You are now reading:

UOB Business Outlook Study 2024 (Indonesia): Positivity buoyed by digital success

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Indonesia): Positivity buoyed by digital success

Despite facing a string of macroeconomic challenges in 2023, Indonesia saw its economic growth hit more than five per cent, aided by both construction and manufacturing sectors. Indonesian businesses, too, have reflected a buoyant outlook.

According to the UOB Business Outlook Study 2024 (SMEs & Large Enterprises), 92 per cent of respondents expect an improved business performance in 2024. To fuel growth, businesses are prioritising digitalisation and seeking new business partnerships.

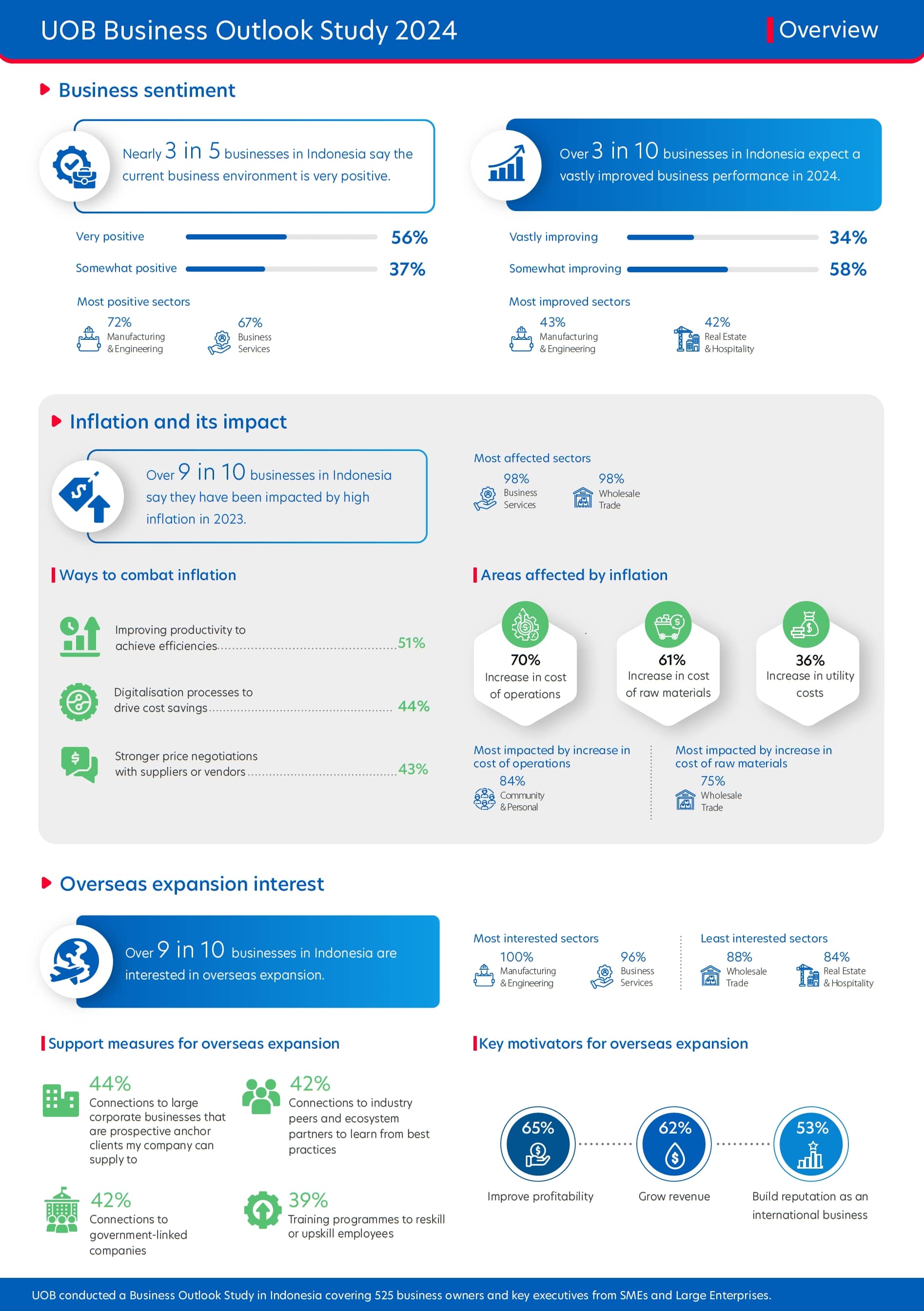

Figure 1: Snapshot of the key insights from businesses in Indonesia

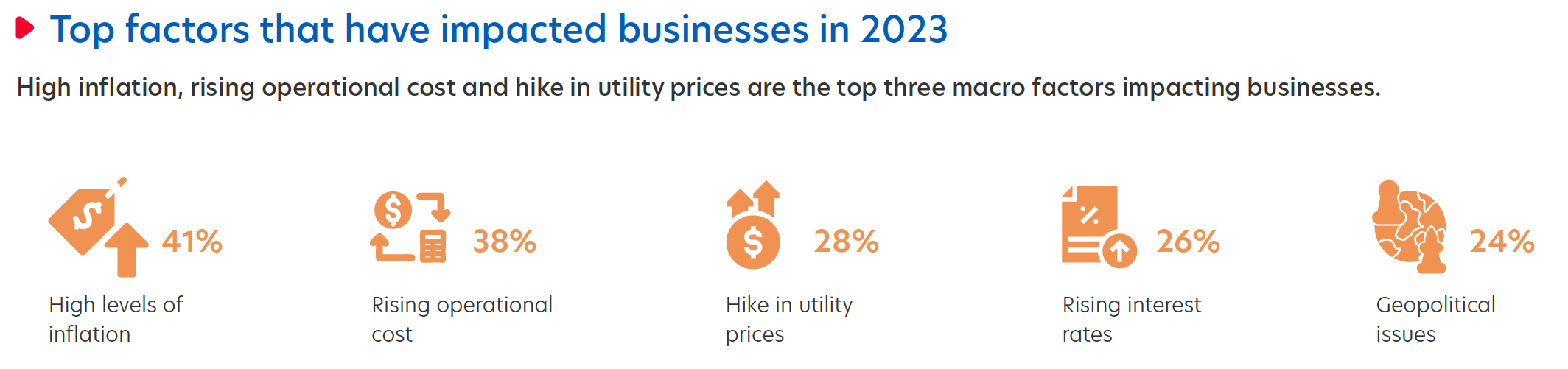

High inflation has impacted the bottom lines of nine in 10 businesses, leading to increased operating cost, material expenses, and utility bills.

