You are now reading:

UOB Business Outlook Study 2025 (Vietnam): Pushing for growth and reform

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Vietnam): Pushing for growth and reform

Vietnam’s business landscape is recalibrating in the face of rising costs, inflation, and global policy shifts.

Following US President Donald Trump’s announcement of ‘reciprocal’ tariffs in April, Vietnam was hit with one of the highest rates among America’s trading partners—a staggering 46 per cent on its exports to the United States.

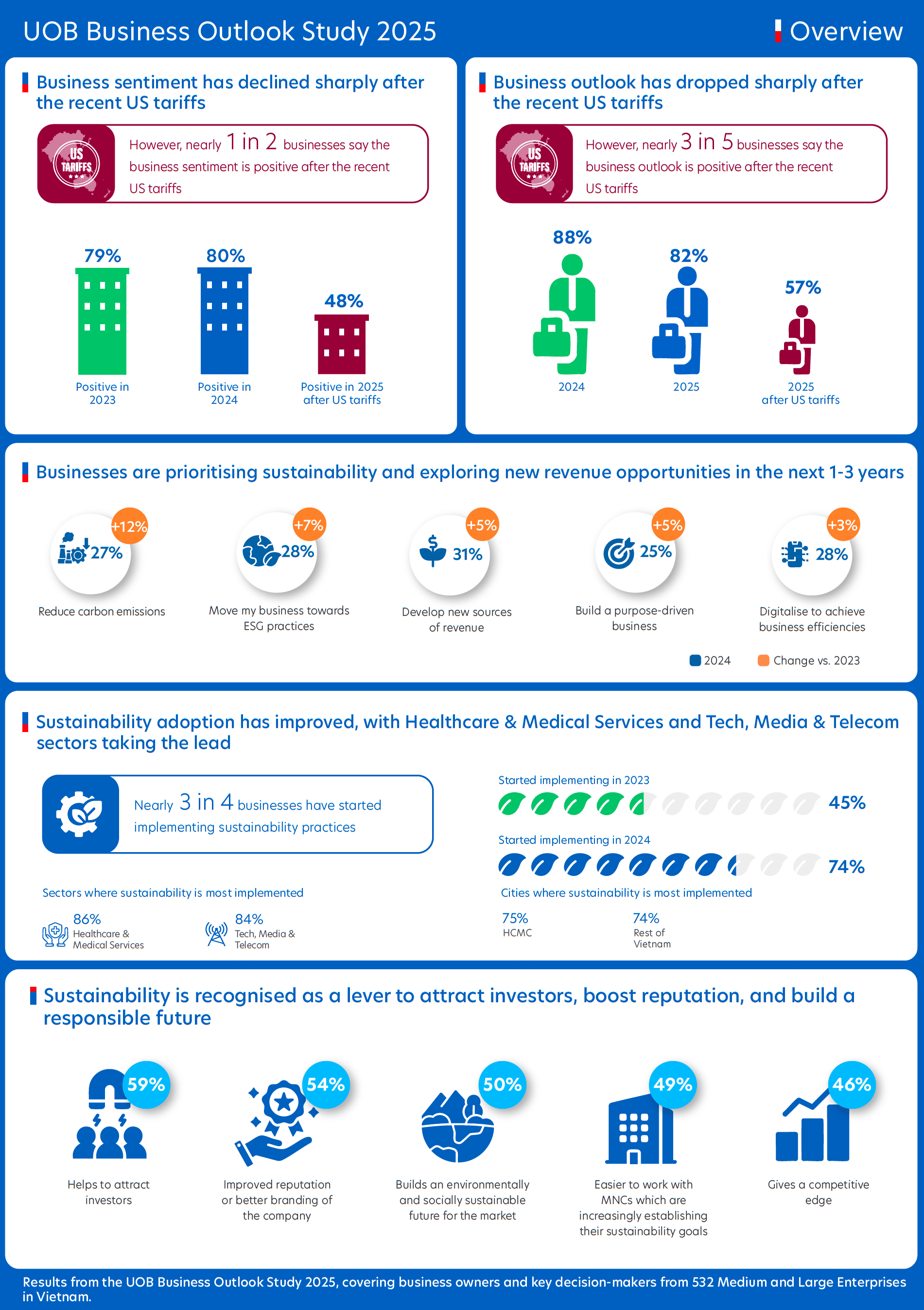

The impact on business sentiment was immediate, with positive sentiments falling from 80 per cent at the start of the year to just 48 per cent, according to the UOB Business Outlook Study 2025.

