You are now reading:

UOB Business Outlook Study 2025 (Mainland China): Restructuring supply chains

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2025 (Mainland China): Restructuring supply chains

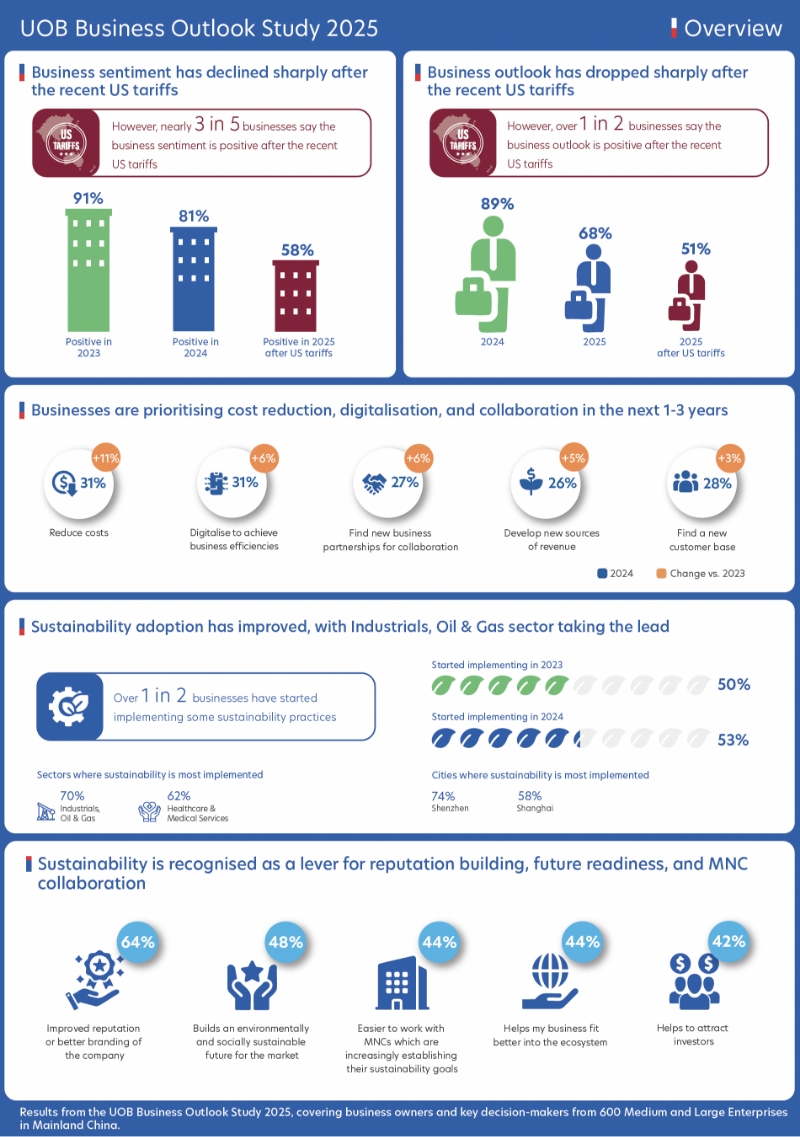

Mainland China’s economic outlook for 2025 reflects cautious optimism, with businesses reevaluating their growth models in the face of external pressures. According to the UOB Business Outlook Study 2025, 58 per cent of businesses in Mainland China reported positive sentiments toward the operating environment, falling from 81 per cent in early 2025.

Although short-term confidence has taken a hit, many companies are planning for medium- to long-term gains by doubling down on innovation, digitalisation, and regional market expansion. These findings signal a shift from reactive cost containment toward building structural competitiveness.

Figure 1: Snapshot of the key findings from businesses in Mainland China

The announcement of new US tariffs in April 2025 adds pressure for Chinese enterprises. Across sectors, businesses report anticipated increases in operational and raw material costs. According to the study, 39 per cent of surveyed companies expect inflation to rise by a lot, while 77 per cent expect an increase in raw material and production costs as a direct result of the tariffs.

