You are now reading:

UOB Business Outlook Study 2025 (Regional): Tariff pressures test optimism in ASEAN and Greater China

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Regional): Tariff pressures test optimism in ASEAN and Greater China

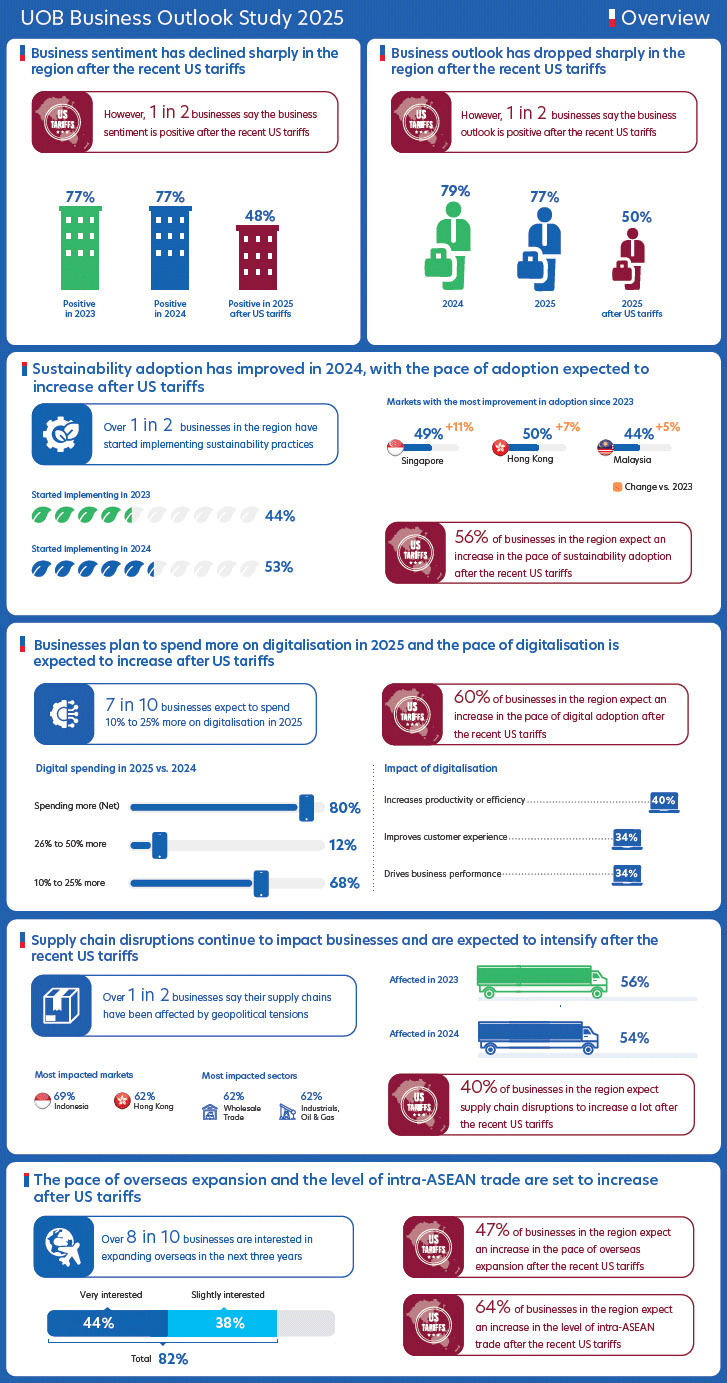

At the start of the year, 77 per cent of businesses in ASEAN and Greater China reported positive sentiment. However, this optimism has dropped sharply to 48 per cent following the announcement of new US tariffs. Nearly one in two businesses now expect inflation and production costs to rise significantly, prompting a more cautious outlook and shifts in operational strategies.

Since Donald Trump’s victory in the US presidential election last year, two-thirds of businesses had already anticipated rising tariffs and began taking proactive measures to reduce costs, such as diversifying their supplier base. What they hadn’t expected was the severity of the tariffs – a situation that remains fluid as negotiations continue.

Amid ongoing macroeconomic uncertainty, the UOB Business Outlook Study 2025 reveals that:

Figure 1: Snapshot of the key findings from businesses in ASEAN and Greater China

Supply chain management remains a critical focus, with 90 per cent of businesses prioritising strengthening their supply chains, particularly in China, Indonesia, Thailand, and Vietnam.

However, disruptions persist, affecting more than half of businesses in the region. Rising supply costs driven by inflation and interest rates are adding further strain.

Additionally, geopolitical tensions, network limitations, and inventory management issues exacerbate supply chain vulnerabilities.

