You are now reading:

ASEAN Consumer Sentiment Study 2024 (Singapore): Staying financially prudent amidst rising costs

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2024 (Singapore): Staying financially prudent amidst rising costs

After a challenging 2023, Singapore’s business landscape is picking up speed. In the first quarter of 2024, the economy grew 2.7 per cent year-on-year — the fastest pace in 18 months.

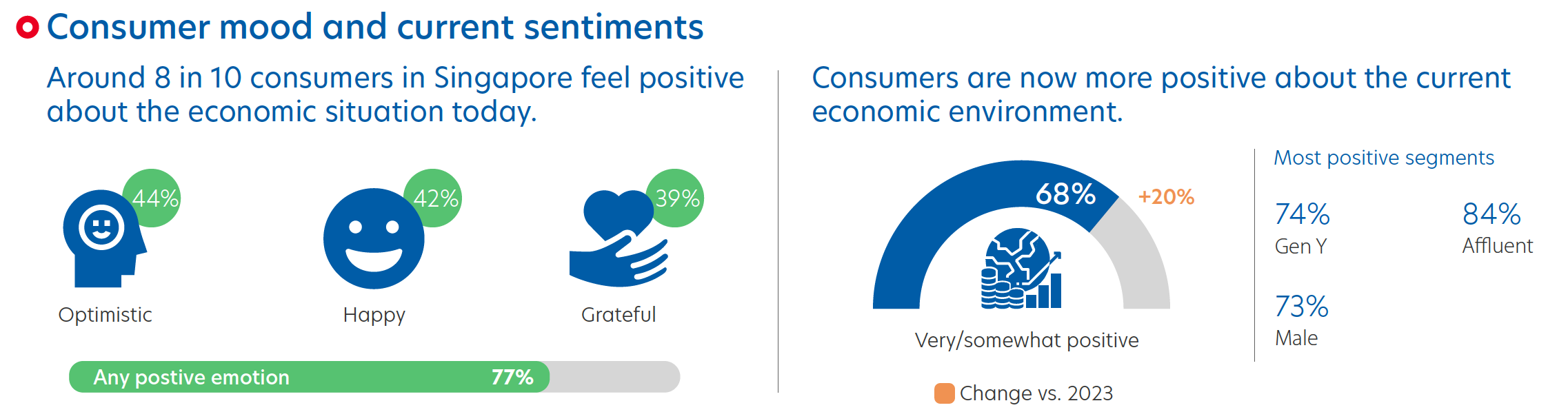

The mood among Singaporean consumers has brightened in tandem with this economic momentum. According to the ASEAN Consumer Sentiment Study 2024 — Singapore report, over three in four Singaporeans feel positive about today’s economic situation. This marks an 11 per cent increase as compared to last year.

At the same time, consumers remain prudent about their finances as cost-of-living increases. Their shifting financial habits and spending patterns across age groups reflect this concern.

Compared with 2023, Singaporeans’ sentiments have become significantly more positive.

68 per cent say that they feel positive about the nation’s current economic environment – a sharp increase of 20 per cent from the previous year. Moreover, 67 per cent report feeling positive about Singapore’s future economic performance in the next six to 12 months.

