You are now reading:

UOB Business Outlook Study 2024 (Malaysia): Streamlining costs to maintain growth

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Malaysia): Streamlining costs to maintain growth

Businesses in Malaysia continue to face escalating operational costs. But as the UOB Business Outlook Study 2024 suggests, there are pockets of optimism amongst businesses, where prudence is taking priority to ensure growth.

The positive outlook is reflected in Malaysia’s projected full-year gross domestic product (GDP) growth of 4.6 per cent, up from 3.6 per cent in 2023. The GDP increase is fuelled by stronger consumer spending and robust investment activities.

There are also upcoming mega public infrastructure projects to lift the economy, led by the Mass Rapid Transit Line 3 (MRT3) with an estimated investment of MYR45 billion, and the expanding presence of global data centres in Malaysia.

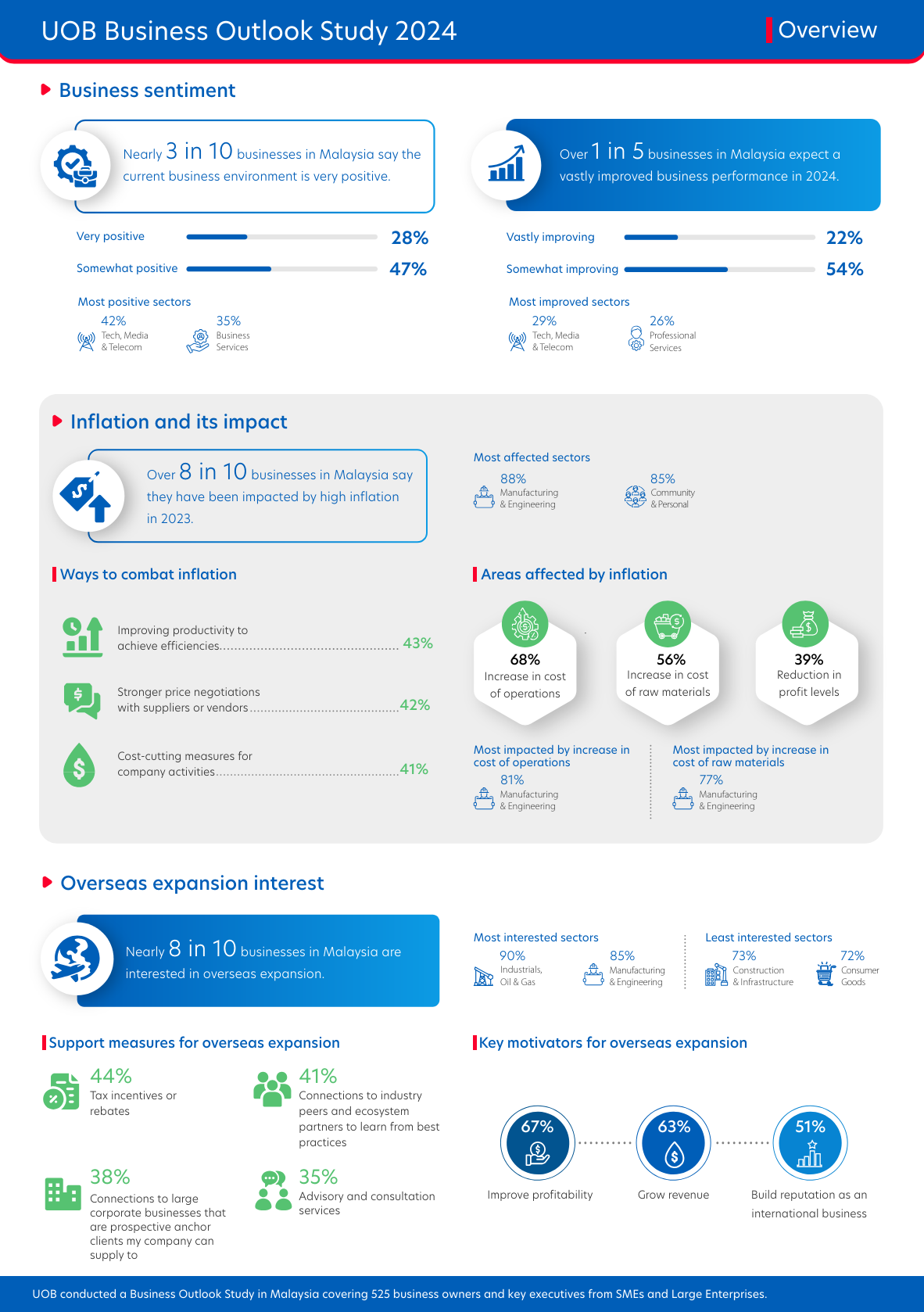

Figure 1: Snapshot of the key insights from businesses in Malaysia

High inflation has impacted eight out of 10 companies leading to a significant increase in operational and raw material costs compared with the previous year. This has affected profitability for four in 10 businesses surveyed.

In response to increased expenses, businesses are implementing cost-cutting measures as they face insufficient cash flow, especially among small enterprises.

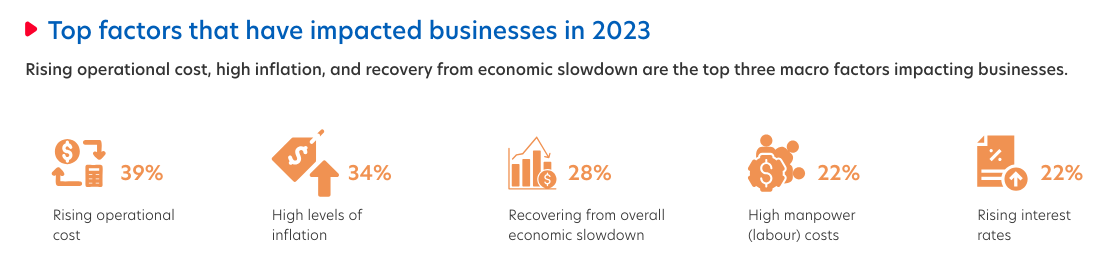

Figure 2: Businesses were most impacted by rising operational costs and high inflation last year

Despite these macroeconomic challenges, three in 10 companies maintain a 'very positive' outlook on the current environment. Sectors such as industrials, oil and gas (90 per cent) and business services (80 per cent) were more optimistic.

Encouragingly, seven in 10 firms anticipate improved performance in 2024, though cost reduction remains a crucial focus to promote business growth. Businesses are also focusing on enhancing productivity and engaging in stronger vendor negotiations to combat inflationary pressures.

