You are now reading:

UOB Business Outlook Study 2024 (Thailand): Shifting priorities to spur sustainable growth

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Thailand): Shifting priorities to spur sustainable growth

Last year, Thailand’s GDP growth reached 1.9 per cent, which was slower than projected amidst weakening exports and an overall global slowdown.

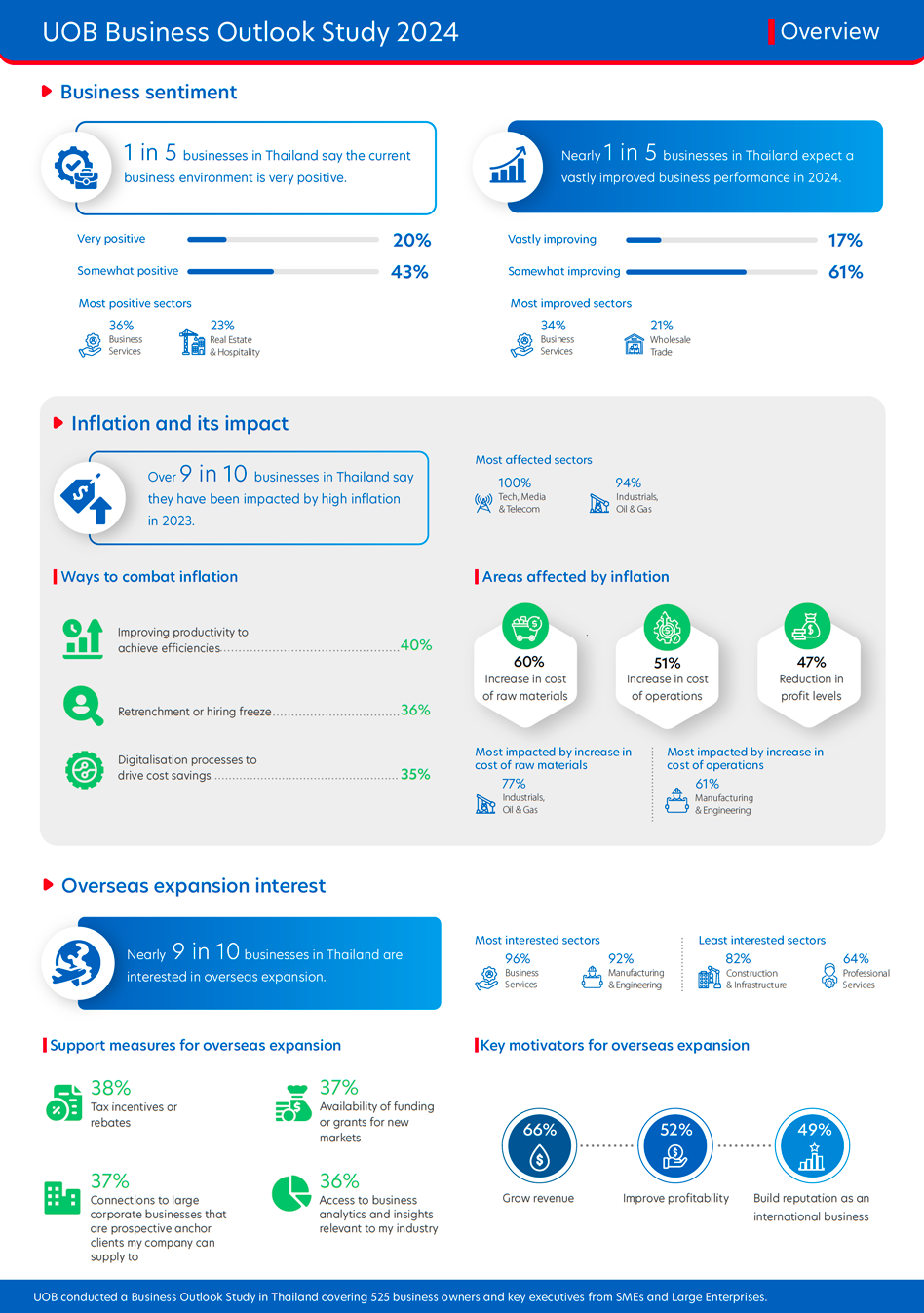

However, according to the UOB Business Outlook Study 2024 (SMEs & Large Enterprises), the business environment in Thailand remains optimistic, with six in 10 businesses expressing a positive outlook.

