You are now reading:

ASEAN Consumer Sentiment Study 2023 (Regional): Digital banking grows amidst economic woes

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

ASEAN Consumer Sentiment Study 2023 (Regional): Digital banking grows amidst economic woes

ASEAN economies are among the fastest growing in the world. By 2030, the region is projected to have a GDP of US$4.5 trillion, making it the fourth-largest economy in the world. ASEAN's population is also expected to hit 723 million, of which nearly 575 million will be internet users, representing a large, digitally-native market.

For the past four years, UOB has been tracking consumer sentiments across Singapore, Malaysia, Thailand, Indonesia and Vietnam through our flagship ASEAN Consumer Sentiment Study. Highlights from this year’s study include:

"As a barometer of regional sentiment towards the economy as well as pertinent areas of interest such as spending and financial behaviour and technology, the findings from UOB ACSS 2023 offer valuable insights for consumers and businesses, to adapt and poise themselves to navigate the current uncertain economic environment."

Jacquelyn Tan, Head, Group Personal Financial Services, UOB

Survey respondents shared their sentiments, concerns and expectations in their daily outlook. Overall, consumers across the region were optimistic, with 77 per cent of respondents reporting positive emotions. Consumers in Indonesia (88 per cent) and Vietnam (85 per cent) were the most positive.

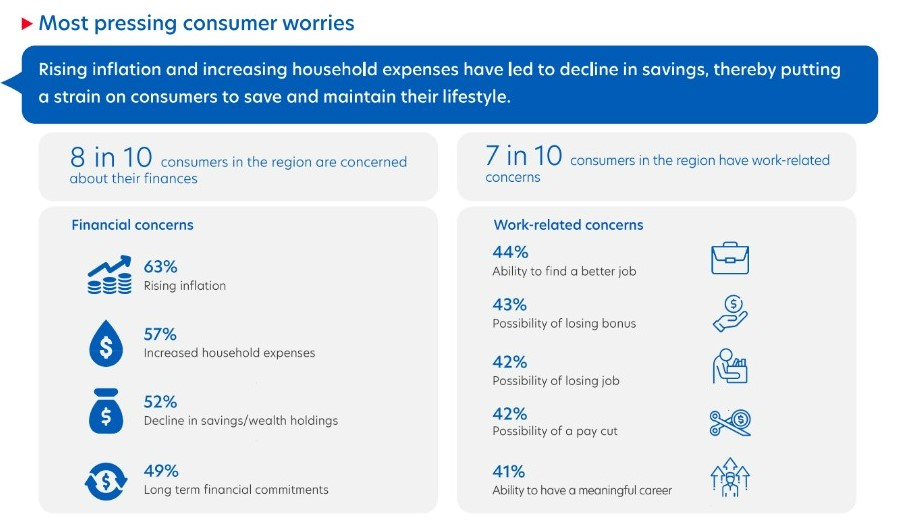

However, the overall percentage of positive sentiments declined compared with last year. This is rooted in uncertainty and higher expenses caused by inflation, which in the last year rose rapidly in the region. As a result, eight out of 10 consumers were concerned about their finances, with 63 per cent citing rising inflation and 57 per cent reporting increased household expenses as their top concerns. A further seven out of 10 worried that their country would go into a recession in the next six to 12 months.

Figure 1: Survey results of respondents’ most pressing concerns.

That said, three out of five consumers believed they would be better off by the middle of 2024. Consumers in Indonesia (68 per cent) and Vietnam (72 per cent) felt the most optimistic about the future performance of their country’s economy.

The cost of food, utilities and transport goods and services increased in ASEAN as inflation reached a nine-year high in 2022. This was exacerbated by the depreciation of regional currencies due to tightened monetary policies in developed economies, which led to higher import costs. The exception would be the Singapore dollar, which the Monetary Authority of Singapore kept strong.