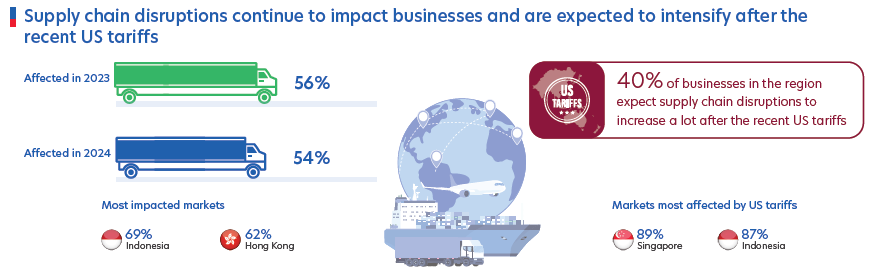

Figure 2: Most businesses in Singapore and Indonesia anticipate their supply chains being impacted by the US tariffs

The recent tariffs have heightened these challenges, with businesses across the region, particularly in Singapore and Malaysia, anticipating greater supply chain disruptions. Sectors such as Tech, Media & Telecom and Medium Enterprises are especially concerned about the impact of tariffs on their supply chain.

To counter these risks, businesses are turning to localisation—sourcing more materials domestically—and diversification to build supply chain resilience. One third of businesses are digitalising inventory status for better supplier oversight.

At the same time, four in 10 companies are actively seeking partnerships and industry collaborations to navigate ongoing challenges.

Digitalisation is well underway across ASEAN and Greater China, with increasing success in digital adoption across most markets.

Nearly half of businesses are now integrating emerging technologies, such as artificial intelligence (AI), generative AI (GenAI) and Internet of Things (IoT) into their operations.

“We are deploying a lot more AI technology ourselves and aim to spend a good amount of resources in deploying AI in our day-to-day operations in order to streamline processes and make up for the skillset gap.”

Vice President & Head of Emerging Markets, Tech Sector, Singapore

Despite the enthusiasm for going digital, cost remains a major barrier.

“The cost of hardware and sourcing (for the right technology) has increased for the last few years. AI deployment and solutioning is far more costly than what businesses think.”

CEO, Tech Sector, Hong Kong

Beyond costs, security risks and a lack of in-house expertise continue to limit widespread adoption.

Nevertheless, nearly seven in 10 businesses plan to increase their digitalisation budgets in 2025 by 10 per cent to 50 per cent. The tech and healthcare sectors, in particular, are leading this investment push.

Post-tariff, 60 per cent of businesses expect to ramp up the pace of digital adoption. Many businesses are seeking support in choosing the right solutions and addressing cybersecurity concerns.

This ongoing commitment to digital transformation highlights its critical role for both internal efficiency and external growth.

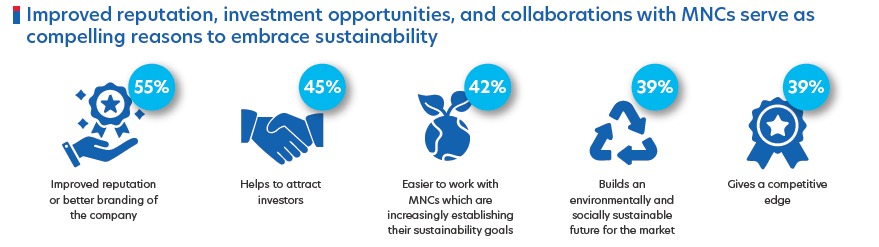

Sustainability adoption is on the up. One in two businesses in the region have implemented sustainability practices, which is an improvement from 2023 (44 per cent).

Specifically, Singapore, Hong Kong and Malaysia have seen the most progress in going green.

In Greater China, large enterprises are leading this sustainability shift. Across ASEAN, on the other hand, medium enterprises place greater emphasis on sustainability.

Figure 3: Better branding, investment prospects and MNC collaboration pushing sustainability adoption

Following the recent tariff announcements, 56 per cent of businesses anticipate an increase in the pace of sustainability adoption.

However, small enterprises continue to lag due to limited awareness and ongoing discussions rather than concrete action.

Cost concerns are a significant barrier, as businesses struggle with passing increased costs onto customers and accessing sustainable financing solutions. Beyond financial constraints, knowledge and skills gaps remain critical challenges.

Despite these hurdles, businesses are seeking more than just financial support. They are looking for better infrastructure, collaboration opportunities, and sector-specific insights to aid implementation.

