You are now reading:

UOB Business Outlook Study 2024 (Mainland China): Embracing digital, using data to manage supply risks

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2024 (Mainland China): Embracing digital, using data to manage supply risks

At the close of 2023, China exceeded its gross domestic product (GDP) targets, achieving a 5.2 per cent year-on-year growth to reach RMB126 trillion (US$17.4 trillion). This outpaced the 4.5 per cent GDP recorded in the first quarter.

With a targeted growth of five per cent this year, China is rolling out various stimulus measures to boost its economy. As the world’s leading supplier, exports remain the key growth driver this year, with a forecasted export growth of 7 per cent (2023: -4.6 per cent), according to UOB’s estimates.

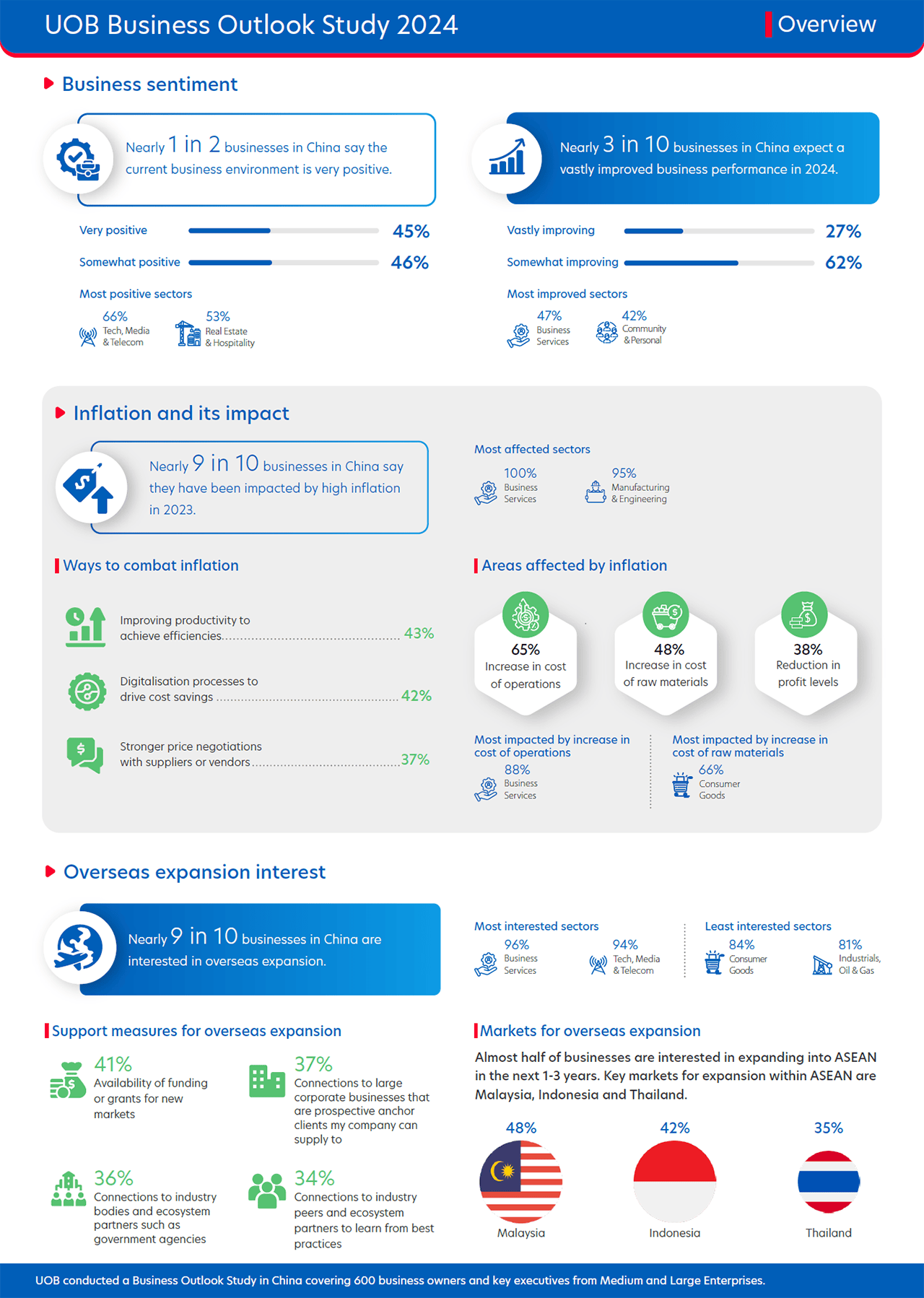

This upswing is reflected in the UOB Business Outlook Study (SMEs & Large Enterprises) 2024, which reveals that overall business sentiment in Mainland China remains hopeful. Nearly half of the study’s respondents felt ‘very positive’ about the current business environment, although this positivity has eroded by 17 percentage points versus 2022.