When respondents across the region were asked questions to track the changes in their spending habits and financial behaviours, they reported that their spending on utilities (42 per cent) and groceries (34 per cent) increased the most compared with last year.

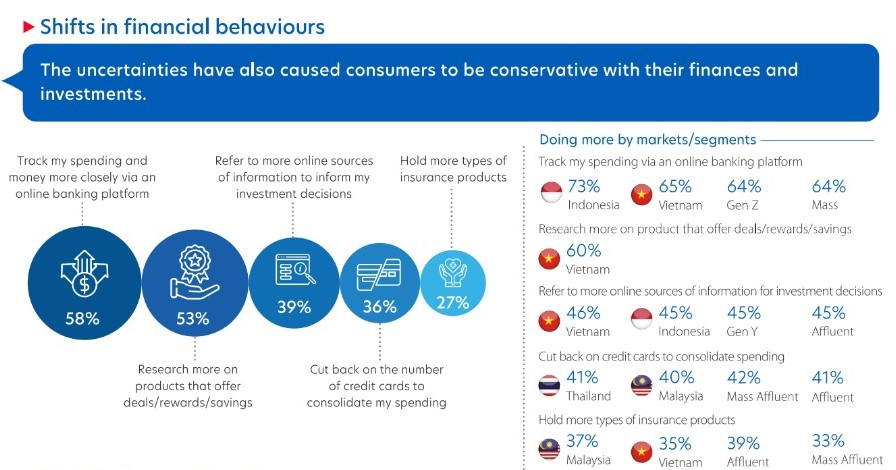

More consumers are tracking their spending closely – and making the most of digital platforms and apps to help them monitor their expenses, research offers and rewards, and even make investment decisions.

Fifty-eight per cent of consumers in the region said they used their online banking platforms to closely track their spending, with a higher concentration in Indonesia (73 per cent) and Vietnam (65 per cent). Sixty per cent of consumers in Vietnam said they regularly researched products that offered them deals, rewards and savings.

Figure 2: Consumers’ change in behaviour in response to financial uncertainty.

As banks in Southeast Asia shift towards digitalisation to improve customer experience and increase operational efficiency, more consumers prefer banking on their mobile phones. This is especially evident in Indonesia (62 per cent of consumers), Thailand (61 per cent) and Vietnam (57 per cent). Gen Y, Mass Affluent and Affluent consumer segments were more likely to use digital banking channels. Meanwhile, consumers in Thailand (30 per cent) and Vietnam (29 per cent) also showed a preference for roboadvisors – automated, algorithm-based financial planning platforms – to guide their investments.

Online channels have emerged as the preferred channel for banking activities such as opening a new account and applying for simple banking products. The exception is Malaysia, where more customers prefer opening new banking accounts at a branch (43 per cent) rather than online (27 per cent). Baby boomers across the region were the least likely to conduct banking activities online.

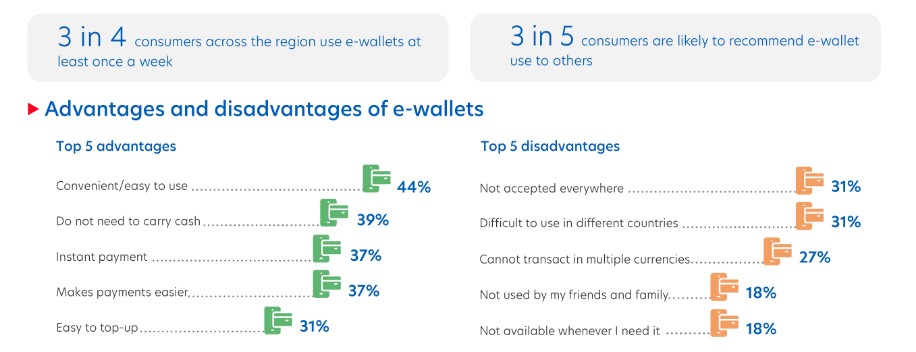

The most popular digital payment methods in the region were e-wallets (used by 56 per cent of all respondents), e-commerce payment platforms (49 per cent) and mobile banking apps (49 per cent). Respondents cited convenience and ease of payments as the key reasons for using these payment methods.