In response, the Vietnamese Government has accelerated trade negotiations and is exploring ways to restructure its economy to support growth, especially in the areas of digital, green and circular development. Despite the macroeconomic uncertainty, the Government is keeping its 2025 gross domestic product (GDP) target of at least 8 per cent growth for now.

With strong fundamentals in manufacturing, digitalisation, and sustainability, Vietnam remains well-positioned to adapt and attract long-term investment.

Figure 1: Snapshot of the key findings from businesses in Vietnam

As business sentiment softens, especially among large enterprises, 57 per cent of respondents expect growth in the year ahead – a drop of 25 percentage points.

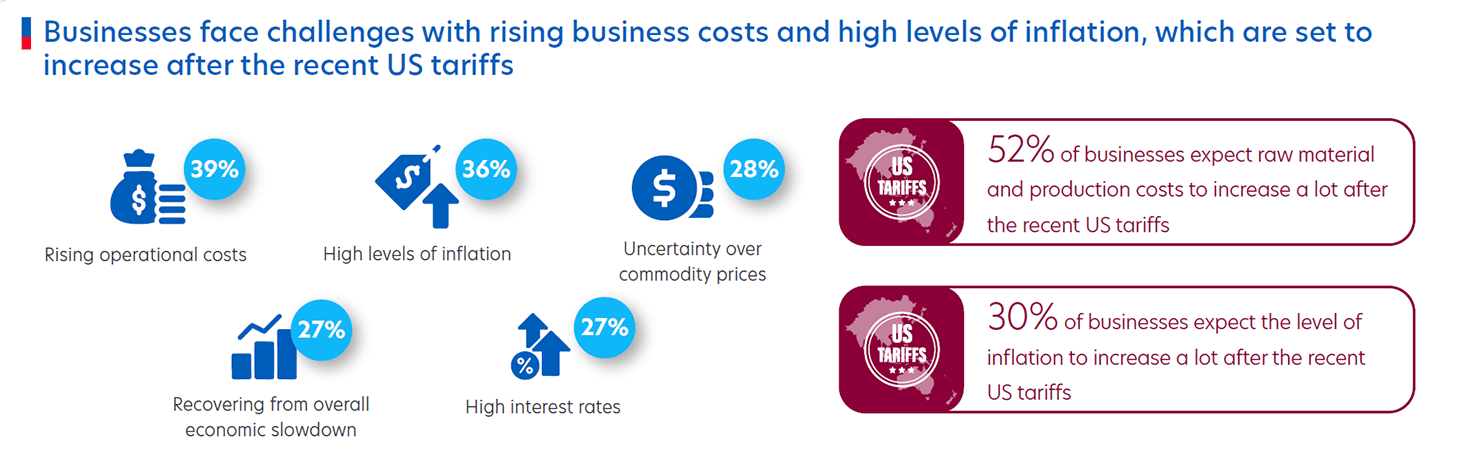

Cost escalation is driving this recalibration. Operational expenses now top the list of concerns, rising to 39 per cent from 31 per cent last year. Six in 10 firms cite growing pressure from raw materials and operations, with equipment costs biting deeper than before.

Rather than stalling, businesses are adapting. The focus is now on creating long-term value: unlocking new revenue streams, streamlining through digital tools, and building greener operations. Tax incentives, strategic partnerships, and better access to funding are helping turn these ambitions into action.

Figure 2: Key concerns of Vietnamese businesses

More than 90 per cent of respondents view sustainability as important, and three in four have already begun implementation. Medium Enterprises and firms in Hanoi are leading the way, driven by tighter operational discipline and rising investor expectations.

Vietnam’s rise as a key China Plus One alternative has put business reputation high on the corporate radar. Sustainability is a way to attract investors (59 per cent), boost reputation (54 per cent), and build a responsible future (50 per cent). It also opens doors to partnerships with multinationals and supports more efficient resource use – particularly among Medium Enterprises.