Malaysian businesses are eyeing international markets for growth. The report reveals that eight in 10 companies are considering expanding abroad in the next three years to boost profits and revenue.

Companies in the business services (90 per cent) and manufacturing and engineering (87 per cent) lines were the most interested in using digital platforms for cross-border trade.

ASEAN and Mainland China emerged as the primary target markets for expansion among Malaysian businesses. Within ASEAN, Singapore, Thailand and Indonesia were identified as countries with more potential for growth.

However, four in 10 companies face hurdles such as a lack of funds and knowledge, and encounter difficulties with navigating local regulations and taxes. The respondents shared that they prefer to be supported through financial incentives and assistance in building local connections to tap the region’s ecosystem.

Figure 3: Top factors motivating businesses in Malaysia to expand abroad

A stable supply chain network is vital for successful ventures overseas. Our report shows that eight in 10 companies consider supply chain management (SCM) important to their business, particularly in the manufacturing and engineering sector and among medium enterprises.

While geopolitical tensions persist, most businesses agree that this has had less impact on SCM versus the previous year. However, challenges persist in the form of rising supply costs, high interest rates and procurement hurdles.

To ensure stable supply of goods, businesses are adopting strategies such as diversifying suppliers across markets and enhancing inventory management. Additionally, the integration of e-commerce platforms is proving instrumental in stabilising supply chains.

Financial partners play a pivotal role in supporting these efforts. Export services, import services, and trade credit insurance are among the top trading needs identified by businesses, highlighting the importance of collaborative partnerships in navigating supply chain complexities.