Figure 2: Businesses were most impacted by high inflation and rising operational costs last year

However, Indonesian businesses remain upbeat, with nearly three in five expressing a ‘very positive’ outlook towards the current business environment.

Nearly half expect the business environment to improve by 2025, a higher number compared with the previous year. With revenue growth projections remaining strong post-pandemic, nine in 10 anticipate annual revenue growth.

To make this a reality, businesses are focusing on product/service expansion, collaboration with industry bodies, and digitalisation efforts.

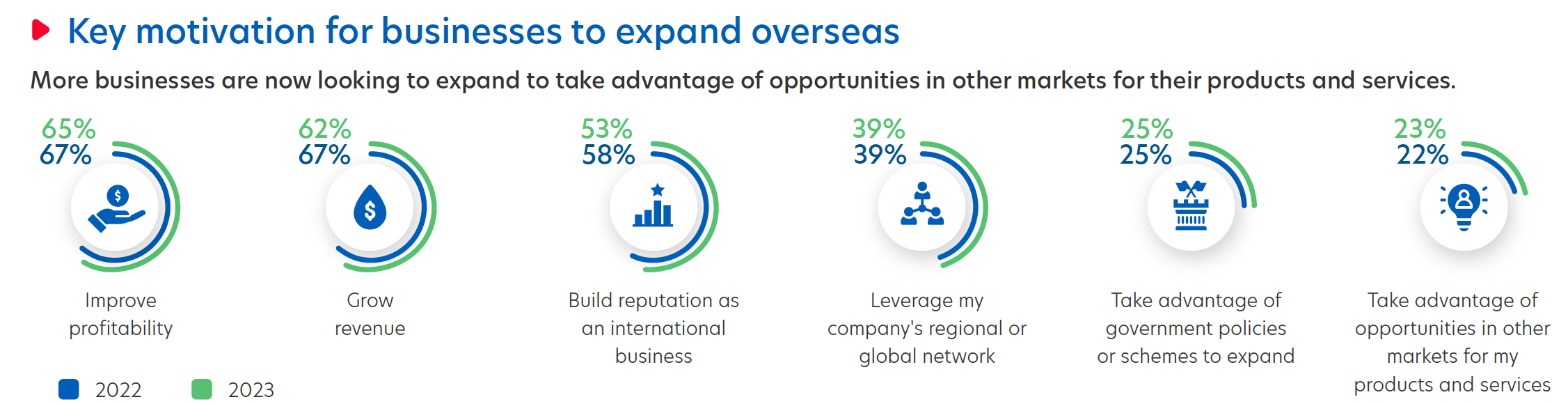

Driven by increased profitability and growth, more than nine in 10 Indonesian businesses are keen on expanding overseas within the next three years. Companies within the manufacturing and engineering sector and medium enterprises show stronger interest in venturing abroad.

