You are now reading:

UOB Business Outlook Study 2025 (Hong Kong): Cost pressures and global shifts redefine priorities

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Hong Kong): Cost pressures and global shifts redefine priorities

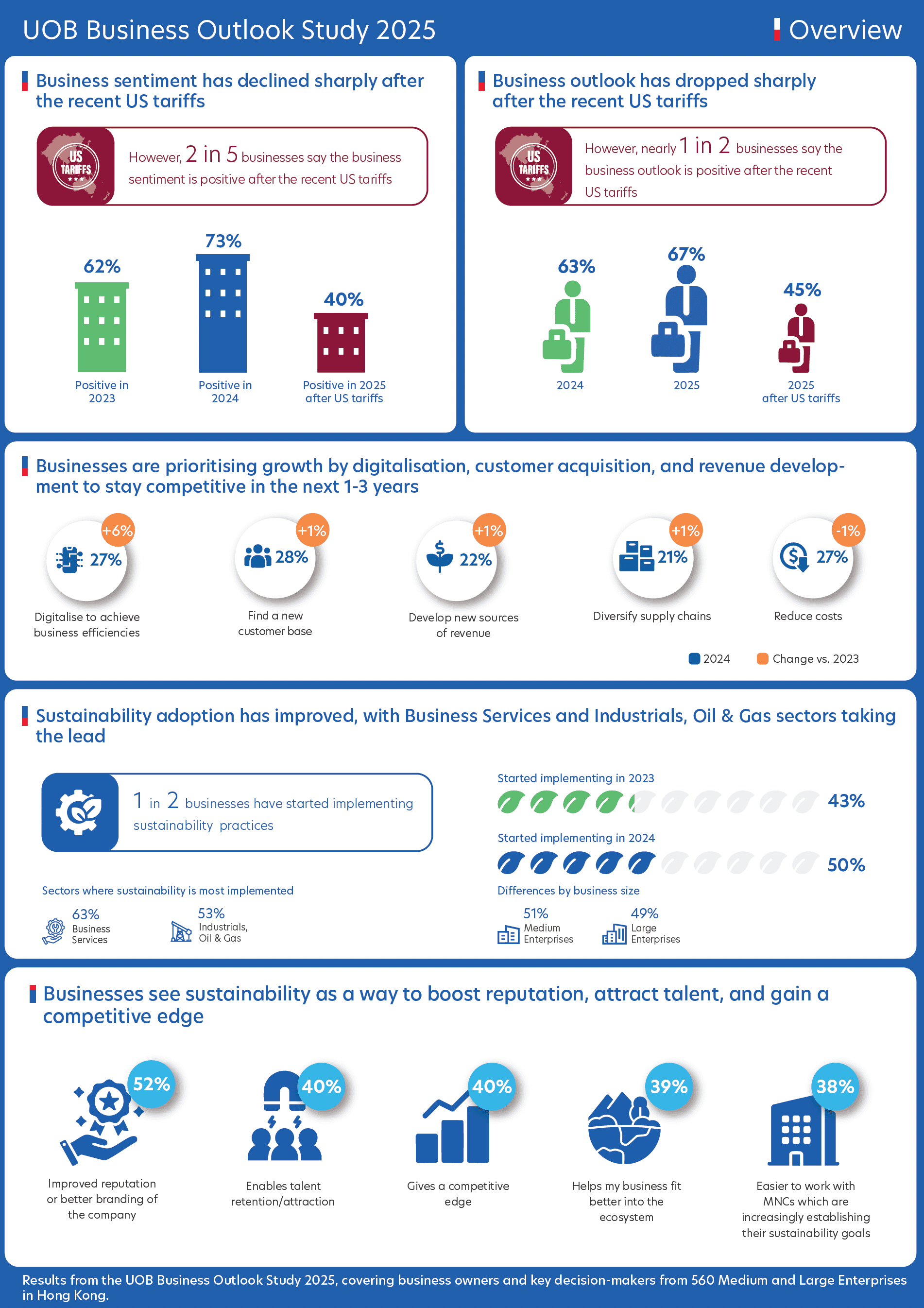

According to the UOB Business Outlook Study 2025, rising operational costs, talent shortages, and ongoing geopolitical tensions continue to challenge Hong Kong’s business environment. In response, companies are proactively evolving their strategies and realigning priorities to navigate these headwinds.

The recent United States (US) tariff announcements have added a layer of urgency – pushing companies to rethink their digital infrastructure, overseas expansion plans, and workforce models.

Figure 1: Snapshot of the key findings from businesses in Hong Kong

Business sentiment in Hong Kong improved in 2024, driven by revenue gains, particularly among Large Enterprises and the Professional Services sector. However, the announcement of new US tariffs has dampened confidence for the year.