Figure 1: Survey results of respondents’ mood in today’s economic situation

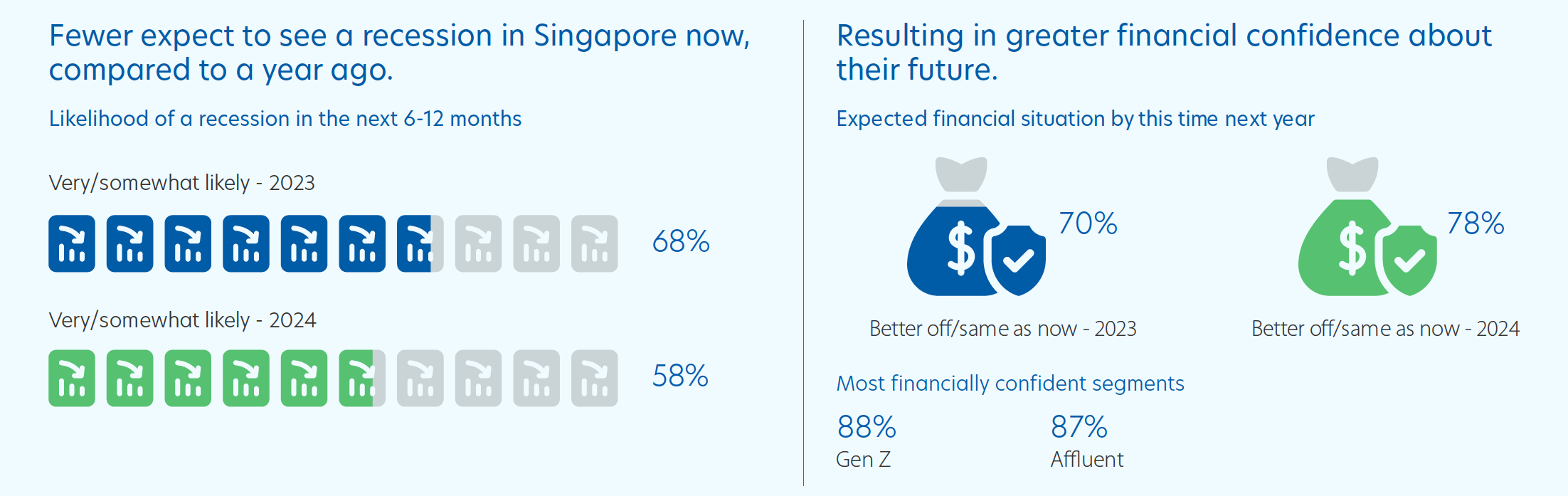

This optimism may be prompted by lowered fears of an upcoming recession. Only 58 per cent of respondents believe Singapore is likely to face a recession within the next six to 12 months, which is 10 percent lower than respondents of the previous year. This outlook also skews significantly more positive than the regional average of 71 per cent.

Figure 2: Likelihood of a recession and expected financial situation

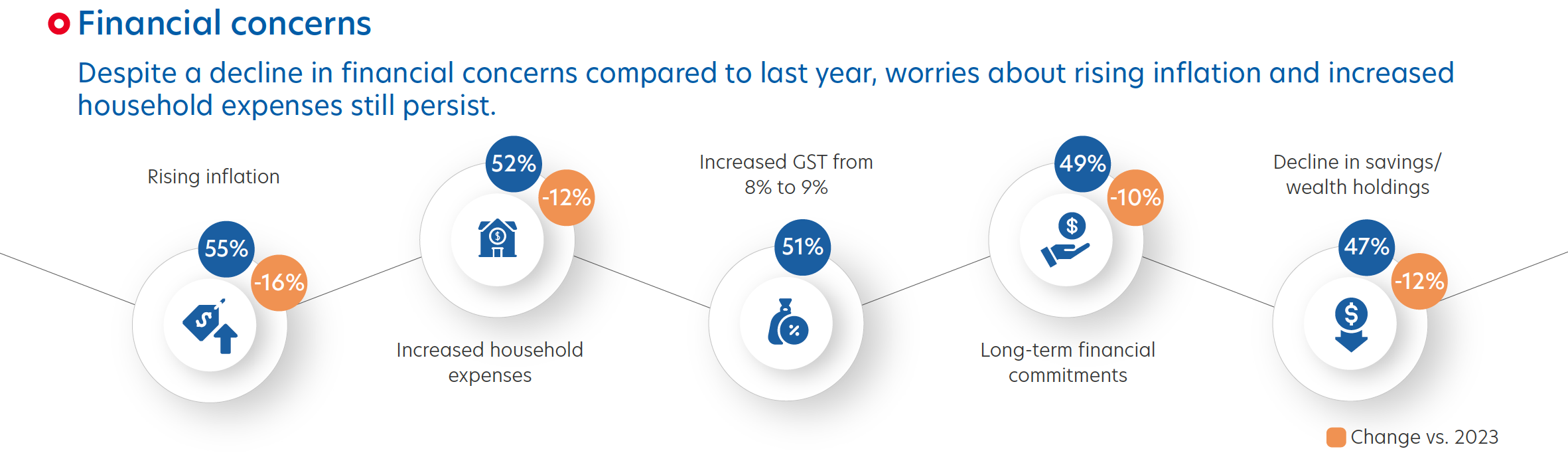

Nevertheless, the rising cost of living continues to weigh heavily on consumers’ minds. Some of the key reasons driving this worry are rising inflation, increased household expenses, and the latest GST increment.

Figure 3: Respondents’ top financial concerns

Work-related worries are another top stressor for nearly six in ten Singaporeans. Such worries can be traced back to finances, with respondents citing concerns about their ability to find a better job and the possibility of taking a pay cut.

