You are now reading:

UOB Business Outlook Study 2025 (Singapore): Bright horizon for companies despite looming tariff impact

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Singapore): Bright horizon for companies despite looming tariff impact

After a tough inflationary 2023, Singapore businesses entered 2024 with stronger optimism. According to the UOB Business Outlook Study 2025, over eight in 10 businesses expressed confidence in improved performance this year, driven largely by reduced inflation impacts.

However, this optimism has been dampened by the recent US tariff announcements, sharply lowering sentiment across sectors. Businesses are now recalibrating their strategies to prepare for an environment marked by geopolitical uncertainties, rising costs, and supply chain disruptions.

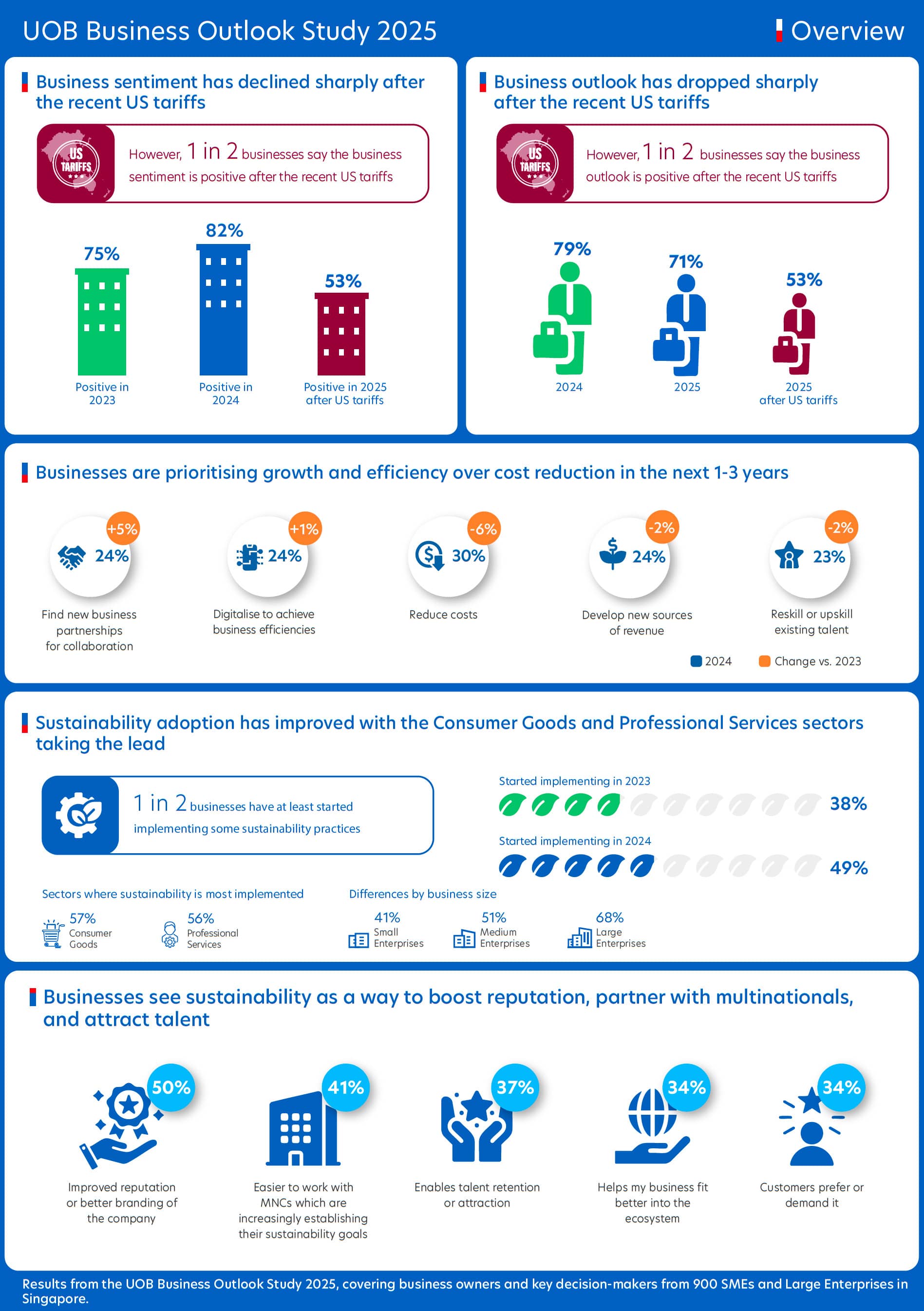

Figure 1: Snapshot of the key findings from businesses in Singapore

Positive sentiment had surged from 75 per cent in 2023 to 82 per cent in 2024, with nearly all sectors and medium-sized enterprises showing strong revenue growth. This rise was largely fueled by a sense of inflation reprieve, allowing businesses to reset their performance expectations and investments for the year. But the US tariff announcement caused a significant decline in sentiment: fresh data shows only about half of businesses now remain positive, reflecting a shift to a more cautious and conservative outlook.