Figure 1: Snapshot of the key insights from businesses in Mainland China

Driven by continued revenue growth since 2022, two in five companies expect an improvement in the business environment after 2027.

High inflation has significantly impacted nearly nine in 10 companies, primarily through increased operating costs, which have strained profit margins. The top factors that have impacted businesses in 2023 are rising operational costs, the overall economic slowdown and high manpower costs.

Businesses in China have been adopting several strategies to mitigate the effects of inflation. These include enhancing productivity, accelerating digitalisation efforts, and negotiating stronger pricing agreements with suppliers and partners.

Figure 2: Businesses were most impacted by rising operational costs last year

Nearly nine in 10 companies are keen on expanding internationally within the next three years, mainly to improve profitability and to build a reputation as an international business.

Cross-border digital trade platforms are particularly popular among Chinese businesses, with over nine in 10 showing interest in using them – higher than the regional average.

Figure 3: Top factors motivating businesses in China to expand abroad

The leading markets for future expansion are ASEAN and Hong Kong. Within Southeast Asia, Malaysia, Indonesia, and Thailand are the top markets marked for expansion.

However, two in five respondents cited significant challenges in venturing abroad, including a lack of in-house expertise, insufficient customer bases, and difficulty in finding suitable partners.

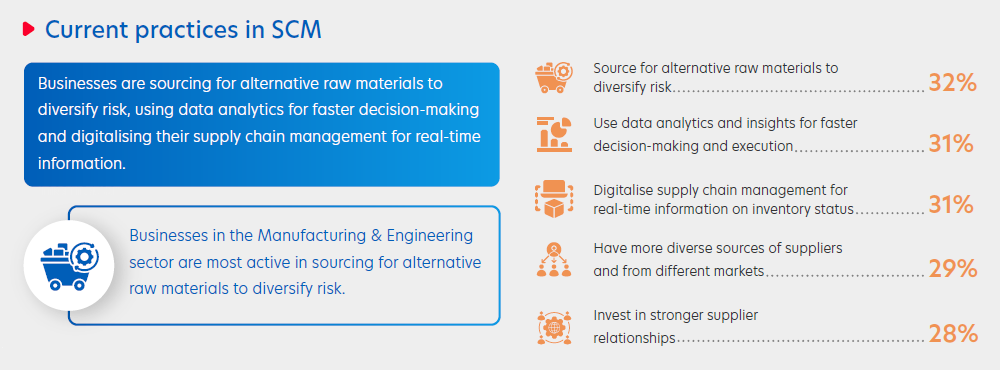

As the world's largest exporter, it is no surprise that nine in 10 businesses in China consider supply chain management (SCM) critical to their operations.

While global events and ongoing conflicts still hold considerable sway over supply chains, fewer businesses in China report being impacted by geopolitical tensions compared with 2022.

However, businesses still face rising supply costs due to high inflation and high interest rates, along with other challenges in procuring supplies or raw materials.

To stabilise supply chains, firms have been raising awareness internally about supply chain risks, using data to drive decisions, and digitalising SCM platforms for real-time information on inventory status. Their preferred support for stabilising supply chains are opportunities for collaboration, connections to the right technology partners, and training programmes to reskill or upskill employees.

