You are now reading:

ASEAN Consumer Sentiment Study 2024 (Regional): Positive outlook amidst inflation and rising expenses

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Regional): Positive outlook amidst inflation and rising expenses

ASEAN economies remain among the fastest-growing in the world, supported by the continued expansion of domestic demand, strong foreign direct investment and a robust tourism industry. In 2022, the ASEAN nations' gross domestic product (GDP) amounted to USD 3.6 trillion – more than double its GDP in 2009 – and is on track to continue its stellar momentum.

For the past five years, UOB has been tracking consumer sentiments across Singapore, Malaysia, Thailand, Indonesia and Vietnam through our flagship ASEAN Consumer Sentiment Study. Highlights from this year’s study include:

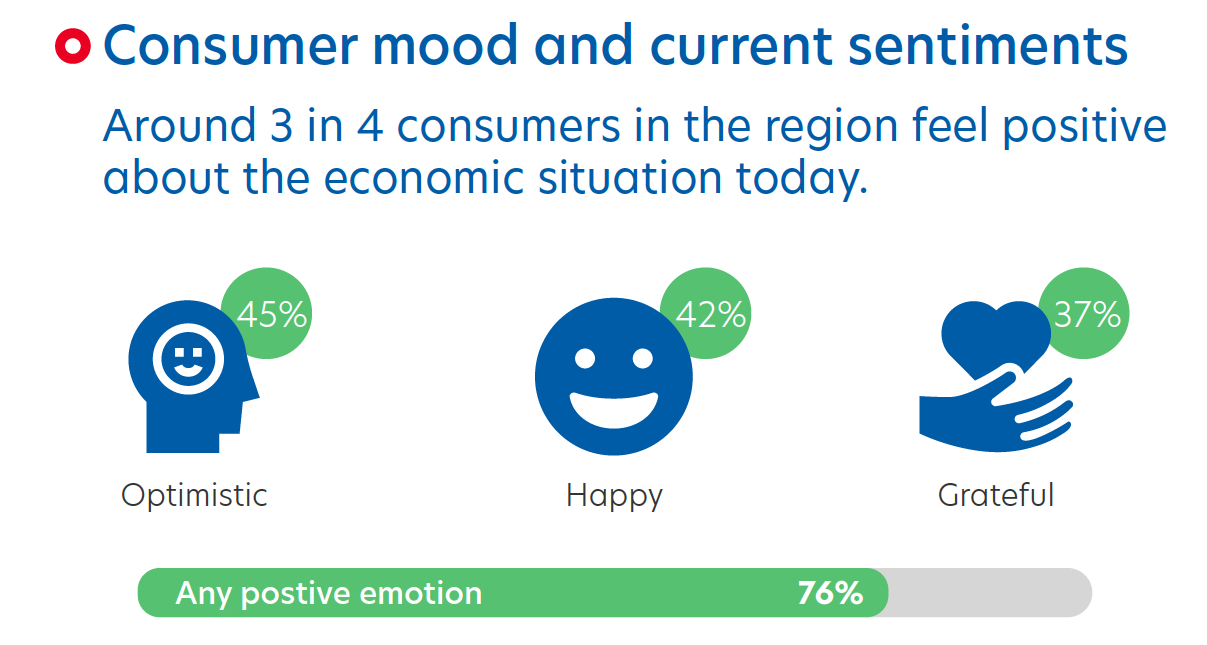

Similar to last year, positivity permeates the region in the context of today’s economic situation. The majority of respondents (76 per cent) reported feeling mostly positive emotions, with the top three positive emotions felt being optimistic (45 per cent), happy (42 per cent) and grateful (37 per cent).

Figure 1: Survey results of respondents’ mood in today’s economic situation

Indonesian and Vietnamese respondents were the most positive in the region with 84 per cent experiencing positive emotions, surpassing Singapore (77 per cent), Thailand (71 per cent) and Malaysia (63 per cent). In terms of demographics, Gen Y (79 per cent), Affluent (81 per cent) and Male (78 per cent) segments experienced more positive moods than others in the region.