The primary markets for expansion remain close to home, with ASEAN (Malaysia, Singapore, Thailand) and the Rest of North Asia (South Korea, Japan) as preferred spots.

Figure 3: Top factors motivating Indonesian businesses to expand overseas

The Indonesian e-commerce market is projected to grow significantly, from US$52.9 billion in 2023 to US$86.8 billion by 2028, highlighting its remarkable potential. To facilitate expansion efforts, many are embracing cross-border digital trade platforms that offer access to international markets and enable seamless transactions.

However, two in five face challenges such as finding suitable partners, securing financing, and having limited in-house communication/marketing resources. Opportunities to connect with perspective partners, industry peers, and government-linked companies will help drive their expansion efforts.

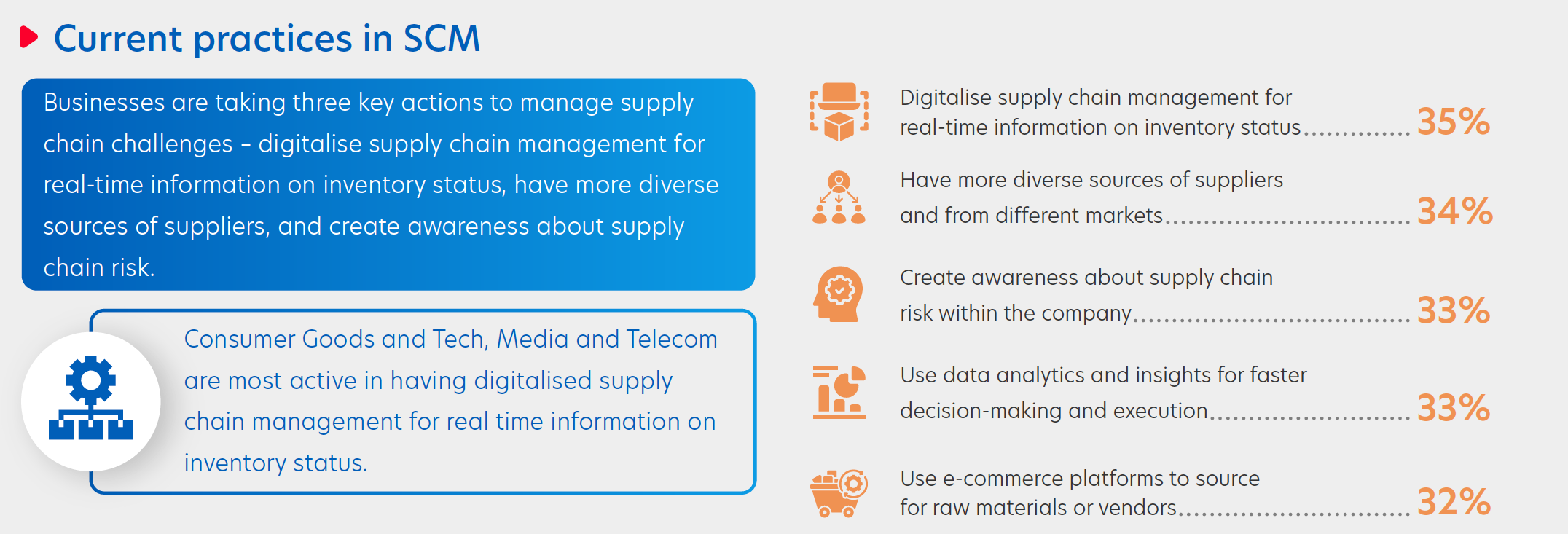

Supply chain management is deemed crucial by more than nine in 10 businesses, notably for those in manufacturing and engineering, and the tech, media and telecom sectors.

According to the report, while fewer Indonesian businesses are now impacted by geopolitical tensions compared with 2022, the country continues to be more affected than the regional average.

Rising supply costs, exacerbated by high interest rates, pose significant challenges, particularly for businesses in the construction and infrastructure sector.

