The world is entering a period of market uncertainty, and small and medium enterprises (SMEs) must adapt fast to weather the storm. With rising inflation and an extended global economic slowdown on the horizon, businesses are turning the focus on building resilience to stay competitive.

The ASEAN SME Transformation Study 2022, jointly conducted by UOB, Accenture, and Dun & Bradstreet (D&B), reveals that ASEAN SMEs are accelerating efforts in two key areas: digitalisation and sustainability. To thrive in a changing landscape, 66 per cent of SMEs have increased their technology spending from 2020. From digital marketing to operational processes, SMEs are investing in digitalisation across diverse business areas. At the same time, sustainability is a growing strategic priority for two out of three SMEs.

These two business megatrends were key themes at this year's World FinTech Festival (WFF) 2022 series in Thailand and Malaysia. Organised in partnership with UOB, WFF 2022 Thailand and Malaysia were themed 'Banking for Businesses: A Spotlight on SMEs'. Bringing together leaders, policymakers and entrepreneurs, the festivals explored how SMEs can accelerate their digitalisation and sustainability efforts to thrive in an uncertain business environment.

As the highly anticipated Singapore FinTech Festival approaches this November, here are six key takeaways from WFF 2022 Thailand and Malaysia.

A panel discussion on 'SME Digitalisation Journey' at the World FinTech Festival 2022 Malaysia.

The speakers are (left) Anne Tham, Group CEO & Founder, ACE EdVenture, Gopi Ganesalingam, Senior Vice-President of Ecosystem, Malaysia Digital Economy Corporation (MDEC), Ho Hui Ming, Executive Director, Country Head, Business Banking, UOB Malaysia, Salim Dhanani, CEO, BigPay, Sopnendu Mohanty, Chief FinTech Officer, Monetary Authority of Singapore (MAS), Chairman, Elevandi, and the moderator is Wilson Beh, President, FinTech Association of Malaysia

Photo: UOB

Payment connectivity is powering regional ambitions

Increasingly, SMEs in ASEAN are setting their sights on cross-border growth. In UOB's ASEAN SME Transformation Study 2022, 74 per cent of respondents revealed a keen interest in expanding across ASEAN. Another 43 per cent indicated ambitions for venturing globally beyond ASEAN.

During WFF Thailand and Malaysia, panellists highlighted how the accelerated growth of ASEAN's digital economy is unlocking new opportunities for SMEs to expand regionally. One key enabler of this has been the advancement of domestic and cross-border payment connectivity.

Fuelled by the pandemic, digital payments adoption has surged in Southeast Asia among both consumers and businesses. The next step in facilitating business transactions is cross-border fast payment, which is fast becoming a reality. One promising sign is the first-of-its-kind integration between Thailand's national fast payment system PromptPay and Singapore's PayNow, which allows fund transfers to flow seamlessly and instantly between Singapore and Thailand customers.

Looking ahead, regulators are focused on supporting SMEs by improving regional payment rails and making data systems interoperable. MAS, for instance, has already announced plans to link fast payments systems with India and Malaysia.

Besides simplifying regional operations for SMEs, this infrastructure will also open opportunities for FinTechs to build smarter payment solutions. Panellist Aung Kyaw Moe, Founder & CEO of 2C2P, urged SMEs to look beyond their domestic market and dream bigger. “SMEs have many more opportunities than they did ten to fifteen years ago. Today, they can stand shoulder-to-shoulder with large enterprises with the technology and tools that governments are providing.”

Speakers at a panel on 'Business Strategies, Digitisation & Sustainability', during the World FinTech Festival 2022 Thailand.

The speakers are (left) Sathit Boonchalok, Senior Vice President, Head of Product Management, Business Banking, UOB, Chonlawat Ruengpreechavech, CEO, Clinton Intertrade (SME), Nareerat Santhayati, Vice President, Sustainable Development Department, Stock Exchange of Thailand (SET), Sopnendu Mohanty, Chief FinTech Officer, MAS, Chairman, Elevandi, Aung Kyaw Moe, Founder & CEO, 2C2P, and the moderator is Darwin Smarnond, Managing Director - Financial Services Accenture Thailand

Photo: UOB

Support for digital transformation is at hand

With economic headwinds on the horizon, SMEs must turn to digital transformation to develop greater resilience. As the ASEAN SME Transformation Study shows, 47 per cent of businesses plan to digitalise their operational processes to lower operational costs amidst high inflation. And for SMEs embarking on digitalisation, there is no shortage of help available from industry leaders and institutions.

Thai SMEs, for one, can look to the Stock Exchange of Thailand (SET) for acceleration programmes centred around digital innovation, design thinking, and digital management.

To boost SMEs' competitiveness in a digital future, SET is also slated to launch a new project on 'Creating a culture of innovation'. Developed in collaboration with Microsoft and Mission to the Moon, the programme aims to help companies hone innovation capabilities in four aspects: people, process, data and technology.

