Export Services

Convert trade receivables into cash, manage working capital and minimise risk

Overview

Our comprehensive suite of export solutions support your sale of goods and services by unlocking tied-up cash, mitigating risks, and providing working capital solutions. This way, you can expand to new markets and grow your business confidently.

Type of Solutions

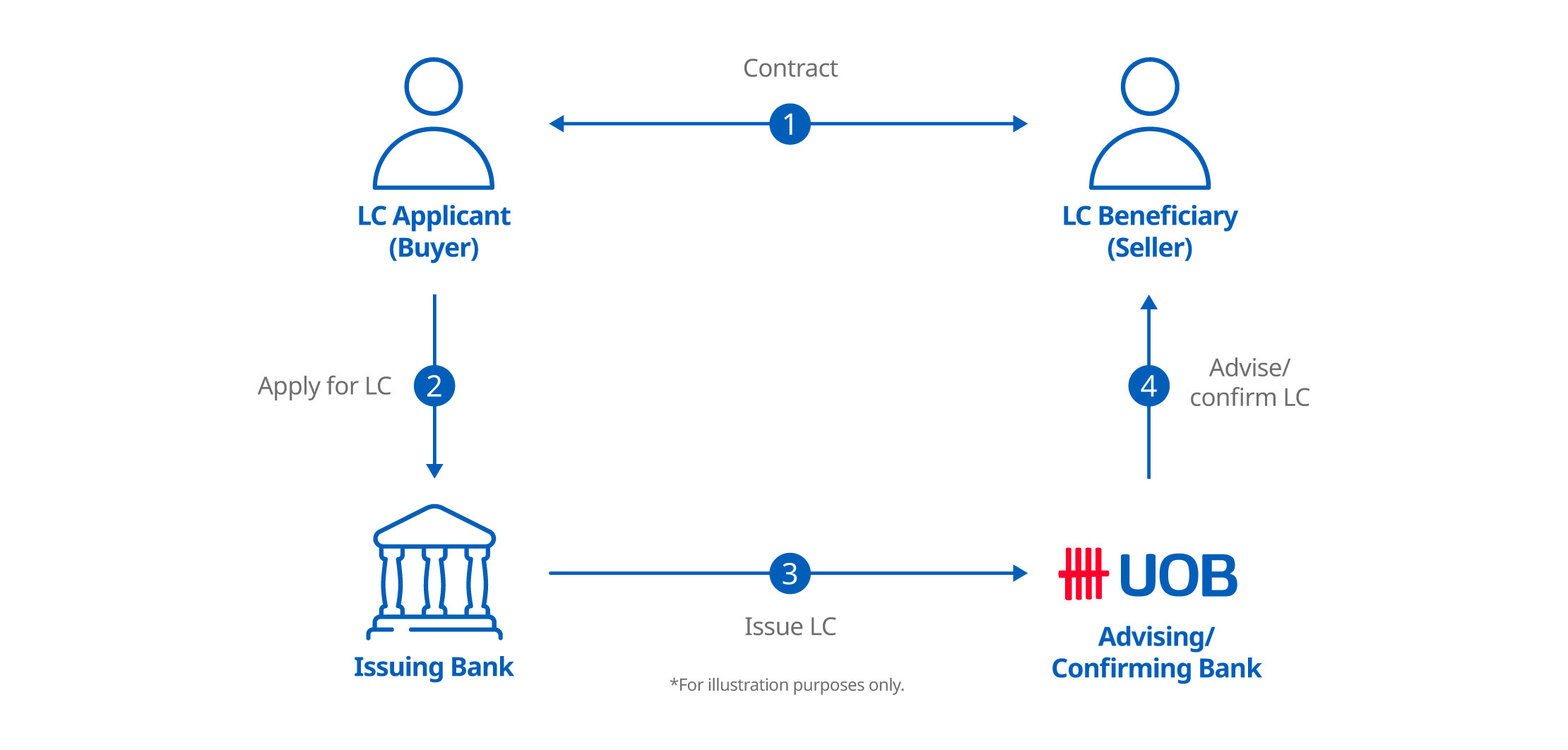

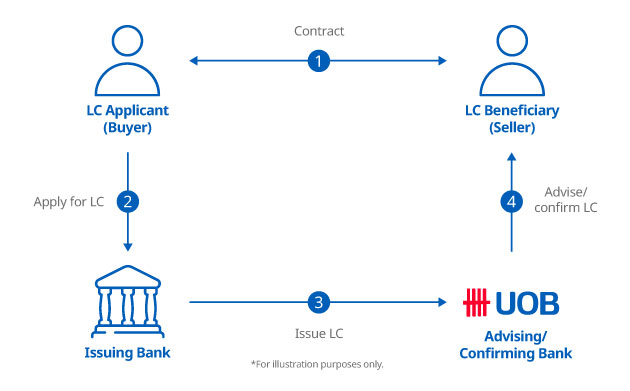

Export Letter of Credit Advising

UOB, the Advising Bank, will authenticate your Letter of Credit before releasing the LC to you. With this, you can be assured of the authenticity of your LC, giving you greater peace of mind. You will receive a notification from us when we receive the LC.