Topping up these digital wallets is usually done through banking apps (77 per cent) and credit or debit cards (38 per cent).

Figure 3: Reasons why consumers use e-wallets – and current barriers they experience.

This is in keeping with Southeast Asia’s digital economy, which is projected to reach US$1 trillion by 2030 and fuelled by a young, digital native population with just over 70 per cent smartphone penetration rate. Add in a vibrant e-commerce scene and barriers to accessing traditional banking and financial products, and these are all factors that make the region ripe for disruption from digital-first financial service providers.

In the future, 22 per cent of respondents said they are interested in using mobile wallet-linked debit or credit cards for payment, while 21 per cent are looking at apps that have built-in banking and financial services – perhaps paving the way for more widespread use of superapps. The majority of consumers (71 per cent, and particularly in Indonesia, Thailand and Vietnam) are comfortable sharing their financial data in one platform, citing better access to financial information and improved financial planning. This is despite eight out of 10 having lingering concerns over security risks.

Consumers are also turning towards digital platforms to access trading and wealth management services. About three out of four consumers have used these to invest via cryptocurrency exchanges (33 per cent), online-only trading platforms (32 per cent) and traditional online brokerage platforms (29 per cent).

Trust in banks has risen as well for consumers in Indonesia, Thailand and Vietnam compared with the rest of the region. In Singapore, the trust level remained the same for three out of four consumers.

Nearly 90 per cent of consumers from emerging markets in Asia Pacific want to practise more sustainable lifestyles. A smaller but growing number are already starting to do their part in sustainable consumption, making personal choices that are driven not only by environmental concerns but also because sustainability makes economic and financial sense.

Respondents equate sustainable development in their country with good health and well-being, affordable clean energy, and decent work and economic growth. More than half of consumers across the region were more likely to spend on sustainable products and services that relate to their daily needs, such as food and beverages (84 per cent) and personal care (81 per cent). Choosing sustainable products is driven by the desire to protect the planet for future generations (59 per cent) and wanting their own children to have a better future (51 per cent).

Across the markets, consumers in Indonesia and Thailand displayed more sustainable behaviours compared with other markets.

Four out of five consumers in the region were at least aware of sustainable finance products. Sustainable insurance is popular predominantly in Indonesia and Vietnam.

When asked to measure their stress levels at work, 53 per cent of employees said they felt calm, particularly in Vietnam (72 per cent) and Indonesia (62 per cent). This is despite continued economic concerns: 63 per cent of workers across the region were worried about rising inflation, followed by increased household expenses (57 per cent).

There are workplace worries as well. Amid a backdrop of widespread technological change, the digital revolution changing jobs and the push for a more sustainable future, 91 per cent of employees said that their top challenge in the next six to 12 months was upskilling or reskilling to stay relevant for the job market. This was followed by establishing trust between employers and employees (89 per cent) and work culture, which includes employee well-being, diversity and transparency (87 per cent).

Employees want their employers to provide mental health support, and 54 per cent of workers identified flexible working hours as one of their top expectations for mental health support. This is particularly true for employees in Singapore (59 per cent).

At UOB, we help businesses navigate the dynamic landscape of the ASEAN region to unlock its full potential. Contact us to find out more about our tailored solutions, industry knowledge and market expertise.

The following ACSS 2023 (Regional) reports and infographics are now available for download:

The ASEAN Consumer Sentiment Study (ACSS) is UOB’s regional flagship study analysing consumer trends and sentiments in five countries: Singapore, Malaysia, Thailand, Indonesia and Vietnam. Now in its fourth year, the survey was conducted in June 2023 and captures the responses of 3,400 consumers across different demographic groups in this dynamic region.

Some of the areas covered include:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