Figure 1: Snapshot of the key insights from Thai businesses

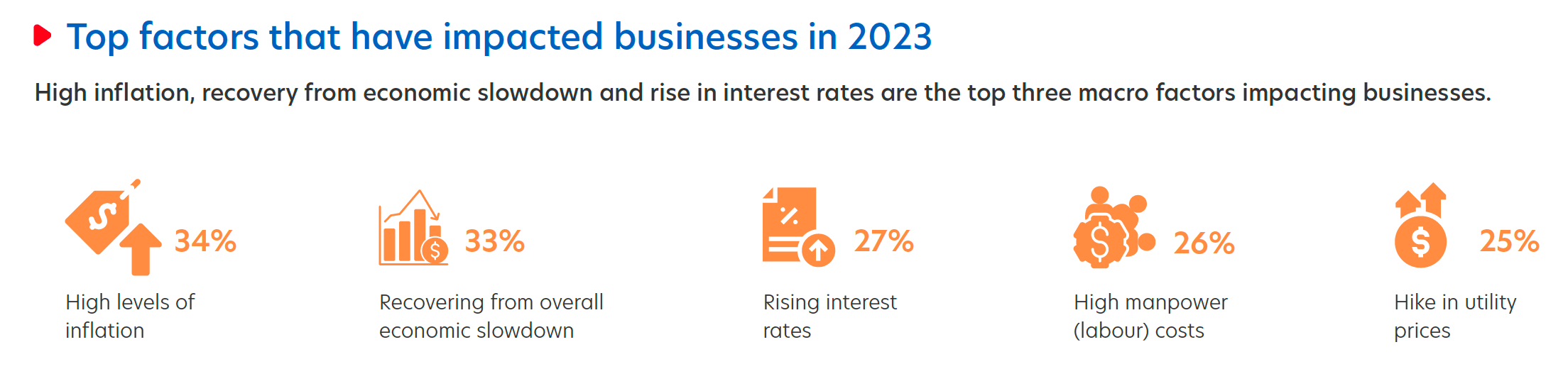

High inflation, recovery from an economic slowdown, and rising interest rates had impacted businesses in 2023. Inflation increased raw material and operational costs, reducing profitability for nearly half of businesses surveyed.

Figure 2: Businesses were most impacted by high inflation and rising operational costs last year

Despite these challenges, nearly eight in 10 businesses expect an improved performance in 2024 – similar to the regional average.

Thai companies are combating these pressures by improving productivity, implementing hiring freezes, and embracing digitalisation. By focusing on doing more with less, controlling labour costs, and investing in advanced technologies, businesses aim to reduce inefficiencies and lower expenses.

To achieve their priorities, companies plan to enhance customer experience, collaborate with ecosystem partners, and adopt digital solutions to automate processes. These strategies aim to boost efficiency and reduce costs.

This proactive approach helps mitigate the impact of inflation and positions companies for long-term growth and resilience.

