You are now reading:

UOB Business Outlook Study 2025 (Indonesia): Resilience amid shifting tides

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Indonesia): Resilience amid shifting tides

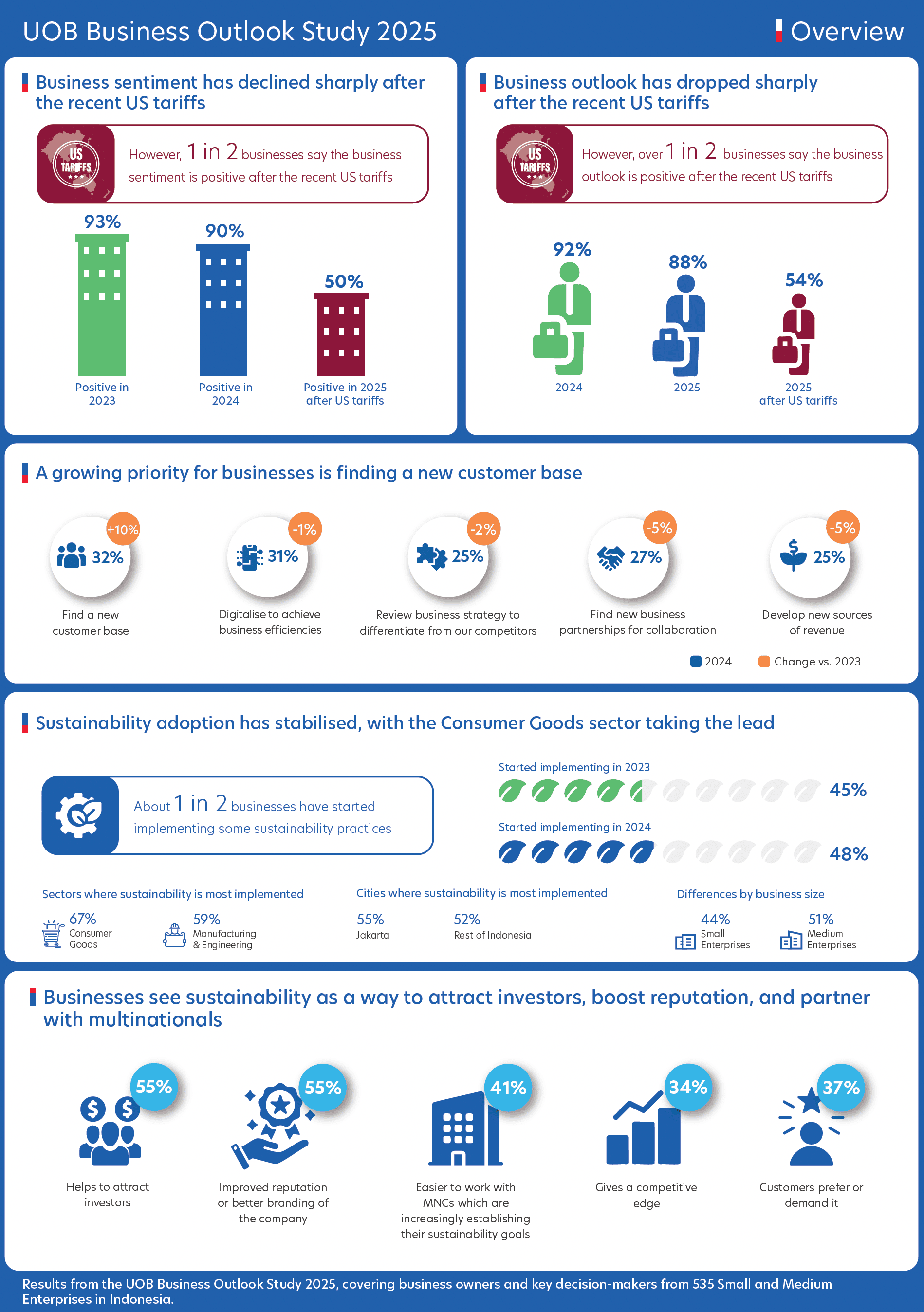

At the start of 2025, business sentiment in Indonesia was broadly positive, though increasingly tempered by a sharper focus on emerging risks.