In Malaysia, access to finance and government support for digitalisation is also made available through the Malaysia Digital Economy Corporation. The MDEC's latest initiative, DE Dagang, aims to help businesses move to e-commerce platforms. For financial support, SMEs can take advantage of grants like the Smart Automation Grant and the 4IR Catalyst Grant to innovate and enhance efficiency.

Kamaradzaman Bin Mohd Bakri (left), Senior Director of Green Growth Group, Malaysian Green Technology and Climate Change Corporation (MGTC), and Melissa Moi, Head of Sustainable Business, UOB, speaking at the World FinTech Festival Malaysia 2022.

Photo: UOB

Sustainability must be a long-term business strategy

Sustainability is no longer a buzzword - it has become a must-have for SMEs to attract consumers and capital.

Today, 82 per cent of Asia-Pacific consumers believe companies should be transparent about their environmental impact. In turn, investors increasingly expect businesses to disclose, evaluate, and enhance their Environmental, Social and Governance (ESG) performance. Having a rigorous sustainability strategy is thus essential to win investor support.

Yet prioritising sustainability remains a challenge for SMEs. At WFF Malaysia, Melissa Moi, Head of Sustainable Business, UOB polled attendees on whether their businesses had committed to achieving net-zero emissions. “Only two or three of you in this room have made the commitment to net zero,” she highlighted. “There is an urgent need to halve the world's emissions by 2030. Net zero is a key concept that asset managers and companies are talking about, and that countries are committing to.”

To truly embed ESG into their business model, SMEs must understand how sustainability enhances their profitability and competitive edge. At WFF Thailand, Nareerat Santhayati, Vice President, Sustainable Development Department, SET, shared three key ideas for SMEs and their leaders to keep in mind when building their sustainability strategy:

- ESG must be integrated into the long-term business strategy. “ESG cannot be a one-off or philanthropic activity,” she shared. “SMEs should review the business landscape, explore opportunities, and analyse why consumers need your products and services. From there, you can identify ESG issues that impact your bottom line and integrate these into your business strategies.”

- What gets measured gets managed. SMEs need to measure their business performance against ESG targets and use metrics that align with industry guidelines when planning their ESG strategy. Proper disclosure enables SMEs to build trust with investors.

- Sustainability is a long journey. “Sustainability requires constant improvement in tandem with expectations from investors and consumers,” she said. To succeed, partnerships and engagement with stakeholders are a must.

Accelerating sustainability adoption with ecosystem support

Since sustainability is a long journey, SMEs should seek out support from a strong regional ecosystem to smoothen their path. During WFF 2022, several representatives from government agencies and regulatory bodies highlighted a low rate of uptake for sustainability incentives by institutions - despite SMEs' challenges in adopting sustainability.

In UOB's ASEAN SME Transformation Study 2022, 60 per cent of SMEs cited high initial costs as the top barrier to implementing sustainability. Another 48 per cent faced challenges resulting from lack of expertise and know-how.

To overcome cost-related challenges, SMEs can leverage solutions from ecosystem partners like banks. Sathit Boonchalok, Senior Vice President, Head of Product Management, Business Banking, UOB, highlighted various ecosystem programmes spearheaded by UOB, including:

- The U-Solar programme, designed to help businesses in Singapore, Malaysia, Indonesia, and Thailand switch seamlessly to solar power.

- Sustainable financing solutions, covering frameworks for the circular economy, green building development, sustainable trade finance, smart cities, and transition finance.

In terms of expertise, SMEs can tap initiatives from banks and regulatory authorities, such as:

- The FinLab's Sustainability Innovation Programme is a five-week programme designed to help SMEs understand their sustainability needs and transform into sustainable businesses.

- Project Greenprint, developed by MAS, is a collection of initiatives to help GreenTech businesses connect with investors and perform sustainability reporting.

- Malaysia's Green Technology Financing Scheme provides financing for users and producers of green technology in six key sectors: energy, water, building and township, transport, waste, and manufacturing.

