the implications? Lee Sue Ann, Economist |

|

| 17 August 2020 | Technical Outlook For USD Index Quek Ser Leang, Market Strategist |

|

| 22 July 2020 | How do we view China's 2Q2020 growth & outlook? Ho Woei Chen, Economist |

|

| 22 July 2020 | 中国2020年二季经济增长和下半年展望 何玮珍, 经济师 |

|

| 14 July 2020 | Will Asian FX recover further in second half of 2020? Peter Chia, Senior FX Strategist |

|

Further reading

We use cookies to improve and customize your browsing experience. You are deemed to have consented to our cookies policy if you continue browsing our site.