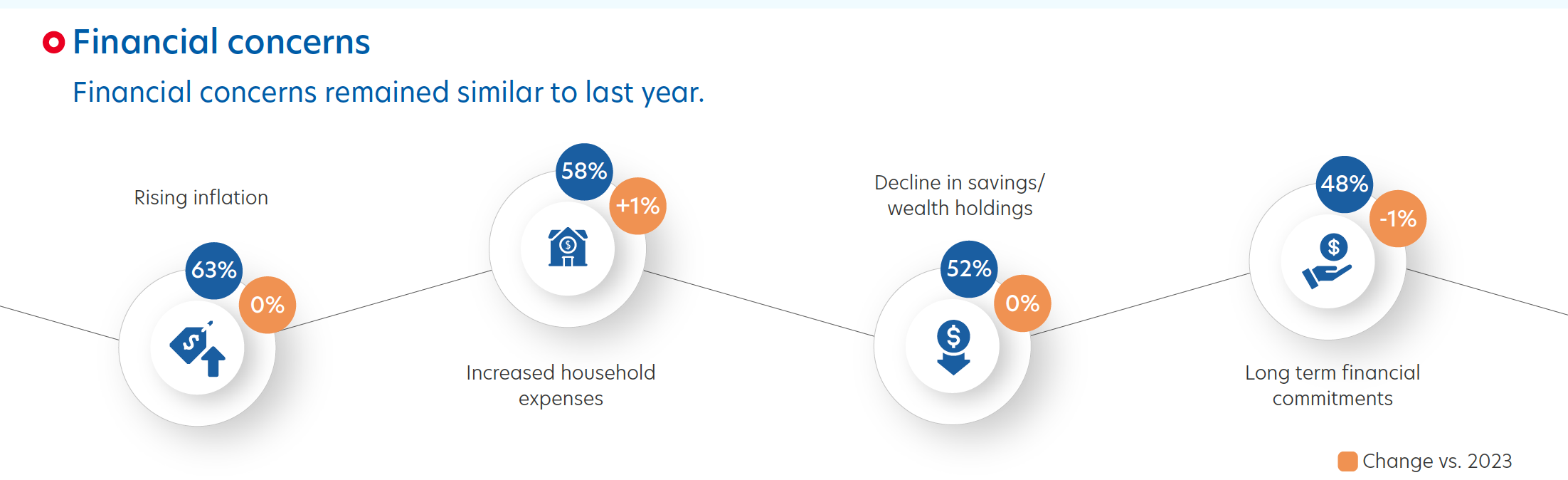

However, finances are a top concern across the region, particularly in Malaysia (85 per cent) and Thailand (80 per cent). Rising inflation (63 per cent) and increased household expenses (58 per cent) are the primary causes for concern.

Figure 2: Respondents’ top financial concerns

A decline in savings and long-term financial commitments are concerning for those in Malaysia (62 per cent) and Thailand (58 per cent), more so now than before. But positivity persists as more than four in five in the region expect to be financially the same or better off by this time next year.

