You are now reading:

UOB Business Outlook Study 2025 (Thailand): Supply chain disruptions spark regional pivot

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Thailand): Supply chain disruptions spark regional pivot

The ripple effects of the recent US tariffs have swept across ASEAN countries and Thailand is no exception.

Findings from the UOB Business Outlook Study 2025 reveal that business sentiment in Thailand, which started the year on cautious footing, has taken a visible hit. It highlights the fragile confidence among Thai businesses navigating a high-cost, high-risk environment.

While optimism has not vanished entirely, the shift in mood reflects deeper pressures such as rising inflation, operational cost burdens, and the compounding impact of global economic shifts.

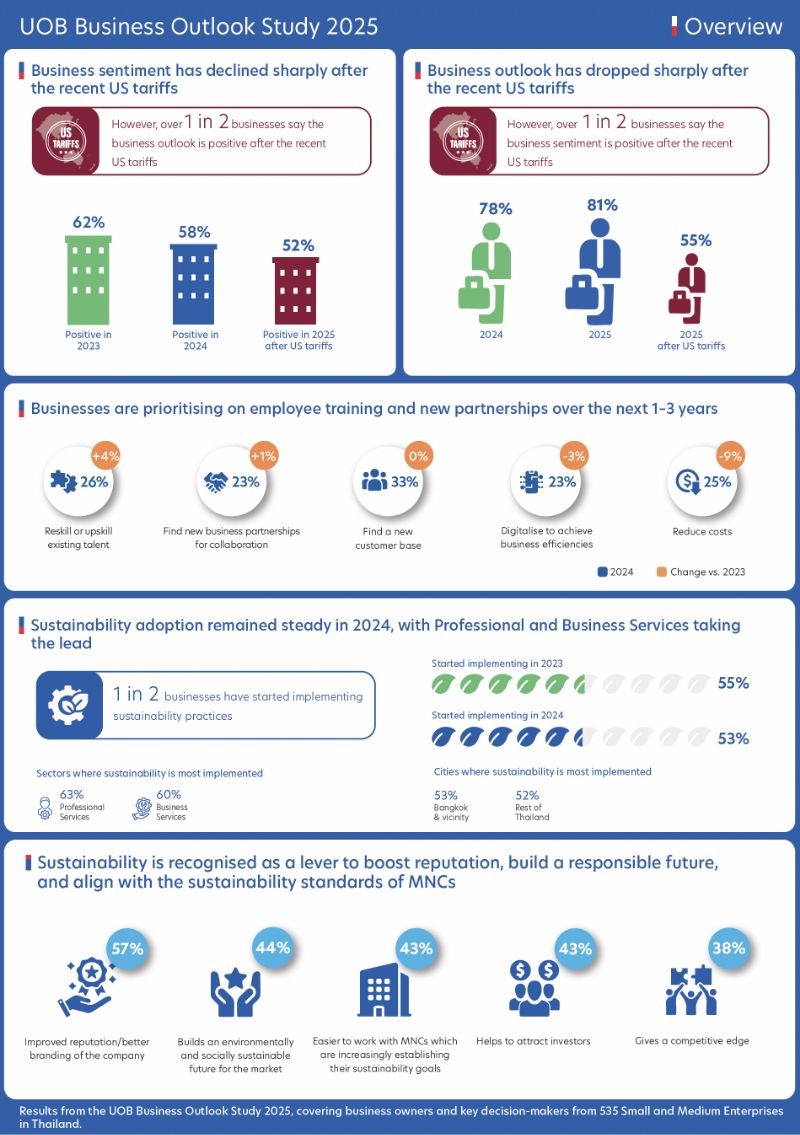

Figure 1: Snapshot of the key findings from businesses in Thailand

While positive business sentiment has slipped by 6 percentage points from 58 per cent in early 2025, Thailand’s business outlook has taken a larger hit, dropping by 26 percentage points.

Rising operational costs and inflation remain the twin challenges across all business sizes.

Following the tariffs, over half of Thai businesses expect inflation to increase further, while 60 per cent anticipate mounting cost pressures. The Real Estate and Hospitality sectors are especially affected by it.

In response, businesses are getting pragmatic. Three in five have already implemented cost-cutting measures to soften the blow of impending tariffs, with Medium Enterprises taking the lead (67 per cent).

Yet, cost management is only part of the picture. There’s a growing shift towards long-term thinking. Many are doubling down on revenue growth strategies such as finding new customer bases and forging strategic partnerships.