Government policy underpins the winds of change towards sustainable energy. A revised energy roadmap targets phasing out coal usage by 2050 and expanding solar and wind capacity. Challenges persist, however, from infrastructure gaps to pricing pressure and profit concerns.

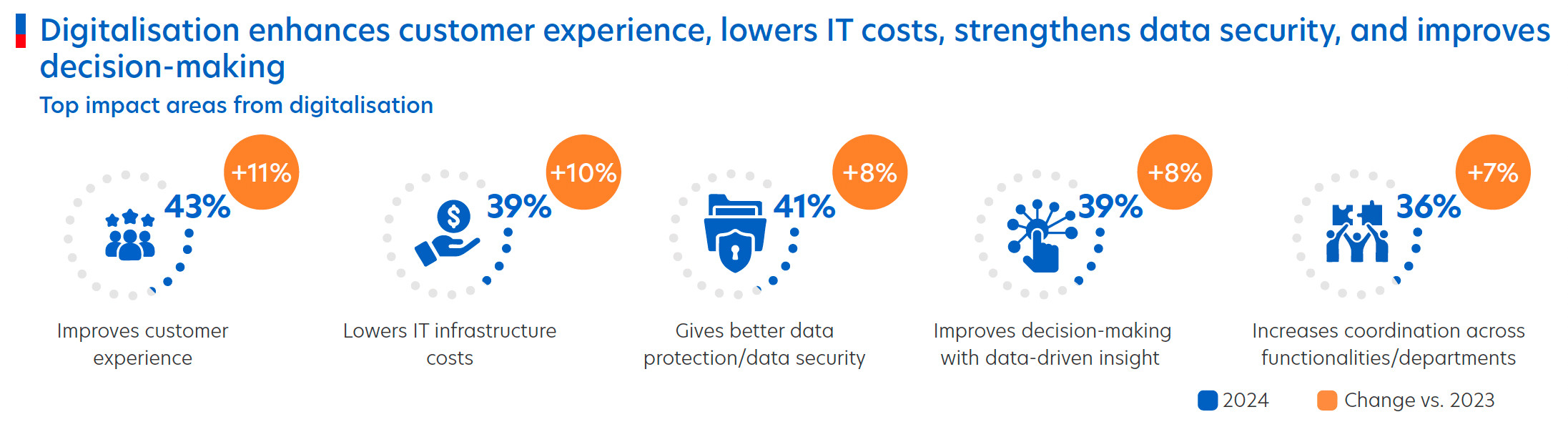

Digital adoption is surging across Vietnam, with over 90 per cent of businesses now using digital solutions. Large Enterprises lead in adoption, but Medium Enterprises are driving future growth – nine in 10 plan to increase investments in digital transformation in 2025.

Figure 3: Key benefits for firms due to digital adoption

Firms are prioritising logistics, partner management, and marketing. The returns are clear: improved customer experience, stronger performance, and wider reach. But risks are rising. Cybersecurity tops the list of concerns, followed by data breaches.

“We are struggling with cybersecurity and are vulnerable to attacks. We hope that we’re not big enough to warrant an attack.”

CEO, Entertainment Sector, Vietnam

Vietnam’s new data laws, set to take effect in July 2025, aim to strengthen digital trust and data governance. To keep up, businesses need better training, access to trusted tech providers, and sector-specific insights.

