The two countries account for more than three quarters of ASEAN’s total FinTech funding in first nine months of 2022, driven by mega deals totalling to 37 per cent of total investments

Singapore, 3 November 2022 – ASEAN remains an attractive proposition for Financial technology (FinTech) funding investments amidst external pressures, with Singapore and Indonesia accounting for more than three-quarters of ASEAN’s total Fintech funding, according to the FinTech in ASEAN 2022 report by UOB, PwC Singapore and the Singapore FinTech Association (SFA).

In first three quarters of 2022, investments in ASEAN’s FinTech sector garnered US$4.3 billion, which is 7 per cent out of the total US$63.5 billion poured into FinTech globally during the same period, up from just 2 per cent in 2018. Compared with the same period in 2021, despite a lower number of deals, the average deal size increased to US$26.5 million from US$23 million. Funding into late-stage FinTechs made up 54 per cent of the total investments in the first nine months of 2022, up from 43 per cent last year, as investors grew more selective, placing a greater focus on FinTechs that have a clearer pathway towards profitability and sound financial management.

Among the six biggest ASEAN economies1, Singapore and Indonesia retained their strong foothold to secure the lion’s share of Fintech funding, mainly driven by 10 mega deals2 that accounted for 37 per cent of all funding in ASEAN. Singapore-based FinTech firms continued to attract the most deals in ASEAN, securing more than half (55 per cent) of the total 163 deals, amounting to US$1.8 billion in funding, 43 per cent of total funding in ASEAN. Indonesia obtained a substantial 11 percentage point gain in FinTech funding share over the last year, with 25 per cent of the total deals amounting to US$1.4 billion.

Ms Janet Young, Managing Director and Group Head, Channels & Digitalisation and Strategic Communications & Brand, UOB, said, “Investments in ASEAN’s FinTech firms clocked in US$4.3 billion in the first nine months of 2022 – higher than the combined sum from 2018 to 2020. While the global economy may be in for challenging times ahead, the numbers so far signal a vote of confidence in ASEAN’s FinTech industry. At UOB, we stay committed to build the future of ASEAN through our close collaboration with FinTech partners by empowering their growth and connecting them with the region. These partnerships enable us to create better and more seamless digital solutions that are accessible and brings value to all our customers.”

Payments remains the most funded FinTech category in ASEAN

Across ASEAN, payments and alternative lending continue to attract the most amount of funding, amounting to US$1.9 billion and US$506 million respectively, in the first nine months of 2022. Crypto firms are now the third most funded FinTech category in the region with US$461 million in funding, despite the broader crypto market’s volatile performance this year. There were 8 mega deals from these categories worth close to US$2 billion in total, accounting for 46 per cent of all FinTech funding in ASEAN. With a volatile market and an uncertain macroeconomic outlook, the number of new FinTech firms set up across ASEAN has dropped to an all-time low of 127 companies this year.

Ms Wong Wanyi, FinTech Leader, PwC Singapore, said, “Innovation often looks to the next generation, and Gen Zs are now mature enough to drive significant shifts in consumer behaviours as well as usage of technologies, with the rest of society following suit. This is in part fuelling the proliferation of GameFi, the metaverse, and digital assets such as cryptocurrencies and NFTs as we’re seeing it. That being said, it is important to be mindful that no ‘boom’ is complete without some turbulence along the way. FinTech players that succeed at discerning opportunities from the hype, and create a foundation that helps them gear up for the web3 economy will be better placed to demonstrate their value to investors and build trust with stakeholders.”

Mr Shadab Taiyabi, President of the SFA said, “Despite the global uncertainty, it’s clear that ASEAN continues to be a bright spot for funding investments. We are heartened to see the resilience within the FinTech ecosystem as players continue to flourish across subsectors like payments and alternative lending. Now more than ever, SFA remains committed to fostering a sense of collaboration and camaraderie between stakeholders and industry players. Together, we hope to continue driving innovation that benefits the growth of the FinTech ecosystem and the wider Singapore community.”

Embedded finance

As digital services continue to proliferate in ASEAN, more consumers are familiar and comfortable with using embedded finance services, propelling more non-financial companies to find ways to embed financial services within their apps, such as including in-app payments, and lending. According to the UOB ASEAN Consumer Sentiment Study (ACSS) 2022 and survey conducted by UOB, PwC and SFA3, ASEAN consumers have a high awareness of embedded financial services, with an average 81 per cent of survey respondents knowing of apps with built-in financial services.