Rising costs across operations, labour, and inflation continue to weigh on Hong Kong businesses.

Figure 2: Business costs and inflation are expected to rise after the US tariff announcement

Businesses are not standing still. Medium-sized firms are focused on building new customer relationships and collaborative partnerships, while larger enterprises are prioritising digitalisation and environmental, social, and governance (ESG) initiatives.

Across the board, firms are calling for support in three key areas: business transformation, digital infrastructure, and skills development to keep pace with changing demands.

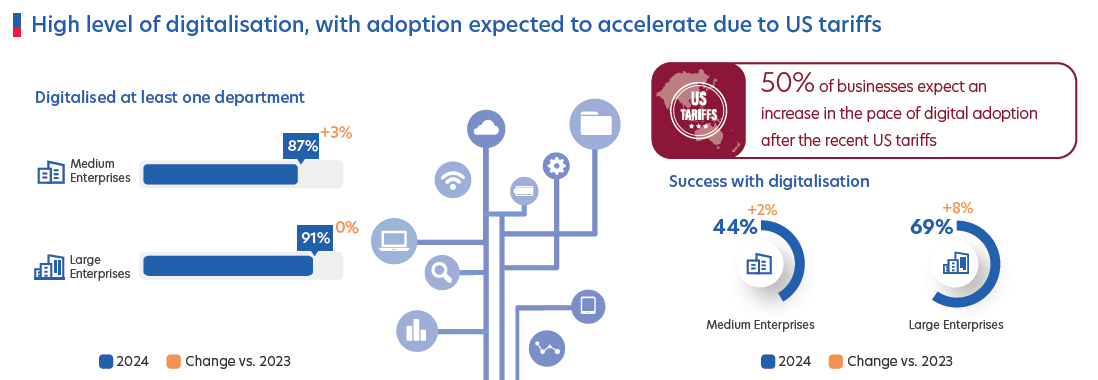

Digital adoption remains high, with over eight in 10 businesses already implementing solutions. In 2024, companies that invested in digital tools reported stronger performance and better decision-making.

The recent tariff changes have also accelerated this push. Businesses now view digitalisation not just as a tool for efficiency, but as a way to remain agile in an unpredictable environment. That includes platforms for forecasting, supply planning, and customer analytics.

Figure 3: One in two businesses expect digital adoption to hasten

FinTech adoption reached 92 per cent in 2024, driven by demand for faster payments, cost control, and improved accuracy. Finance, accounting, and investment tools are becoming core to daily operations.

Beyond FinTech, adoption of AI, generative AI, and IoT is also rising, reflecting a broader shift toward tech-enabled decision-making. Security, regulatory clarity, and return on investment remain key hurdles, but interest continues to grow as firms look for scalable, future-ready solutions.

“Many of our business functions are on the cloud. We can forecast the new trends seen in overseas markets, source for the required material in advance, and plan ahead. But this is restricted to medium-sized vendors.”

CFO, Wholesale Trade sector, Hong Kong

Sustainability efforts have gained real ground. In fact, the tariffs have led to businesses picking up the pace on sustainability adoption. Forty-eight per cent of Hong Kong businesses expect an increase in sustainability practices.

While 83 per cent of businesses consider sustainability important, one in two businesses have begun implementing sustainability practices in their operations – an increase of 7 percentage points from 2023.

Primarily driven by reputation – followed by talent attraction and ecosystem alignment – recent tariff pressures have reinforced ESG practices as a risk and resilience tool.

Figure 4: Better branding and talent attraction are increasing sustainability adoption

Firms are also focusing on initiatives that deliver tangible economic returns such as energy savings, waste reduction, and ecosystem fit. But access to green financing and technical know-how remains a barrier, especially for medium-sized firms.

Supply chain management (SCM) is a priority for 86 per cent of businesses. New US tariffs and ongoing cost pressures have made localisation and diversification more important.

Companies are investing in real-time inventory systems to improve responsiveness and reduce risk. Most businesses continue to source from local markets and ASEAN countries and plan to maintain this strategy.

Support needs are evolving toward technology integration, supply chain analytics, and financial instruments such as trade credit insurance and letters of credit.