Figure 4: Top practices to manage supply chain volatility

To fortify their supply chains, businesses are prioritising digitalisation, supplier diversification, and internal risk awareness. Collaborative opportunities and connections with technology partners offer essential support in ensuring supply chain stability.

Top trading needs from financial partners include export services, invoice financing, and import services, highlighting the importance of financial support in navigating supply chain complexities.

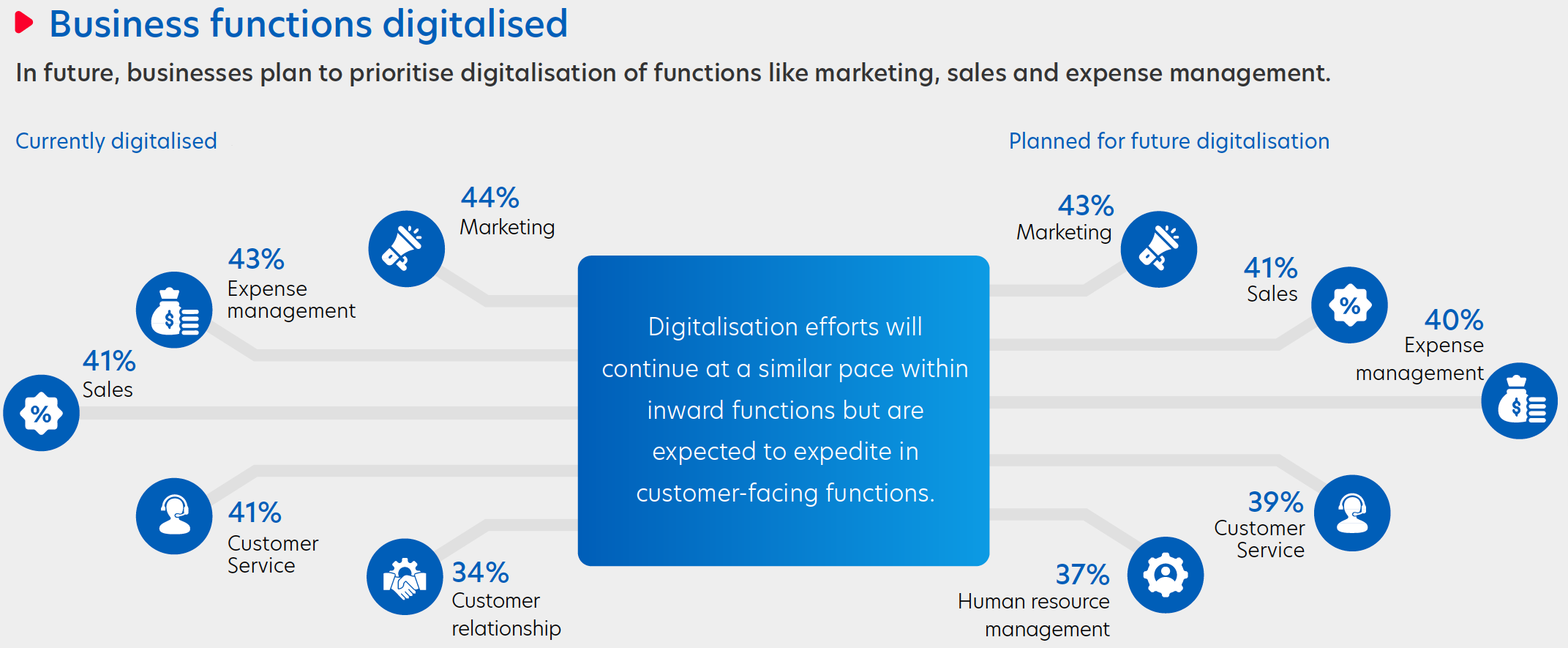

The digital adoption rate remains high, with nine in 10 companies embracing digitalisation in at least one department. Businesses in manufacturing and engineering, tech, media and telecom sectors, along with medium enterprises, lead the way in digital adoption.

Digitalisation has proven instrumental in driving productivity, increasing customer outreach, and enhancing overall business performance.

Figure 5: Functions being digitalised by businesses in Indonesia

However, concerns over cybersecurity (47 per cent), data breaches (36 per cent), and high implementation costs (31 per cent) remain key challenges for businesses on their digital adoption journey.

Hence, Indonesian businesses lag behind others in the region in embracing digital solutions. This lag can be partly attributed to the disparity in digital adoption across different regions of Indonesia, where infrastructure and access to technology vary widely.

