You are now reading:

UOB Business Outlook Study 2023 (Mainland China): Positive outlook despite global challenges

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Discover how their spending and financial habits are changing with insights from UOB’s consumer confidence barometer.

Find out how we can help you fast-track your investments in the JS-SEZ.

Learn moreyou are in UOB ASEAN Insights

You are now reading:

UOB Business Outlook Study 2023 (Mainland China): Positive outlook despite global challenges

Asia is recovering against the backdrop of an unsteady global economic recovery, and is projected to contribute about 70 per cent to global growth in 2023, according to the International Monetary Fund. This is largely due to the reopening of Mainland China’s borders.

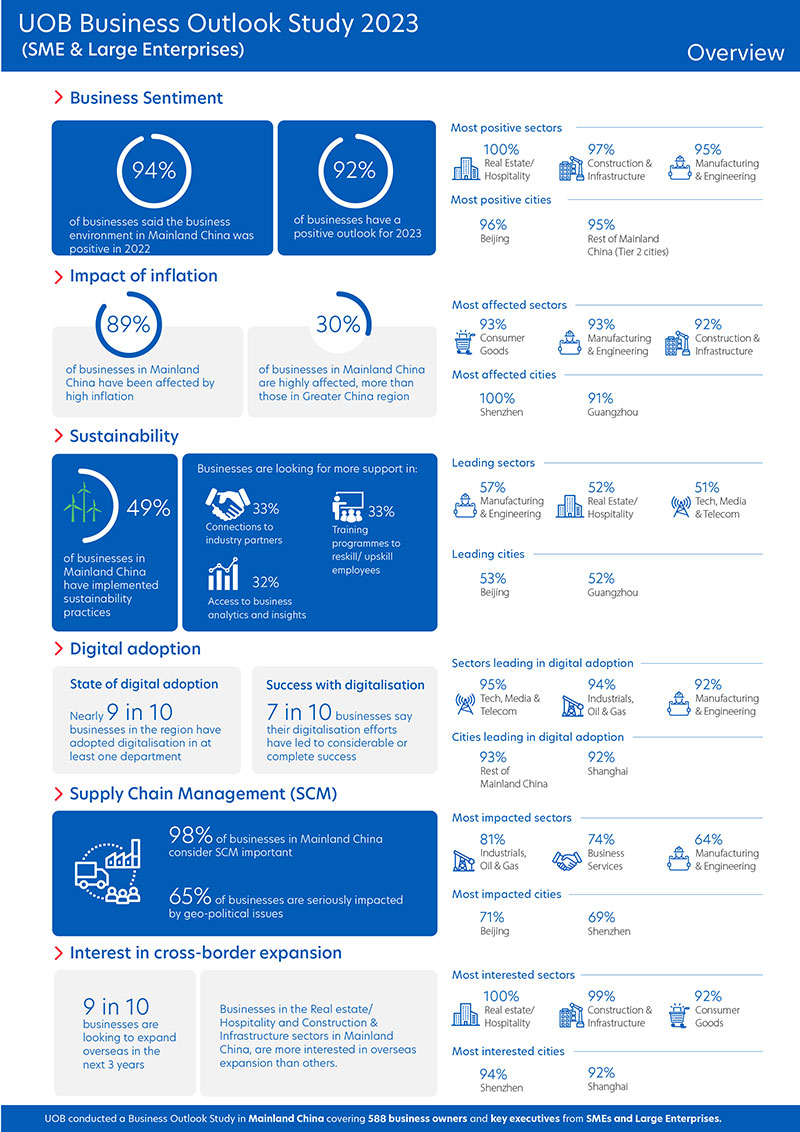

According to the UOB Business Outlook Study 2023 (SME & Large Enterprises), despite COVID-19 and the effect of protracted lockdowns, nine in 10 Chinese firms share positive sentiments for 2023. Firms have also shared their major priorities for the future, which include diversifying their supply chains as well as to digitalise their business.

Figure 1: Snapshot of the key findings from businesses in Mainland China.

The positive perception by businesses in Mainland China was reflected across all sectors in various cities. At the same time, most businesses experienced revenue growth compared with the previous year.