Findings from the UOB Business Outlook Study 2025 painted a picture of stability, with 90 per cent of businesses expressing a favourable outlook for the year.

Since then, however, that optimism has faced headwinds—most notably from the recent US tariff announcements, which have introduced new uncertainties and prompted business leaders to rethink their strategies.

Figure 1: Snapshot of the key findings from businesses in Indonesia

Inflationary pressures, rising operational costs, and declining consumer demands continue to test the resilience and adaptability of businesses in Indonesia. Despite this, their ambition is clear. Businesses are prioritising revenue growth from 2026 onwards, with a strong focus on digitalisation and expanding their customer bases.

Businesses are seeking support through collaboration opportunities, tax incentives, and improved customer interaction channels to maintain momentum.

Digitalisation remains a key driver of performance, with nine in 10 Indonesian businesses digitising at least one area of operations.

Encouragingly, there is a notable uptick in commitment with almost nine in 10 of businesses planning to increase digitalisation spending in 2025, exceeding last year’s levels.

Post-tariff data shows this momentum is growing with 61 per cent of businesses. Digitalisation is also expected to accelerate, driven by productivity gains and improved business performance.

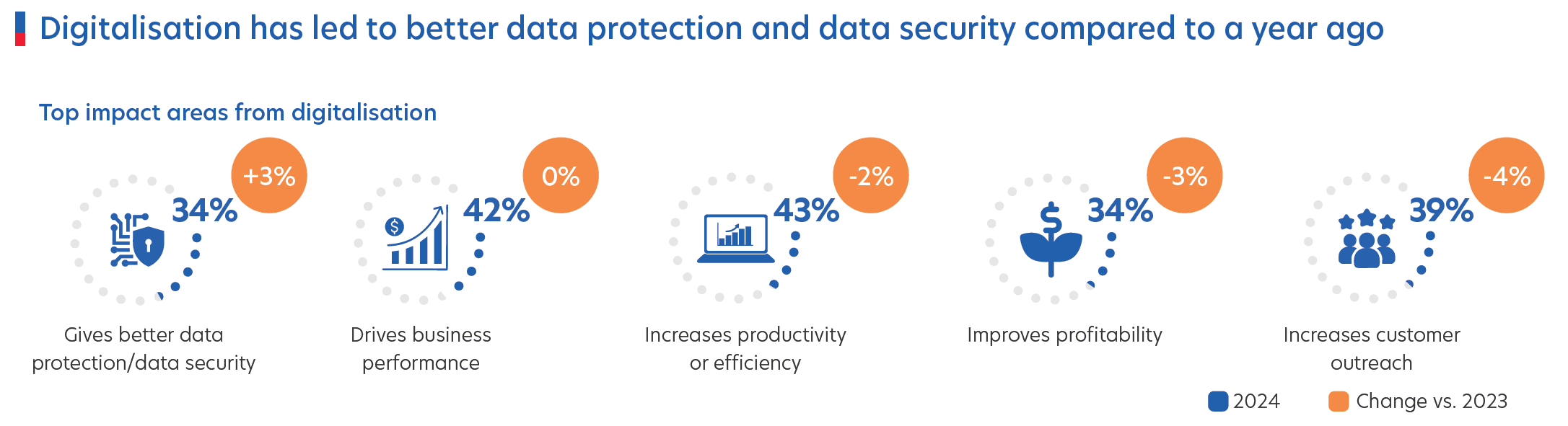

Figure 2: Key benefits for businesses due to digital adoption

Yet, the path forward is not without its complexities. Cybersecurity stands out as a key concern, particularly as businesses scale their digital footprints.

FinTech adoption continues to be on an upward trend, with 94 per cent of businesses incorporating FinTech solutions – specifically in investment, finance, and accounting.

