You are now reading:

US: "Liberation Day" tariffs very broad-based & material

you are in Research

You are now reading:

US: "Liberation Day" tariffs very broad-based & material

On “Liberation Day” (2 Apr), US President Trump announced a national emergency to “increase the nation’s competitive edge, protect our sovereignty, and strengthen our national and economic security”.

This declaration allowed him to invoke the International Emergency Economic Powers Act (IEEPA) and enabled him to issue an Executive Order, on the imposition of a 10% baseline tariff on all imports to the US from all countries, and among all these countries, reciprocal tariffs are imposed on several economies & one economic bloc (EU comprises 27 countries).

The “reciprocal” rates are based on the US government’s tally of the tariffs and nontariff barriers those countries imposed on US goods, and the customised levy imposed under Trump’s proposal, is approximately equal to half of that calculated amount (i.e. Tariffs charged to US by Thailand= 72%, proposed US reciprocal tariff on Thailand= 36%). That said, according to USTR, the reciprocal tariff rates are calculated simply based on the US’ trade deficit with the said country divided by the said country’s exports to the US and adjusted by price elasticity of import demand and tariff pass-through to import prices.

Trump’s announcement of “Liberty Day” tariffs has unfortunately realized our pessimistic case of trade scenarios with 40% probability into reality (link).

The risk for US trade policy tilting towards a more negative outcome of higher tariffs (closer to 60% tariff rate for China as claimed by Trump during his election campaign), punitive reciprocal tariffs for major and lesser trading partners, coupled with the imposition of a blanket tariff for all US imports (10%), and an earlier than expected implementation timeline, has significantly impacted our outlook for the US.

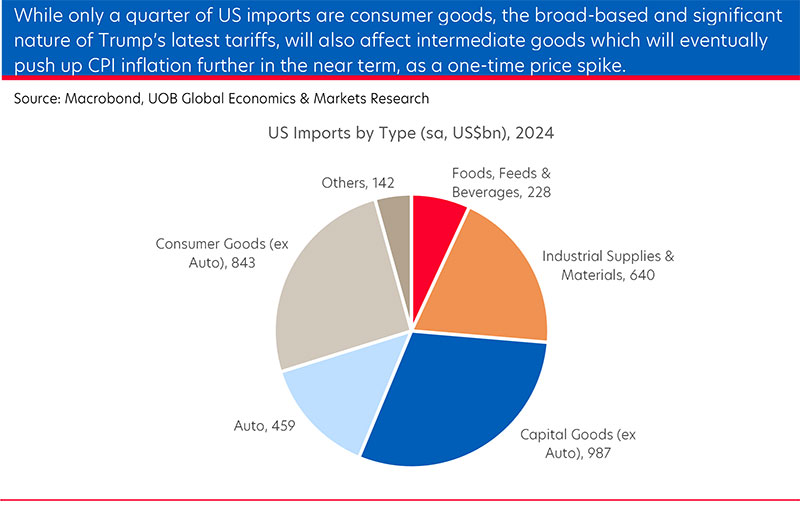

The impact of this scenario will be significantly weaker growth outlook for the US and Asia, accompanied by higher US inflation outturns, which we assume to be a one-time spike in prices before coming off from the headline inflation sometime next year.

GDP – lowered to 1.0% (from previous forecast of 1.8%)

CPI inflation – raised to 4.0% (from previous forecast of 2.5%)

FOMC rate cuts – raised to three 25-bps cuts to 3.75% by end-2025 (from previous 1 cut in 2025). We keep the two cuts for 2026, implying a lower terminal rate of 3.25% in 2026 (previous forecast was 3.75%). In this case, the Fed could justify the rate cuts by pointing to the fact that inflation was induced by supply side shocks rather than demand-driven price increases.

Notwithstanding that there could be 2 quarters of consecutive declines or “technical recession”, the probability of US entering into an economic recession or stagflation is now more material and we estimate it at 40% chance, from 20-25% prior to Liberation Day.

Suan Teck Kin

Head of Research

Follow Teck Kin on LinkedIn

Alvin Liew

Senior Economist

Follow Alvin on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.