Figure 2: Singaporean companies are seeking partnership opportunities for further growth

Meanwhile, geopolitical issues have become a growing challenge across the board, with nearly one in five businesses naming it as a top concern in 2024, compared with 14 per cent the previous year. Notably, even among those currently less positive, half believe conditions will improve by 2026–2027, reflecting underlying resilience and confidence in the long-term fundamentals of the Singapore market.

To brace for these challenges, companies are ramping up digital adoption, innovation, and business partnerships. Already, 83 per cent have adopted digital solutions in at least one department, with medium and large enterprises leading the way.

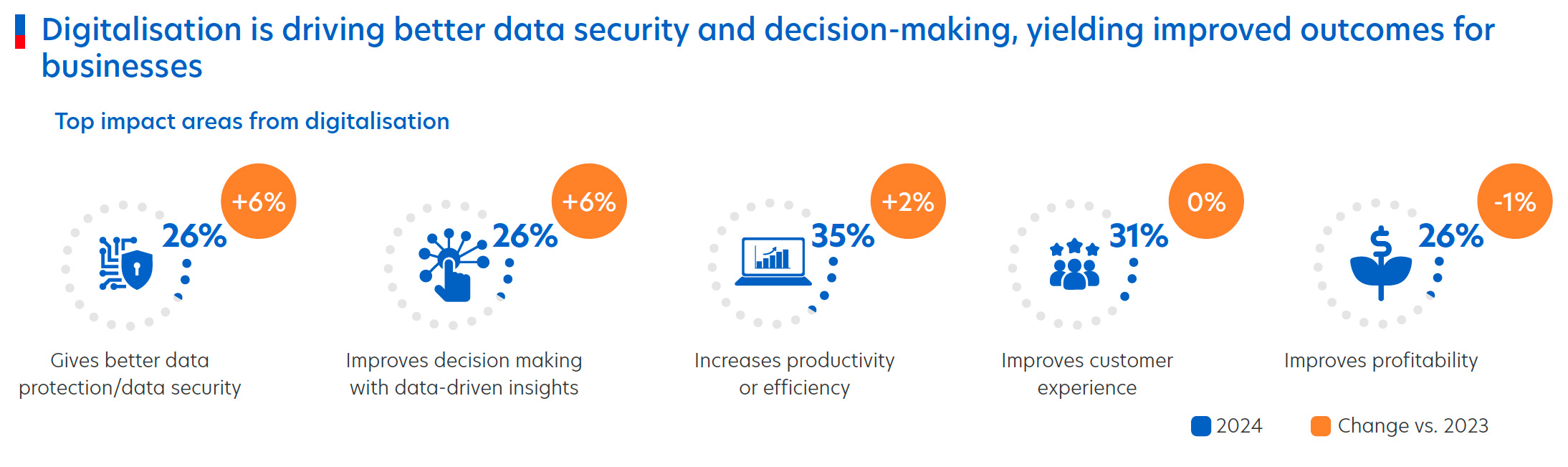

Businesses report clear benefits, including improved productivity, enhanced customer experiences, and better data security. The pace of digitalisation is expected to accelerate even further in response to cost pressures from tariffs, as businesses look to automate processes, improve operational efficiency, and reduce dependence on manual workflows.