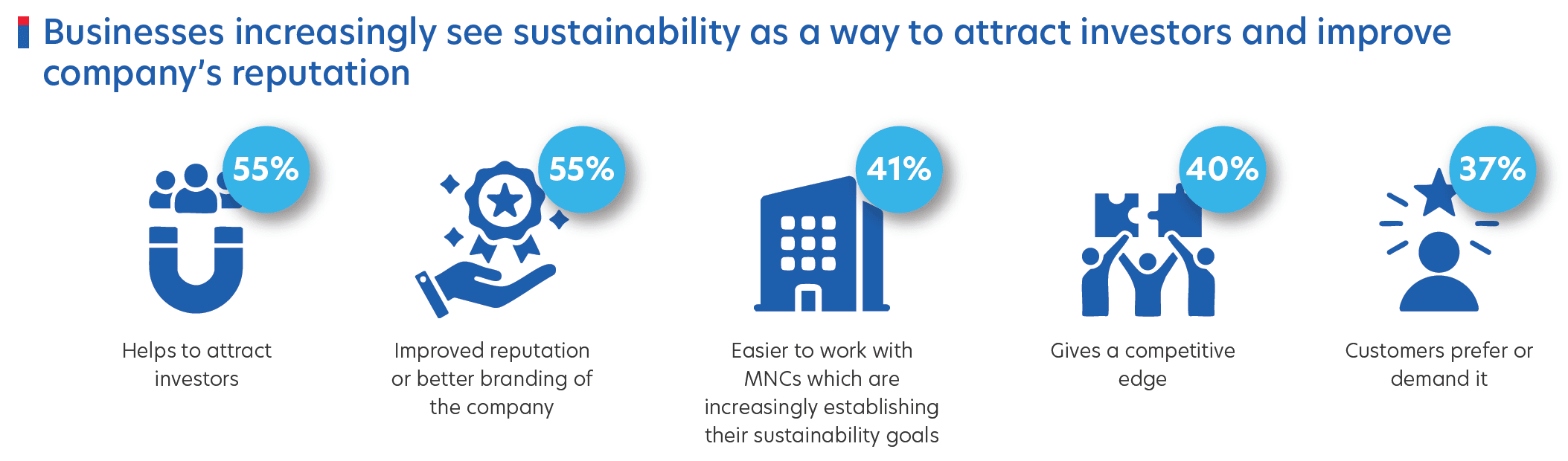

Sustainability continues to strengthen its foothold in the Indonesian business landscape. In 2024, nearly half of businesses had already implemented sustainable practices, with a consistent nine in 10 recognising its strategic importance.

Figure 3: Reasons why Indonesian companies are adopting sustainable practices

Following the tariff developments, about three in five businesses now anticipate faster adoption of sustainability practices. Beyond environmental responsibility, sustainability is increasingly viewed through a commercial lens to attract investment and enhance corporate reputation.

Energy-efficient upgrades and resource optimisation are among the most common tactics deployed. However, profitability concerns and the potential for increased end-customer pricing can challenge the transition.

Businesses are also signalling a clear need for support such as tax relief and collaborative partnerships. These can ease businesses from short-term financial strain while enabling long-term impact.