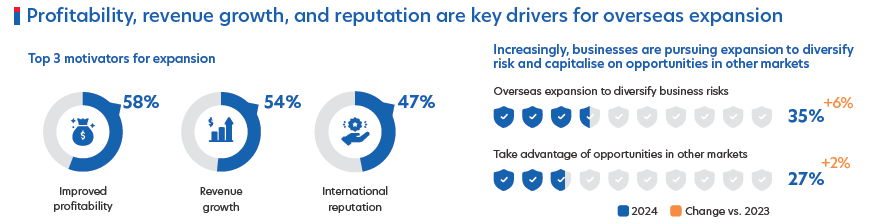

Expanding overseas remains a key growth strategy, with over 80 per cent of businesses expressing interest in entering new markets. This trend is especially strong among businesses in Indonesia, Vietnam, Thailand, and China.

Following recent tariff announcements, businesses in Indonesia and Malaysia anticipate an acceleration in their overseas expansion efforts. In contrast, the outlook in China appears more cautious—over half of Chinese businesses expect a slowdown in their international expansion, suggesting a potential shift towards focusing on domestic opportunities.

Figure 4: Top three factors driving overseas expansion for businesses

ASEAN remains the preferred expansion destination, but businesses are also eyeing opportunities in South Korea, Japan, North America, and South Asia.

Notably, Malaysia has emerged as a prime destination for Chinese businesses looking to establish a foothold in ASEAN. Businesses from Indonesia and Vietnam look to Singapore, perhaps to build their regional base.

With the tariff uncertainty, 64 per cent of businesses now expect an increase in intra-ASEAN trade. This highlights the region's growing importance as a collective trading hub.

Despite strong ambitions, businesses face hurdles in overseas expansion, particularly in finding reliable partners, establishing a customer base, and securing adequate funding.

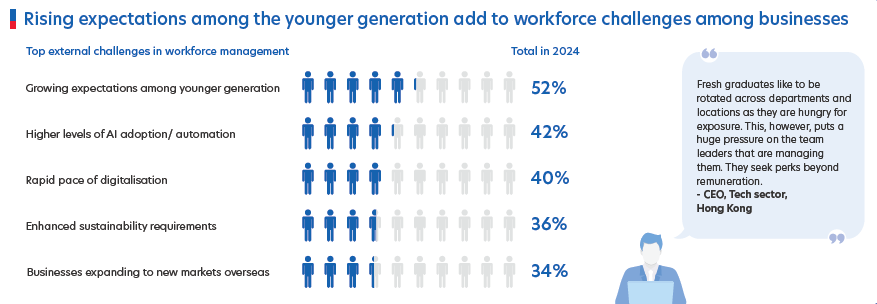

Talent attraction and retention remain a pressing challenge, as six in 10 businesses are affected by workforce or manpower-related issues.

Increasing expectations from employees, particularly among the younger generation, are among the workforce challenges across the region.

Figure 5: Younger talent expectations and AI adoption are reshaping workforce challenges

Additionally, rapid digitalisation, AI adoption, and automation are reshaping workforce dynamics, as four in 10 businesses find these changes difficult to manage.

The tariff impact is also being felt on the workforce front, with 37 per cent of businesses expecting workforce challenges to intensify significantly moving forward.

In response, businesses prioritise competitive salaries, employee training, and digital transformation initiatives to enhance workforce retention and efficiency.