Figure 3: Key benefits for businesses due to digital adoption

FinTech use is also growing, particularly in finance, accounting, and payments. More than eight in 10 businesses now use or plan to use FinTech solutions, reflecting its role in streamlining financial management and enabling more flexible cash flow strategies.

Sustainability adoption has increased steadily, with nearly half of Singapore businesses now implementing sustainable practices – up from 38 per cent in 2023. US tariffs have further pushed businesses to accelerate sustainability efforts, as they seek to mitigate cost pressures and align with evolving stakeholder expectations.

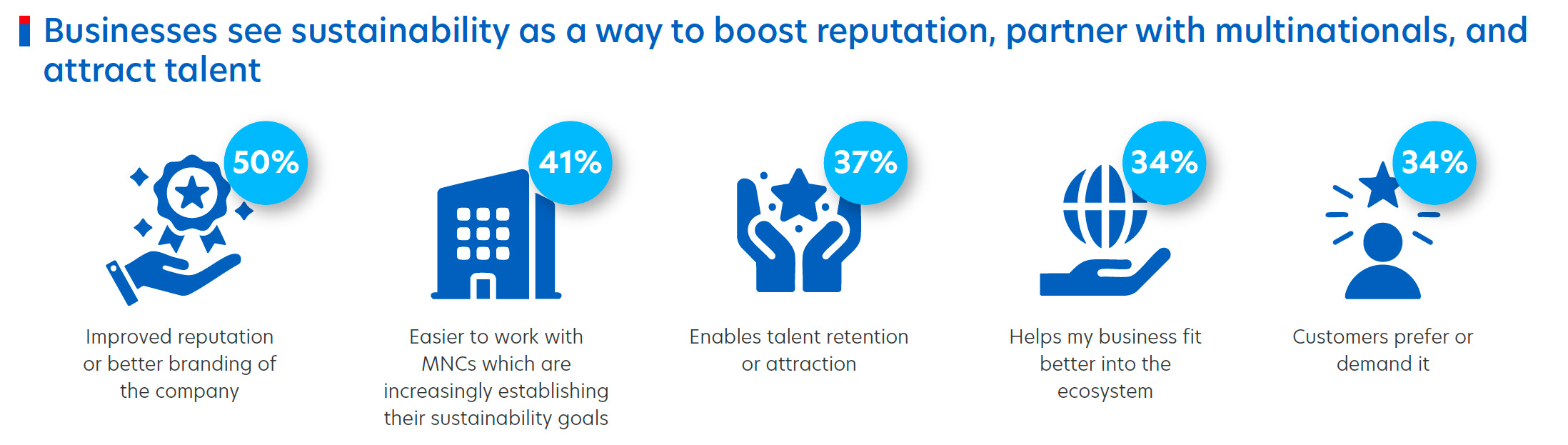

Figure 4: Better branding, MNC collaboration, and talent attraction are pushing sustainability adoption

Over 80 per cent of companies now consider sustainability important – a jump in 10 percentage points since last year – particularly among medium enterprises, where customer and investor demands are most pronounced. The biggest motivators include enhancing business reputation, improving relationships with multinational clients, and strengthening talent management strategies.

Yet, despite the acknowledged importance, only one in five view sustainability as a top business priority, signalling a gap between intention and execution. Barriers remain, driven by cost concerns, lack of in-house expertise, and limited access to sustainable financing. Businesses are calling for stronger government and industry support, including targeted funding, expert guidance, and clearer roadmaps to help them achieve sustainability goals.

Supply chain management has become increasingly critical as over half of Singapore businesses report disruptions – largely fueled by geopolitical tensions, the post-pandemic landscape, and now the US tariffs. Medium-sized enterprises are particularly impacted, citing rising supply costs, shipping delays, and sourcing difficulties as their top concerns.

