UOB’s FY23 core net profit1 rose 26% to record S$6.1 billion

Record earnings underpinned by expanded regional franchise and strong total income growth

Singapore, 22 February 2024 – UOB Group reported a record core net profit1 of S$6.1 billion, up 26%, for the financial year ended 31 December 2023 (FY23). Including the one-off Citigroup integration costs, net profit was at S$5.7 billion, also a record high.

The Board recommends the payment of a final dividend of 85 cents per ordinary share. Together with the interim dividend of 85 cents per ordinary share, the total dividend for FY23 will be S$1.70 per ordinary share, representing a payout ratio of approximately 50%.

In FY23, the Group’s core net profit grew 26% and crossed the S$6 billion mark for the first time to a new high of S$6.1 billion, driven by strong income growth and an enlarged customer franchise. Net interest income rose 16% to S$9.7 billion, on the back of strong margin expansion of 23 basis points and a loan growth of 2% in constant currency. Net fee income grew 4% to S$2.2 billion, led by higher credit card and wealth fees, although this was moderated by softer loan-related fees. Asset quality remained stable with non-performing loan (NPL) ratio at 1.5%.

Group Wholesale Banking income grew 14% to S$7.1 billion, led by strong growth in the transaction banking business, which now accounts for more than half of the Group Wholesale Banking income. Cross-border income also did well, rising 9% from 2022 levels.

Group Retail income increased 36% to S$5.5 billion, led by a strong increase in net interest income. Credit card fees surged 66% to a new high of S$382 million, underscored by higher customer spending and an expanded regional franchise. Amid cautious investor sentiment, wealth management income rose 13%, supported by our growing bancassurance market share and a pick-up in demand for fixed income products. Despite market volatility, strong net new money inflows of S$22 billion grew assets under management from affluent customers to S$176 billion. As of the end of 2023, our retail customer count surpassed 8 million, with about 1 million organic new-to-bank customers. More than half of these new-to-bank customers were acquired digitally.

The Group continued to make good progress on its sustainability agenda in 2023. In October, it set up the Sustainability Advisory Panel comprising three independent industry experts to advise the Board and Management on UOB’s sustainability strategy, targets and initiatives. The Group’s sustainable financing portfolio reached S$44.5 billion in FY23. The Group will continue to work closely with its customers to support them on their transition to a low-carbon economy.

One-off bonus payment for junior employees

In line with the latest recommendations by Singapore’s National Wages Council to help employees cope with the rising costs of living, UOB will provide its junior employees, Class II officers and below, an extra month of bonus on a one-off basis. This additional bonus will be paid to about 6,000 employees across the Group, of which about 600 are in Singapore. The Group is committed to ensuring that the wage structure of its employees is fair and competitive, complemented by a comprehensive range of perks and benefits that are sustainable for the long-term, including enhanced medical support, training programmes and more.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “The Group delivered a record core net profit for the year, fuelled by strong income growth through a diversified business franchise even as we strengthen our balance sheet. We remain prudent in maintaining ample liquidity and funding while we continue to invest to seek quality and resilient growth.

“Global economic outlook remains uncertain in the near term, but Southeast Asia continues to be a bright spot. We are optimistic about ASEAN’s potential, driven by improved domestic demand, robust tourism recovery and strong investment flows into the manufacturing sector as companies reconfigure their supply chains. Our strong franchise across ASEAN positions us well to capture opportunities in the region.

“Our Citigroup integration is on track. We have successfully integrated our Citigroup portfolios in Malaysia and Indonesia, with Thailand and Vietnam following suit in the coming months. With our strengthened market position and larger regional franchise, we will focus on enhancing our offerings and capabilities as we serve our expanded customer base.”

