Virtual Account

The smarter solution to manage your receivables

Overview

Timely and accurate information is key to efficient accounts receivable (AR) management. With UOB Virtual Account solution, you can streamline and automate your AR reconciliation. Our simple and cost-effective end-to-end solution enables you to quickly identify all incoming remittances from your clients, regardless of the payment type and currency.

Benefits

Simplify your accounts receivable

Streamlined AR reconciliation through effective payer identification.

Enhance working capital

Optimise reconciliation workflow for improving liquidity.

Save time and effort

Reduce administrative and manual processes involved with cheque and cash collection.

Improve relationship with your clients

Better sales cycle due to timely release of credit lines.

How It Works

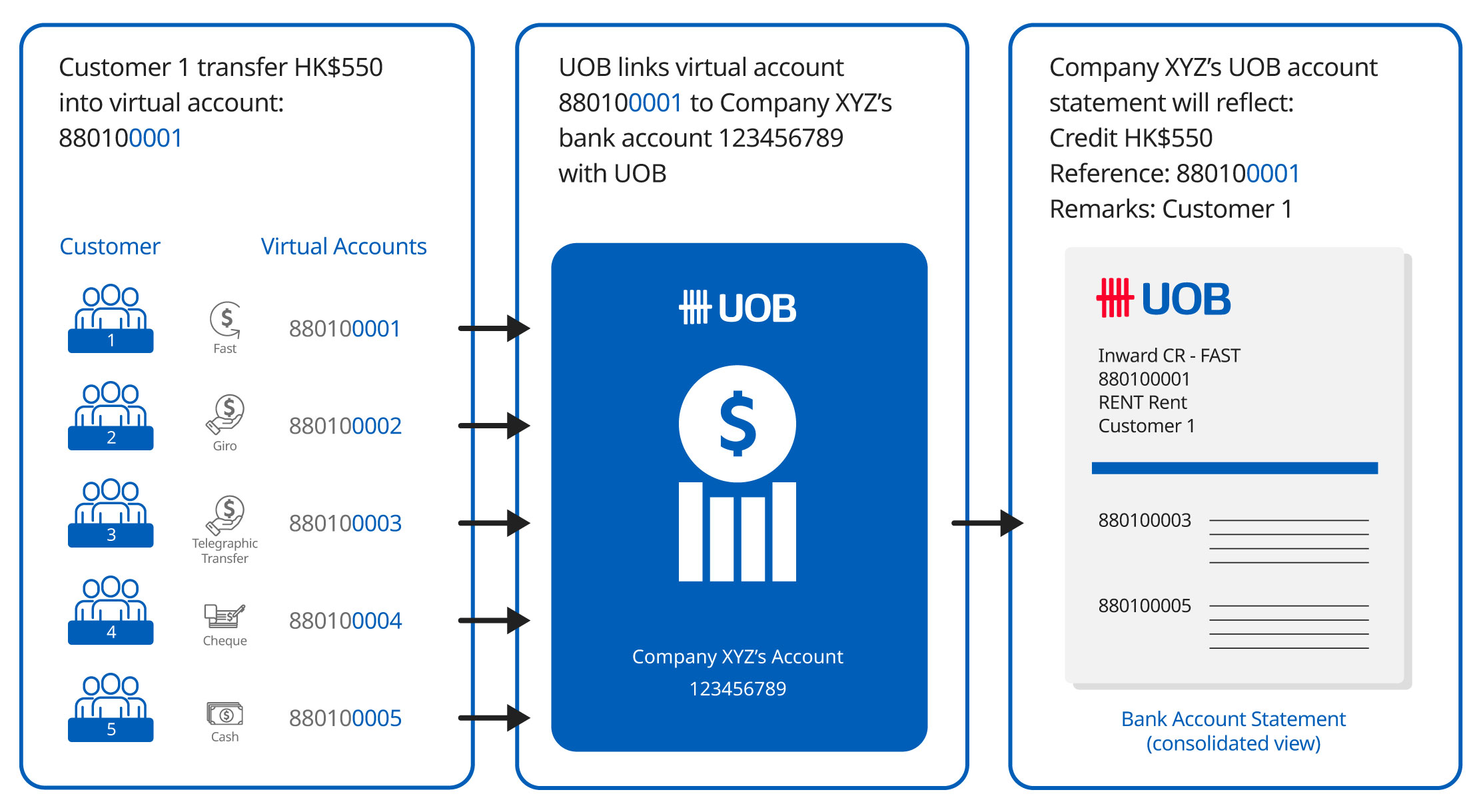

With UOB Virtual Account solution, the bank assigns a range of virtual account numbers for you to provide to your clients for their respective payments to you. Alternatively, you