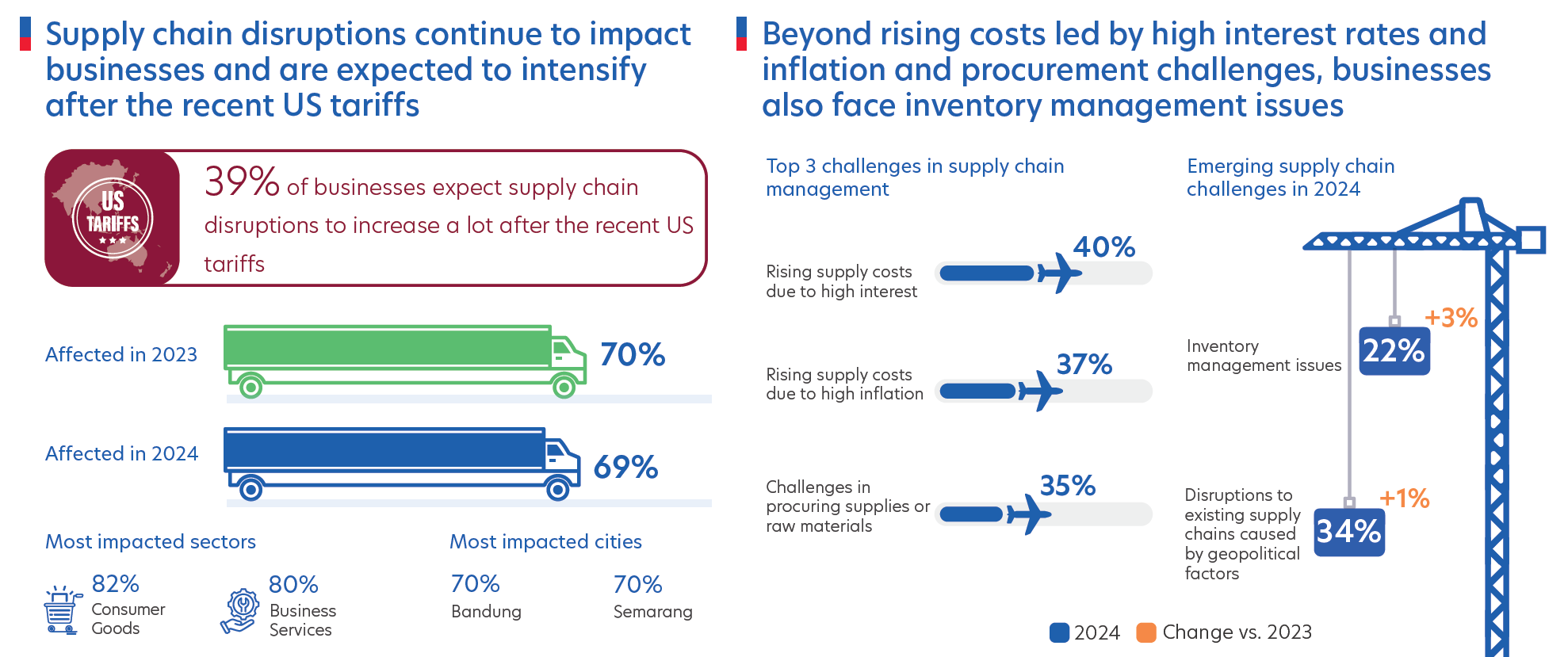

Supply chain management continues to rank among the highest priorities, with over nine in 10 businesses recognising its critical importance. This has been a consistent trend since previous years and is especially true in the Consumer Goods, Wholesale Trade, Industrials, and Oil & Gas sectors.

New findings following the tariff announcement reveal heightened anxiety, with 87 per cent of businesses anticipating greater supply chain disruptions.

At the same time, 66 per cent of businesses expect intra-ASEAN trade to grow. Both sourcing and end-customer locations are heavily concentrated within Indonesia and ASEAN, indicating strong regional integration.

To weather ongoing disruptions, businesses are actively pursuing collaboration opportunities and connections to ensure supply chain stability.