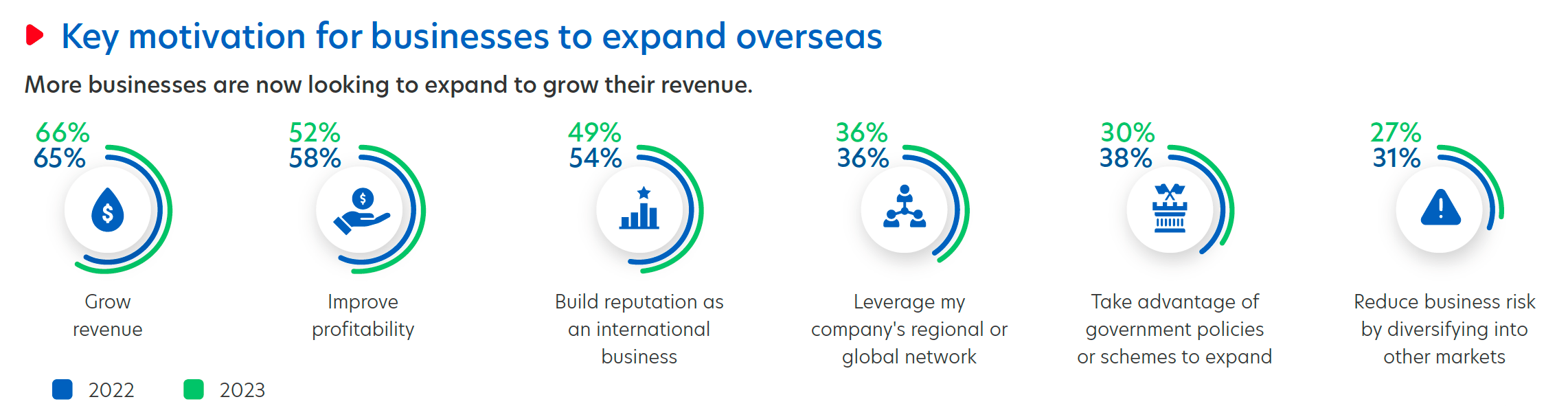

Interest in overseas expansion remains high as Thai businesses prioritise customer and revenue growth. Almost nine in 10 businesses aim to expand internationally within the next three years.

Figure 3: Top factors motivating Thai businesses to expand overseas

Thai companies are keen on leveraging cross-border digital trade platforms to reach new customers but require networking assistance and product training to drive adoption.

ASEAN and Mainland China are the primary targets for expansion, with Singapore, Malaysia, and Vietnam as top markets. Notably, Vietnam is generating increased interest – nearly one in two Thai businesses identify it as a key market for future growth.

Thailand is currently Vietnam’s top trading partner in ASEAN and is its ninth-largest foreign investor, with both countries committing to achieve US$25 billion in bilateral trade volume by 2025. This growth is driven by expanding mutual trade and investment and improving inter-trade market access.

However, almost four in 10 businesses face challenges due to a lack of in-house talent, limited access to overseas customer bases, and a shortage of legal, regulatory, and compliance support. Partnering with experts who have the local knowledge and experience is essential to navigate these diverse regional challenges effectively.

