You are now reading:

UOB Business Outlook Study 2024 (Singapore): Companies unfazed despite inflation woes

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Singapore): Companies unfazed despite inflation woes

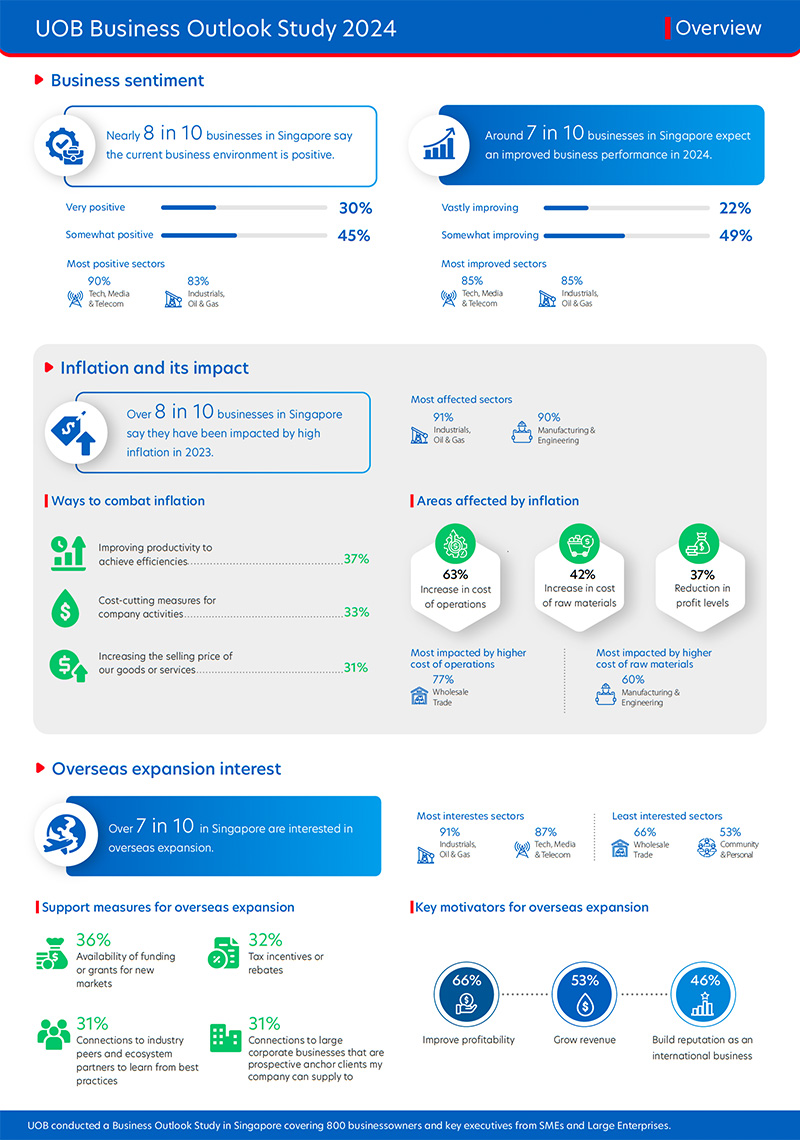

With high levels of inflation persisting in the past year, Singapore businesses are looking to combat and cushion the impact. According to the UOB Business Outlook Study 2024 (SME & Large Enterprises), there remains a sense of optimism among Singapore companies, with eight in 10 stating that the current business environment is positive.

Figure 1: Snapshot of the key insights from Singapore businesses.

Looking ahead, around seven in 10 Singapore companies are expecting an improved performance this year, with a portion of them (22 per cent) predicting a vastly improved showing. The most positive sectors include tech, media and telecom (90 per cent) as well as industrials, oil and gas (83 per cent).

The optimism is encouraging, since more than eight in 10 businesses have been impacted by high inflation – resulting in rising operational costs and a reduction in profit levels.