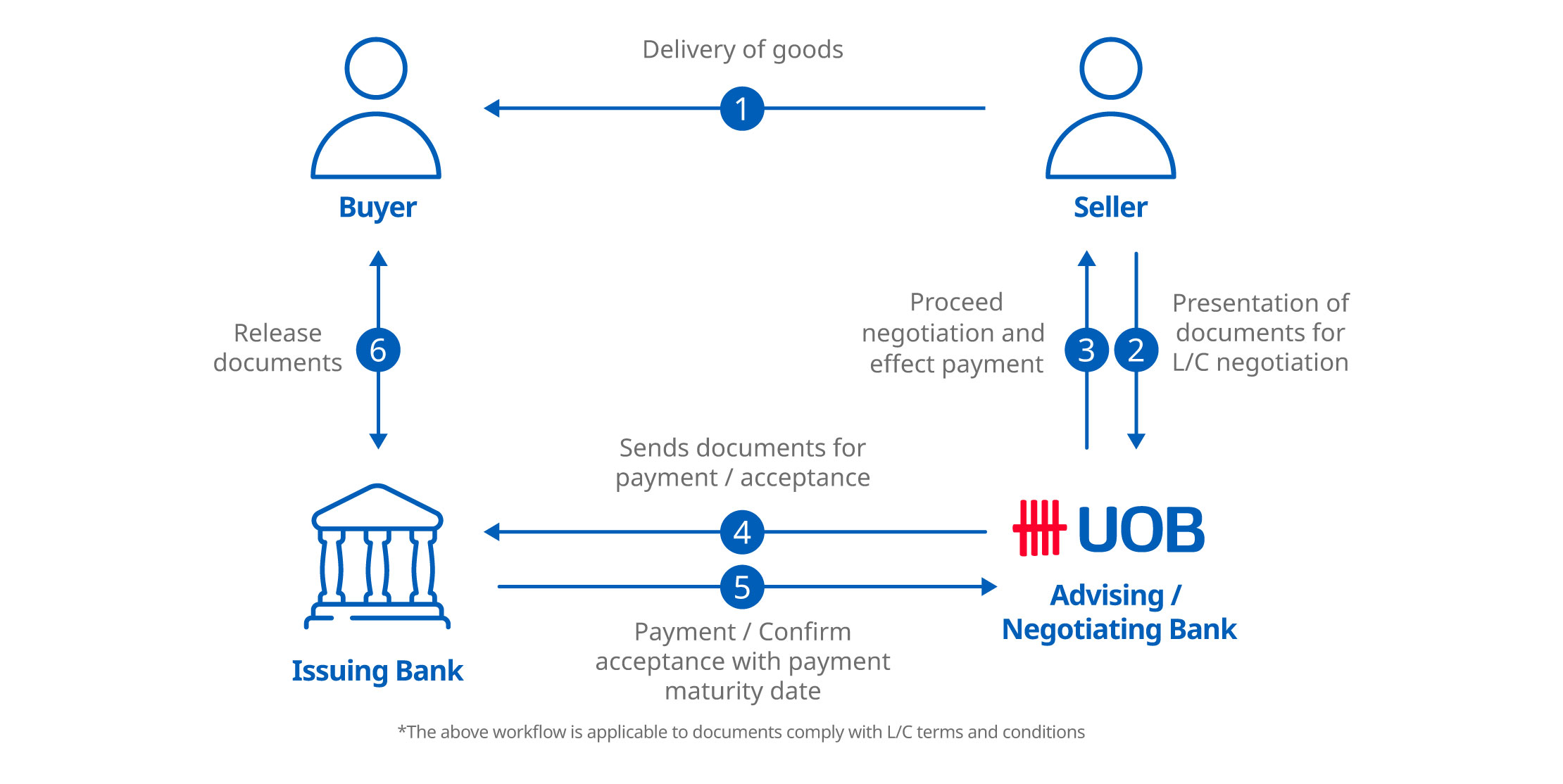

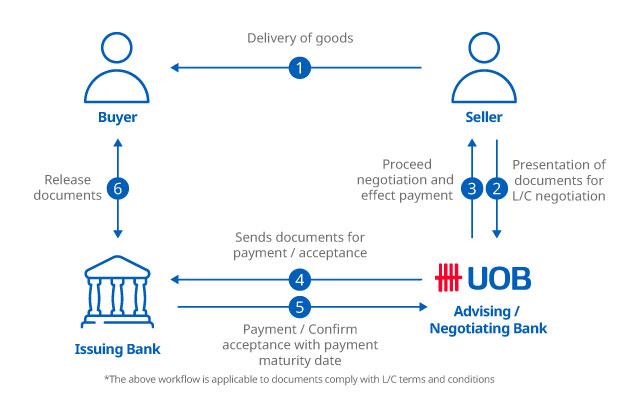

Export Letter of Credit Discounting/Negotiation

You can instruct UOB to present relevant documents to the buyer’s bank on a date set by you. Upon payment or acceptance of drafts payable, the buyer’s Bank will present the documents to the buyer, giving you greater peace of mind.

Export Transferrable Letter of Credit

If you are a middleman/reseller in a transaction, you can request for UOB to transfer your Export Transferrable LC to the final seller. This will eliminate the hassle of issuing an LC to purchase the goods before selling them against an Export LC, thereby helping you quickly secure the goods you have purchased.

Export Letter of Credit (LC) Confirmation

If you are unfamiliar or uncertain about the credit rating of the LC issuing bank or the operating environment the bank is domiciled in, you can request for your buyer to allow UOB to confirm the letter of credit. Obtain greater peace of mind when we mitigate the risks associated with the transaction.