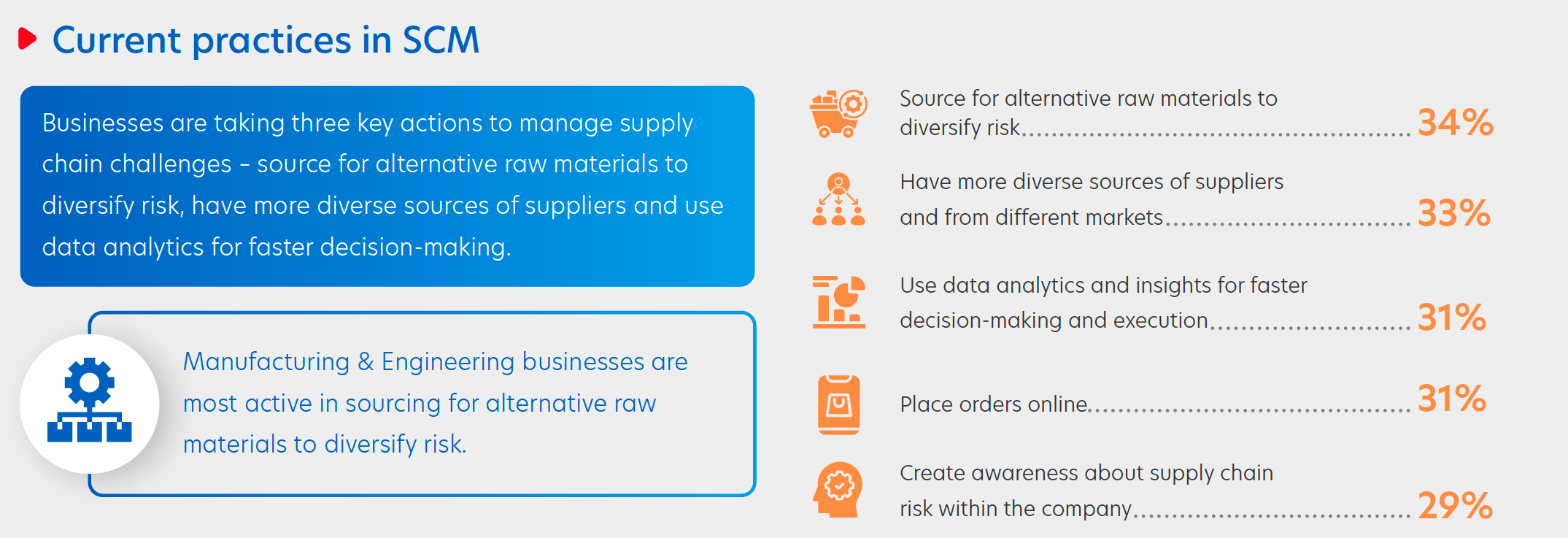

Supply chain management is crucial for businesses in Thailand, with nine in 10 considering it essential.

This is especially true for the manufacturing, engineering, and tech, media, and telecom industries, as well as medium enterprises where 98 per cent in each sector emphasised its importance.

Despite ongoing geopolitical challenges, their impact on supply chains has lessened compared to last year. However, companies still face significant hurdles due to rising supply costs from high inflation, increased interest rates, and procurement challenges.

Figure 4: Top practices to manage supply chain volatility

To ensure stable supply chains, companies are focusing on sourcing alternative raw materials, diversifying suppliers, and leveraging data analytics for informed decision-making.

Companies are also seeking tax incentives or rebates, connections with ecosystem partners to learn best practices, and quicker turnaround on loan applications to achieve greater stability.

Trade credit insurance, import and export services are top trading needs for businesses, underscoring the critical role of financial support in maintaining robust supply chains.

