You are now reading:

UOB Business Outlook Study 2023 (Regional): Unpacking sentiments across ASEAN and Greater China

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2023 (Regional): Unpacking sentiments across ASEAN and Greater China

In the past year, skyrocketing operational costs, high inflation and rising interest rates have tested the resilience of many businesses recovering from the pandemic. Despite these challenges, SMEs and large enterprises across ASEAN and Greater China remain largely sanguine about the business environment, according to the regional findings from the UOB Business Outlook Study 2023 (SME & Large Enterprises).

Here is a snapshot of the report’s findings.

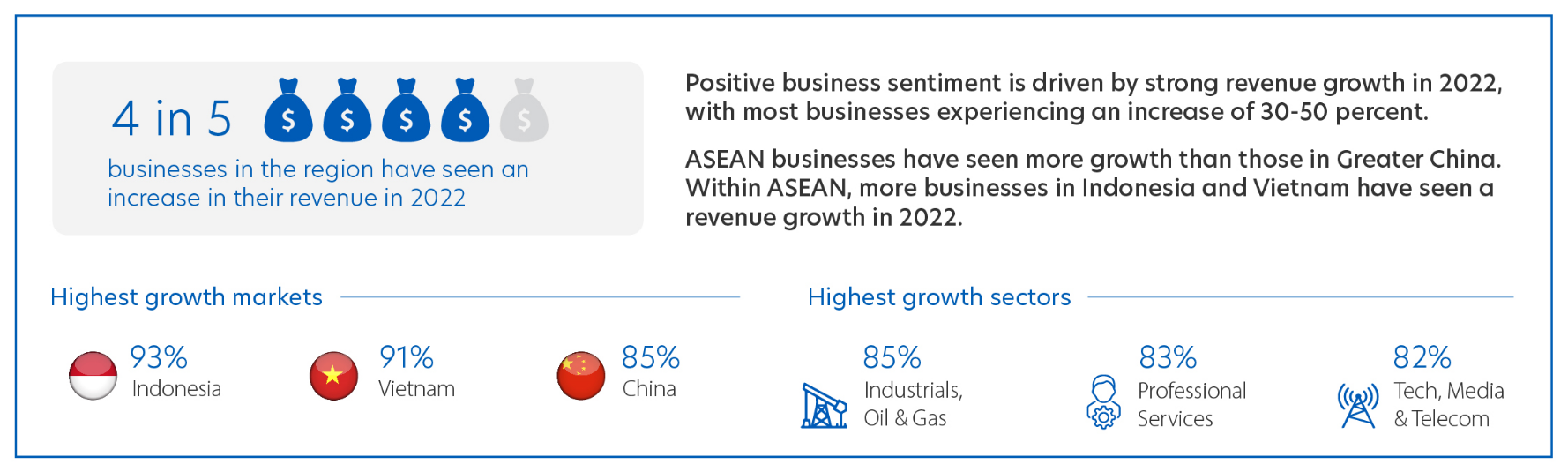

Sentiments about the current business environment are largely positive, led by Mainland China (94 per cent), Indonesia (93 per cent), and Vietnam (89 per cent). This comes on the back of four in five businesses reporting revenue growth in 2022, versus 2021. However, challenges persist, with businesses wrestling with rising operational costs, inflation, a slowing economy, and increasing interest rates.

Firms in ASEAN were more affected by high inflation and increased raw material costs than those in Greater China. To negate this, almost one in two firms are working on ways to improve productivity to save costs.

In the next one to three years, digitalisation is seen by businesses as one of the key priorities to help save costs and mitigate high inflation – along with the focus on customer acquisition.