Figure 4: More supply chain disruptions are expected in the near future

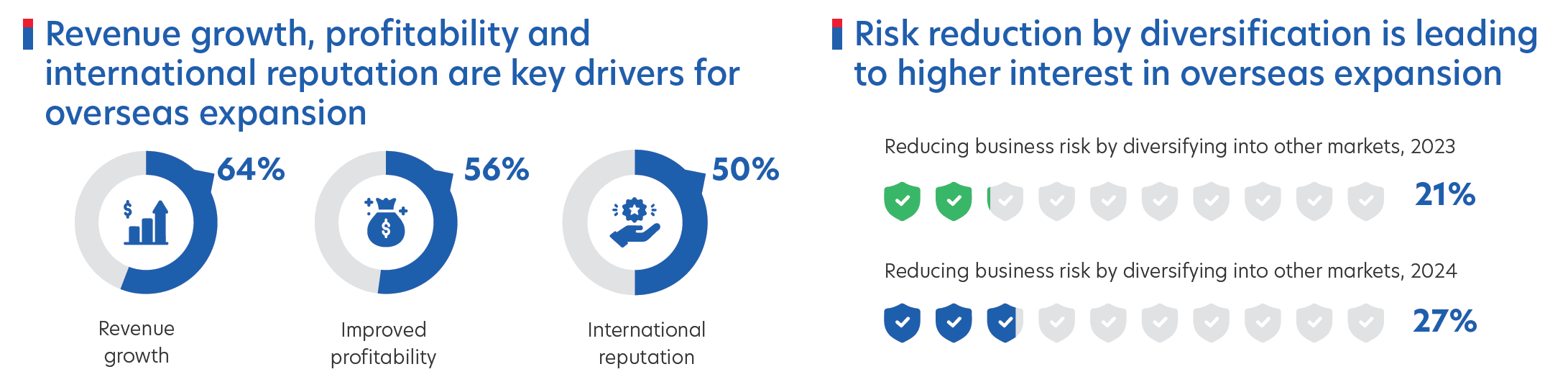

Despite prevailing headwinds, businesses continue to look outward for growth opportunities.

Nearly nine in 10 businesses in Indonesia expressed interest in overseas expansion, motivated by revenue growth. Interest in cross-border digital trade platforms remained stable from 2023 to 2024, with over nine in 10 companies consistently expressing slight to strong interest.

Figure 5: Top three factors driving overseas expansion for companies

Post-tariffs, Indonesian businesses expect the pace of overseas expansion to accelerate, particularly among medium enterprises. ASEAN markets remain top targets for expansion, with Malaysia, Singapore, Brunei, and Thailand leading the list. China and the broader North Asia region are also in focus.

“I want to increase my company’s presence and Singapore would be a great place to have our headquarters in terms of financial security."

CEO, Industrials Sector, Indonesia

However, entering new markets brings its own set of challenges. Finding the right partners (41 per cent), accessing funding (37 per cent), and finding collaboration opportunities (34 per cent) remain significant hurdles.

