Data is the rails on which the digital economy runs. As we become more digital-focused in more areas of our lives, the proliferation of data being generated and data being stored will only continue to grow. In the digital economy, how we build our data network and use data will shape us as a person, as a business and as a society. The integration of digital into everyday life has increased over the past few years especially with the introduction of the smartphone, and the COVID-19 pandemic has only accelerated our digital footprint.

As digitalisation impacts every aspect of the way we live and work, the traditional silos of data usage and storage will continue to be broken down. Take for example the data we generate when we track our exercise and steps or when we log our calorie intake. We can choose to share these same sets of data with a variety of third-parties, from health and wellness apps, to our doctors, our insurers and many others who then use it to provide us with personalised products and services.

In ASEAN, we are still at the early stages of our data journey. We have the opportunity to start the journey on the right footing by championing a common set of principles on how industries can use data responsibly. These principles should be the standard that guides companies as they balance data-driven customer innovation with ethics.

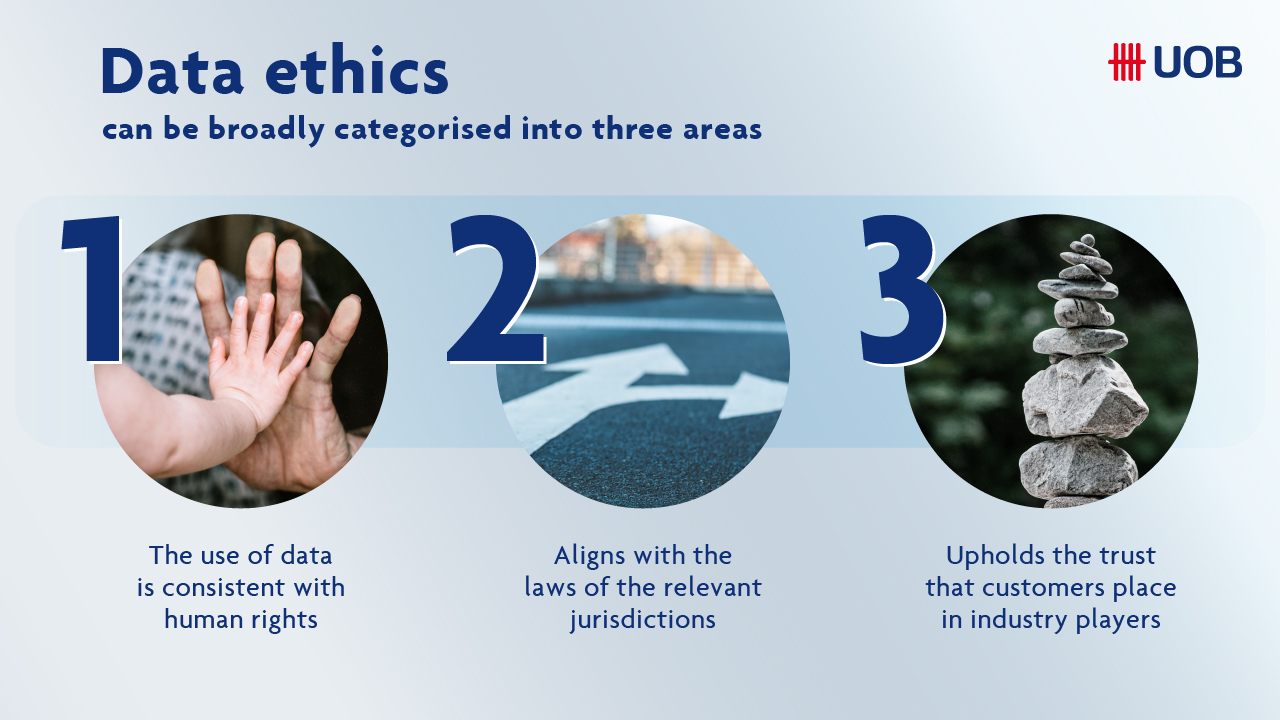

As part of the ethical use of data, it is important that each industry sets up a body that looks specifically at ensuring the responsible and sustainable use of it. Data ethics can be broadly categorised into three areas – that the use of data is consistent with human rights, aligns with the laws of the relevant jurisdictions and upholds the trust that customers place in industry players.

The above image is by UOB and an addition to the original article published on The Business Times.

The above image is by UOB and an addition to the original article published on The Business Times.

Charting the grey areas

What is the ethical and responsible way of using data for businesses? This question alone is more complex than it may seem at first glance and that is why it is important for organisations to come together and agree on a set of data principles and standards to be held accountable for.

For example, in the area of credit assessment for financial institutions, some may argue that certain socioeconomic data sets such as residential addresses should be excluded from credit scoring models as this could lead to unintended and unintentional bias.

However, discouraging the use of such relevant and impactful data sets without due consideration and discussion may lead to unintended consequences such as overextending credit to customers who may not be able to repay the debt which then leads to emotional, mental and fiscal stress on them. This goes against Fair Dealing guidelines under which financial institutions must ensure that they are acting in their customers’ best interest and offer financial solutions such as an appropriate credit line that best meet customers’ needs and overall wellbeing.

People are the drivers behind data analytics and AI

As we use data analytics and artificial intelligence (AI) for our businesses, it is important to keep in view the reason we are doing so – to benefit people. Whether using AI to serve customers better or to enhance work processes so that our employees can do more and do better, technology should be an enabler for people. When customer data is being used to build data models, having customer-centricity in mind will ensure that their interests and privacy are protected. Businesses must be transparent – show customers that the company’s data governance, policies and process meet and even go above and beyond the laws of the jurisdictions in which they reside.

Captains of industries lead by example

Because data is used across businesses and purposes, companies must link arms with others in the industry to ensure that there is a common standard for businesses to use data that protects human and consumer rights and society more broadly.

At UOB, we have a multi-disciplinary data ethics task force to develop a governing framework, policies and processes that ensure the Bank uses data in a responsible and ethical manner. We are sharing the lessons that we are learning along the way on the application of data ethics in real-world situations with others in the banking and finance industry. One way we do this is through the Monetary Authority of Singapore’s Veritas Consortium, of which we are proud to be a founding member. Veritas aims to develop a framework to which all in the industry can refer to ensure fairness, ethics, accountability and transparency (FEAT) in the use of AI and data analytics in finance.

The Veritas Consortium is a good example of how industries and regulators can partner to ensure they have the right foundation upon which their data-driven initiatives are built. There are also many similar initiatives around the world that are government-led or industry-led. If your industry does not have a body that champions the ethical use of data, take the lead. Doing right by customers through the ethical use of data is the responsible and sustainable way to do business.

This article was authored by Richard Lowe, Chief Data Officer at UOB, and was first published by The Business Times. This article shall not be copied, or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and its employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.