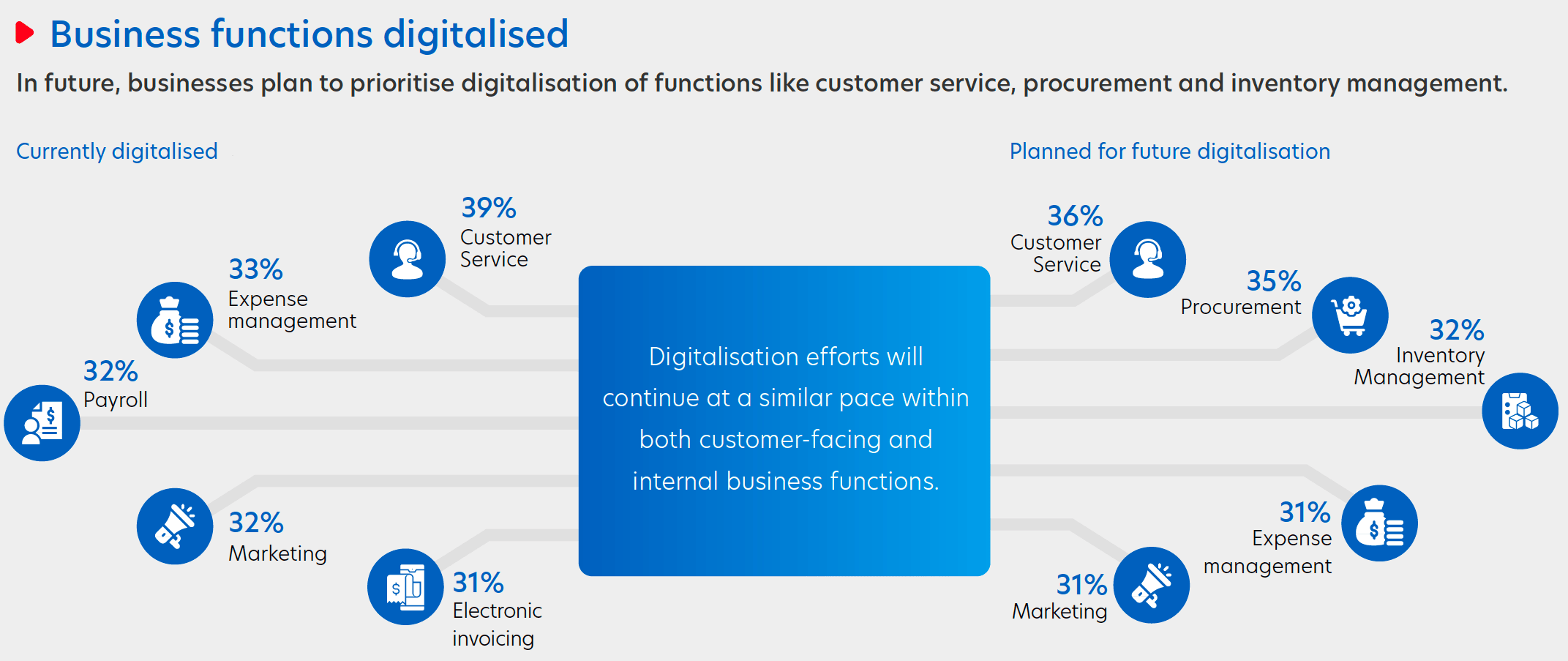

The digital adoption rate remains high among nine in 10 businesses in Thailand. Nearly four in 10 have adopted digital solutions across their entire operations, surpassing the regional average.

The consumer goods (96 per cent) and tech, media, and telecom (95 per cent) sectors are at the forefront of this digital transformation.

Digitalisation has significantly driven customer outreach, enhanced customer experience, and accelerated speed to market. While customer service and internal functions have seen extensive digitalisation, more complex areas like supply chain and partner management trail behind and are expected to progress more slowly.

Businesses face several challenges in digital adoption, primarily high implementation costs, a lack of digital skills among employees, and cybersecurity concerns. As digital initiatives mature, the lack of in-house expertise and effective change management becomes more apparent.

Small enterprises particularly seek support in employee training, whereas medium enterprises aim to access best practices from ecosystem partners.