To cope with these challenges, firms are reconfiguring their supply chains, localising procurement, and strengthening partnerships with regional trade partners. In fact, about 58 per cent of businesses expect intra-ASEAN trade to gain momentum, signalling a strategic rebalancing away from tariff-exposed markets.

Digital transformation continues to be a cornerstone of business growth in Mainland China. More than 90 per cent of businesses surveyed have either adopted digital tools in at least one department or plan to in the near future. Digitalisation is most common in operations, customer service, and finance, where automation and analytics deliver measurable gains.

Beyond efficiency, digital transformation also provides insulation from trade-related risks. With supply chain transparency and data-led forecasting, businesses are increasingly relying on technology to optimise procurement, production, and customer engagement.

Figure 2: Key benefits for companies due to digital adoption

However, adoption challenges remain. About 54 per cent of businesses cite cost as a key barrier, while others point to limited access to skilled talent. Despite these hurdles, nearly three in five (59 per cent) have increased their investment in digital tools since the tariff announcements, underscoring their commitment to tech-led resilience.

Sustainability adoption continues to climb, albeit incrementally. Around 53 per cent of businesses in Mainland China have integrated sustainability into their operations, a slight increase from 2023. Among these, energy efficiency, waste management, and procuring from sustainable businesses top the list of initiatives.

The primary motivators include improved brand reputation, alignment with investor expectations, and compliance with multinational partner requirements. Medium enterprises, in particular, are showing greater momentum in sustainability adoption, often influenced by supply chain pressures and funding eligibility criteria.

Figure 3: Reasons why Chinese firms are adopting sustainable practices

Following the US tariff announcement, more than half of businesses indicated that they intend to accelerate sustainability efforts to reduce future vulnerabilities. However, challenges persist: nearly 40 per cent cite high implementation costs, and three in 10 report limited infrastructure or expertise as a roadblock.

To bridge this gap, businesses are increasingly looking to banks, government agencies, and industry partners for support in funding, skills development, and technical advice.

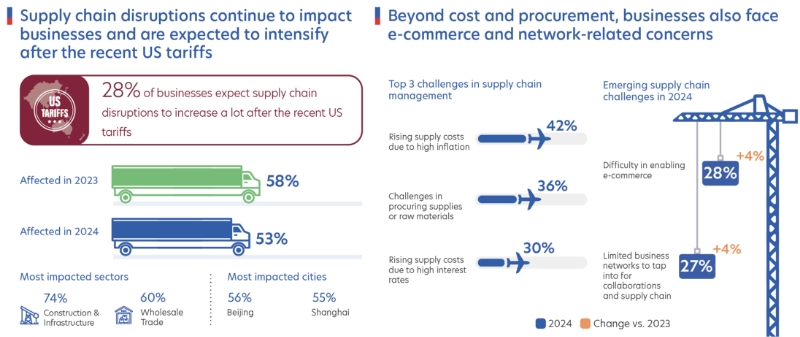

Supply chain resilience has emerged as a dominant business priority in Mainland China, particularly in the wake of ongoing geopolitical shifts and trade sanctions. More than half (53 per cent) of respondents say they continue to experience supply chain disruptions, with the Construction & Infrastructure and Wholesale Trade sectors reporting the biggest strain.

As a result, businesses are actively diversifying supplier networks, localising procurement, and turning to ASEAN markets for greater stability.

Figure 4: Supply chain pressures are expected to continue in the near future

Companies are also strengthening inventory management and implementing just-in-case models to prevent shortages.

Despite global uncertainties, Mainland Chinese businesses remain committed to international expansion. Over four in five companies indicate plans to expand overseas within the next three years, driven by the need to tap into new growth markets, diversify revenue, and raise brand visibility.

The top motivations for overseas growth are profitability (67 per cent), revenue diversification (49 per cent), and reducing business risk (42 per cent). ASEAN countries – including Singapore, Malaysia, and Vietnam – remain the most attractive destinations due to geographic proximity and growing consumer demand.

Figure 5: Top three factors driving overseas expansion for businesses

That said, businesses also report challenges, particularly around market intelligence, regulatory compliance, and finding reliable partners. Funding remains a top concern, especially for small and medium enterprises that lack access to cross-border financing tools.

