UOB ASEAN Consumer Sentiment Study shows more people are building financial resiliency

Amid the protracted COVID-19 pandemic, ASEAN consumers have learned to grapple with constant changes in social distancing rules and are preparing themselves to live with a “new norm” of endemic COVID-19 by 2023. This was among the key findings from the latest UOB ASEAN Consumer Sentiment Study 2021 released today.

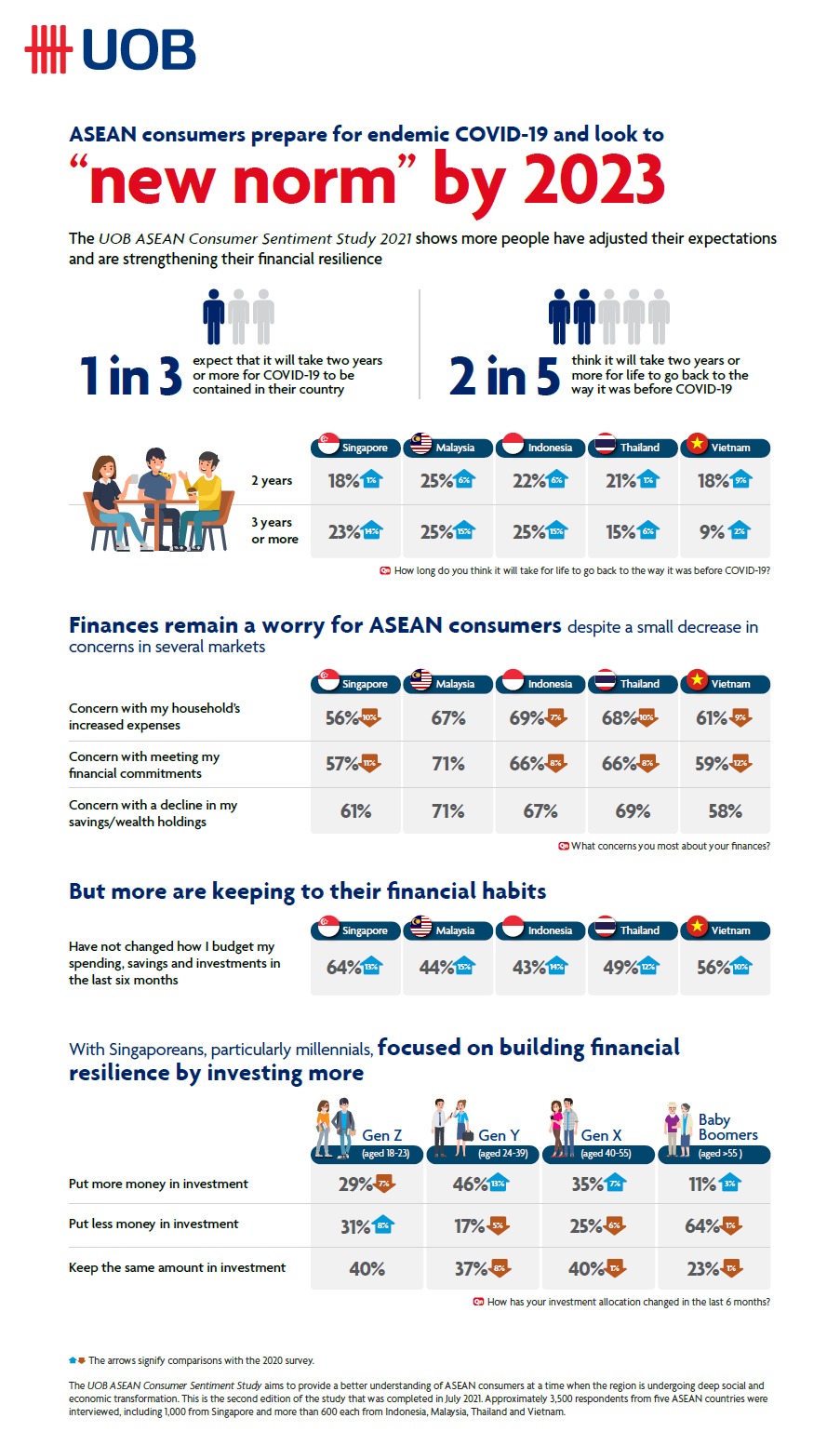

One in three respondents (33 per cent) in the region now expect that it will take two years or more for COVID-19 to be contained in their country, an increase of 18 per cent from the previous year. Two out of five respondents (40 per cent) also believe that it will take two years or more for life to go back to the way it was before COVID-19, an increase of 15 per cent from the previous year. When asked if vaccinations are important for life to return to normal, eight in 10 respondents (81 per cent) agreed with that statement.

While more ASEAN consumers adjust their expectations and prepare themselves for COVID-19 to become endemic, the majority of respondents (68 per cent) feel more mentally prepared for new lockdown measures, indicating that consumers are becoming more ready to face such events.

Finances remain a worry but focus is on building financial resilience for the long term

On personal finances, about six in 10 respondents indicated uneasiness around increased household expenses (64 per cent), meeting long-term financial commitments (63 per cent) and a decline in their savings and wealth (65 per cent).

However, the study found that consumers across ASEAN are settling into the new norm brought about by the pandemic and are keeping to the financial habits they had adopted a year ago. More than half of the respondents (53 per cent) said that they have not changed their budgeting in the last six months, compared with 2020 when 60 per cent of consumers readjusted their budget in bracing themselves for the impact of COVID-19.

In Singapore, consumers are looking for opportunities to strengthen their financial resilience. They are more upbeat about investing, with close to two in five (38 per cent) consumers putting more money into investments in the past six months, an increase of eight per cent from last year. Leading the way are millennials1, with close to half of them (46 per cent) indicating that they plan to invest more. One in two Singaporean respondents (51 per cent) who have invested said they are choosing to buy more into stocks and bonds.

Ms Jacquelyn Tan, Head of Group Personal Financial Services, UOB said, “Financial well-being plays an important role in an individual’s overall mental health as it minimises the stress and anxiety that they experience, especially in these uncertain times. As Singaporeans adapt to the ‘new norm’ and get back on track with their lives, it is important that they continue to build up their financial resilience by saving and investing for the long term. This will help to ensure that they are financially prepared for future uncertainties while staying on course in achieving their financial goals such as retirement.

“To help our customers on their investment journey, we have made investing simpler and easier with SimpleInvest. It enables our customers to invest through UOB TMRW, our digital banking app, from as little as $100. Close to 90 per cent of our customers using SimpleInvest are new to unit trust products and we see them making monthly investments of $1,500 on average. Additionally, 35 per cent of those using SimpleInvest have started a regular investment plan. This is a positive sign that Singaporeans are more confident and taking steps to strengthen their financial resilience and to achieve their long-term financial goals.”

The UOB ASEAN Consumer Sentiment Study aims to provide a better understanding of ASEAN consumers at a time when the region is undergoing deep social and economic transformation. This is the second edition of the study that was completed in July 2021. Approximately 3,500 respondents from five ASEAN countries were interviewed, including 1,000 from Singapore and more than 600 each from Indonesia, Malaysia, Thailand and Vietnam.

1 Aged 23 to 39 years old