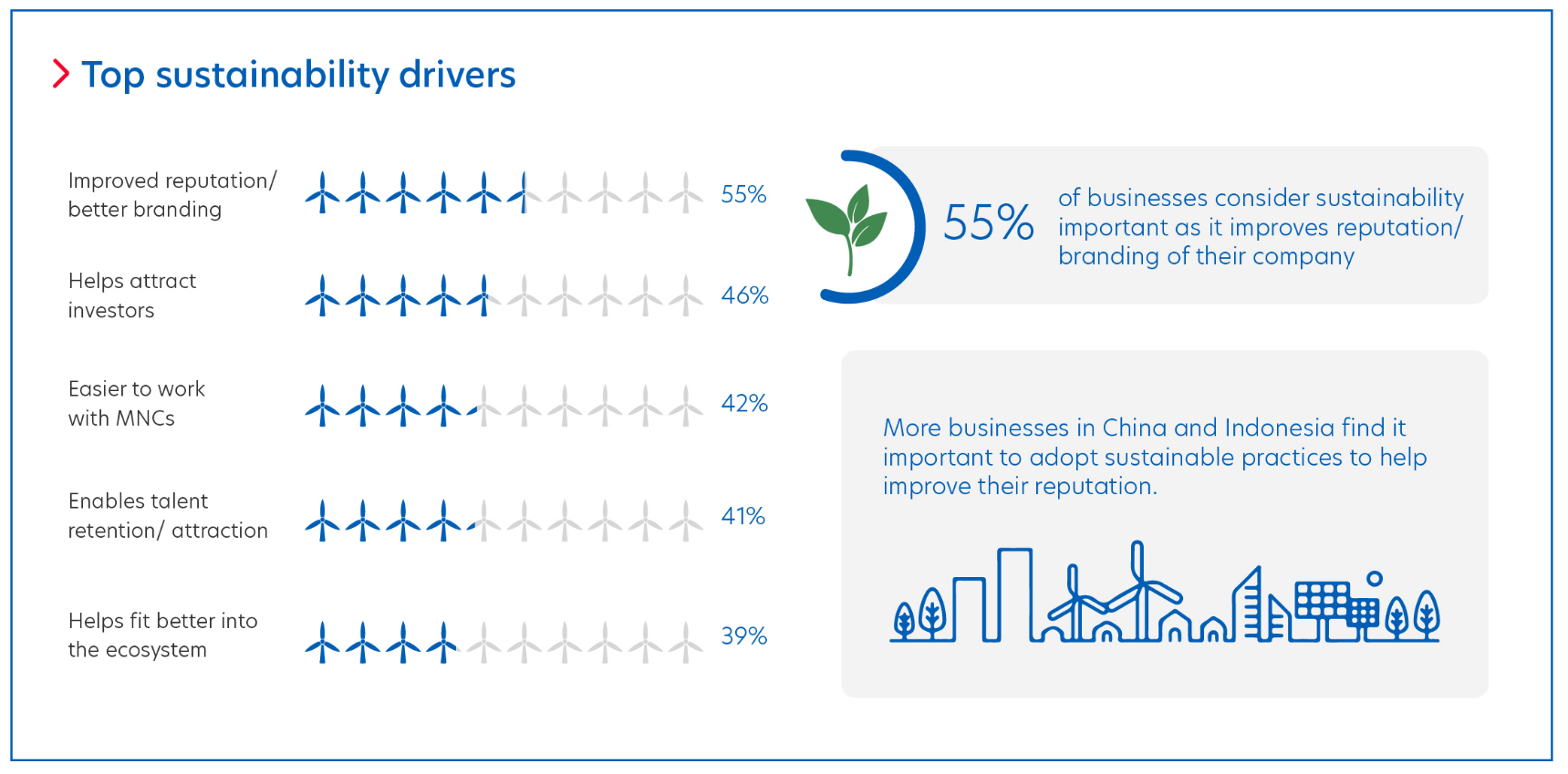

Sustainability in business has gained momentum, with more than 40 per cent of businesses having implemented sustainable practices. To that, more companies in Thailand and Vietnam are leading the green initiative. Most businesses recognise the importance of sustainability, while barriers to adoption include increased costs to customers, a negative impact on profits, as well as a lack of sustainable financing – particularly in Mainland China.

Despite these challenges, businesses are driven towards net-zero goals to safeguard the environment and uphold their sustainability commitments. Businesses in ASEAN are also calling for tax incentives and sustainable financing, while those in Mainland China seek connections to industry peers as well as access to business analytics and insights.