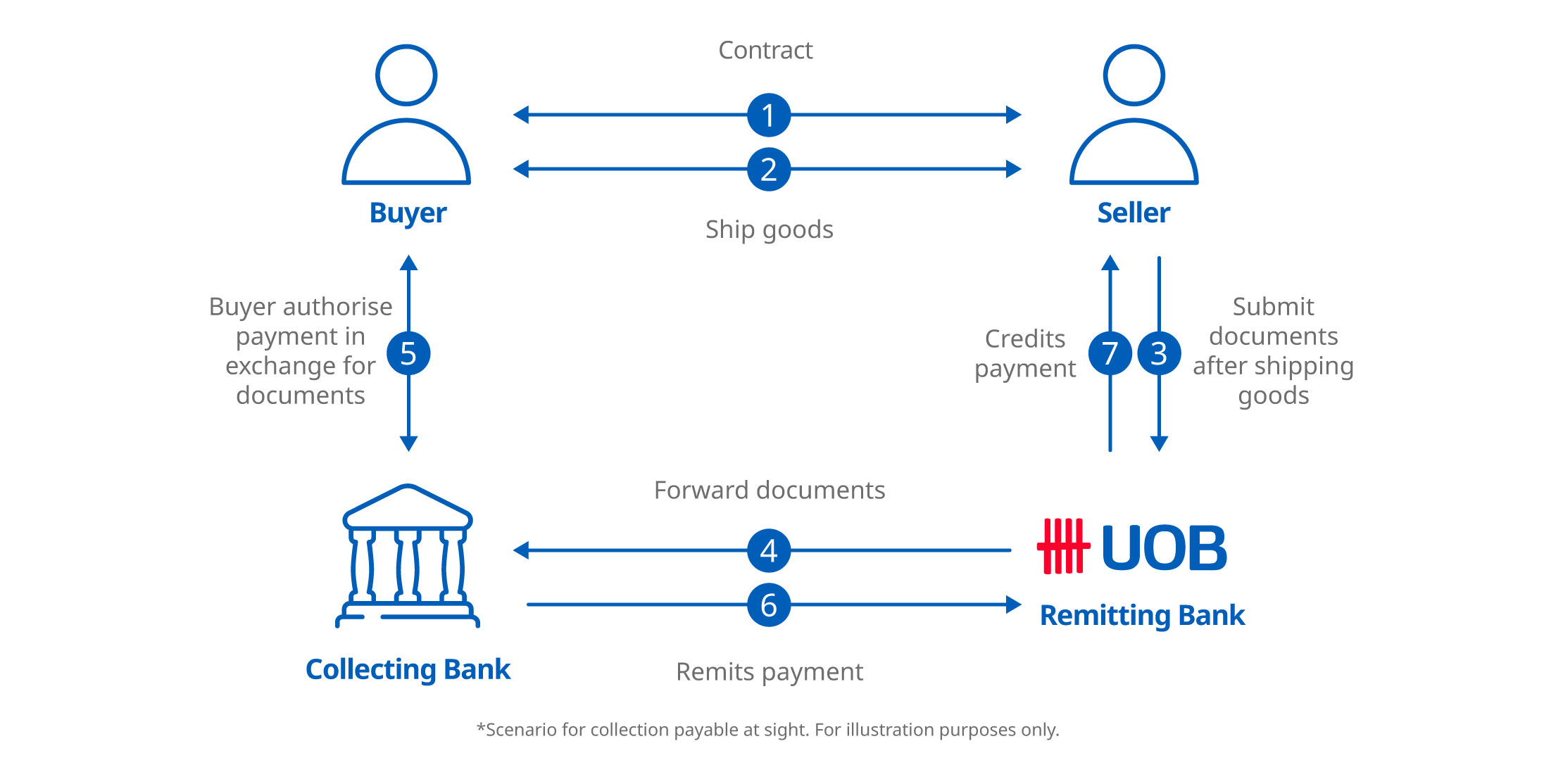

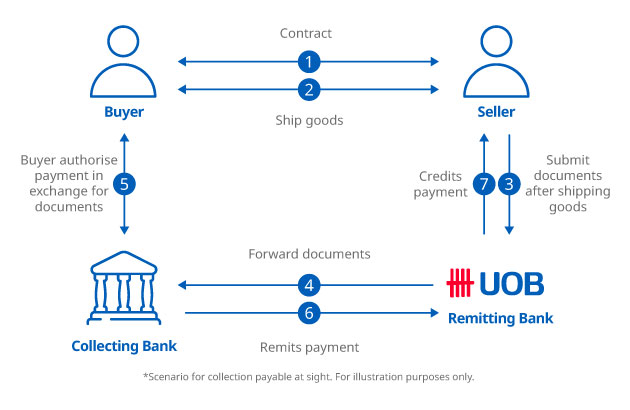

Export Documentary Collection

You can instruct UOB to present relevant documents to the buyer’s bank on a date set by you. Upon payment or acceptance of drafts payable, the buyer’s Bank will present the documents to the buyer, giving you greater peace of mind.

Export Bill Purchase

UOB can provide an advance to you by financing your export bills at full value, before you receive payment from your buyers. The advance will be based on your facility with UOB.

Export Packing Credit

UOB provides pre-shipment financing to facilitate the purchase of raw materials and the preparation of goods for shipment. An Export LC or Purchase Order should accompany the application of the packing credit. Receipts from the Export proceeds will ultimately be used to pay off the financing.

Open Account Trade Finance

Improve your cash flow with short-term trade financing. Based on valid supporting documents, UOB will provide Open Account Financing for the credit period offered by the seller to the buyer, enhancing your relationship with your buyer.

To borrow or not to borrow? Borrow only if you can repay!

Apply Now

Call/Fax Us

Please call us at (852) 2910 8888 (Monday to Friday, 9am-5pm, excluding public holidays) or fax to us at (852) 2910 8899.

You may also like

Import Services

Benefit from in-country expertise, greater liquidity, better working capital and the electronic tracking of all your transactions.

Guarantees and Standby Letter of Credit

We provide assurances to your clients and partners on behalf of your business, allowing you to leverage on UOB’s strong credit rating, through bonds, guarantees, and letters of credit.

Financial Supply Chain Management

However complex your supply chain, we’ll help maximise profits, strengthen supplier relationships and minimise cost with pre-shipment financing, early payment discounting and dealer financing.