“Right now, my challenge is to develop and create a stronger ecosystem within Asia. One of the biggest challenges is ensuring suppliers are credible, accredited, and certified to prevent counterfeit goods."

Managing Partner, Manufacturing Sector, Singapore

In response, companies are sharpening their focus on inventory management, diversifying their supplier base, and strengthening regional supply networks, especially within ASEAN.

Intra-ASEAN trade is emerging as a promising area for greater supply chain resilience, with businesses looking to reduce reliance on single markets and spread risk across multiple partners. To succeed, companies highlight the need for better access to funding, improved supply chain analytics, and stronger regional collaboration to weather future disruptions.

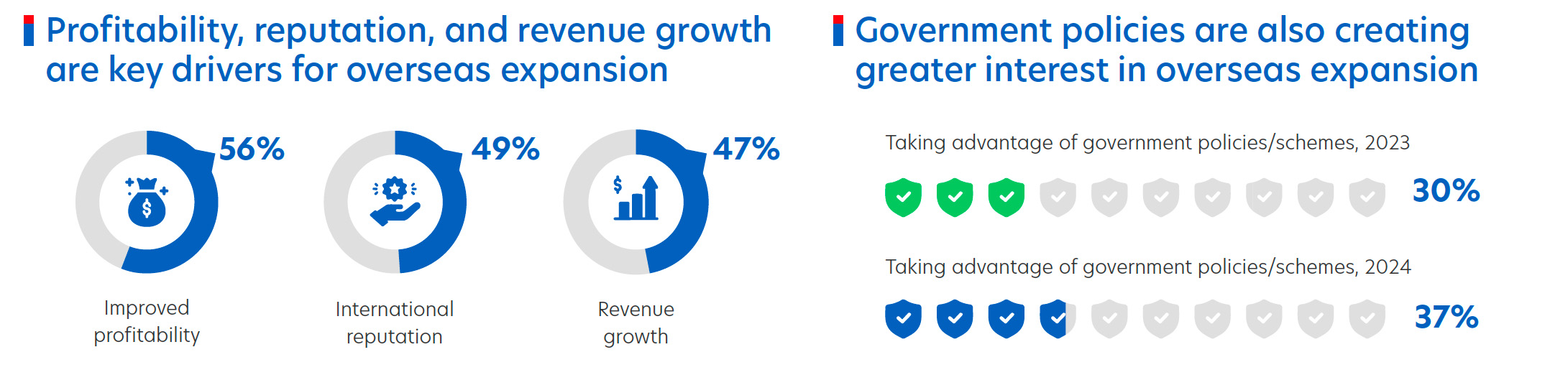

Despite headwinds, Singapore businesses remain ambitious. Eight in 10 companies plan to expand overseas expansion within the next three years, driven by profitability goals (56 per cent), the desire to enhance international reputation (49 per cent), and revenue growth ambitions (47 per cent).

ASEAN and China dominate these expansion plans, with Malaysia, Indonesia, and Thailand leading the list of preferred markets. Interestingly, certain sectors, such as consumer goods and industrials, are cautiously exploring opportunities in North America and Oceania, reflecting a growing interest in geographic diversification.

Figure 5: Top three factors driving overseas expansion for businesses

However, businesses continue to face familiar barriers, such as finding the right partners, building customer bases in unfamiliar markets, and navigating complex regulatory and funding environments.

