UOB Notional Pool

Notionally offsetting your cash balances to reduce borrowing costs

Overview

With UOB Notional Pool service, you can reduce or even eliminate your working capital borrowing costs without physically moving your funds.

How It Works

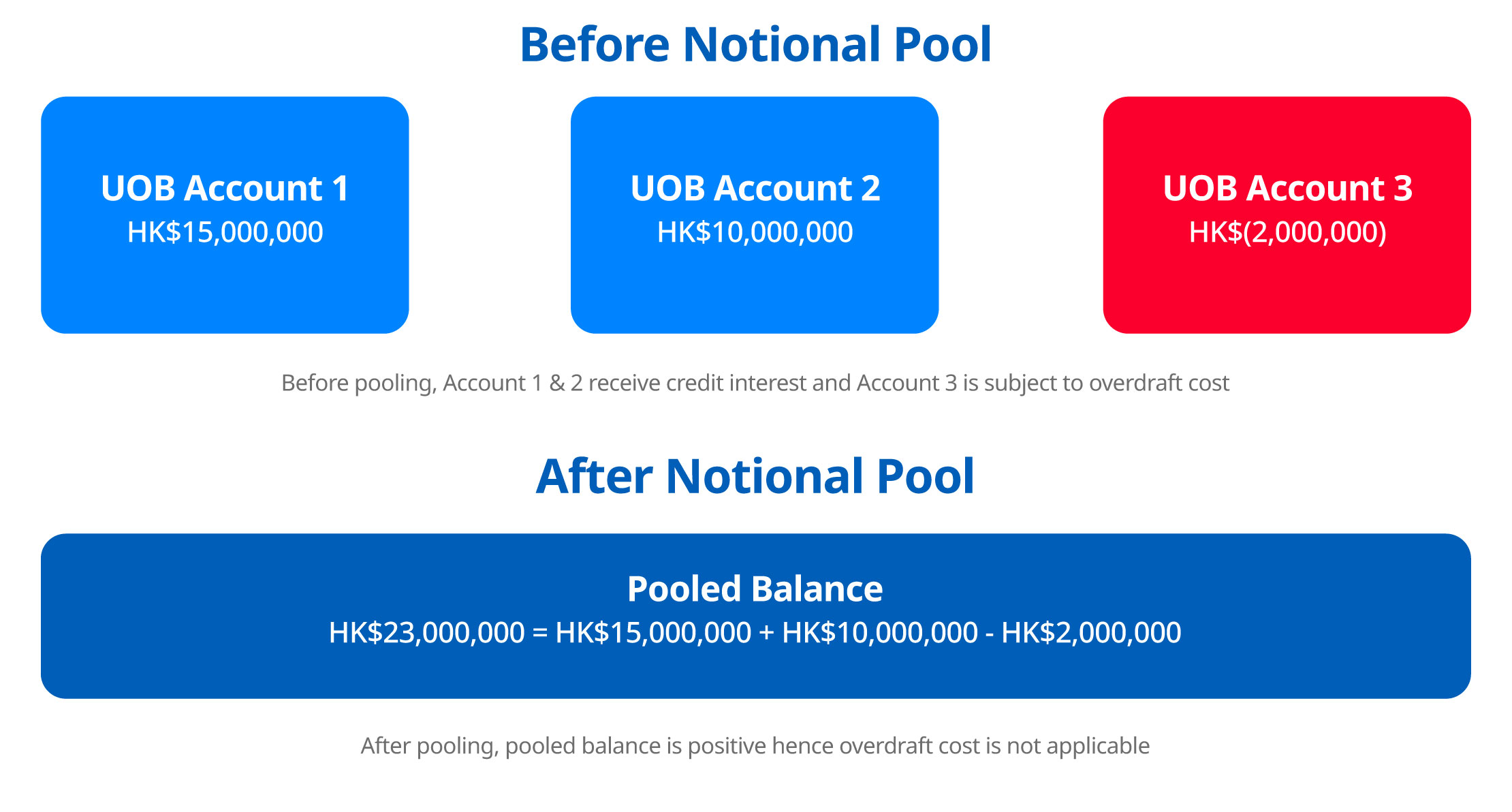

- Debit and credit balances across your participating accounts are notionally offset.

- By notionally using your own credit balances to offset your overdrafts, UOB is able to reduce or even eliminate your overdraft costs via a Pool Benefit.

Apply Now

Call Us

Please call us at (852) 2820 6663 (Monday to Friday, 9am-6pm, excluding public holidays)

You may also like

LIQUIDITY MANAGEMENT

UOB Cash Sweep

Automated centralisation of cash flows for better control over your funds.