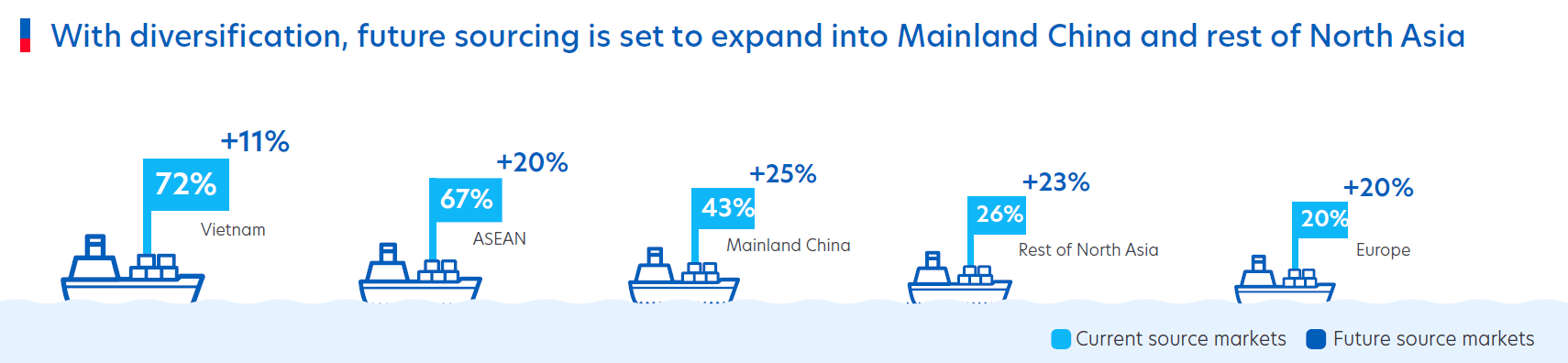

Vietnamese businesses are retooling their supply chains amid rising pressure. Nine in 10 respondents say supply chain stability is essential – especially in Consumer Goods, Manufacturing, and Business Services.

Escalating costs from inflation and interest rates are forcing firms to reassess sourcing strategies and operational efficiency.

Beyond cost, companies are managing inventory constraints, geopolitical uncertainty, and limited supplier network. In response, many are broadening their sourcing beyond ASEAN, eyeing China, North Asia, and Europe to reduce concentration risk.

Figure 4: Vietnamese businesses plan to further diversify their suppliers

To reinforce resilience, businesses are doubling down on supply chain digitalisation. Strong existing supplier relationships provide a foundation, but scalability remains a challenge.

Companies are now turning to solution providers and industry collaborations to close capability gaps and build a more agile, future-ready supply chain.

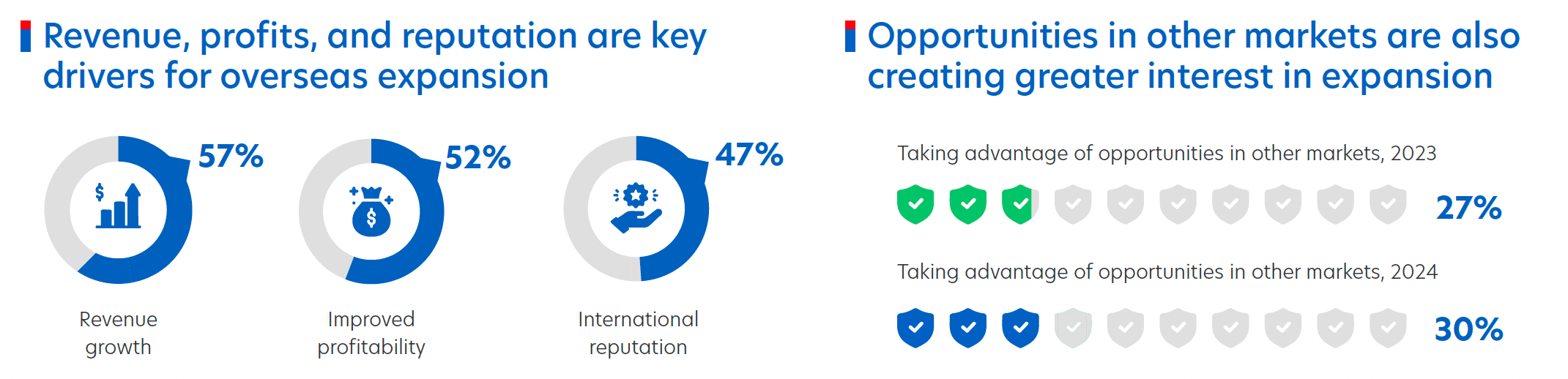

Nearly nine in 10 respondents are eyeing overseas expansion – driven by growth and profit ambitions. Interest is broadening beyond Asia, with one in four firms prioritising Europe for both current and future growth.

Figure 5: Top three factors driving overseas expansion for Vietnamese businesses

Thailand and Singapore remain top ASEAN targets. Notably, seven in 10 businesses in Hanoi plan to expand into Thailand, signalling strong regional integration.