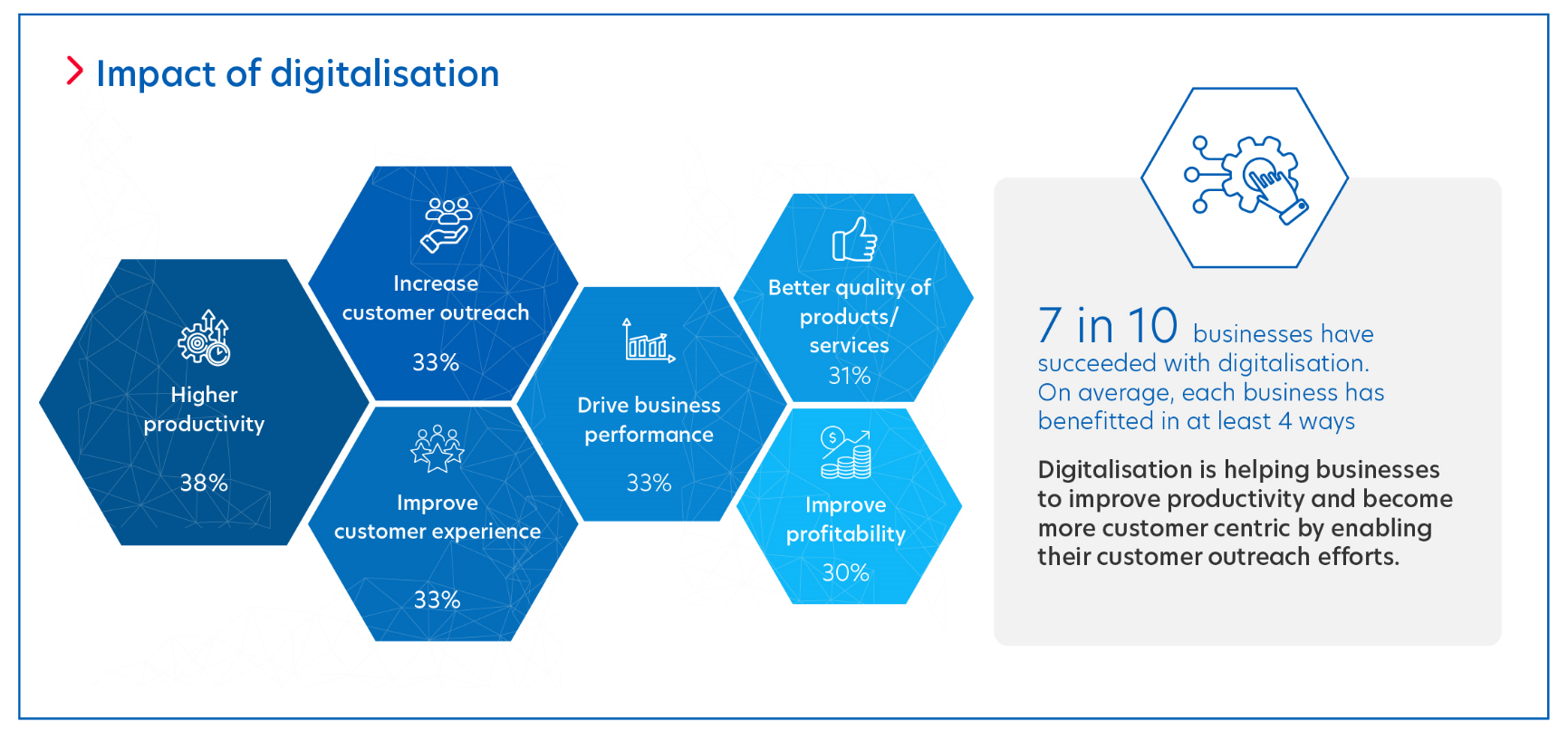

Digital transformation is gaining traction, almost 90 per cent of businesses adopting digitalisation in at least one department. When it comes to the number of companies that have adopted digitialisation, Mainland China, Indonesia, and Thailand are leading the race. The most significant benefits include improved productivity, enhanced customer experience, and wider customer outreach.

Businesses are also expecting to spend more on digitalisation this year, with more than half planning to spend 10 to 25 per cent more. However, cybersecurity issues, data breach risks, and a lack of digital skills pose significant challenges.