Figure 4: Top practices to manage supply chain volatility

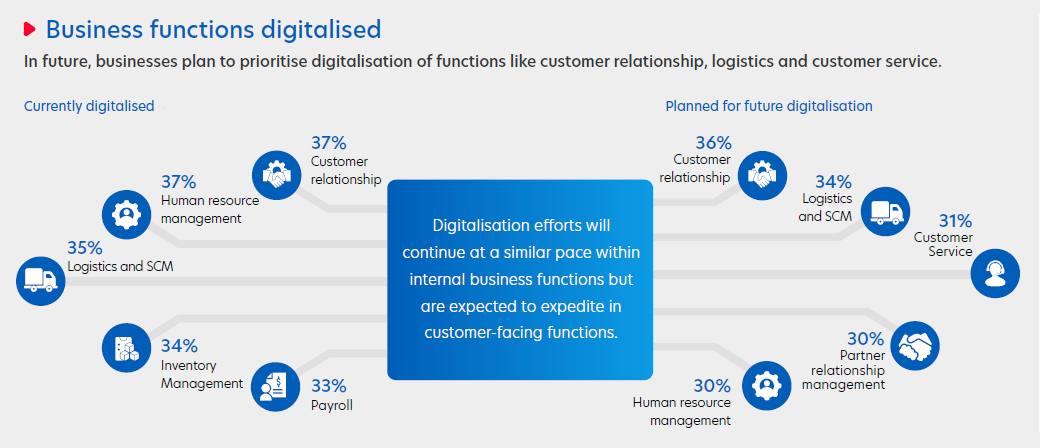

The digital adoption rate continues to be high, with nine in 10 businesses having digitalised at least one department. The tech, media and telecom sector is leading the way in adopting digital solutions, positioning businesses in Mainland China ahead of their regional counterparts in digital adoption.

Many businesses have already digitalised internal functions and are now moving towards digitalising customer-facing and logistical functions. For instance, Tencent and Alibaba have announced significant investments in AI-driven customer service platforms and blockchain-based supply chain solutions to streamline operations and improve efficiency.

This adoption has driven productivity, increased coordination across departments, and improved the quality of products and services.

Figure 5: Functions being digitalised by businesses in China

However, high implementation costs, cybersecurity concerns, and a lack of digital skillsets remain key challenges. As digital transformation initiatives mature, the lack of in-house expertise has become increasingly obvious.

To drive future digitalisation efforts, it is essential to offer opportunities for collaboration with industry bodies, access to knowledge and expertise, and connections to the right technology providers.

Sustainability is vital for nine in 10 businesses, especially for manufacturing, engineering, and business services.

Many companies have adopted sustainable practices, primarily to enhance their reputation, collaborate more easily with multinationals, and to integrate better into the ecosystem.

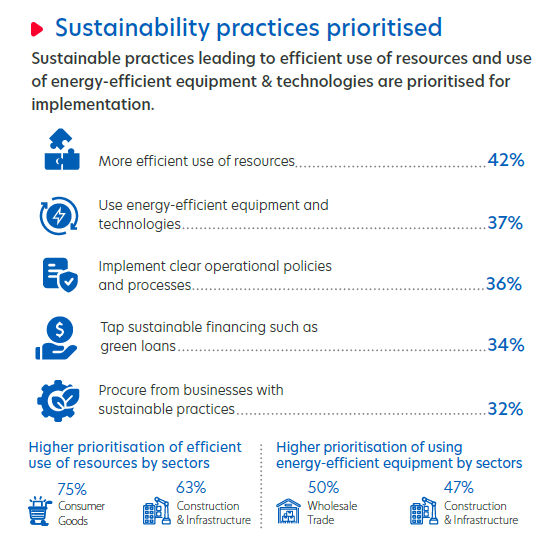

Figure 6: Chinese businesses welcome sustainable practices for direct cost savings

However, the adoption rate has stagnated, with two in five businesses yet to implement these practices.

Despite recognising its importance, many businesses struggle with adopting sustainability practices. Key barriers include concerns about profit impact, increased costs, and insufficient infrastructure for renewable energy.

Businesses seek sustainable financing and connections to training providers to overcome these challenges. These are essential for facilitating the adoption of sustainability practices and ensuring long-term success.

UOB is dedicated to supporting businesses on their sustainability journey by offering tailored financing solutions, helping businesses navigate the complexities of implementation and achieve their sustainability goals.

As businesses in ASEAN and Greater China face a challenging landscape, we want to help them seize opportunities, forge new paths, and reimagine a sustainable future together.

With more than 80 years of experience, UOB has an extensive regional network with a deep understanding of ASEAN dynamics.

At UOB, we are committed to helping businesses navigate the dynamic landscape of the ASEAN region to unlock their full potential. From cross-border trade support to green financing, UOB offers tailored solutions, industry knowledge, and market expertise.

The UOB Business Outlook Study 2024 (Mainland China) surveyed 600 business owners and key executives from Medium and Large Enterprises to understand their views on key topics, including:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