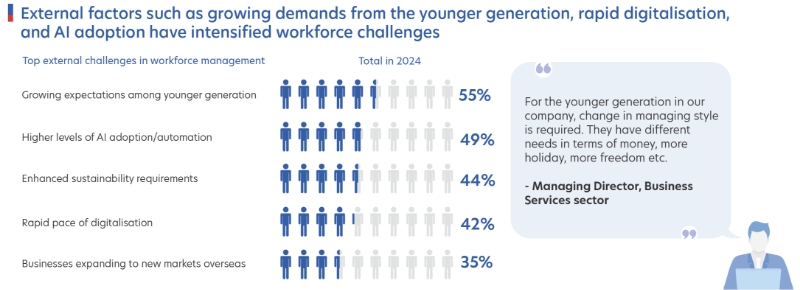

Workforce issues are affecting three in five businesses, with the manufacturing and engineering sector feeling the impact most acutely. Following the US tariffs, 24 per cent expect workforce challenges to worsen – driven by inflation and higher business costs.

About half of firms highlight finding the right talent and retaining their employees to be the key challenges. These firms are now witnessing growing expectations among their younger employees.

Figure 6: Younger talent expectations and rapid digitalisation are contributing to workforce challenges

Rising interest in AI, sustainability, and digitalisation is reshaping workforce planning. Businesses are adapting by offering higher pay and prioritising staff training to motivate and retain employees.

One in two leadership roles in Mainland Chinese businesses are now held by women. Women leaders are particularly prominent in Business Services, Real Estate and Hospitality, as well as Healthcare & Medical Services sectors.

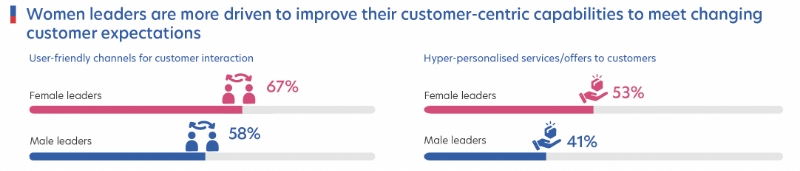

Women-led businesses in the study demonstrated a strong emphasis on operational efficiency, employee well-being, and sustainability. Many also show greater agility in adopting digital tools, though they tend to be more conservative in risk-taking and revenue diversification.

Figure 7: Areas of strength of women in business

The study also reveals that Next Gen leaders – business leaders who have taken over their family business – are increasingly shaping business direction across sectors. These leaders are particularly prevalent in the Healthcare and Business Services industries, and are driving a shift in priorities.

Next Gen leaders place greater emphasis on sustainability, governance, and workforce well-being. They are also early adopters of emerging technologies such as AI and blockchain, using them not only for efficiency but also for competitive advantage.

Their leadership style tends to be participative and purpose-driven, with a strong preference for transparent communication, ESG integration, and regional collaboration.

The 2025 outlook for businesses in Mainland China suggests a move from reactive to adaptive strategies. Digital tools, regional partnerships, and sustainable practices are becoming essential building blocks for resilience.

Businesses that can balance immediate cost challenges with longer-term investments in capability building are most likely to thrive in this evolving landscape. Whether through regional diversification, digital transformation, or inclusive leadership, the direction is clear: growth through adaptability.

As businesses in Mainland China look ahead, they are looking for clarity, tools, and strategic support. With its deep regional network and customised solutions, UOB stands ready to help businesses transform with confidence. From sustainable financing and cross-border trade solutions to digital tools and advisory services, UOB is a trusted partner for growth. Contact us to find out more.

The UOB Business Outlook Study 2025 (Mainland China) surveyed 600 business owners and senior executives from SMEs and Large Enterprises in Mainland China. Conducted online in January 2025, with a follow-up dipstick study in April 2025 after the US tariffs, the study offers insights into:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

03 Jul 2025 • 6 mins read

30 Jun 2025 • 6 mins read

25 Jun 2025 • 5 mins read