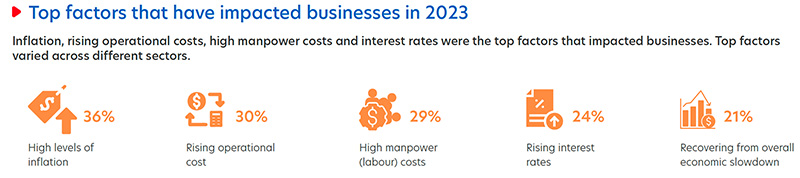

Figure 2: Businesses were most impacted by high inflation and rising operational costs last year.

In a bid to manage high inflation, companies are also looking to balance cost-cutting measures with productivity improvements in the next one to three years. To achieve that, businesses are focusing on various initiatives, including adopting digital solutions to automate processes (25 per cent), investing in employee training (25 per cent) and extending the company’s range of products or services (24 per cent).

Looking beyond its borders, seven in 10 Singapore businesses are keen to expand overseas, driven by a desire to improve profitability and grow revenue. The most interested sectors are industrials, oil and gas (91 per cent), tech, media and telecom (87 per cent) as well as manufacturing and engineering (85 per cent).

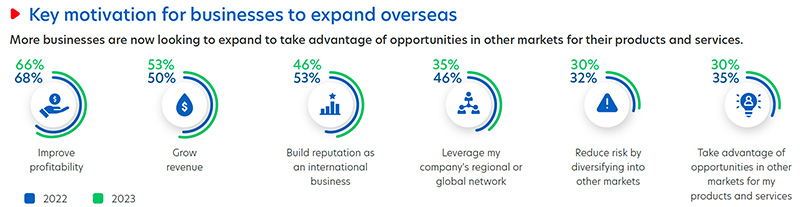

Figure 3: Top factors motivating Singapore businesses to expand overseas.

According to the report, ASEAN (52 per cent) and Mainland China (33 per cent) are the top two regions that businesses have picked for their foreign ventures. Within ASEAN, countries like Malaysia (60 per cent), Indonesia (50 per cent), and Thailand (43 per cent) are attractive to Singapore companies.

To mitigate risks associated with cross-border expansion, companies should prioritise finding the right local partners, leveraging local insights and forming strategic alliances in order to understand the nuances of new markets.

Supply chain management (SCM) continues to be important for Singapore businesses (80 per cent), with one in two stating that geopolitical tensions have affected their supply chains.

However, fewer businesses are affected now than a year ago, with industrials, oil and gas being the most impacted sector (69 per cent) and wholesale trade being the least affected (41 per cent).

Companies face the challenge of rising supply costs propelled by inflation (38 per cent) and interest rate hikes (36 per cent), coupled with procurement hurdles (26 per cent). These factors create a complex landscape that businesses will have to navigate to secure their supply chains.

Figure 4: Top practices to manage supply chain volatility.

To tackle those challenges, businesses are adopting various solutions, including improving inventory management (25 per cent), fostering stronger supplier relationships (24 per cent), and leveraging data analytics for quicker decision making (24 per cent).

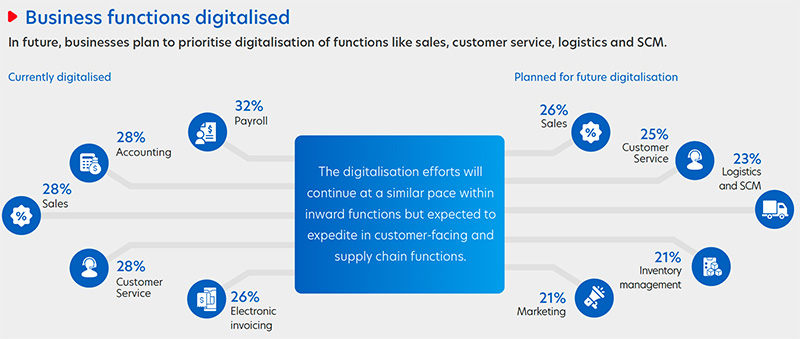

The state of digital adoption continues to be a key topic for Singapore companies. According to the report, more than seven in 10 businesses have digitalised in one or more departments, with 24 per cent stating that full adoption has taken place across the business.

In terms of function, digitalisation is most prevalent within payroll (32 per cent) and accounting (28 per cent), while future digitalisation efforts are being prioritised for customer-facing and supply chain functions, such as sales (26 per cent) and customer service (25 per cent).