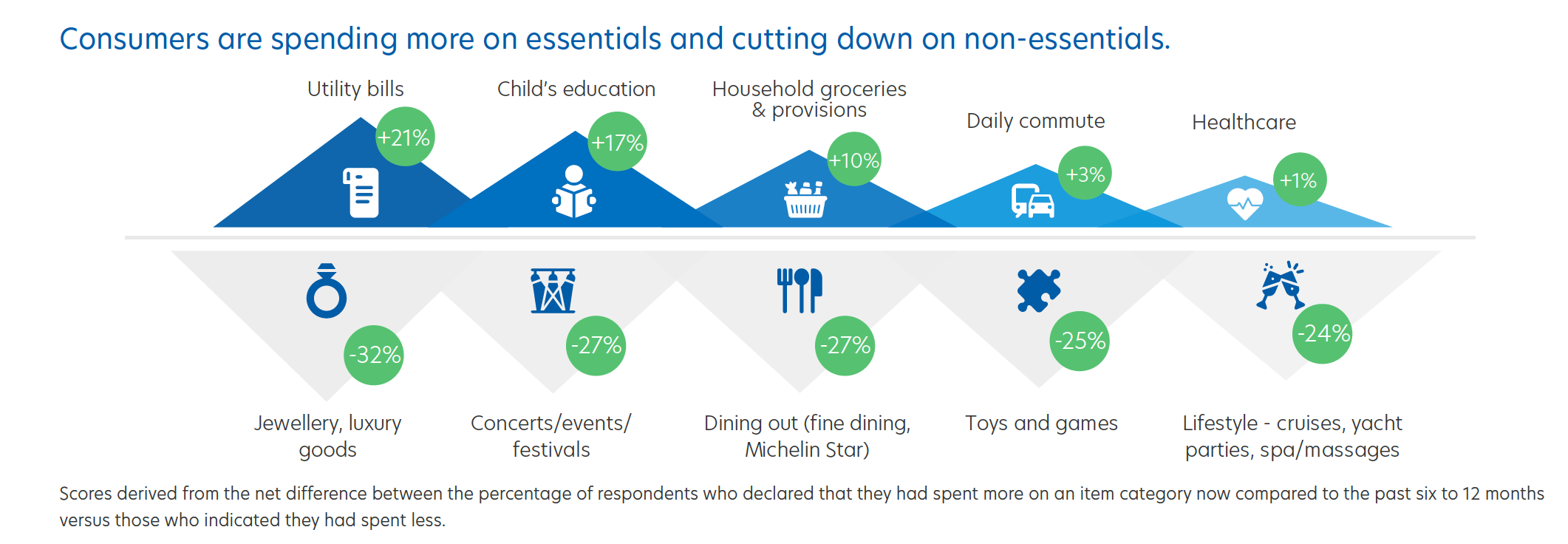

Due to rising costs of living, consumer spending has gone up across the region. Utilities (21 per cent), child education (17 per cent), and groceries (10 per cent) are the top three categories where spending has increased1.

Figure 3: Top 5 categories where spending increased and top 5 categories where spending decreased

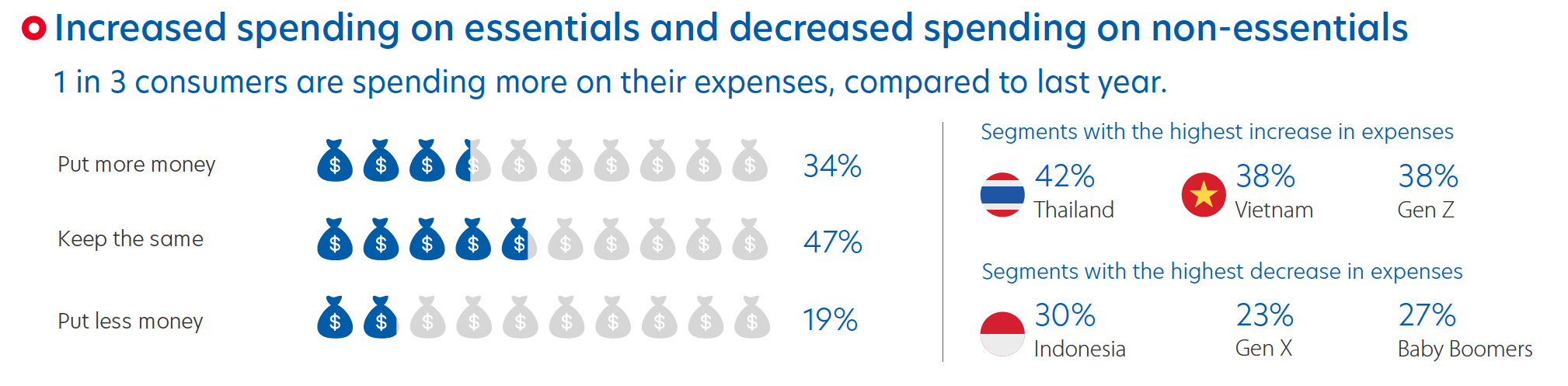

Budget allocation for expenses is also higher than before at 34 per cent – a 10-percentage point increase from 2023. Fewer consumers are putting money into savings (32 per cent, down 3 percentage points compared to the previous year’s study), perhaps due to rising prices.