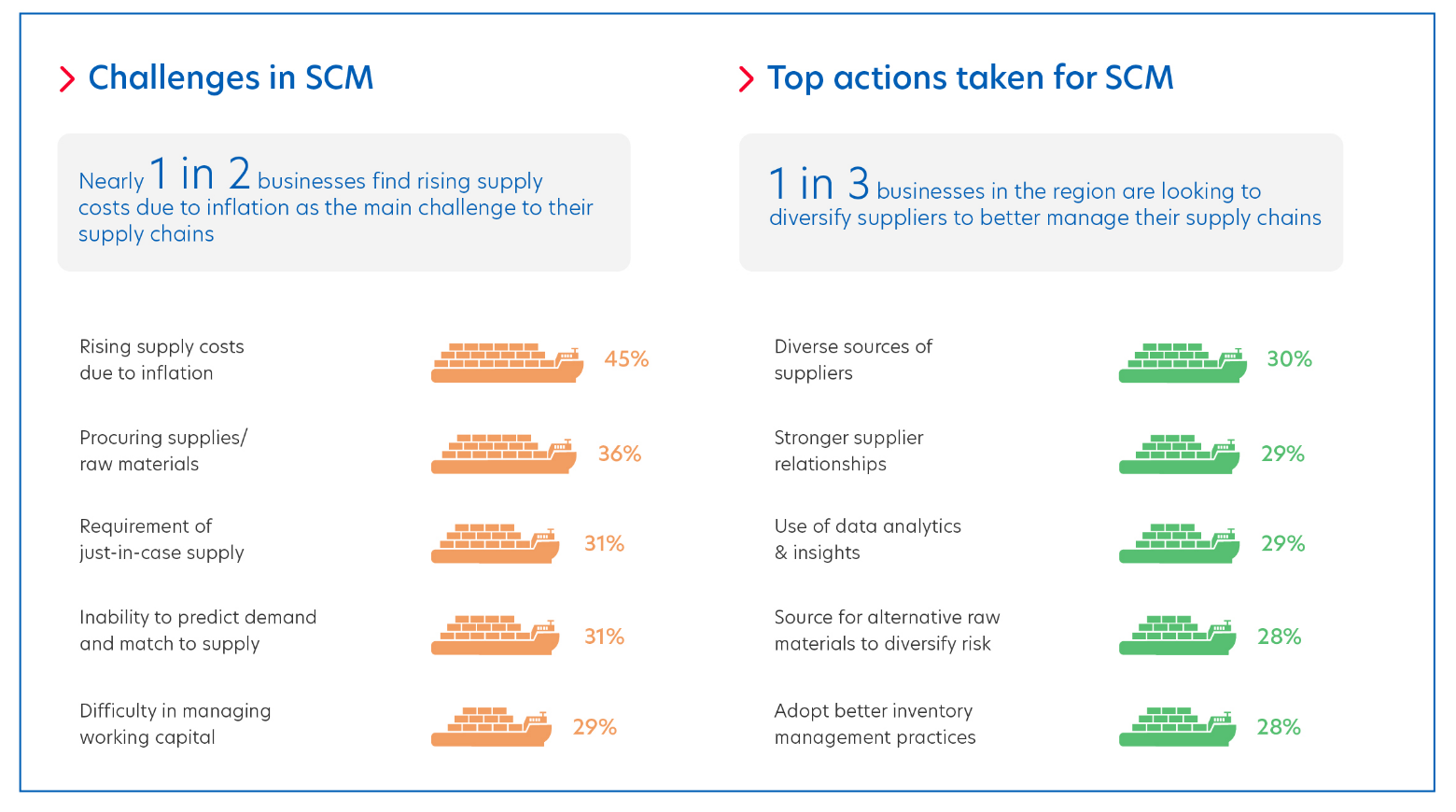

A majority of businesses acknowledge the importance of supply chain management (SCM), and many have experienced disruptions due to global trade tensions. Rising supply costs and difficulties procuring supplies are major concerns, particularly in Indonesia and Malaysia.

To ensure stability, businesses across the region are diversifying suppliers, building stronger supplier relationships and leveraging data analytics as well as insights.