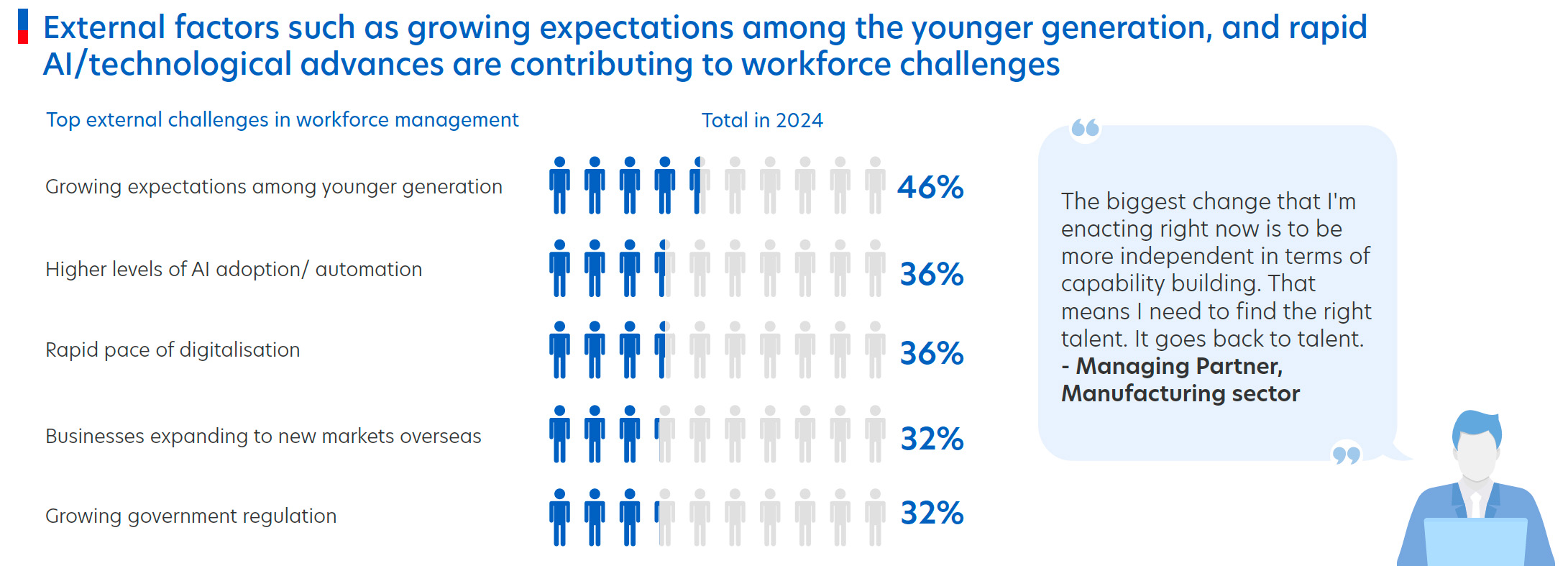

More than three in five businesses are grappling with workforce-related challenges. Rising employee expectations around pay, work-life balance, and flexible arrangements, along with difficulties in attracting and retaining talent, are stretching company resources. Large enterprises feel these pressures even more acutely, particularly when combined with inflation and rising operational costs triggered by the tariffs.

Figure 6: Younger talent expectations and AI adoption are reshaping workforce challenges

To remain competitive, businesses are focusing on upskilling initiatives, offering more competitive compensation packages, and providing flexible working arrangements that can meet evolving employee needs.