Figure 4: Budget allocation on expenses

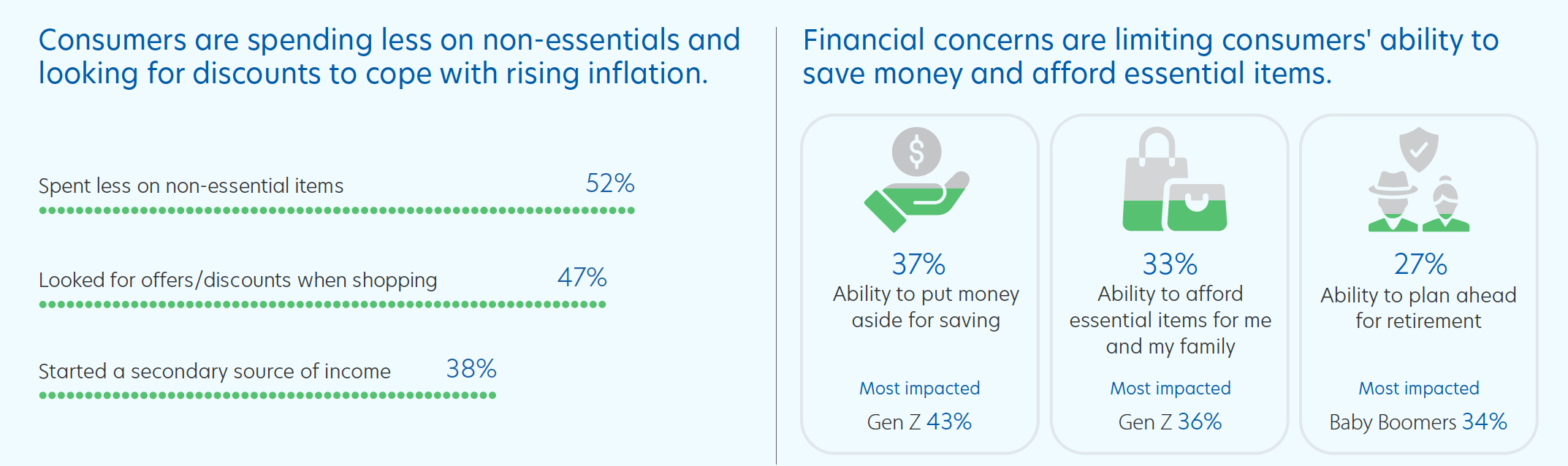

In response to financial worries, many across the region are tightening their purse strings. More than half (52 per cent) of consumers said they spent less on non-essentials, particularly those in Malaysia (60 per cent). Others actively sought offers and discounts while shopping, especially those in Indonesia (52 per cent) and Malaysia (54 per cent).

Figure 5: How consumers are coping with inflation and most worrying financial situations

More consumers are using digital resources to monitor and build their wealth (61 per cent across the region, three percentage points higher than the previous study), especially among the Gen Z. Investment-wise, nearly six in 10 have invested more than 10 per cent of their annual income in various financial instruments.

