Singapore, 31 October 2023 – UOB today released its first net zero progress report on its commitment to reach net zero by 2050, as it makes positive headway in meeting the targets set for its focus sectors.

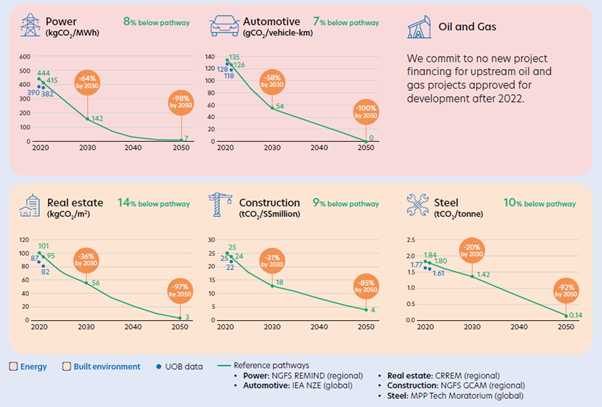

UOB’s net zero commitment includes specific reduction targets for five sectors – power, automotive, real estate, construction and steel. Based on its 2022 data, the Bank achieved reductions in emissions intensities across all five sectors, with the various metrics at seven to 14 per cent below the respective net zero target reference pathways.

The Bank’s commitment made last year also includes no new financing for upstream oil and gas projects approved for development after 2022. Together, the six sectors make up about 60 per cent of its corporate lending portfolio.

Using internationally-recognised climate science models, UOB based its sectoral targets on regional pathways that align with global net zero goals. This approach reflects UOB’s strong belief in the need for a just transition in Southeast Asia, to support socioeconomic growth and improve energy access across the region’s diverse economies.

The report details the opportunities and challenges faced in meeting the net zero targets across sectors, and explains how the Bank is stepping up efforts to engage clients and deepen collaboration with global and regional stakeholders on decarbonisation.

Mr Wee Ee Cheong, Deputy Chairman and Chief Executive Officer, UOB, said, “At UOB, we support an orderly and just transition to net zero so that economies continue to grow and people’s access to energy continues to improve. We are here to catalyse funding and support our customers on their transition journey. We have also taken steps to transform our operating processes and to deepen our collaboration with the larger ecosystem of stakeholders, including across all levels of government, economy and society to effect transformative changes.

"Building on our promise to do right by our customers and stakeholders, we want to create a positive impact for individuals, businesses and communities. Together, we can forge a sustainable future for the people and businesses in our home region of ASEAN and those connecting with the region.”

Certain figures presented in these charts may not reflect the absolute values due to rounding.

UOB has developed a holistic programme to operationalise its net zero commitment. The programme focuses on four key areas:

- Developing sectoral plans, which include setting targets, measuring progress and capturing opportunities across sectors;

- Supporting customers by providing advisory and financial solutions to help them in their decarbonisation journey;

- Embedding net zero in the Bank’s operating model across governance, policies, processes and capabilities; and

- Driving effective stakeholder engagement and working collaboratively with a broader ecosystem of governments, regulators, industry and trade associations, and peers to drive collective action.

UOB has extended S$38 billion in sustainable financing as at the end of September 2023. The Bank will continue to develop and expand its suite of sustainable finance frameworks and solutions, and seek opportunities with clients to support their decarbonisation efforts.

For more information on UOB’s net zero commitment and progress, please visit https://www.uobgroup.com/sustainability/sustainable-banking/net-zero-commitment.page.

UOB has also launched a sustainability-themed film that demonstrates its belief that people and the planet must progress together in harmony. To watch the film, please visit: https://www.uobgroup.com/sustainability/index.page.