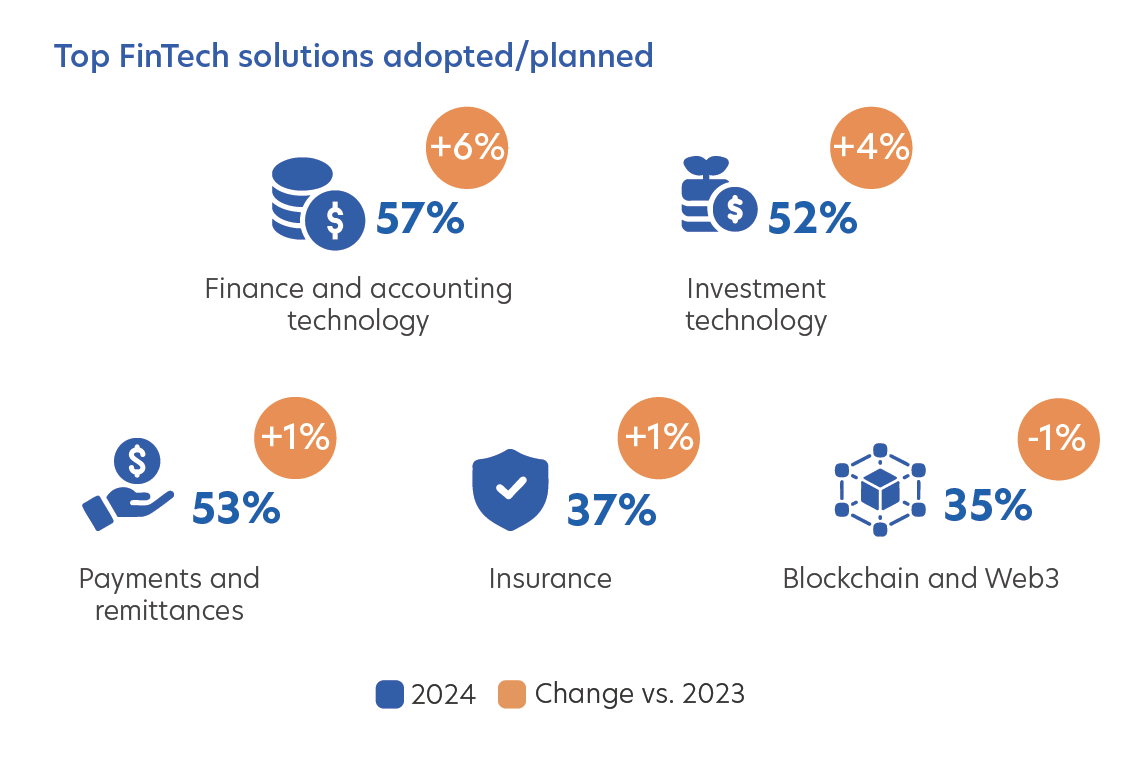

FinTech adoption is widespread, with nine in 10 businesses leveraging digital financial solutions into their operations. There has been higher adoption in Vietnam and Indonesia, though comparatively lower than adoption rates in Malaysia and Singapore.

Figure 6: Finance and accounting technology is the most adopted FinTech solution

More than half of the businesses in the region use finance and accounting technology, as well as payment and remittance solutions.

Meanwhile, companies in Indonesia and Vietnam are expanding their use of FinTech to include investment technology and insurance services.

The top three drivers of FinTech adoption include faster transactions, seamless user experiences, and cost reductions.

Overall, the percentage of businesses adopting or planning to adopt FinTech solutions increased from 88 per cent in 2023 to 90 per cent in 2024.

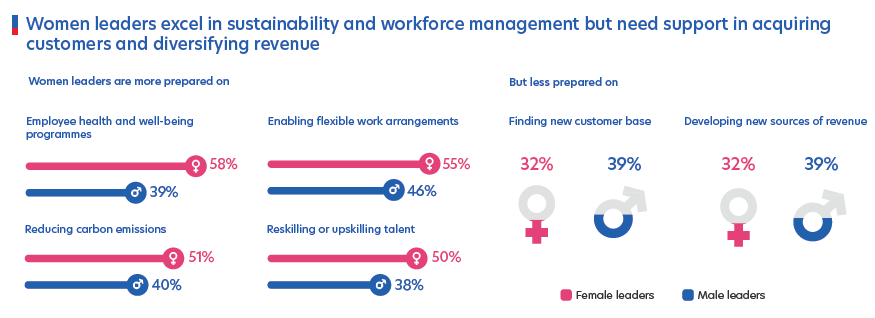

Figure 7: Strengths and support areas for women leaders

Women now make up 39 per cent of business leaders and report stronger revenue performance compared with male-led businesses.

They are particularly active in customer-facing and service industries, where they have demonstrated strong performance in 2024 and are poised for sustained growth in 2025.

Notably, women leaders are more inclined to pursue overseas expansion, leveraging cross-border digital trade platforms to scale their businesses beyond domestic markets.

Almost 60 per cent of business leaders in the region belong to the Next Generation (Next Gen) category, with a strong presence in SMEs and the Tech, Media & Telecom sector.

Next Gen leaders – defined as leaders who have taken over their family business – bring a heightened sense of optimism, driven by revenue growth in 2024 and ambitious expectations for 2025.

Their leadership style prioritises digital transformation, both for internal operational efficiency and customer-facing engagement, positioning them at the forefront of innovation in the region.

Businesses across ASEAN and Greater China are entering 2025 with a strong focus on digitalisation, sustainability, and supply chain resilience.

While economic challenges persist, optimism remains high as companies look to expand beyond domestic markets and embrace technological advancements.

At UOB, we are committed to helping businesses navigate this rapidly evolving landscape.

From cross-border trade support to sustainable financing, we offer tailored solutions, market expertise and industry knowledge. Contact us to find out more.

The UOB Business Outlook Study 2025 (SMEs & Large Enterprises) surveyed nearly 4,200 business owners and senior executives from various sectors across Indonesia, Malaysia, Singapore, Thailand, Vietnam, Mainland China and Hong Kong SAR. Conducted online in January 2025 with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This year’s edition also introduces three new focus areas that reflect today’s evolving landscape:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

13 May 2025 • 6 mins read

06 Dec 2024 • 4 mins read

02 Dec 2024 • 4 mins read

Get the full UOB Business Outlook Study 2025 (Regional). Download now