To move forward, Thai businesses are looking for tangible support. Financial aid (92 per cent), trade and supply chain support (65 per cent), and consultancy and training support (50 per cent) top the list of needs as businesses brace for further uncertainty and work towards a more resilient future.

Digitalisation remains a strong pillar of business transformation, with nearly four in 10 businesses fully integrating digital tools across their operations. However, industries such as Consumer Goods, Industrials, and Oil & Gas are trailing in digital maturity.

Post-US tariff announcements, 68 per cent of businesses expect digitalisation to accelerate, especially among Medium Enterprises.

Figure 2: Key benefits for firms due to digital adoption

Digital adoption has enhanced customer engagement, customer reach, and speed to market. As a result, businesses intend to digitalise customer-facing functions and supply chain processes.

Cybersecurity risks remain the top concern, followed by costs and rising data breach risks. To address these, businesses are turning to training programmes, access to knowledge and expertise, and industry-relevant analytics and insights.

Sustainability is firmly on the radar for Thai businesses, but translating intent into action remains a work in progress.

While over 90 per cent of enterprises consider it important, actual adoption sits at just 53 per cent. This figure is due to slower take-up among Medium Enterprises.

The recent US tariff announcement has added new urgency to this agenda. More than three in five businesses now anticipate an accelerated shift towards sustainability.

Yet, the barriers remain familiar: lack of infrastructure, higher costs, and inadequate financial support. Many businesses also grapple with consumer purchasing behaviour. End customers are unwilling to pay more for sustainable products, resulting in revenue and profit pressures on businesses.

Figure 3: Reasons why Thai businesses are adopting sustainable initiatives

Still, the intent to move forward is clear. Nearly 40 per cent of businesses are actively exploring renewable energy infrastructure. They are also seeking advisory services, training programmes, and access to business analytics and insights.

“I think there is a growing trend of customers looking for sustainable and eco-friendly products, which is challenging because those products, by definition, are not mass-produced, hence, they are more expensive.”

CEO, Tech, Media & Telecom sector, Thailand

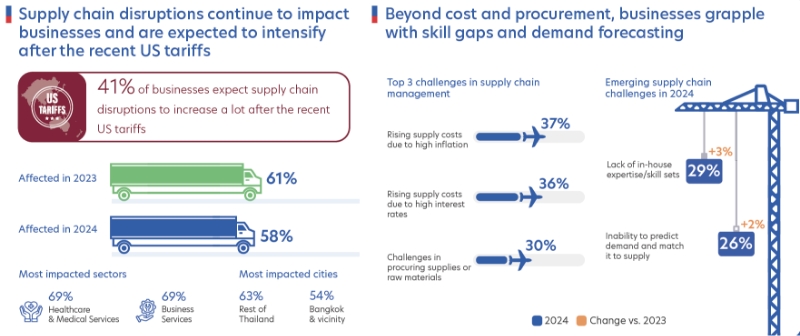

With supply chains still under strain, nine in 10 companies consider supply chain management (SCM) as important to their business.

Inflation and high interest rates have driven up supply costs. Four in 10 businesses rely more on data analytics for faster decision-making to stabilise their supply chains. In fact, analytics has overtaken diversification as the top SCM action in 2024.

The pressure has only intensified following the US tariff announcements. Eight in 10 Thai businesses now anticipate greater disruptions across their supply chains.

In response, many are turning to regional alternatives, with intra-ASEAN trade expected to rise.

Figure 4: More supply chain disruptions are expected in the near future

"90 per cent of the ingredients or the raw materials can be locally sourced, allowing access to various supplier options and enhancing bargaining power. However, a major challenge lies in the volatility of exchange rates and tariffs, which pose significant uncertainties and risks.”

CMO, Tech, Business Services sector, Thailand

Thai businesses are seeking diverse support in SCM, ranging from tax incentives and technology access to workforce training and strategic partnership.

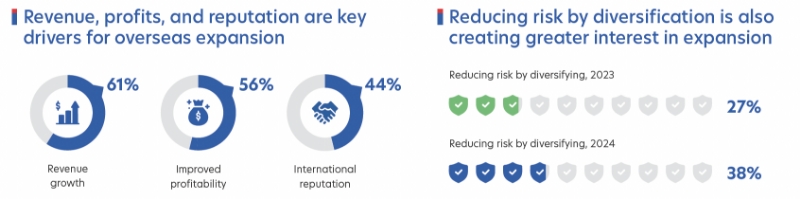

Thai businesses are looking beyond borders with growing conviction. Nearly 90 per cent expressed interest in overseas expansion, with top destinations being within ASEAN. Following the tariffs, more than half anticipate the pace of expansion to accelerate.