Figure 5: Functions being digitalised by businesses in Thailand

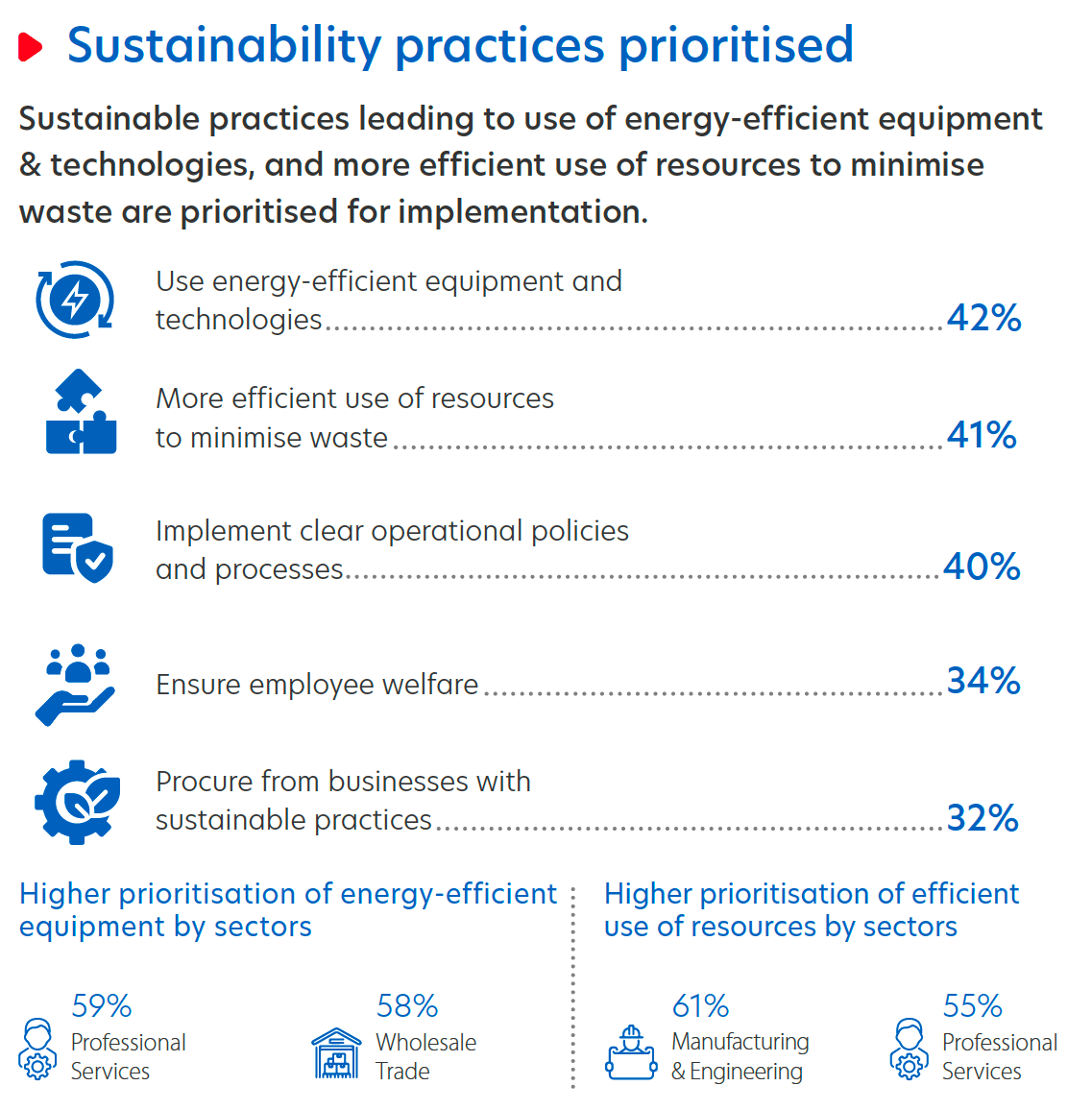

Sustainability adoption remains stagnant, with just over five in 10 companies implementing such practices. Although more than nine in 10 acknowledge the importance of sustainability, and half consider it very important, the gap suggests many are not fully committed to sustainable practices.

Companies are driven to adopt sustainability for improved business reputation (56 per cent), attracting investors (50 per cent), and enabling talent retention (46 per cent). These benefits highlight the long-term value and competitive advantage sustainability can offer.

Practices that lead to the efficient use of resources and technologies driving minimum waste are prioritised.

However, nearly three in 10 companies cite increased costs, impacts on short-term revenues, and profit as significant obstacles to implementing sustainability measures. These financial pressures make it challenging for businesses to prioritise sustainability over immediate economic concerns.

To support more businesses in adopting sustainable practices, financial measures such as tax incentives and subsidies are essential. Additionally, developing renewable energy infrastructure and fostering connections with industry bodies and government agencies can provide the necessary support and resources.

The UOB Sustainability Compass acts as a guiding tool for business leaders, helping them navigate uncertainties. It provides them with the know-how and connects them to the right partners, advancing their sustainability journey.

Figure 6: Thai businesses welcome sustainable practices for direct cost savings

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (Thailand) surveyed 525 business owners and key executives from SMEs and Large Enterprises to understand their views on key topics, including:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