You are now reading:

Vietnam: 1Q25 GDP overshadowed by Trump tariffs

you are in Research

You are now reading:

Vietnam: 1Q25 GDP overshadowed by Trump tariffs

Vietnam’s real GDP moderated to 6.93% y/y in 1Q25, according to the National Statistics Office on Sun (6 Apr). The pace is slightly below our and consensus view of 7.1% and behind the 7.55% growth in 4Q24.

The slower pace is partly due to festive season of Lunar New Year holidays, as factory activity moderated during the quarter while exports momentum picked up. Manufacturing output slowed to 9.3% y/y from 9.97% in 4Q24. While the latest PMI data suggest that Vietnam’s manufacturing sector returning to expansion zone in Mar after 3 straight months contraction, the data may be put to a severe test after the announcement of “reciprocal tariff” by US President Trump on 2 Apr.

After an upbeat year in 2024 and a somewhat respectable 1Q25 GDP report, that is already in the past. What the markets are focusing on is the surprisingly large 46% reciprocal tariff slapped against the country by US President Trump that is set to be effective 9 Apr, in an unprecedented announcement that lifted the average US tariff rate to a level not seen in a century.

US: “Liberation Day” tariffs very broad-based & material

While there are efforts underway by Vietnamese officials to negotiate with the US, the outcome remains highly uncertain. Vietnam Communist Party General Secretary To Lam offered to reduce tariff rates to zero, according to US President Trump who said both had a phone call on 4 Apr. A delegation led by Deputy PM Ho Duc Phoc is now in the US for negotiations. We had expected the US to levy a rate of around 10% for most countries on Liberation Day, which would have been more tolerable, but that turns out to be just the universal baseline tariff rate and that additional reciprocal rates are to be added on globally.

Vietnam is particularly vulnerable to trade restrictions and would need to brace for the impact of the tariff spreading through ahead, due to the open nature of its economy: export constitutes 90% of Vietnam’s GDP, second highest after Singapore (174%) in ASEAN, as well as its outsized exposure to the US market.

The US accounted for 30% share of Vietnam's exports of USD 402 bn in 2024 and its largest market, followed by China (15%) and South Korea (6%). The major products sold to the US in 2024 include electrical products HS85 (USD 41.7 bn), mobile phones and related HS84 (USD 28.8 bn), furniture HS94 (USD 13.2 bn), footwear HS64 (USD 8.8 bn), apparel knitted HS61 (USD 8.2 bn), and apparel nonknitted HS62(USD 6.6). Products from these sectors accounted for nearly 80% of the shipments that Vietnam sent to the US in 2024.

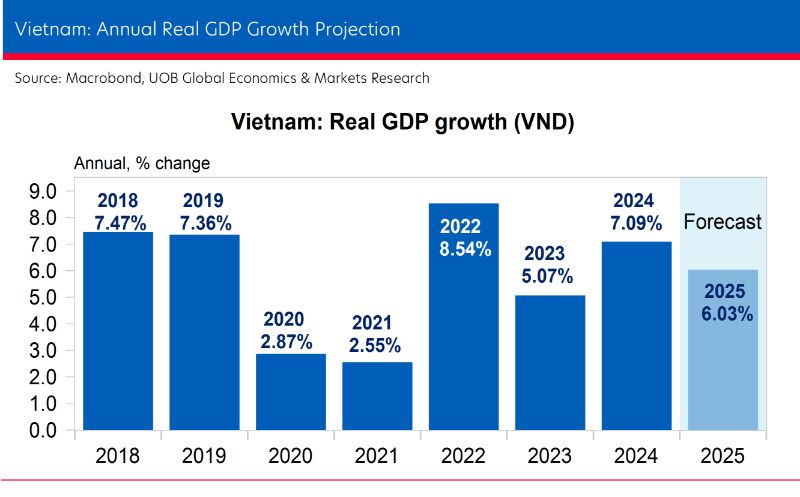

In view of the significant downside risks, we’re lowering our forecast for Vietnam’s GDP growth in 2025 by 1% pt to 6.0% (from previous call of 7.0%), vs 7.09% in 2024. We are pegging the growth projections for 2Q25 and 3Q25 at 6.1% and 5.8%, respectively. Under these conditions, both the reqlized FDI and registered FDI could back towards the USD 20 bn level this year. As these are just preliminary assessments, the risks are tilted towards the downside given the unprecedented nature of the US tariff measures.

The National Assembly had previously set a growth target of 6.5-7.0% for 2025, while Prime Minister Pham Minh Chinh has maintained “at least” 8% of expansion this year. Given the circumstances, these official projections may require further reassessment unless the reciprocal tariff can be reduced to somewhere around 20% or better, from the current 46%.

Suan Teck Kin

Head of Research

Follow Teck Kin on LinkedIn

Peter Chia

Senior FX Strategist

Follow Peter on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.