That said, the challenges brought about by the pandemic were inescapable, with multiple companies affected by myriad factors. High inflation, for example, has led to increased operating expenses and raw material costs for one in two businesses.

In terms of impact, businesses in certain cities were more susceptible to the widespread disruption, including the likes of Guangzhou and Shenzhen.

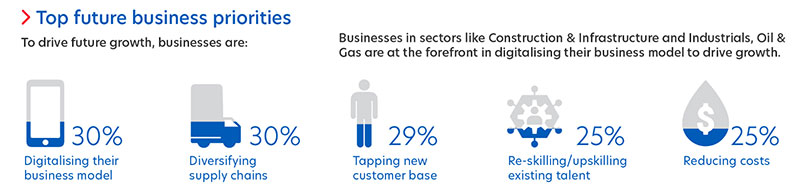

Figure 2: Businesses are refining their strategies to recover from the impact caused by the pandemic.

To combat these headwinds, companies must straddle different business priorities such as digitalisation and diversifying supply chains to future-proof themselves (see Figure 2), while addressing the impact of inflation. To achieve their priorities, companies are looking to connect with industry peers as well as to strike more partnerships with industry bodies.

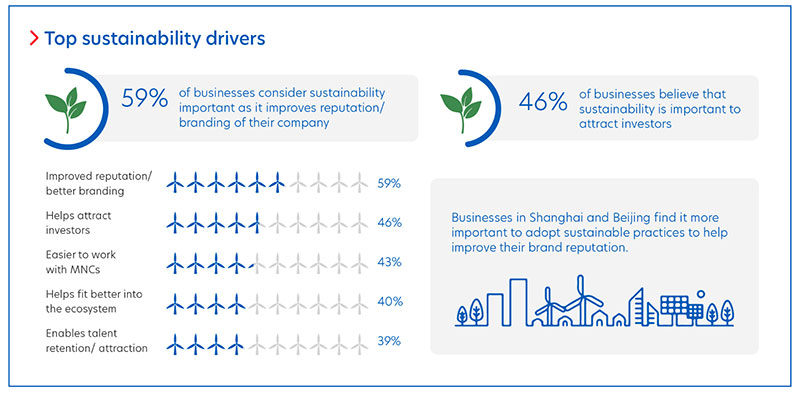

Sustainability is gaining significant importance among businesses, with three in five businesses recognising its value. These businesses are driven by the desire to improve their reputation, attract investors, and establish smoother collaborations with multinational corporations (MNCs).

Figure 3: Top reasons why companies in Mainland China are pursuing sustainability.

Nearly half of the companies surveyed have implemented sustainable practices, establishing clear operational policies to ensure sustainable operations and maximising resource efficiency to minimise waste.

Factors that hinder widespread adoption include a lack of accessible sustainable financing options, concerns about short-term revenue impact, and having a limited understanding of which initiatives to prioritise.

To overcome these barriers, businesses intend to connect with industry peers so as to adopt best practices, as well as gain access to analytics and insights specific to their industries.

In today’s rapidly evolving digital landscape, businesses must be ready to embrace digitalisation to remain competitive. An increasing number of companies are incorporating digital technologies and processes into their operations, in sectors such as e-commerce, cloud computing, and artificial intelligence.

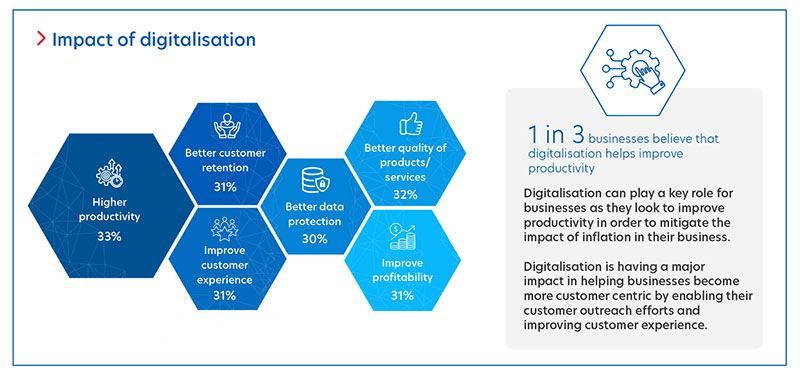

Figure 4: Chinese companies are experiencing the benefits of going digital.