Financial Performance

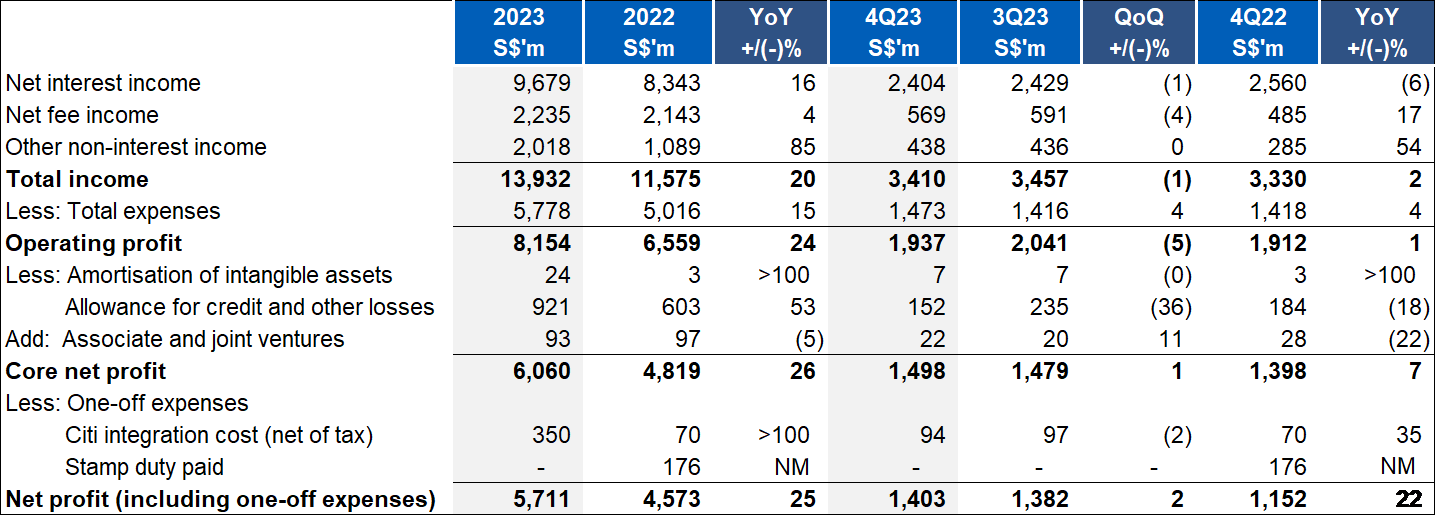

FY23 versus FY22

Core net profit for FY23 grew 26% to record S$6.1 billion from a year ago, driven by strong net interest income and trading and investment income. Including the one-off expenses, net profit was at S$5.7 billion.

Net interest income rose 16% to S$9.7 billion. Net interest margin increased 23 basis points to 2.09% from higher interest rates and loan growth of 2% in constant-currency terms.

Net fee income was S$2.2 billion, up 4% as credit card fees surged 66% to a new high of S$382 million, underscored by higher customer spending and expanded regional franchise, as well as higher wealth fees. This was partly offset by softer loan-related fees amid cautious corporate sentiment.

Compared with a year ago, other non-interest income doubled to S$2.0 billion, driven by all-time high customer-related treasury income and strong performance from trading and liquidity management activities.

Core operating expenses rose 15% to S$5.8 billion. The broad-based expense growth to support strategic initiatives was outpaced by income growth, and cost-to-income ratio improved by 1.8% points to 41.5%.

Total allowance was S$921 million due to higher specific allowance on a few non-systemic corporate accounts, as well as pre-emptive general allowance set aside during the year.

4Q23 versus 3Q23

Core net profit for the fourth quarter was up 1% to S$1.5 billion. Including the one-off integration expenses, net profit stood at $1.4 billion.

Net interest income was stable at S$2.4 billion. Net interest margin moderated to 2.02% mainly from loans margin compression due to competition for high quality credits. Net fee income eased to S$569 million, as loan-related fees normalised from previous quarter high. However, credit card fees continued strong momentum to register a new high, boosted by holiday card spending, while wealth fees saw modest recovery. Other non-interest income relatively unchanged at S$438 million.

Total core operating expenses rose 4% to S$1.5 billion with the cost-to-income ratio at 43.2%. Total allowance decreased to S$152 million, mainly due to lower specific allowance and release of pre-emptive general allowance.

4Q23 versus 4Q22

Net interest income decreased 6% from lower net interest margin. Net fee income was 17% higher, driven by strong growth in credit card fees backed by an enlarged franchise, coupled with recovery of wealth management fees. Other non-interest income surged to S$438 million on higher customer-related treasury income and strong performance from trading and liquidity management activities.

Cost-to-income ratio increased from 42.6% to 43.2%, excluding one-off expenses. Total allowances fell 18% mainly on lower specific allowance.

Asset Quality

Asset quality remained stable with NPL ratio at 1.5% as of 31 December 2023. New NPA formation was more than offset by recoveries and write-offs. The non-performing assets coverage stood at 101% or 209% after taking collateral into account. Performing loans coverage was maintained at a prudent level of 0.9%.

Capital, Funding and Liquidity Positions

The Group’s capital position strengthened with Common Equity Tier 1 Capital Adequacy Ratio improving to 13.4% for the quarter. Liquidity remained ample with the average all-currency liquidity coverage ratio at 158% and net stable funding ratio at 120%, both well above regulatory requirements. Loan-to-deposit ratio was healthy at 82.2%.

1Excluded the one-off expenses related to the acquisition of Citigroup’s Malaysia, Thailand, Vietnam and Indonesia consumer banking business.