Various price hikes were announced last year in Singapore: public transport fares hiked by 7 per cent from December 2023, while water prices went up by 20 cents per cubic metre in April 2024. The top categories that Singaporeans report forking out more for include utilities (25 per cent), daily transportation (11 per cent), and child education (11 per cent)1.

In response, some consumers are tightening their belts. The top categories where spending decreased was dining out (fine dining, Michelin Star) and luxury goods.

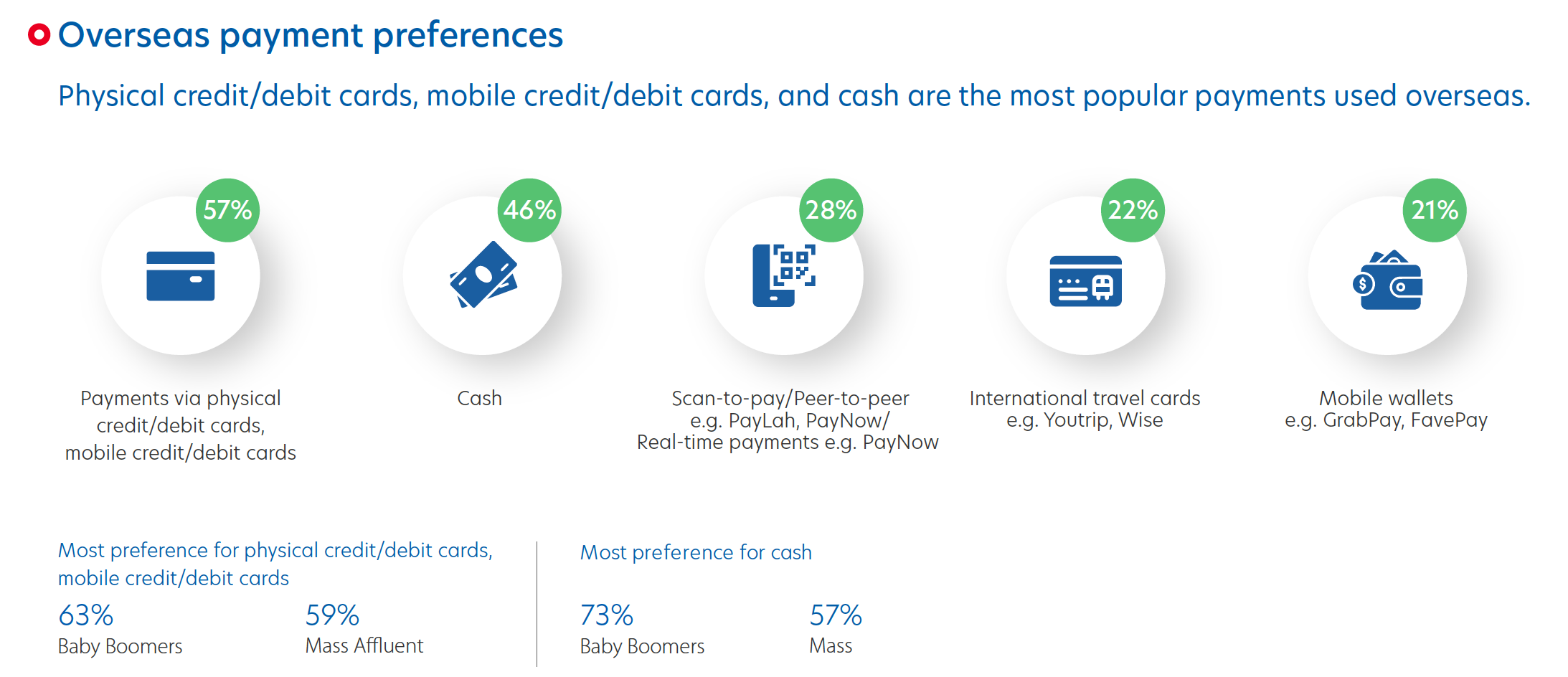

Financial concerns aside, Singaporeans remain no stranger to overseas spending. Over three in four have spent money overseas in the past year — whether through holidays, business trips, overseas investments, or overseas bank transfers.

Location-wise, Singaporeans are spending the most money in Malaysia, Thailand and Indonesia, across categories such as leisure, business, investments and overseas bank transfers.

Bolstered by recent advances in cross-border payment linkages, payment via physical/mobile credit or debit cards have displaced cash as the most preferred payment method during overseas trips, with 57 per cent preferring this payment method. Nearly one in two preferred cash, while 28 per cent use scan-to-pay or peer-to-peer or real-time payment platforms.

