Delivering Long-term and Sustainable Returns

Led by the vision and experience of our leadership, UOB has grown over the past 80 years to become one of the leading banks in Asia today. We remain focused on the fundamentals of banking, maintaining our balance-sheet strength and enhancing our capabilities to cater to our customers’ needs.

Our fundamentals underpin our ability to stay resilient through market cycles to achieve steady earnings, and our commitment to deliver sustainable returns to our investors over the long term.

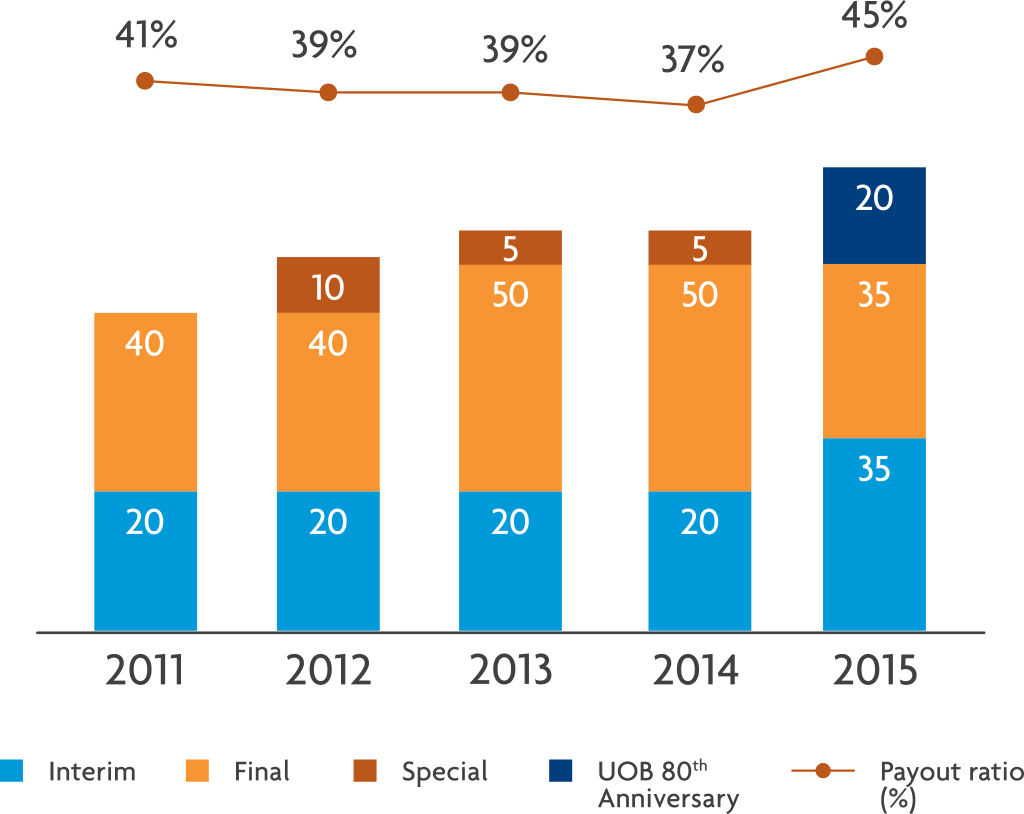

Dividends are usually payable on a half-yearly basis. Where applied, the scrip dividend scheme gives shareholders the option to receive the dividend in cash and/or new UOB shares.

Since UOB was publicly listed in 1970, we have consistently paid dividends to our shareholders through business cycles. To commemorate UOB’s 80th anniversary in 2015 and to share our success with shareholders, we declared a special one-off dividend of 20 cents per share. Backed by our steady financial performance, we achieved a total annualised shareholder return of 5.0 per cent over 2011 to 2015, compared with Singapore’s stock market average of 1.1 per cent1.

UOB’s dividend per share (cents) and payout ratio for 2011-2015

Selected Investment Metrics on UOB |

2011 |

2012 |

2013 |

2014 |

2015 |

| Share price ($) | |||||

| Highest | 21.00 | 20.23 | 22.10 | 24.72 | 25.05 |

| Lowest | 14.42 | 15.15 | 18.63 | 19.40 | 18.20 |

| Daily average | 18.23 | 18.52 | 20.51 | 22.27 | 21.85 |

| Last done | 15.27 | 19.81 | 21.24 | 24.53 | 19.65 |

| Price-to-earnings ratio (x)a | 12.75 | 10.77 | 11.15 | 11.25 | 11.26 |

| Price-to-book ratio (x)a | 1.38 | 1.27 | 1.34 | 1.30 | 1.22 |

| Net dividend yield (%)a | 3.29 | 3.78 | 3.66 | 3.37 | 4.12 |

| Return on average ordinary shareholders’ equity (%) | 11.1 | 12.4 | 12.3 | 12.3 | 11.0 |

| Total annualised shareholder return over 2011 to 2015 (%) | 5.0 |

| a | The daily-average share prices are used in computing these three ratios. |

We have consistently relied on our internal capital generation ability to support expansion plans, with the last major capital raising exercise being in 2001 during the Overseas Union Bank takeover. In 2015, we purchased 1.7 million ordinary shares for $37 million, and we used 1.3 million treasury shares2 solely to meet our obligations under the employee long-term incentive plans.

