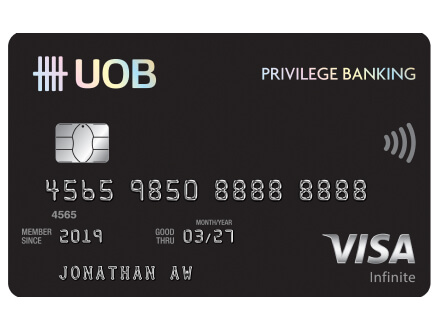

A world of exclusive privileges awaits

Specially curated benefits for your evolving lifestyle await with the UOB Privilege Banking Card. Just for you, the annual card membership fee of S$1,962 (inclusive of 9% GST) for the first year will be waived, along with two complimentary supplementary cards*.

Get in touch

Get in touch

Call our 24-hour UOB Privilege Concierge at 1800 222 9889 (Singapore) or +65 6222 9889 (overseas).

For existing Privilege Banking clients

Tap on the Privilege Banking icon on your home page on the UOB TMRW app for your Client Advisor's name and contact details.

Start a Privilege Banking relationship with us

Sign up as a Privilege Banking client with a minimum of S$350,000 (or its equivalent in a foreign currency) in qualifying assets under management.

Leave us your contact details and a Client Advisor will contact you.

Things you should know

Important Notice

Sales representatives, if any, may be remunerated for the recommendation or sale of this card.

Terms and conditions

*The UOB Privilege Banking Card is offered to Privilege Banking clients of UOB who maintain a minimum asset under management of S$350,000 (or its equivalent in a foreign currency) with UOB. Applicant must also have a minimum annual income of S$30,000 (or S$40,000 for non-Singaporean/non-PR). If you do not meet the income requirement, a minimum fixed deposit of S$150,000 is required for the UOB Privilege Banking card. The UOB Privilege Banking card comes with a joining fee of S$1,962 (inclusive of 9% GST). Enjoy first year free membership, with our compliments, along with 2 complimentary supplementary cards. Subsequent waiver of annual card membership fee is available upon request for Privilege Banking clients who maintain a minimum asset under management of S$350,000 (or its equivalent in a foreign currency) with UOB. Terms and conditions apply and subject to Bank’s approval.

#Terms and conditions apply for all above-mentioned benefits and privileges. Please refer to uob.com.sg/PVcardprivileges for details.

^Cardmembers will be awarded with UNI$30,000 (equivalent to 60,000 air miles) two (2) months after the payment due date of the Membership Fee annually. UNI$30,000 will only be awarded upon receipt of full payment of Membership Fee and will not be awarded if the Membership Fee is waived. Advance crediting of UNI$ is not permissible. Cardmembers can choose to convert their UNI$ into air miles at the conversion rate of UNI$1 = 2 air miles. Visit uob.com.sg/rewards for details.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Please refer to UOB Insured Deposit Register for a list of UOB accounts / products that are covered under the Scheme.