2018

ANNUAL REPORT

Financial

Highlights

Total Income

Total income rose 6% to $9.12 billion, led by strong growth in both net interest income and net fee and commission income.

Net interest income grew 13% to $6.22 billion, driven by broad-based loan growth and higher net interest margin. Net interest margin increased five basis points to 1.82%, in line with the rising interest rate environment.

Net fee and commission income for the year increased 5% to $1.97 billion, driven by the strong performance in loan-related, credit card, trade-related and fund management fees. Other non-interest income declined 20% to $930 million mainly due to unrealised mark-to-market on investment securities and lower gains from sale of investment securities.

Net interest income grew 13% to $6.22 billion, driven by broad-based loan growth and higher net interest margin. Net interest margin increased five basis points to 1.82%, in line with the rising interest rate environment.

Net fee and commission income for the year increased 5% to $1.97 billion, driven by the strong performance in loan-related, credit card, trade-related and fund management fees. Other non-interest income declined 20% to $930 million mainly due to unrealised mark-to-market on investment securities and lower gains from sale of investment securities.

$9,116

million

+ 6%

Net Profit After Tax

Net earnings for the year rose to a new high of $4.01 billion, up 18% from a year ago.

$4,008

million

+ 18%

Customer Loans/Deposits

Customer deposits grew 7% to $293 billion, led by growth in Singapore Dollar deposits.

The Group's funding position continues to be strong with healthy loan-to-deposit ratio at 88.2% as at 31 December 2018.

Spurred by strong capital and funding, net customer loans grew 11% from a year ago to $259 billion in 2018. The growth was broad-based across all territories and industries.

The Group's funding position continues to be strong with healthy loan-to-deposit ratio at 88.2% as at 31 December 2018.

Spurred by strong capital and funding, net customer loans grew 11% from a year ago to $259 billion in 2018. The growth was broad-based across all territories and industries.

Note: Net customer loans were net of total allowance.

Net Customer Loans

$259

billion

+ 11%

Customer Deposits

$293

billion

+ 7%

Loan/Deposit ratio

88.2

%

+ 3.1% pt

Shareholders’ Equity/Return on Equity

Return on equity improved to 11.3% driven by record earnings in 2018.

Shareholders' equity increased 2% from a year ago to $37.6 billion as at 31 December 2018, mainly driven by higher retained earnings.

Shareholders' equity increased 2% from a year ago to $37.6 billion as at 31 December 2018, mainly driven by higher retained earnings.

Shareholders’ Equity

$37.6

billion

+ 2%

Return on Equity

11.3

%

1.1% pt

Total Assets/Return on Assets

Return on assets for 2018 similarly increased to 1.07% on improved earnings.

The Group's total assets grew 8% to $388 billion in 2018 mainly on higher loan volume.

The Group's total assets grew 8% to $388 billion in 2018 mainly on higher loan volume.

Total Assets

$388

billion

+ 8%

Return on Assets

1.07

%

+ 0.09% pt

Capital Adequacy Ratio (CAR)

As at 31 December 2018, the Group's strong capital position remained well above the MAS minimum requirements with Common Equity Tier 1 and Total CAR at 13.9% and 17.0% respectively.

CET1 CAR

13.9

%

- 1.2% pt

Total CAR

17.0

%

- 1.7% pt

Loans by Geography

Singapore, which accounted for 52% of Group loan base, registered 8% growth year on year to reach $137 billion while regional countries contributed a strong growth of 15%.

Note: Loans by geography are classified according to where credit risks reside, largely represented by the borrower's country of incorporation/operation for non-individuals and residence for individuals.

$262

billion

+ 11%

Overseas Profit Before Tax Contribution

The Group's net profit before tax was 15% higher at $4.83 billion. Contributions from overseas was slightly lower at 39.6% in 2018 when compared with 40.8% a year ago.

39.6

%

- 1.2% pt

Five-Year Group Financial Summary

2014

2015

2016

2017

2018

Selected Income Statement Items ($ million)

Total income1

7,258

7,807

7,790

8,563

9,116

Total expenses1

2,947

3,356

3,425

3,739

4,003

Operating profit1

4,311

4,451

4,365

4,824

5,113

Net profit after tax2

3,249

3,209

3,096

3,390

4,008

Selected Balance Sheet Items ($ million)

Net customer loans

195,903

203,611

221,734

232,212

258,627

Customer deposits

233,750

240,524

255,314

272,765

293,186

Total assets

306,736

316,011

340,028

358,592

388,099

Shareholders’ equity2

29,569

30,768

32,873

36,850

37,628

Financial Indicators (%)

Cost/Income ratio

40.6

43.0

44.0

43.7

43.9

Non-performing loans ratio

1.2

1.4

1.5

1.8

1.5

Return on average ordinary shareholders’ equity

12.3

11.0

10.2

10.2

11.3

Return on average total assets

1.10

1.03

0.95

0.98

1.07

Return on average risk-weighted assets

1.94

1.74

1.51

1.63

1.93

Capital adequacy ratios

Common Equity Tier 1

13.9

13.0

13.0

15.1

13.9

Tier 1

13.9

13.0

13.1

16.2

14.9

Total

16.9

15.6

16.2

18.7

17.0

Per ordinary share

Basic earnings ($)

1.98

1.94

1.86

1.99

2.34

Net asset value ($)

17.09

17.84

18.82

20.37

21.31

Net dividend (cents)3

75

90

70

100

120

Dividend cover (times)3

2.70

2.22

2.73

2.04

2.00

-

With effect from 1 January 2018, operating profit is presented net of fee and commission expense. The comparative figures have been restated to conform with the current period's presentation.