However, firms cite difficulties in finding the right partners, securing funding, and navigating regulatory environments.

Limited access to market insights and collaboration opportunities further constrain progress. Addressing these gaps will be key to unlocking Vietnam’s full outbound potential.

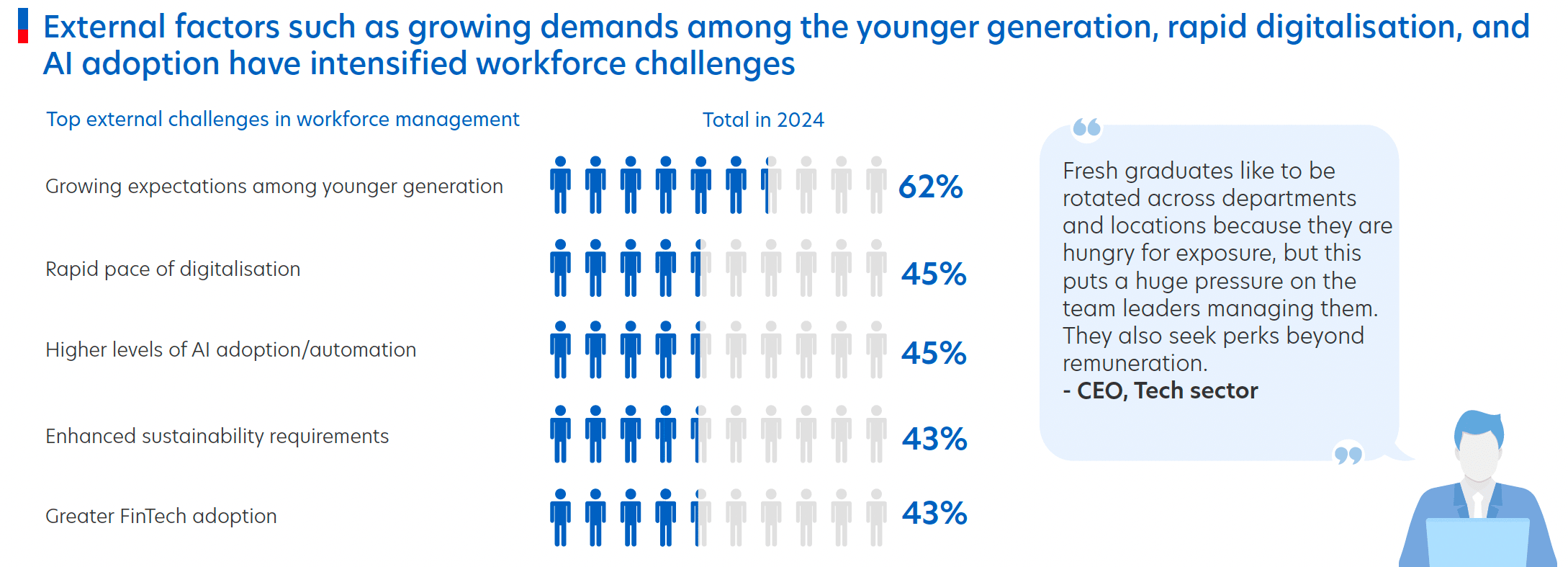

Workforce issues are affecting one in two Vietnamese firms, with Wholesale Trade and Professional Services feeling the strain most. The core challenge lies in meeting higher employee expectations while retaining talent and preventing outflow to more competitive markets.

Figure 6: Younger talent expectations and rapid digitalisation have added to workforce challenges

In response, firms are boosting pay, benefits, and training. Two in five are also redesigning work models with digital tools, job rotation, and cross-functional collaboration to better align workforce capabilities with evolving business needs.

As competition for talent intensifies, the ability to retain and develop people is becoming a core pillar of enterprise resilience and long-term performance.