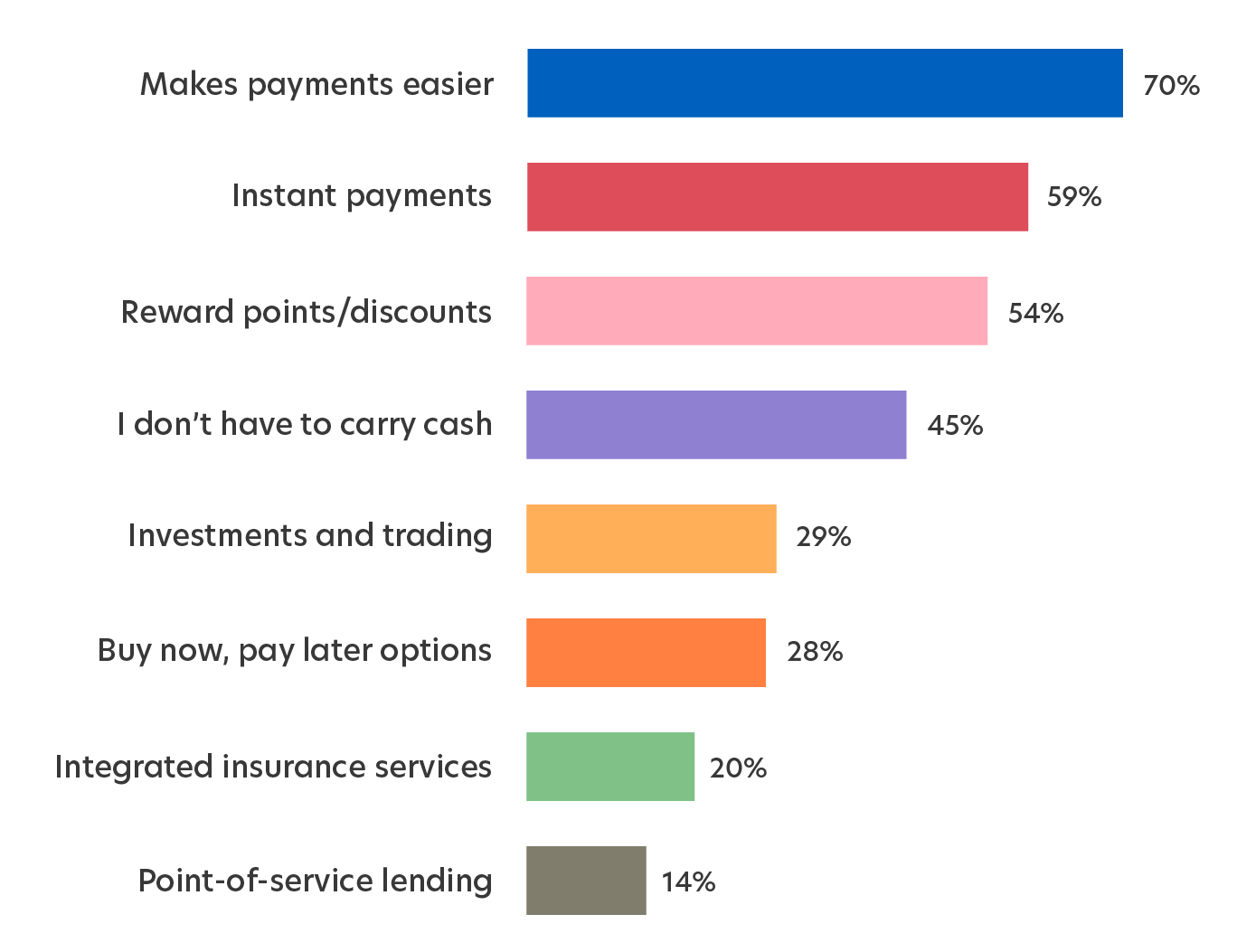

Reasons for using embedded finance apps across ASEAN-6

In terms of usage, 70 per cent of survey respondents have reported using applications with a form of financial service that has been embedded into the platform, with Thailand and Vietnam leading the region at 83 per cent. Singapore’s lower usage (55 per cent) may be due to the population’s financial needs being well-served by a mature financial ecosystem and products like credit cards. On average, almost every three in four of respondents who use apps with embedded finance will use the them at least once a week, demonstrating the potential of such apps to increase user engagement.

Many consumers enjoy the convenience of being able to complete banking activities online through an integrated platform. Results from ACSS also show that the top 3 banking activities done online by consumers include checking status of rewards such as cash rebates and miles (90%), applying for a simple banking product like credit card (82%), and opening a new bank account (69%). With the UOB TMRW app, which is an all-in-one solution that supports the all new and existing customers’ banking, payment and lifestyle needs, customers can save and make payments, monitor and make their investments through SimpleInvest, as well as take their pick from rewards personalised to them through Rewards+, providing them with a seamless banking experience anytime, anywhere.

For the full FinTech in ASEAN report 2022, pls visit this link.

1Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam

2Funding deals of more than US$100M

3The Fintech in ASEAN report collated results based on the UOB ASEAN Consumer Sentiment Study 2022 and a supplementary survey in the Philippines by UOB, PwC and SFA. The two surveys were conducted between June to August 2022, amongst 3,754 respondents across 5 markets – Indonesia, Malaysia, Singapore, Thailand and Vietnam for ACSS 2022, and another 559 respondents in Philippines for the supplementary survey.