You are now reading:

China: PBOC eases monetary policy to cushion tariff impact

you are in Research

You are now reading:

China: PBOC eases monetary policy to cushion tariff impact

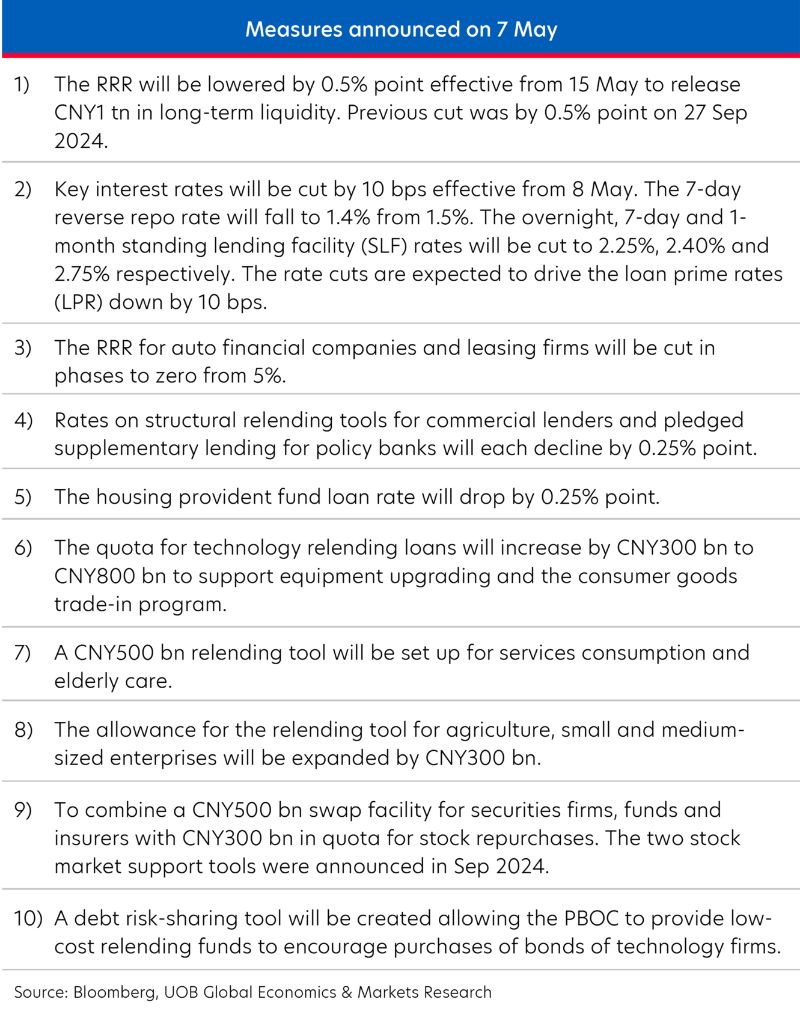

The People’s Bank of China (PBOC) announced cuts to the banks’ reserve requirement ratio (RRR) and key interest rates at a press briefing on Wed (7 May). The 10 measures unveiled today are China’s first stimulus package in response to US’ tariff escalation since the 2 Apr ‘Liberation Day’ and follows the late-Apr Politburo meeting where policymakers pledged to “fully prepare” emergency plans and cut the RRR and policy rates “at a proper time”.

The cuts to banks’ RRR and key interest rates are in line with expectation as recent US dollar weakness provided the opportunity for PBOC to ease monetary policy, coming ahead of the FOMC decision tonight.

China’s central bank also provides additional support to targeted sectors with rates on structural relending tools for commercial lenders and pledged supplementary lending for policy banks to be cut by 25 bps and the housing provident fund loan rate to drop by 25 bps. PBOC announced new re-lending facilities for service consumption and elderly care as well as an increase in quota for relending loans to support equipment upgrading, consumer goods trade-in program, agriculture and the small & medium enterprises. These represent the key drivers in China’s boost for the local consumption and industrial sector.

Overall, the size of the stimulus package may be slightly smaller compared to that in Sep 2024 where the 7-day reverse repo rate was cut by 20 bps along with 0.5% point cut to banks’ RRR and a slew of measures to support the housing market (such as lower down-payment ratios, mortgage rate cut, re-lending program for affordable housing) and financial markets.

However, the policymakers have continued to indicate strong support for financial market stability which remains important to anchor domestic sentiment. China Securities Regulatory Commission (CSRC) said that China fully supports its sovereign fund, Central Huijin and PBOC in serving the function as a quasi-stabilization fund, potentially limiting the extend of any market sell-off.

The timing of the stimulus reinforces the view that China does not expect a quick resolution to its trade war with US even as they are reported to be commencing discussions. More stimulus measures will be needed to bolster domestic demand if China’s economic downturn becomes more pronounced in a prolonged negotiation process.

In addition to the moves today, we see further room in 2H25 for 20 bps more cut to the benchmark 7-day reverse repo rate (with loan prime rates to fall by 20 bps) and 50 bps cut to banks’ RRR. These moves will bring the 7-day reverse repo rate, 1Y LPR and 5Y LPR to 1.2%, 2.8% and 3.3% by end-2025.

Overall, we still maintain China’s GDP growth in 2025 at 4.3%. Based on current US tariff setting, we expect China’s economy to weaken sharply with growth to slip to around 4.6% y/y in 2Q25 and below 4% y/y in 2H25 (1Q25: 5.4% y/y). There is a high degree of uncertainty in our estimate, depending on when we get a breakthrough in the US-China trade negotiations and the eventual tariff rates as well as policy measures to offset the external challenges.

Ho Woei Chen

Economist

Follow Woei Chen on LinkedIn

This publication is strictly for informational purposes only and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose, and is also not intended for distribution to, or use by, any person in any country where such distribution or use would be contrary to its laws or regulations. This publication is not an offer, recommendation, solicitation or advice to buy or sell any investment product/securities/instruments. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. Please consult your own professional advisors about the suitability of any investment product/securities/ instruments for your investment objectives, financial situation and particular needs.

The information contained in this publication is based on certain assumptions and analysis of publicly available information and reflects prevailing conditions as of the date of the publication. Any opinions, projections and other forward-looking statements regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The views expressed within this publication are solely those of the author’s and are independent of the actual trading positions of United Overseas Bank Limited, its subsidiaries, affiliates, directors, officers and employees (“UOB Group”). Views expressed reflect the author’s judgment as at the date of this publication and are subject to change.

UOB Group may have positions or other interests in, and may effect transactions in the securities/instruments mentioned in the publication. UOB Group may have also issued other reports, publications or documents expressing views which are different from those stated in this publication. Although every reasonable care has been taken to ensure the accuracy, completeness and objectivity of the information contained in this publication, UOB Group makes no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability relating to any losses or damages howsoever suffered by any person arising from any reliance on the views expressed or information in this publication.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.

Comprehensive macro overviews and technical analysis to help you stay ahead of the curve.

Gain a competitive edge with our insights, forecasts and forward looking analysis.

Explore our expert insights on key global issues, crafted to spark conversation and inspire thought.