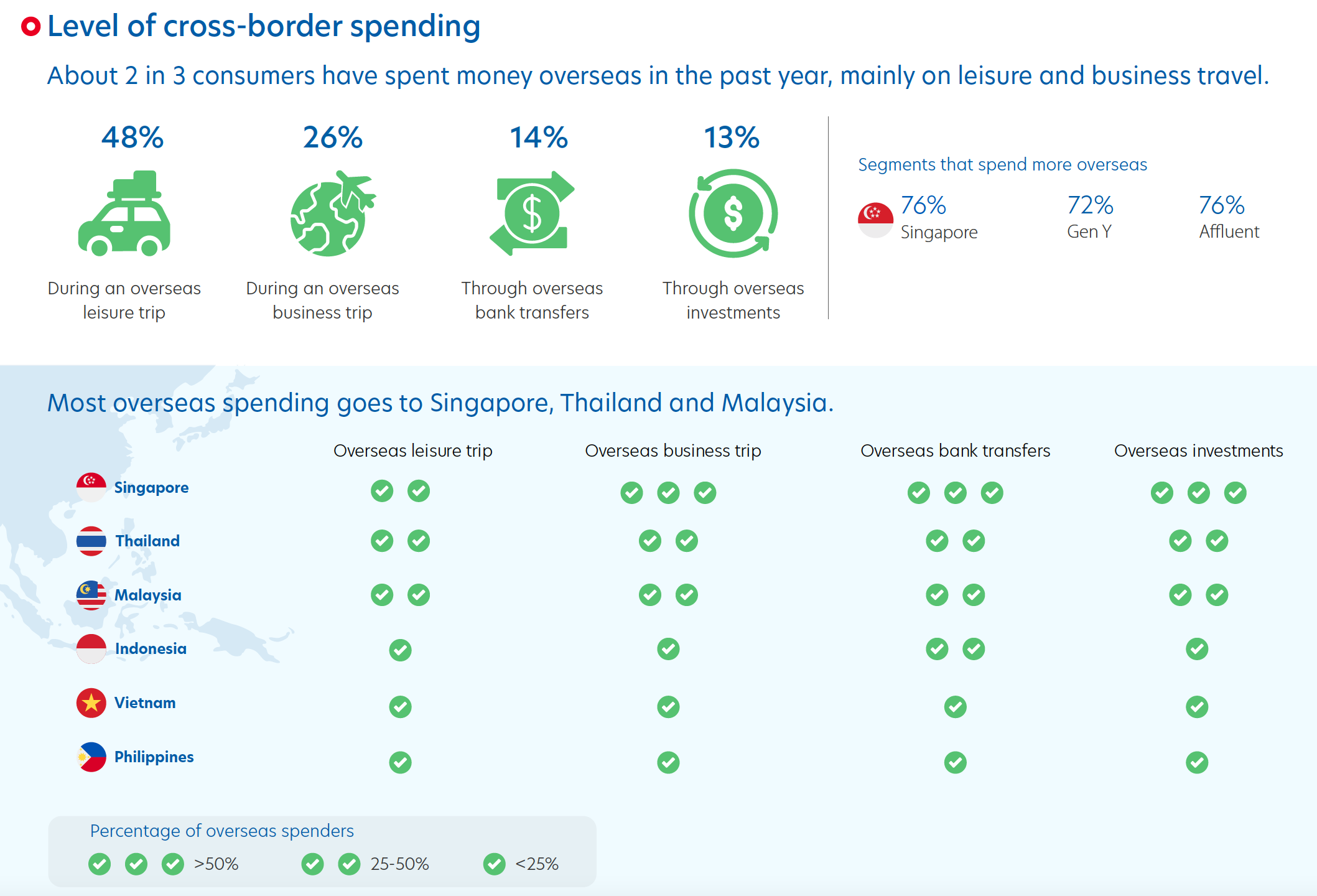

In terms of cross-border spending, two in three consumers in the region have spent money overseas, mainly on leisure and business travel purposes. Across all spending categories, including overseas bank transfers and overseas investments, Singapore, Thailand and Malaysia are the top ASEAN markets where regional spending has taken place.

Upon a closer look, 50 per cent of regional leisure spending was recorded in Singapore, contributed heavily by Indonesian (79 per cent) and Thai (68 per cent) consumers. When it comes to business trips, Singapore is also the preferred destination (63 per cent) for overseas expenditure.