The rate of digitalisation for businesses in Mainland China is promising, with more than seven in 10 adopting digital measures across multiple departments.

Businesses have also indicated that while digitalisation aids customer retention and profitability, the top benefits include higher productivity and delivery of better quality products and services.

Heavy investment by the telecoms industry and the push for 5G adoption have also facilitated the rise of emerging technology such as big data, cloud computing, internet data centres, and Internet of Things. For example, China Unicom, one of the largest telcos in Mainland China, has built more than 16,000 large-scale 5G application projects on a cumulative basis as well as more than 1,600 fully 5G-connected factories in 2022.

Even as digital adoption remains a priority for businesses, respondents cite an increased risk of data breaches, implementation delays and cybersecurity concerns as their biggest challenges.

From the closing of international borders during the pandemic, to the Russia-Ukraine conflict, major events in the past few years have exposed vulnerabilities in supply chains.

Supply chain management is now critical for businesses to maintain efficient operations, cost-effectiveness, and resilience in the face of potential disruptions.

Figure 5: Mainland Chinese businesses are finding new ways to tackle challenges within SCM.

From the study, more than three in five businesses agree that geopolitical factors have highly affected their supply chains. This was strongly felt by respondents in the industrials, oil, and gas industries, with just-in-case supply indicated as their main challenge.

To ensure supply chain stability, companies are investing in strong supplier relationships, digitalising supply chain management, and stocking raw materials ahead of time. Shenzhen, dubbed the Silicon Valley of China, finds strong supplier relationships particularly important.

More than nine in 10 businesses are eager to expand overseas, as such a strategy would provide access to new customers, talent, and resources.

The rise of e-commerce has also reflected a high interest in cross-border digital trade platforms, with 94 per cent of businesses keen to leverage the latter for overseas expansion plans.

Figure 6: Overseas expansion remains key to many businesses’ growth plans.

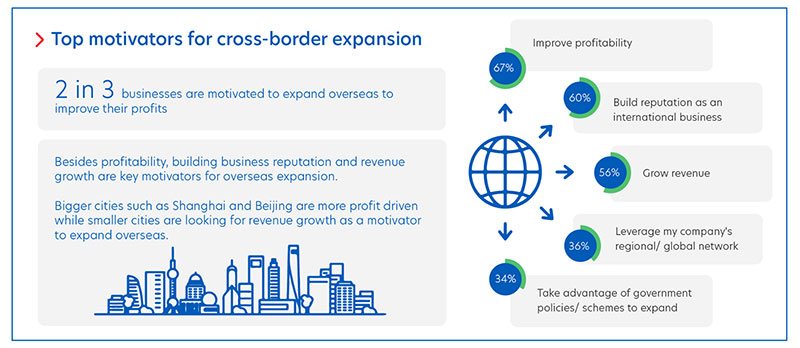

Businesses in Mainland China are also looking to drive revenue beyond their borders – with higher profits and enhanced international reputation listed as key motivators.

Southeast Asia is a favourable market as two in five businesses eye the region for expansion – specifically businesses in consumer goods, industrials/oil and gas, and professional services. With a projected economic growth of six per cent in 2023, ASEAN is deemed an attractive ground for expansion strategies.

Nonetheless, venturing into a new market can be challenging, as one of the key efforts involves navigating the rich cultural diversity within ASEAN.

With more than 80 years of experience, UOB has an extensive regional network, a deep understanding of ASEAN and strategic coverage in China. In 2011, we started a dedicated Foreign Direct Investment (FDI) Advisory Unit to connect Chinese enterprises with government bodies, trade associations, professional service providers and the Bank's client network. We have also set up China Desks in Indonesia, Malaysia, Singapore, Thailand and Vietnam to better support Chinese enterprises as they navigate the diverse business environments across the region. Get in touch with us to find out how we can help your company expand across the region.

The UOB Business Outlook Study 2023 (Mainland China) surveyed 588 business owners and key executives from SMEs and Large Enterprises across the country, to understand their views around:

This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.

09 Dec 2025 • 5 mins read

20 Nov 2025 • 5 MINS READ

06 Nov 2025 • 5 MINS READ

01 Sep 2025 • 5 MINS READ