Figure 4: Preferred payment method during overseas trips

With national education campaigns on financial literacy such as MoneySense, Singaporeans have a good grasp of financially savvy behaviours like saving and retirement planning.

One in two respondents save over 20 per cent of their income every month. Among younger age groups, this habit is stronger: 60 per cent of Gen Zs and 52 per cent of Gen Ys save more than 20 per cent of their income.

The majority of Singaporeans are prepared for a rainy day, with 92 per cent of respondents having an emergency fund. However, only 60 per cent have at least three months’ worth of expenses in their fund.

Amongst Singaporeans with loan liabilities, one in three make the effort to pay an additional amount every few months to help reduce their loan tenure.

In terms of retirement planning, seven in 10 have a fair to very good idea of the money they will need to retire comfortably. Furthermore, 84 per cent have started setting money aside for retirement, with one in four turning to investments to generate retirement income.

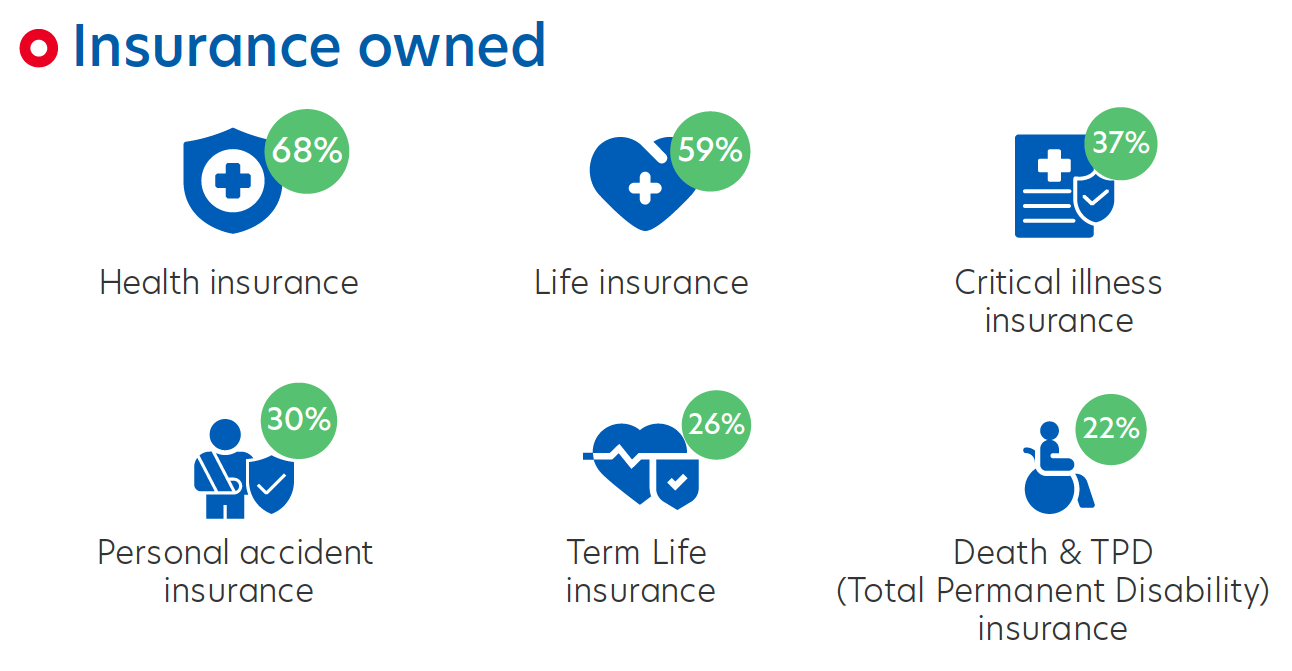

However, in the area of insurance, only 37 per cent of Singaporeans have a critical illness insurance plan, while only one in five have insurance for death and total permanent disability. While ownership of these types of insurance is much higher than those in the region, majority of Singaporeans still need to be better protected in these areas.

Figure 5: Key types of insurance owned

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out about our tailored solutions, industry knowledge and market expertise.

1Scores derived from the net difference between the percentage of respondents who declared they had spent more on a category now compared to the past six to 12 months versus those who said they had spent less.

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fifth year, the survey was conducted from May to June 2024 and captures the responses of 5,000 consumers across different demographic groups in the region. In Singapore, 1,000 consumers were surveyed.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