Figure 4: Top practices to manage supply chain volatility

In today's digital economy, businesses are increasingly embracing new technologies to stay competitive. The Malaysia Digital Economy Corporation awarded the Malaysia Digital Status to 193 companies in the first quarter of 2024, half of which leverage technologies like blockchain, Web3 and artificial intelligence.

In our study, almost eight out of 10 businesses have already embraced digitalisation, with the most digitalised sectors being manufacturing and engineering, and real estate and hospitality.

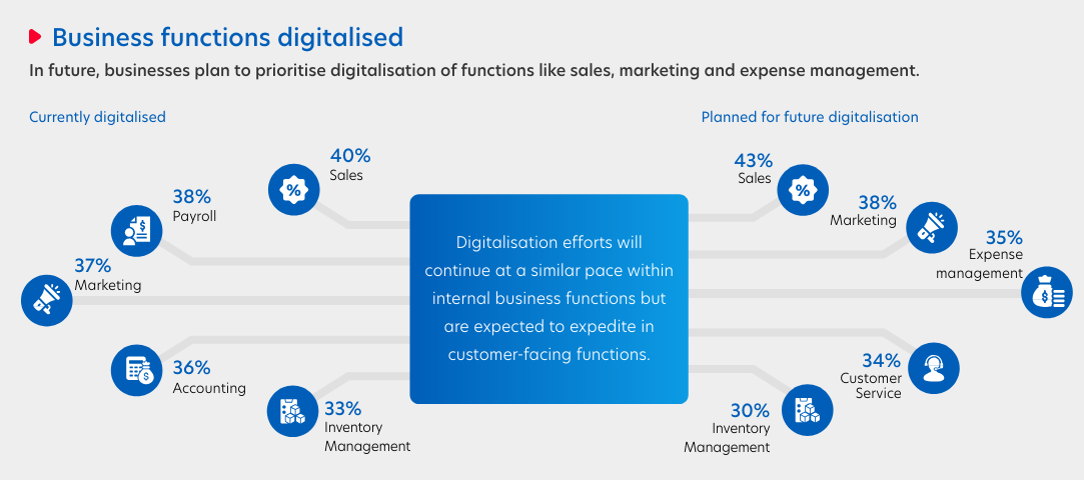

Figure 5: Functions being digitalised by businesses in Malaysia

While functions like sales, payroll, and marketing have undergone digital transformation, there is a pressing need to digitise customer-facing and supply chain operations.

Digitalisation not only enhances productivity and profitability but also elevates overall business performance and customer experience.

However, challenges remain, with Malaysian businesses citing a lack of digital skills, high implementation costs, and cybersecurity concerns.

Small enterprises seek financial support through tax incentives, funding, or grants, while medium enterprises seek access to technology providers and opportunities for industry collaboration.

The adoption of sustainability practices among businesses remains gradual, with only four in 10 having embraced such initiatives. More than half of businesses have yet to implement sustainable practices. This may be in line with the overall focus on alleviating cost pressures instead.

While over eight in 10 businesses acknowledge the importance of sustainability, less than half consider it 'very important,' contributing to the subdued adoption rates observed.

Typically, businesses focus on implementing practices that can be quantified, such as efficient resource usage and the adoption of energy-efficient equipment, particularly in the manufacturing and engineering sector. Additionally, there is an emphasis on addressing employee welfare, with four in 10 companies expressing a growing need in this area.

Figure 6: Companies in Malaysia are prioritising employee welfare and efficient use of resources

Respondents cite several motivations for adopting sustainability, including enhancing business reputation, attracting investors, and fostering smoother collaborations with multinational corporations.

However, the slow adoption of sustainable practices can be attributed to factors such as the increased costs associated with sustainable products and services, limited awareness, and the absence of adequate renewable energy infrastructure.

The UOB Sustainability Compass serves as a guiding tool for business leaders navigating uncertainties or already advancing on the sustainability journey, helping them adapt to an increasingly eco-conscious market.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics. At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (Malaysia) surveyed 525 business owners and key executives from SMEs and Large Enterprises to understand their views on key topics, including:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

02 Dec 2025 • 5 MINS READ

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