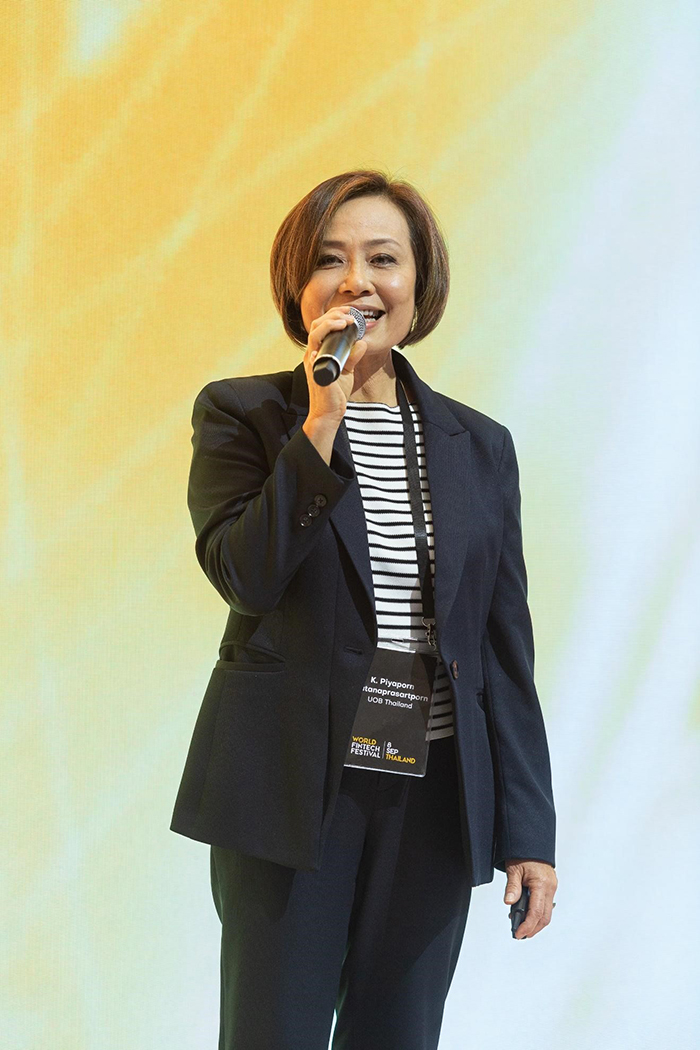

Opening remarks at the World FinTech Festival 2022 Thailand by Piyaporn Ratanaprasartporn, Executive Director and Country Head of Channels and Digitalisation, UOB Thailand.

Photo: UOB

Blockchain will open new doors to financing and fundraising

Securing access to financing is a key challenge for SMEs today, due to high collateral requirements and inadequate financial records. Today's FinTechs are disrupting traditional financing by building alternative data models. Based on this alternative data, FinTechs are bridging the finance gap by developing credit borrowing services based on intent to pay - as opposed to the more traditional 'ability to pay'. This opens up alternative avenues to fundraising and borrowing for SMEs.

One key disruption on the horizon is Web 3.0 technologies - particularly blockchain, which is poised to unlock decentralised forms of lending. Chua Chek Ping, Executive Director, Blockchain & Digital Assets, UOB, shared that blockchain offers alternative, verified data to assess creditworthiness. “Typically, banks are hesitant to provide loans to SMEs due to a lack of verified financial information. By leveraging blockchain and data-sharing APIs, alternative data can be made more accessible and trustworthy, improving SMEs' access to financing.”

At the same time, blockchain-based fundraising can offer a swifter alternative to traditional fundraising, which is often inefficient and costly for SMEs. In a panel discussion on 'Opportunities for SMEs in Web3' at WFF Thailand, Oi-Yee Choo, CEO of Singapore-based private market exchange ADDX, shared insights on cryptocurrency fundraising's benefits for small businesses.

“The efficiency and power of blockchain open up different capabilities for financing, from bonds to funds,” she explained. “For example, large corporates tend to hit the bond market with 200-300 million. This leaves SMEs struggling with intermediate financing; their access to capital is quite limited. But [through blockchain] we've found a space for SMEs to consider financing in smaller tranches - 30 million, 50 million - and to tap the size that they need. Refinancing is done digitally, and there are no high costs of intermediaries or transfers.”

Panellists sharing on 'Opportunities for SMEs in Web3', during the World FinTech Festival 2022 Thailand. (Left) Oi-Yee Choo, CEO ADDX, Chua Chek Ping, Executive Director, Blockchain & Digital Assets, UOB, Jon Russell, Partner, Crypto.com and the moderator Chonladet Khemarattana, President Thai Fintech Association

Photo: UOB

Exploring the business possibilities of blockchain

Beyond financing, blockchain enables bold new frontiers in business growth. With the enhanced liquidity conferred by tokenisation, many forms of assets can now take on investable dimensions and be transacted more efficiently, from wine to art.

Jon Russell, Partner, Crypto.com, highlighted that the time is ripe for SMEs to experiment with blockchain's novel possibilities, such as NFTs. “With the current market climate, it's not a bad time for companies to see what options are out there,” he said. “When [Crypto.com] invests in start-ups that are three to six months old, we look for signs of cumulative use of their product. Businesses with a regular customer base have a great headstart to think about NFT memberships.”

Given the onset of this year's crypto winter, SMEs might be hesitant to dabble in the blockchain space. Responding to this, Jon emphasises the importance of developing viable products and services. “A lot of companies died out during the early days of crypto as they didn't have a coherent product… The companies that survived are those who actually have a viable product or service; they have users and revenue.”

Discovering insights, making connections

To bolster resilience in an uncertain climate, it's clear that SMEs must leverage expertise and support from the wider ecosystem to build digital innovation and sustainability into their business.

For more expert insights from industry leaders, sign up for the Singapore FinTech Festival 2022, happening on 2-4 November. This year's SFF will bring together more than 300 expert teachers and over 300 exhibitors, covering key trends from Web3 technologies to sustainable finance solutions.

Get your festival pass here.