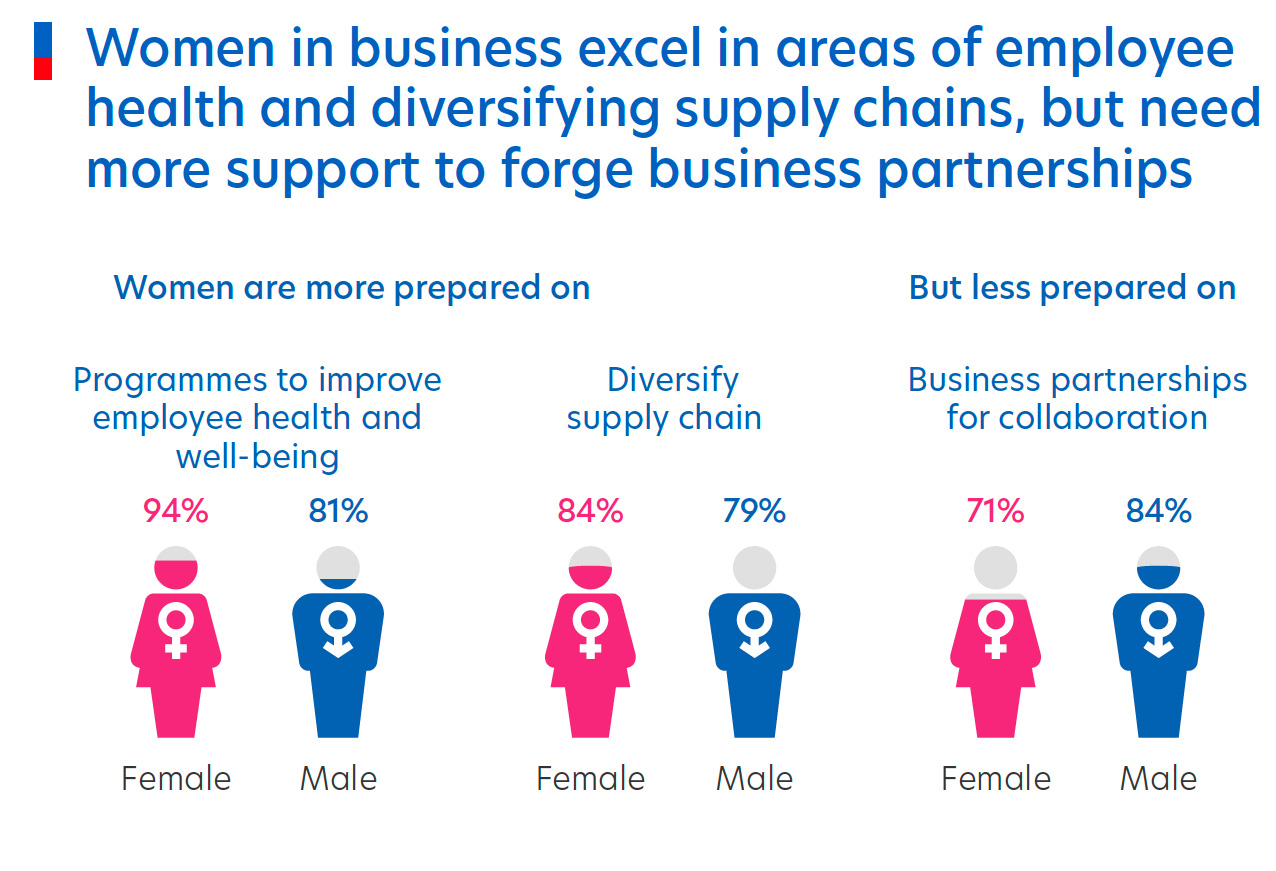

Women hold one in four leadership roles across Singapore businesses, with a stronger presence in the Community & Personal Services sector and among SMEs. They are particularly focused on employee health and wellness initiatives and are actively working to diversify supply chains. However, many women leaders indicate they need greater support to drive digital growth, forge new business partnerships, and meet sustainability goals, particularly in reducing carbon emissions.

Figure 7: Areas of strengths of women leaders and key challenges they face

Next-generation leaders, who now make up nearly half of all business leadership, are concentrated in the Tech, Media, and Telecom sectors and among SMEs. They are more optimistic about the current environment and the future outlook, placing a stronger emphasis on long-term challenges such as governance, innovation, and technological advancement. They are also at the forefront of adopting advanced technologies, such as artificial intelligence, augmented reality, and blockchain, which they view as essential tools for customer retention and market differentiation.

While optimism has fallen since the US tariff announcement, Singaporean businesses are still the most optimistic within ASEAN. They are making strides in sustainability, market expansion know-how, and investing more in digitalisation versus a year ago.

Rising cost pressures and market uncertainty will continue to push businesses to rethink their strategies to build greater resilience. With UOB’s deep regional expertise – spanning tailored financial solutions, sustainable financing, and cross-border trade support – we can help businesses navigate this evolving environment, unlocking new opportunities for growth and success. Contact us to find out more.

The UOB Business Outlook Study 2025 (Singapore) surveyed 900 business owners and senior executives from SMEs and Large Enterprises in Singapore. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

21 May 2025 • 6 mins read

06 Dec 2024 • 4 mins read

02 Dec 2024 • 4 mins read

Get the UOB Business Outlook Study 2025 (Singapore). Download now