-

Relates to the amount attributable to equity holders of the Bank.

-

Included a special dividend of 5 cents in 2014 and 20 cents in 2017 and 2018 respectively. 2015 included UOB's 80th Anniversary dividend of 20 cents.

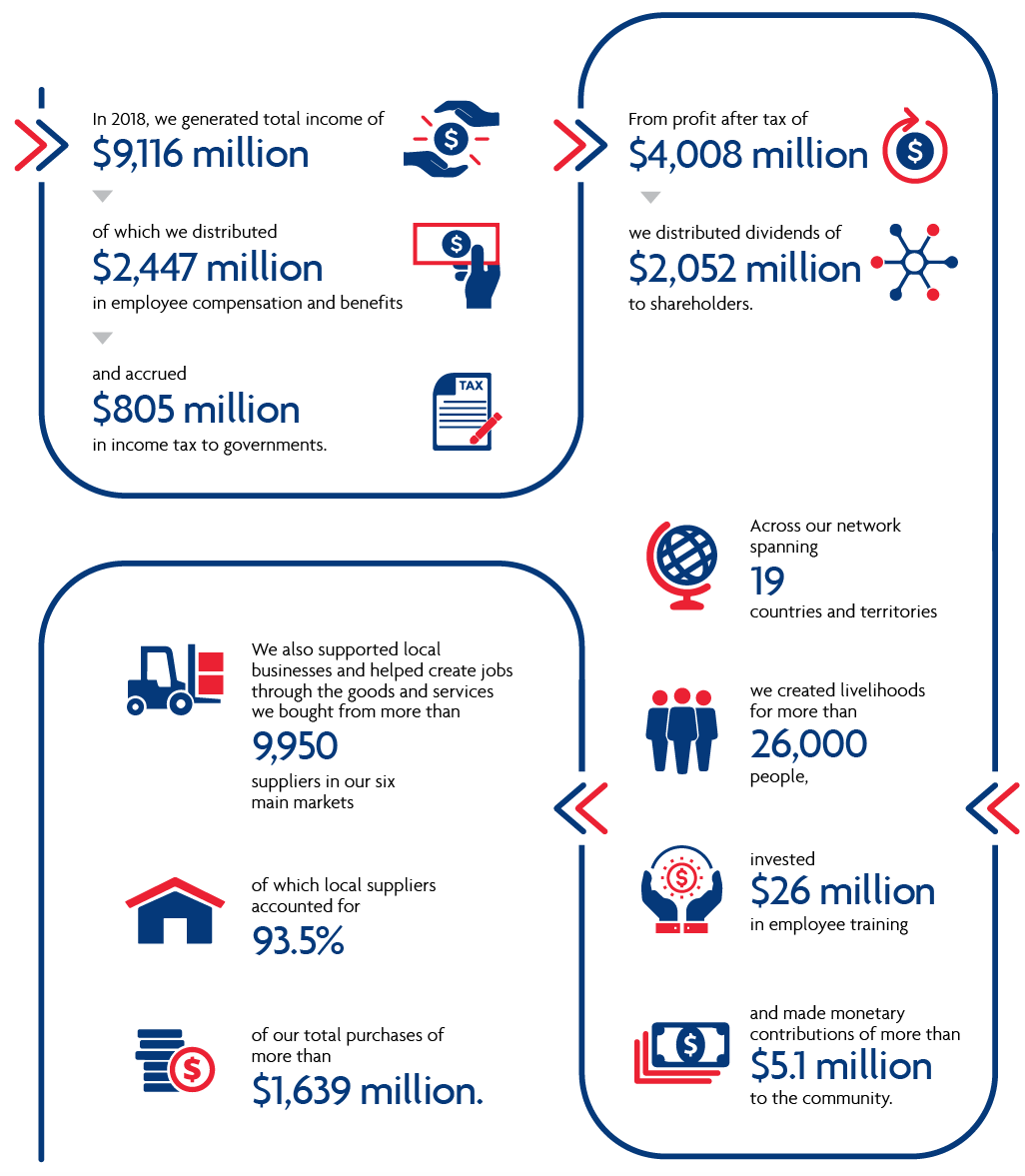

Economic Value of Our Contributions

UOB is committed to contributing to the region’s progress and growth through the direct and indirect economic value we create for our stakeholders.