Addressing this gap requires offering crucial support, including connecting medium enterprises with industry peers and ecosystem partners. Collaborations like such provide valuable insights and resources to navigate the digital landscape effectively.

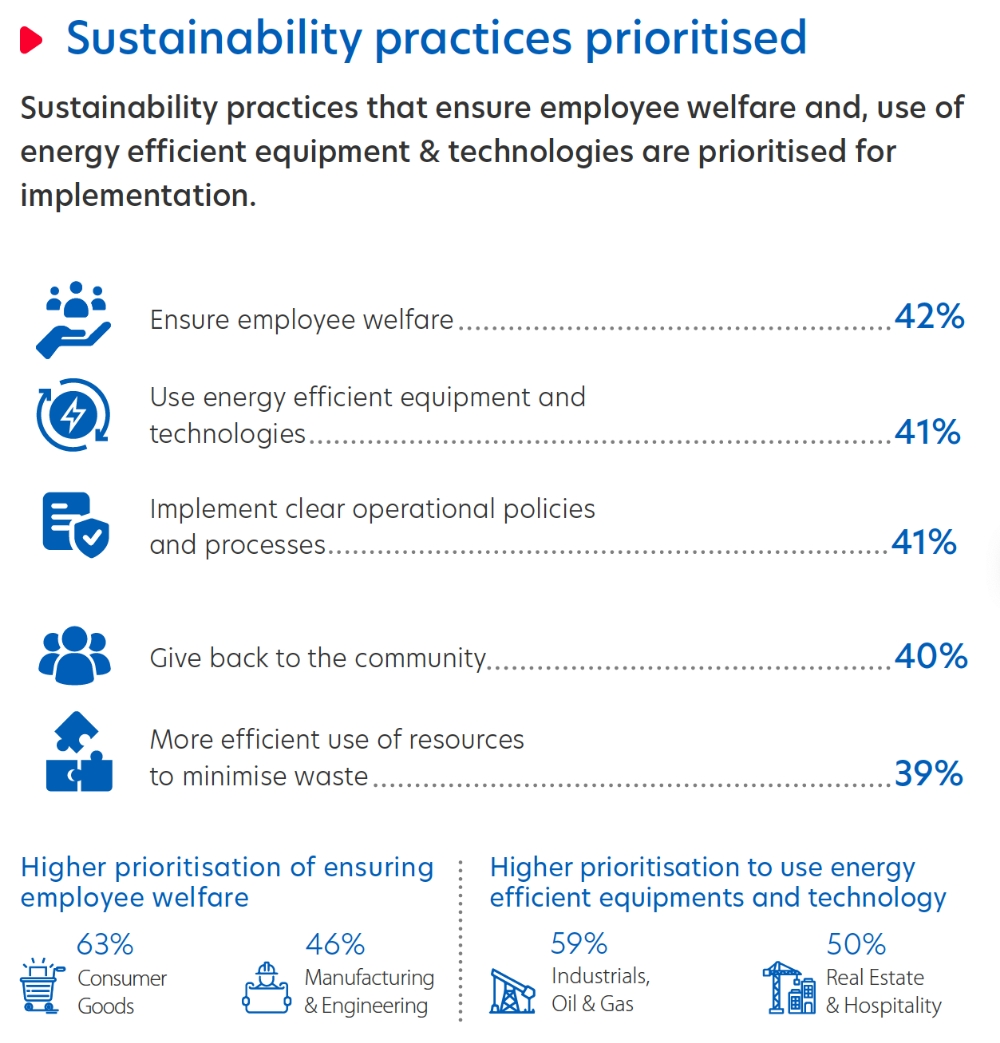

Over nine in 10 acknowledge the importance of sustainability, yet, adoption remains stagnant, with just over two in five companies embracing such practices. Key drivers for sustainability include the desire to enhance business reputation, attract investors, and gain a competitive edge.

Figure 6: Indonesian businesses welcome sustainable practices for direct cost savings

However, nearly three in 10 respondents cite worries about increased costs and insufficient government support. Initiatives such as government or industry awards for sustainable practices provide recognition and serve as learning platforms for businesses looking to kickstart their sustainability journey.

Additionally, financial incentives like tax breaks and sustainable financing options can alleviate profitability concerns.

UOB is committed to supporting businesses on their sustainability journey, offering a suite of tailored financing solutions to address the diverse needs of businesses at every stage of their sustainability journey.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (Indonesia) surveyed 525 business owners and key executives from SMEs and Large Enterprises to understand their views on key topics, including:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