However, businesses face various adoption hurdles, mostly in the shape of high implementation costs (33 per cent), cybersecurity risks (30 per cent), and a digital skills gap (27 per cent), underscoring the need for targeted investments and workforce training.

In response, two in three companies plan to increase their digitalisation budget significantly from 10 per cent to 25 per cent in 2024. Companies are also looking to banks and financial institutions for easier funding access and robust training programmes to facilitate their digital journey.

Figure 5: Functions being digitalised by businesses in Singapore.

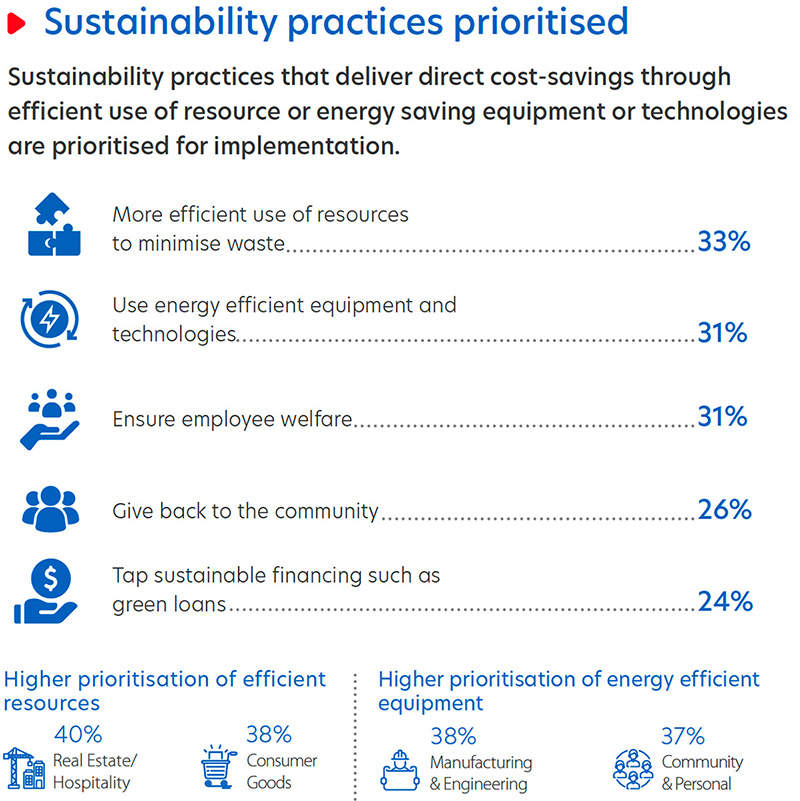

In today’s business world, sustainability is more than just a compliance measure. For Singapore companies, 76 per cent consider it important, with benefits ranging from improved reputation (50 per cent) and easier partnerships with like-minded MNCs (36 per cent), to becoming more attractive for investors (35 per cent).

Some of the prioritised practices include efficient resource utilisation (33 per cent) and the adoption of energy-efficient equipment (31 per cent). The manufacturing and engineering sector places particular emphasis on energy-efficient equipment, aligning with its unique operational and environmental considerations.

Despite its importance, sustainability remains a work in progress for many, with only 38 per cent of businesses having implemented sustainable practices in 2023. Three in 10 businesses cite increased costs, insufficient knowledge, and the lack of manpower as key barriers to implementation.

Figure 6: Singapore businesses welcome sustainable practices for direct cost savings.

To address these challenges, businesses require support such as tax incentives or rebates and easier access to funding.

UOB stands ready to support businesses on their sustainability journey, offering a range of tailored financing solutions. By addressing these hurdles head-on, companies can harness the potential of sustainability to drive positive change and secure long-term success in an increasingly conscious market.

As consumers demand greater accountability and transparency, businesses that embrace sustainability as a strategic imperative are poised to thrive in the evolving business landscape.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (Singapore) surveyed 800 business owners and key executives from SMEs and Large Enterprises to understand their views on key topics including:

This article shall not be copied, or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