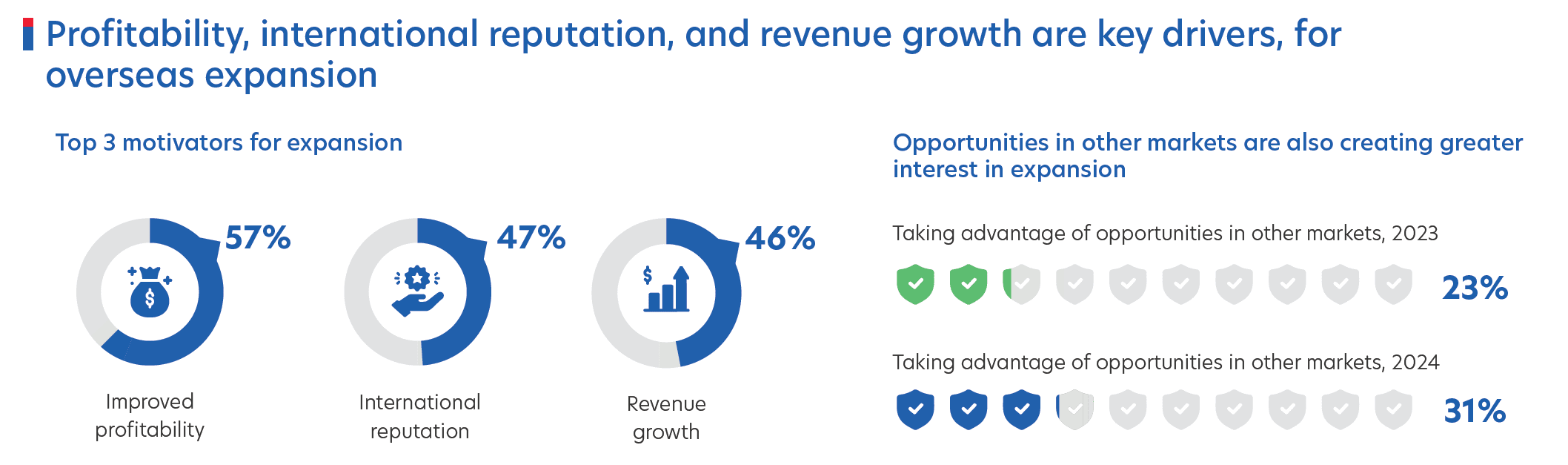

Despite external pressures, overseas expansion remains a key priority. Three in four businesses are planning to expand beyond Hong Kong in the next three years. The main driver is profitability, as firms look to diversify revenue streams and tap into larger or faster-growing markets.

Mainland China and ASEAN remain the primary destinations, followed by Taiwan. Malaysia, Thailand, and Indonesia stand out for their market size, while Singapore remains a strategic regional hub. Larger enterprises are also expanding into North America and Europe to scale further and reach new customer segments.

Figure 5: Top three factors driving overseas expansion for companies

The challenges are familiar—limited customer bases in new markets, difficulty scaling efficiently, and restricted funding. To succeed, firms need better market data, financial support, and access to trusted cross-border platforms to execute on their ambitions.

Two in three businesses are grappling with workforce pressures, driven by talent shortages and cross-market competition.

In response, one in two businesses are raising pay. Others are investing in upskilling and digital transformation, as well as introducing flexible work models.

Figure 6: Younger talent expectations and increased AI adoption are reshaping workforce challenges

Younger workers are driving new demands, seeking faster growth, broader exposure, and alignment with evolving technologies. At the same time, the rise of AI and digital tools is reshaping job roles and skills. For many firms, workforce strategy is now a core part of staying competitive.

Women-led businesses in Hong Kong saw stronger revenue growth in 2024 and are more optimistic about 2025.

They are significantly more prepared in digital adoption, developing new sources of revenue, implementing employee wellbeing programmes, adopting ESG practices and expanding overseas. For women leaders, sustainability is a strategic lever to attract investors and build global partnerships.

The most pressing needs are practical: targeted training and access to cross-border trade networks to convert ambition into scalable results.

Figure 7: Areas of strengths of women leaders and key challenges they face

Next Gen leaders – defined as leaders who have taken over their family business – report stronger revenues and have a more optimistic outlook than their peers.

They’re outpacing professional leaders in digital adoption – reporting higher success rates, stronger profitability, and clearer strategic gains. Still, their focus is not just on technology. They are planning for long-term risks like supply chain shocks and debt pressures, while doubling down on employee productivity and wellbeing.

This approach signals a shift from short-term gains to sustainable performance and business resilience, anchored by proactive planning and strong operational foundations.

As Hong Kong businesses navigate global headwinds and shifting regional dynamics, many are recalibrating their strategies for long-term resilience.

UOB’s regional connectivity and financial expertise – spanning tailored solutions, digital tools, and cross-border capabilities – can support businesses through complexity and change. Contact us to find out more.

The UOB Business Outlook Study 2025 (Hong Kong) surveyed 560 business owners and senior executives from SMEs and Large Enterprises in Hong Kong. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

21 May 2025 • 6 mins read

13 May 2025 • 6 mins read

06 Dec 2024 • 4 mins read

Get the UOB Business Outlook Study 2025 (Hong Kong). Download key findings