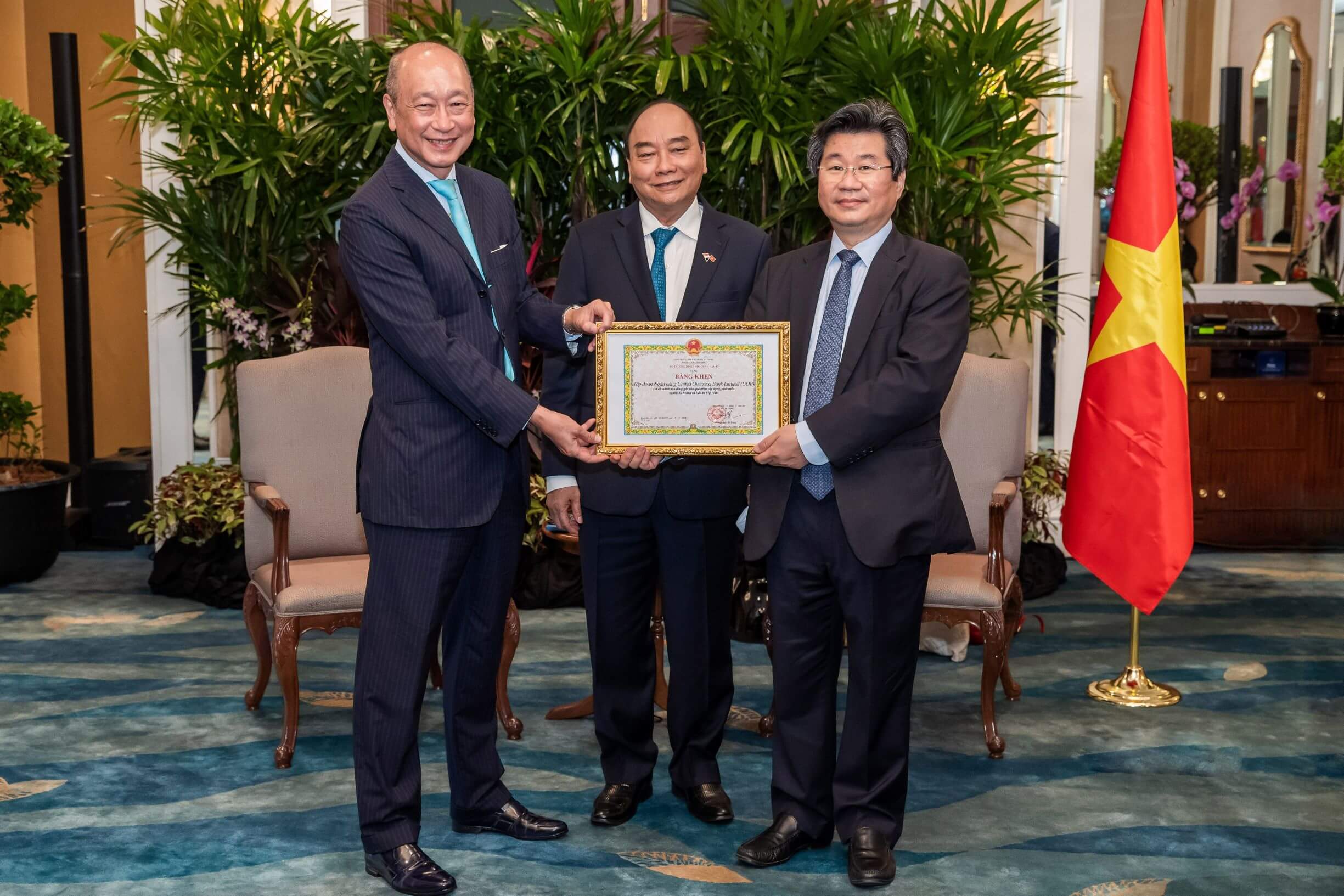

Mr Wee Ee Cheong, Deputy Chairman and Chief Executive Officer, UOB, receiving a certificate of merit from Mr Do Nhat Hoang, Director General, Foreign Investment Agency, Vietnam, in the presence of Mr Nguyen Xuan Phuc, President of Vietnam

UOB received a certificate of merit from Vietnam’s Ministry of Planning and Investment (MPI) at a meeting with President of the Socialist Republic of Vietnam Nguyen Xuan Phuc and senior officials on Saturday. The award was presented by MPI to UOB in recognition of the Bank’s continued efforts in facilitating foreign direct investment (FDI) flows into Vietnam and supporting companies operating in the country. UOB is the first Singapore bank to receive the award.