Within ASEAN, businesses are primarily focused on Malaysia, Singapore, and Vietnam. Beyond the region, China and other North Asian markets follow closely behind.

Figure 5: Top three factors driving overseas expansion for firms

The primary drivers are revenue growth and increased profitability, with one in three medium enterprises also citing government schemes as a motivator. However, considerable hurdles persist, including a lack of local customers, insufficient knowledge, and inadequate legal support.

To overcome these, businesses are seeking greater access to business insights, financial support, and opportunity to connect with industry peers.

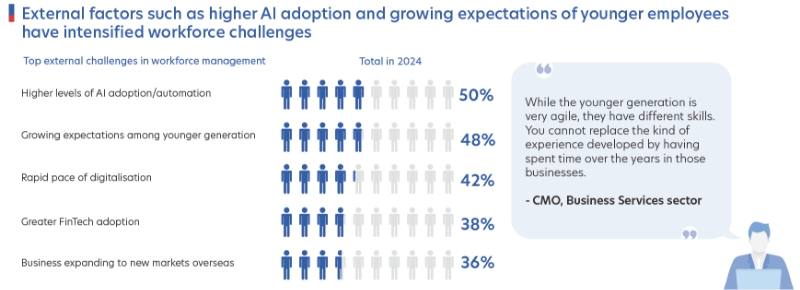

Workforce issues remain a major concern. One in two businesses report being significantly affected by challenges related to workforce expectations, especially around compensation and flexible work arrangements.

These challenges are amplified by rapid advances in AI and growing expectations among the younger generation in the workplace.

Figure 6: Greater AI adoption and younger talent expectations are contributing to workforce challenges

Nearly 40 per cent of Thai businesses report difficulty in retaining talent or preventing them from moving to other lucrative markets. Businesses are addressing these issues through multiple strategies such as offering higher pay, digital transformation, flexible work arrangements, and even job rotations.

Women-led businesses in Thailand are charting an optimistic path forward. Compared to their male-led counterparts, they report a more positive business outlook (83 per cent). These leaders also tend to be younger and are more prominent in small enterprises.

A distinguishing trait among women leaders is their heightened emphasis on customer experience.

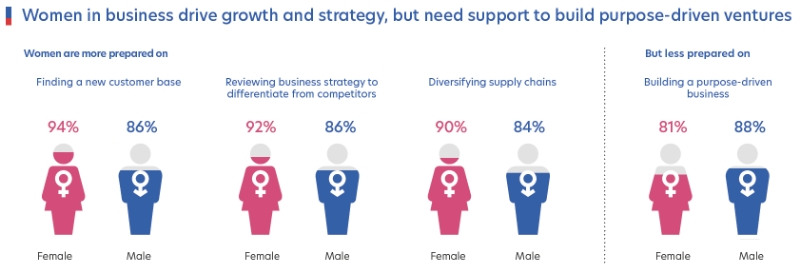

Figure 7: Areas of strengths of women in business and key challenges they face

From improving user-friendly channels for customer interaction (57 per cent) to adopting digital payment for seamless transactions (51 per cent), women-led businesses are leaning into customer-centric approaches to drive growth and loyalty.

Thailand’s business scene is increasingly shaped by a new generation of leaders. More than half of all business decision-makers today are Next Gen leaders—defined as those taking over their family business. They are often found leading General Management (36 per cent) and Marketing/Sales (18 per cent) functions, particularly within the Consumer Goods and Business Services sectors.

These leaders prioritise long-term initiatives, with a strong emphasis on digitalisation and sustainability practices over cost concerns.

Tech-savvy and future-focused, Next Gen leaders are also early adopters of new technologies.

As Thai businesses adapt to mounting costs, supply chain strain, and shifting global trade, many are responding with resilience and recalibration.

From accelerating digitalisation to deepening sustainability efforts and expanding across ASEAN, the focus is on long-term growth through strategic transformation.

With tailored financial solutions, cross-border capabilities, and deep regional insight, UOB is here to support enterprises and to help unlock new opportunities ahead. Contact us to find out more.

The UOB Business Outlook Study 2025 (Thailand) surveyed 535 business owners and senior executives from SMEs and Large Enterprises in Thailand. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

25 Jun 2025 • 5 mins read

12 Jun 2025 • 6 mins read

09 Jun 2025 • 5 mins read

Get the UOB Business Outlook Study 2025 (Thailand). Download key findings