We are among the few highly-rated banks globally, with strong investment-grade credit ratings of ‘Aa1’ by Moody’s Investors Services and ‘AA-’ by both Standard & Poor’s Rating Services and Fitch Ratings. UOB’s proven track record is also reflected in the tight pricing and consistent oversubscription of the Bank’s bonds and capital securities in the past few years.

Regular And Transparent Communications with Investors

We are committed to maintaining regular and transparent communications with the investment community, including our shareholders, investors, shareholder proxy voting agencies, equity and fixed-income analysts and credit rating agencies. Our investor relations policy governs our engagement with these stakeholders and stipulates that disclosure of information should be conducted on a timely and fair basis.

UOB is covered by the research teams from more than 20 brokerage firms globally. Through constant dialogues with our investment community, our senior management keep investors abreast of UOB’s financials, milestones and other material developments. This is especially important during times of economic uncertainty and market volatility.

In 2015, we met more than 500 analysts and investors and shared with them UOB’s corporate strategy, operational performance and business outlook at the following events:

- Quarterly results briefings, fronted by our senior management, with conference call facilities arranged for overseas analysts and investors. Analysts and investors in Singapore were also invited to post-results luncheons every quarter;

- Investor meetings, conferences and roadshows held in Europe, the US, Hong Kong, Kuala Lumpur and Singapore;

- Our Greater China Corporate Day event in Shanghai, China;

- Meetings with credit rating agencies; and

- Annual general meetings (AGM) and other general meetings.

We disclose pertinent information on a fair, clear and timely basis. General information on UOB, including annual reports, quarterly results, recorded webcasts of results briefings, news releases and presentation slides, including CEO’s AGM presentation slides, are available on our corporate website www.UOBGroup.com. All financial results, news releases, dividends recommended or declared for payment, and other ad-hoc announcements are also available on the SGX website.

Key rating drivers of UOB include its strong capitalisation, resilient credit quality and disciplined funding.

Fitch report dated 27 October 2015

UOB has strong financial fundamentals, namely robust asset quality, good capital adequacy and healthy funding and liquidity profiles. As a result, its rating is among the highest that we assign to banks globally.

Moody’s report dated 13 May 2015

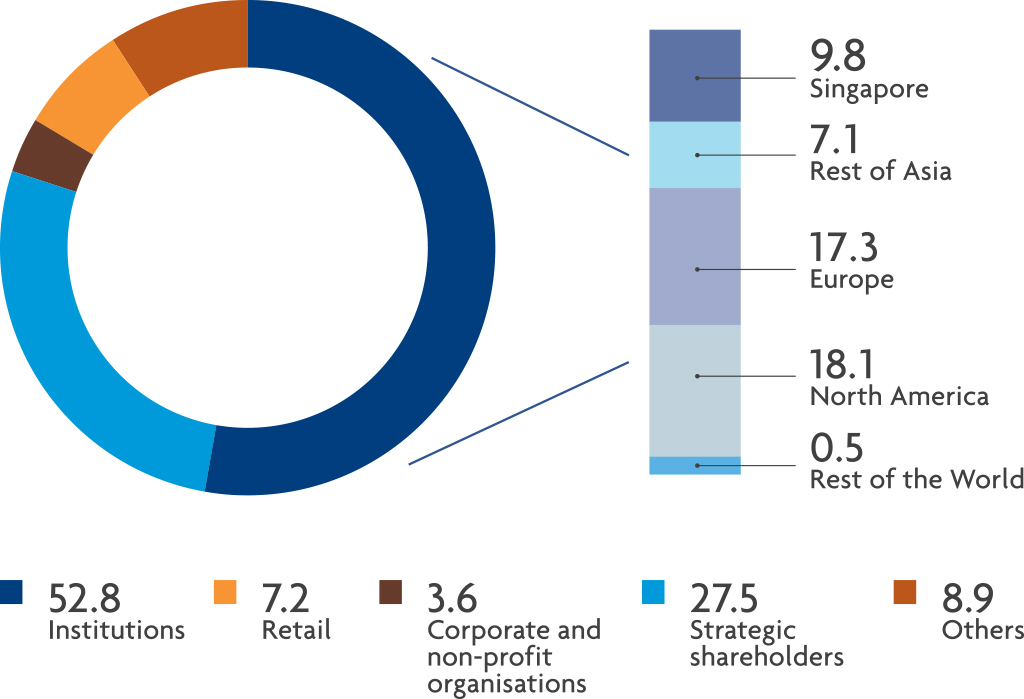

Our diversified shareholder base

Breakdown of UOB’s shareholders as of 31 December 2015 (%)

We have a diverse base of shareholders, including institutions, strategic shareholders, retail investors and other corporate and non-profit organisations. Institutional investors form the largest shareholder group, holding more than half of UOB’s shares. The next largest group are our strategic shareholders among whom are members of the Wee family, including UOB’s Chairman Emeritus Dr Wee Cho Yaw, and Deputy Chairman and CEO Mr Wee Ee Cheong. Their steadfast focus on balancing quality growth with stability is aimed at creating long-term value across the UOB franchise. This approach is aligned with the long-term interests of other shareholders and investors who are seeking stable returns from a sustainable investment.

| 1 | Source: UOB, Bloomberg |

| 2 | Treasury shares are ordinary shares repurchased by the Bank and shown as a deduction against share capital. These may be sold; cancelled; distributed as bonus shares; or used to meet the obligations under employee long-term incentive plans. |