Strong balance sheet position supports continued growth in regional customer franchise Interim dividend increased to 85 cents per share

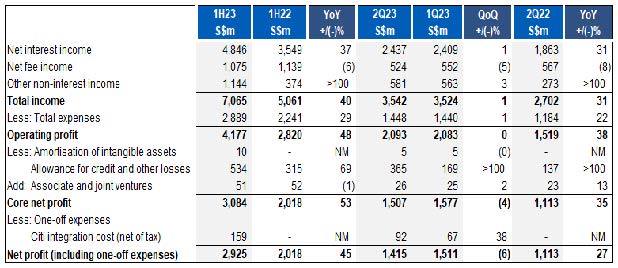

Singapore, 27 July 2023 – UOB Group reported a core net profit1 of S$3.1 billion for the first half of 2023 (1H23), an increase of 53% year on year, supported by robust earnings growth across its diversified business franchise. Including the one-off Citigroup integration expenses, net profit was S$2.9 billion.

The Board declared an interim dividend of 85 cents per ordinary share, representing a payout ratio of approximately 49%. This is also 42% higher than the interim dividend last year.

Core net profit1 for the second quarter of 2023 (2Q23) was 35% higher at S$1.5 billion compared with a year ago. Net interest income for the quarter grew 31%, while other non-interest income rose sharply on higher customer-related treasury income and strong performance from trading and liquidity management activities. Net profit for 2Q23 was S$1.4 billion when one-off Citigroup integration expenses were included.

Asset quality remained stable with non-performing loan ratio at 1.6%. Credit costs were at 30 basis points. Outside of a specific exposure, credit costs remained stable. The Group continues to maintain healthy provision buffers to cushion against uncertainties.

In 1H23, Group Wholesale Banking income increased 24% year on year to S$3.6 billion as the Group continues to focus on good quality credits. Loans rebounded with quarter-on-quarter growth of 2%, supported by trade and event-driven loans to existing clients. Cross-border income grew 17% year on year on the back of the Group’s strength in connectivity despite macroeconomic uncertainties. Transaction banking income now accounts for 53% of total wholesale banking income.

Group Retail’s income in 1H23 rose 58% from a year earlier to S$2.7 billion. Credit card fees remained strong, backed by a sustained consumer spending momentum as well as the consolidation of our Citigroup portfolio. The Group’s retail deposits grew 20% compared with last year. The Group continues to see positive net new money inflows of S$12 billion year to date, which brought total assets under management to S$165 billion, 19% higher than a year ago.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “We have delivered a commendable set of results for the first half of the year, with record core net profit driven by strong net interest income and trading and investment income. Backed by our strong balance sheet, we see continued momentum in our client franchise expansion.

“While the global outlook remains uncertain, we expect the Asean region to stay relatively resilient. Growth will be supported by a more moderate interest rate environment in this region and a pick-up in tourism and demand for services.

“Our Citigroup acquisition is progressing well. Our strengthened market position and customer base open up more opportunities for global partnerships and enhanced offerings for our customers.

“Amid these uncertain times, we are committed to supporting our customers and to delivering value to our stakeholders. We remain focused on investing and building our regional franchise for the long term.”

Financial Performance

1H23 versus 1H22

Core net profit for 1H23 grew 53% to S$3.1 billion from a year ago, driven by strong net interest income and trading and investment income. Including the one-off Citigroup integration expenses, net profit was at S$2.9 billion.

Net interest income increased 37% to S$4.8 billion, boosted by robust net interest margin, which expanded 50 basis points to 2.13% on higher interest rates.

Net fee and commission income eased to S$1.1 billion, from softer lending and capital market activities, while cautious investor sentiments hampered wealth recovery. However, credit card fees registered a new high, spurred by sustained card spending as well as the consolidation of Citigroup’s consumer business in three regional markets.

Other non-interest income surged to S$1.1 billion, driven by record high customer-related treasury income from increased hedging demands and good performance from trading and liquidity management activities.

While total core expenses rose 29% to S$2.9 billion, this was outpaced by income growth, hence cost-to-income ratio improved by 3.4% points to 40.9%. The Group continued to prioritise strategic investment in people and technology while maintaining cost discipline.

Total allowance increased to S$534 million in 1H23 from S$315 million a year ago. Specific allowance was higher largely due to a major corporate account in Thailand. Coupled with pre-emptive general allowance set aside on prudence, total credit costs on loans increased to 27 basis points for 1H23.

2Q23 versus 1Q23

Core net profit for the second quarter was 4% lower at S$1.5 billion. Including the one-off expenses, net profit stood at S$1.4 billion.

Net interest income was stable at S$2.4 billion. Net interest margin moderated to 2.12% as liquidity surplus was deployed into high quality lower yielding assets while loan margin held up at 2.62%. Net fee income declined 5% from the previous quarter to S$524 million from lower wealth fees as investor sentiments remained muted. Other non-interest income was up 3% to S$581 million, as trading and investment income registered another record quarter.

The cost-to-income ratio was unchanged quarter on quarter at 40.9%. Total allowance rose to S$365 million, with total credit costs on loans at 30 basis points, due to specific allowance on a major Thailand corporate account, along with pre-emptive general allowance set aside.

2Q23 versus 2Q22

Net interest income rose 31%, led by a 45 basis point expansion in net interest margin. Loan-related fees and wealth management fees were softer compared to a year ago, as investor sentiments remained subdued. These declines were partly offset by an increase in card fees. Other non-interest income rose sharply to S$581 million on higher customer-related treasury income and strong performance from trading and liquidity management activities this quarter.

The cost-to-income ratio improved 2.9% points to 40.9% on the back of strong income growth and prudent cost management. Total credit costs on loans increased to 30 basis points, as more pre-emptive allowance was made.

Asset Quality

Asset quality remained stable with NPL ratio at 1.6% as of 30 June 2023. The non-performing assets coverage strengthened to 99% or 209% after taking collateral into account. Performing loans coverage improved to 1.0%.

Capital, Funding and Liquidity Positions

The Group’s capital, liquidity and funding positions remained healthy as at 2Q23. Common Equity Tier 1 Capital Adequacy Ratio was steady at 13.6%. The average all-currency liquidity coverage ratio at 167% and net stable funding ratio at 121% were well above the minimum regulatory requirements, while the loan-to-deposit ratio was healthy at 83.5%.

1Core net profit excluded the one-off expenses related to the acquisition of Citigroup’s Malaysia, Thailand and Vietnam consumer banking business.