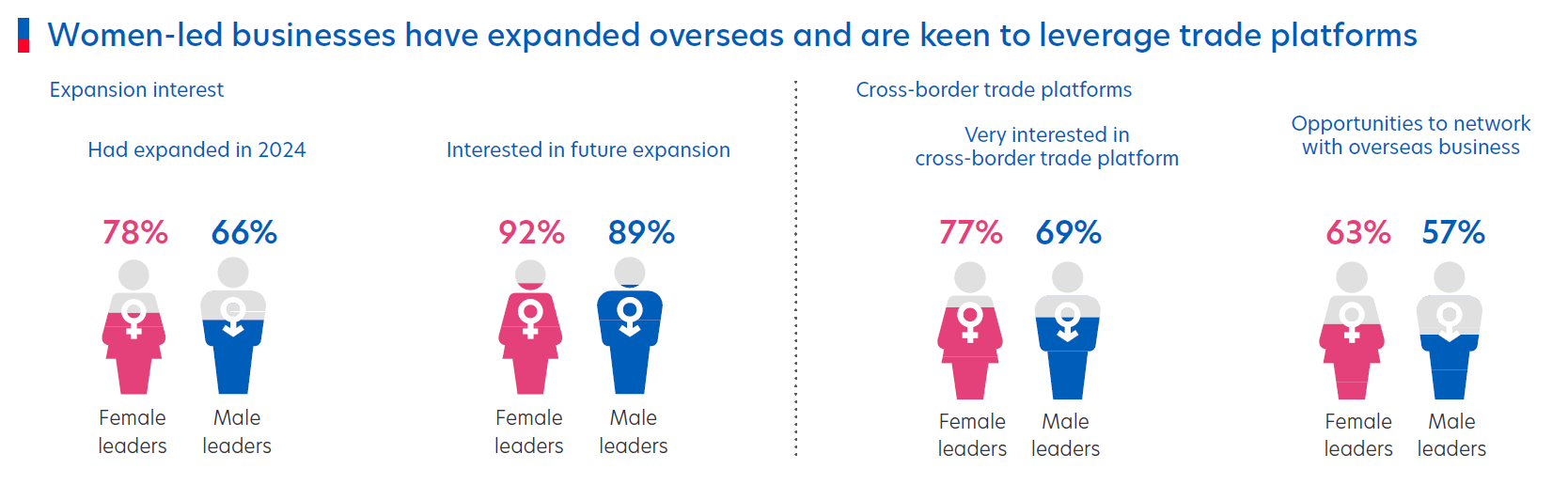

Vietnam has a higher proportion of women leaders at 47 per cent, compared with the ASEAN average of 36 per cent.

In Vietnam, women-led firms are more optimistic than male-led peers about business prospects and expect better revenue growth in 2025.

Figure 7: Women leaders have higher interest in expansion and cross-border trade platforms

Their edge lies in a sharper focus on digital tools for better customer experience. Seventy-seven per cent of women leaders versus 73 per cent of men use AI or chatbots for real-time interaction. Sixty-five per cent of women-led businesses have adopted digital payments to speed up services. This contrasts with 60 per cent of businesses led by men.

Women leaders are also keen to network with international businesses. Seventy-seven per cent are keen on cross-border trade platforms, compared with 69 per cent of men.

Next Gen leaders now make up 73 per cent of business heads in Vietnam, with a greater concentration in the Consumer Goods sector. This is significantly higher than the regional average of 59 per cent.

They bring stronger optimism about business prospects and are more likely to anticipate an improved outlook for 2025.

Their approach is also defined by long-term thinking. Rather than focusing on short-term cost-cutting, they prioritise sustainability, innovation, and new revenue streams.

These Next Gen leaders are steering businesses toward more resilient, future-ready models and are thus open to emerging technologies such as AI, cloud and blockchain.

As Vietnamese enterprises navigate a rapidly evolving landscape, strategic clarity and resilient partnerships will be key. The UOB Business Outlook Study 2025 shows that transformation is underway, but capabilities vary.

At UOB, we are committed to helping businesses turn insight into action – whether through tailored financing, digital innovation support, or sustainable growth advisory. Partner with us to shape your next chapter and drive cross-border success.

The UOB Business Outlook Study 2025 (Vietnam) surveyed 532 business owners and senior executives from Medium and Large Enterprises in Vietnam. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

12 Jun 2025 • 6 mins read

09 Jun 2025 • 5 mins read

21 May 2025 • 6 mins read

Get the UOB Business Outlook Study 2025 (Vietnam). Download key findings