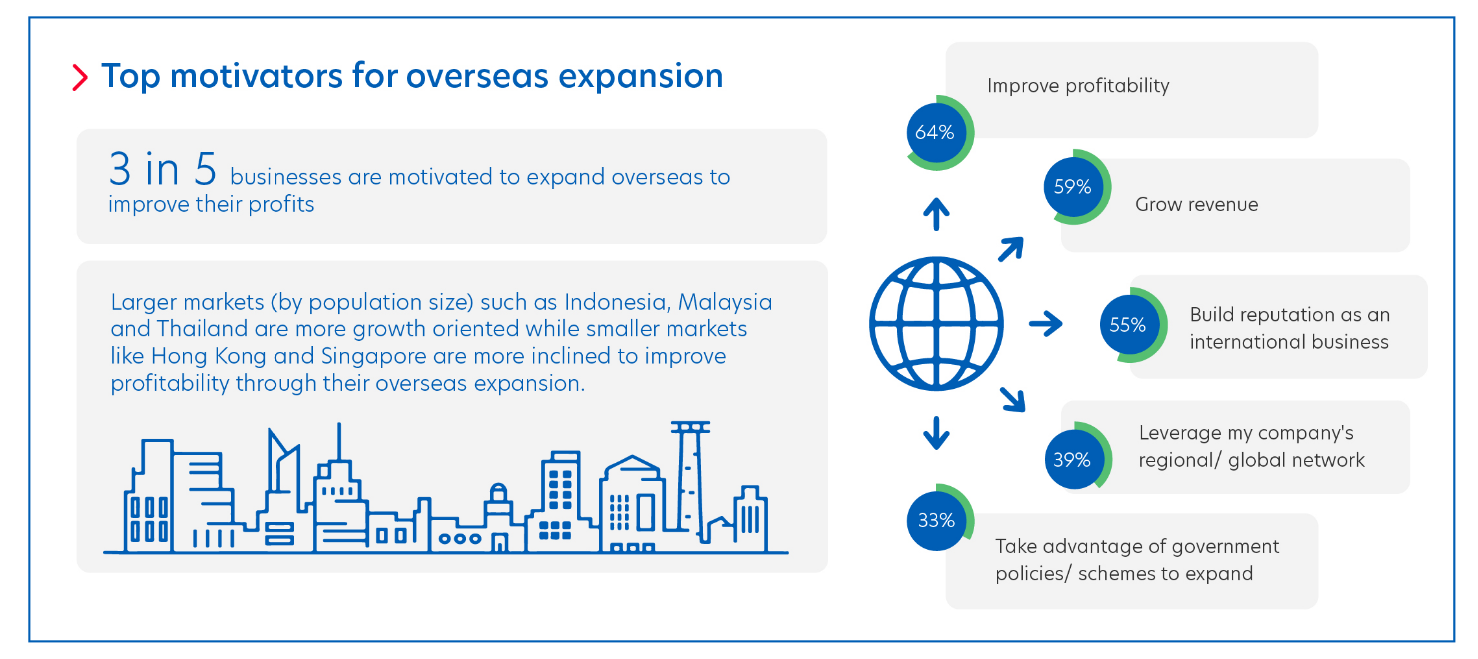

More than 80 per cent of businesses express interest in expanding overseas, with Mainland China, Indonesia, Thailand, and Vietnam leading this trend. Around 85 per cent are interested in using cross-border digital trade platforms for overseas expansion.

When it comes to overseas expansion, some of the key motivators for businesses include the potential increase in profitability, revenue growth, and to building their international reputation. Southeast Asia and Mainland China are the preferred destinations for expansion strategies. Nevertheless, finding suitable partners, sourcing in-house talent, and managing regulatory compliance pose a significant challenge.

The UOB Business Outlook Study 2023 (Regional edition) presents an encouraging picture of the business environment across ASEAN and Greater China. Businesses are increasingly adopting sustainable practices, digitalising operations, and considering overseas expansion.

Despite challenges such as high inflation and supply chain disruptions, the prevailing sentiment remains optimistic, laying a promising foundation for continued growth and innovation.

The UOB Business Outlook Study 2023 (SME & Large Enterprises) surveyed more than 4,000 business owners and key executives from various sectors across Indonesia, Malaysia, Singapore, Thailand, Vietnam, Mainland China and Hong Kong SAR. The quantitative online study – conducted between December 2022 and January 2023 – gathered insights on key themes such as:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

15 Jul 2025 • 6 mins read

03 Jul 2025 • 6 mins read

30 Jun 2025 • 6 mins read

25 Jun 2025 • 5 mins read