Figure 6: Cross border spending and overseas spend locations

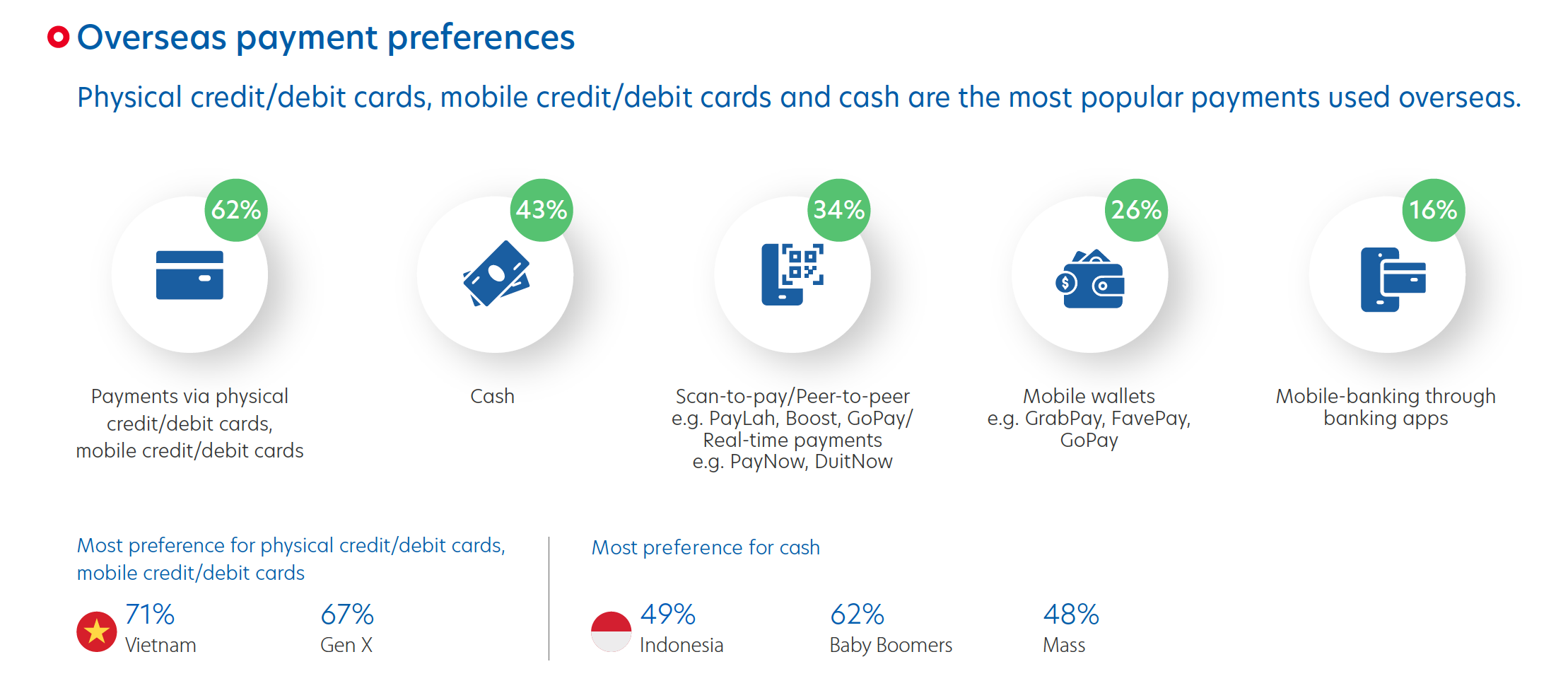

Among those who have spent overseas, 62 per cent of respondents prefer paying by physical or mobile credit/debit cards, displacing cash as the most preferred payment method.

Figure 7: Survey results of respondents’ mood in today’s economic situation

Savings continues to be a priority in the region, with two in five saving more than 20 per cent of their monthly income. Specifically, 54 per cent have set aside at least three months’ worth of expenses as their emergency fund. This habit is prominent, particularly in Singapore, where 60 per cent of respondents save at least three months’ worth of expenses. Across ASEAN, about 70 per cent have a fair to very good idea on the amount they would need to retire comfortably.

Among the generations, the youth (Gen Z and Gen Y) and Affluent display a strong savings mindset with around three in four saving more than 10 per cent of their monthly income. Malaysia notably lags behind other markets when it comes to savings, with most consumers (30 per cent) saving around 10 per cent or less of their monthly income and 6 per cent not saving at all.

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

1Scores derived from the net difference between the percentage of respondents who declared they had spent more on a category now compared to the past six to 12 months versus those who said they had spent less.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

03 Jul 2025 • 6 mins read

30 Jun 2025 • 6 mins read

25 Jun 2025 • 5 mins read

12 Jun 2025 • 6 mins read