can decide on the range of virtual account numbers which you have assigned to your clients to be set up at the bank e.g. using customer number as part of the virtual account number.

When your clients make payments to you through either manual or electronic payment channels, they will indicate the virtual account numbers assigned to them as the crediting account numbers.

Upon receiving these payments, the bank will link the virtual account numbers to your UOB bank account for the crediting of the payments received. The respective virtual account numbers corresponding to your clients will be shown in your bank statement, enabling you to identify the payers with ease for your AR reconciliation.

Apply Now

Call/Fax Us

Please call us at (852) 2910 8888 (Monday to Friday, 9am-5pm, excluding public holidays) or fax to us at (852) 2910 8899.

Terms & Conditions

Terms & Conditions

- Terms and Conditions for UOB Virtual Account

You may also like

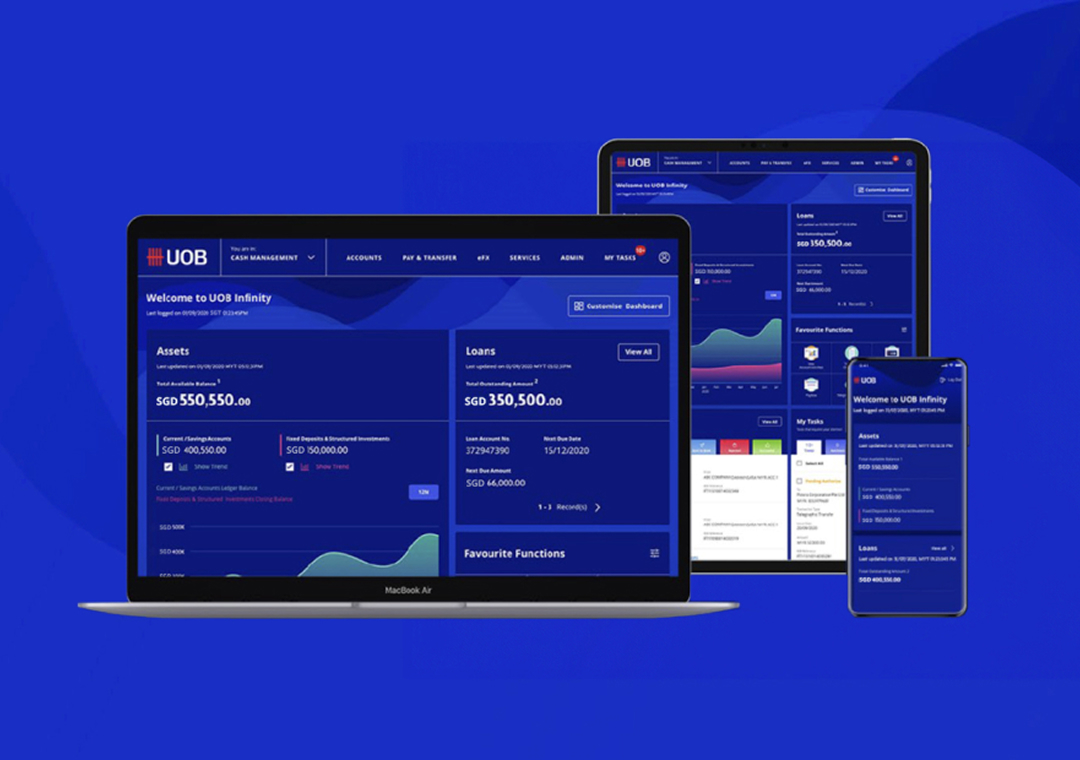

UOB Infinity

A new digital banking experience for business.