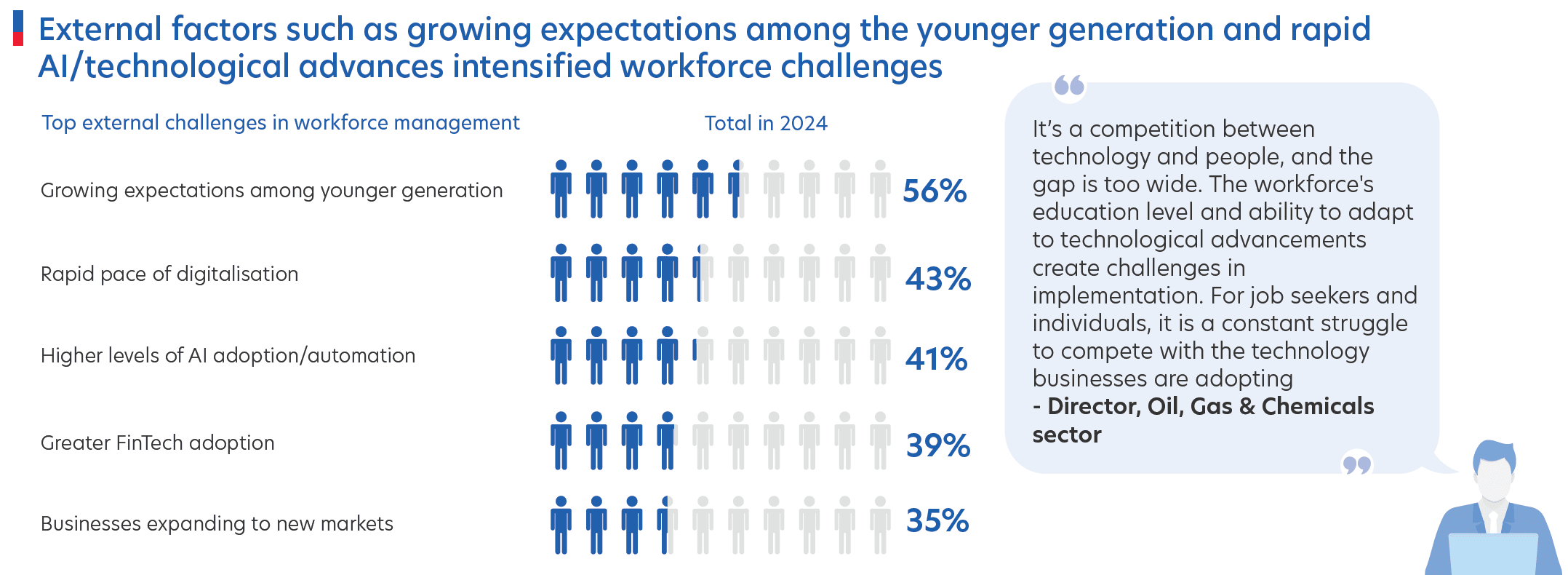

Workforce-related challenges have affected four in five Indonesian businesses across various sectors. The effect was most pronounced in Community & Personal Services (96 per cent) and Wholesale Trade (90 per cent).

Generational shifts and an evolving economic climate have led to core challenges around talent retention, recruitment, and rising employee expectations.

Figure 6: Younger talent expectations and rapid digitalisation are reshaping workforce challenges

The ongoing tariffs are expected to exacerbate these issues as both employers and employees are affected by inflation and rising costs.

In response, over two in five businesses have initiated training programs, salary increments, and automation initiatives. These measures are designed to reduce the widening skills gap and ease the broader economic conditions impacting manpower availability.

Women-led businesses in Indonesia are making strides in workforce welfare and sustainability. Many have invested in initiatives like employee health, diversity, and energy efficiency. However, challenges remain.

Compared to their peers, they are less likely to focus on business expansion or customer acquisition – often due to more limited access to funding, networks, and industry mentorship.

Figure 7: Areas of strengths of women in business and key challenges they face

Support in areas like partnership development and digital upskilling could help unlock further growth potential. With the right tools, women leaders are well-positioned to build purpose-driven, resilient enterprises that contribute meaningfully to Indonesia’s economic future.

Half of Indonesia’s business leaders now belong to the Next Generation (Next Gen) category – those taking over their family business. These emerging leaders are prioritising long-term goals such as digital transformation, ESG adoption, and employee wellbeing, rather than short-term cost-cutting or survival tactics.

They also demonstrate a greater openness to new technologies, including AI, blockchain, and AR, particularly in the Tech, Media & Telecom and Consumer Goods sectors. With strong optimism for Indonesia’s future, Next Gen leaders are driving internal innovation and cultural change – aiming to build businesses that are agile, inclusive, and future-ready.

As Indonesian businesses navigate shifting trade dynamics and economic uncertainty, many are responding with recalibration. From embracing digitalisation and sustainable practices to deepening regional trade ties, the focus is on long-term growth through strategic adaptation.

UOB’s regional expertise – covering tailored financial solutions, sustainable financing, and cross-border trade support – can help businesses navigate an increasingly complicated environment, while opening doors to further growth and success. Contact us to find out more.

The UOB Business Outlook Study 2025 (Indonesia) surveyed 535 business owners and senior executives from Small and Medium Enterprises in Indonesia. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Jun 2025 • 5 mins read

21 May 2025 • 6 mins read

13 May 2025 • 6 mins read

Get the UOB Business Outlook Study 2025 (Indonesia). Download key findings