UOB has helped more than 200 companies from countries including Singapore, Malaysia and China to invest in Vietnam since signing a Memorandum of Understanding with Vietnam’s Foreign Investment Agency in April 20151. These companies, from sectors such as consumer goods, industrials as well as construction and infrastructure, have projected that they would invest more than S$4.6 billion and create more than 20,000 jobs in Vietnam.

The Bank is also set to facilitate a pipeline of S$3.3 billion potential investments from companies in sectors such as manufacturing, technology, and consumer goods in the next three years. These investments are expected to create another 13,000 jobs in Vietnam.

Regionally, Vietnam continues to be an attractive destination for FDI driven by companies’ desire to diversify their supply chains as well as to position themselves for a post-pandemic recovery. In 2021, foreign companies’ commitments rose 9.2 per cent to US$31.2 billion, with the investments mainly in sectors such as manufacturing and processing as well as power plant and power generation. All the top investors are from Asia, namely Singapore (34.4 per cent), South Korea (15.9 per cent) and Japan (12.5 per cent)2.

A spokesman from Vietnam’s Ministry of Planning and Investment said, “Vietnam continues to be an important link in the global supply chain. Our economy is set for a robust recovery this year as we roll back on restrictions and welcome international investors and visitors. We are committed to simplifying processes and procedures to speed up the investments in large and high quality projects from foreign investors.

“We highly appreciate financial institutions such as UOB that help to bring foreign investors to Vietnam.”

Mr Wee Ee Cheong, Deputy Chairman and CEO, UOB, said, “UOB has been helping companies open doors to new opportunities in Vietnam since 1993. In recent years, Vietnam has gained prominence as an investment destination and it is also attracting more interest from foreign investors. UOB is committed to continue investing in Vietnam and expanding our capabilities, including our FDI Advisory services, to support companies’ growth and to contribute to the local economy. Vietnam is one of the key beneficiaries of the Regional Comprehensive Economic Partnership trade agreement. The trade pact will drive more foreign investments to Vietnam and the region, and our extensive network in ASEAN will go a long way in connecting global companies to this fast-growing region in the world.”

UOB is the first Singapore bank to establish a foreign-owned subsidiary in Vietnam in 2018. Today, UOB Vietnam has three offices, two in Ho Chi Minh City and one in Hanoi, and also offers internet and mobile banking services. It also has a dedicated FDI Advisory Unit that was set up in 2013 to provide support for regional clients investing into the country. In 2021, the Bank injected VND2 trillion fresh capital into UOB Vietnam to speed up efforts to build up its digital capabilities to provide more digital solutions to retail and corporate customers. The additional investment will also broaden UOB Vietnam's capabilities to expand its sustainable financing, as well as offshore and trade financing offerings.

Mr Harry Loh, Chief Executive Officer, UOB Vietnam, said, “UOB Vietnam has been steadily rolling out new initiatives, programmes and solutions in the past year to support our clients' needs. As Vietnam reopens its borders and international travel starts to resume, we are confident that companies will be able to ride on its post-pandemic recovery to seize new opportunities in the market.”

1Please refer to UOB news release : "UOB and Vietnam’s Foreign Investment Agency sign MOU to boost trade between Vietnam and Southeast Asia”, 19 April 2015.

2Source: Vietnam’s Ministry of Planning and Investment, https://www.mpi.gov.vn/en/Pages/tinbai.aspx?idTin=52660&idcm=122