From Seed to FinTech is a series that explores FinTechs' entrepreneurial journeys from idea to success, supported by UOB's innovation accelerator The FinLab. As a dedicated ecosystem partner to the region's start-up community, The FinLab has helped drive expansion and innovation for over 14,000 businesses.

Money laundering remains a huge problem worldwide. The United Nations estimates that, annually, the amount of money laundered globally can reach US$800 billion to US$2 trillion, equivalent to two to five per cent of the global gross domestic product (GDP).

Criminals also continue to exploit opportunities as a result of the COVID-19 pandemic, including disrupted supply chains, increasing fraud and online scams, widespread ransomware attacks, and vulnerable digital payment systems.

In light of these challenges, companies are encouraged to adopt regulatory technology (RegTech) solutions. However, financial services firms and companies from other industries are still struggling to keep up with the constantly changing anti-money laundering (AML) regulations, as well as the rapidly evolving money laundering threat landscape.

Given this business environment, RegTech firms like Tookitaki are needed now more than ever. Read on to find out how Tookitaki overcame the challenges of starting up with help and mentoring from The FinLab and co-created an AML ecosystem with UOB.

Thunes, a Singapore-based global payment company, invested over US$20million in Tookitaki in April 2022. Tookitaki co-founder and CEO Abhishek Chatterjee (left) and Peter De Caluwe (right), CEO of Thunes, shared their excitement towards this strategic alliance. Photo: Tookitaki

Tookitaki and the quest to prevent financial crime

Tookitaki is a Singapore-based RegTech startup that develops intelligent AML solutions. Co-founded by CEO Abhishek Chatterjee and COO Jeeta Bandopadhyay in 2014, Tookitaki initially started out by providing data analytics to marketers.

Abhishek, formerly an associate at an investment bank, saw that AML solutions at the time were ineffective at promoting compliance and also struggling to keep pace with the growth of digital banking and online transactions. As such, in late 2016, Tookitaki shifted its focus to machine learning-based platforms for predictive analytics on regulatory compliance.

Tookitaki aims to help financial institutions comply without complications and enable integrated as well as sustainable compliance management. What differentiates Tookitaki from competitors is its unique approach to combating financial crime.

Instead of fighting siloed, where the information vacuum becomes the gaps exploited by bad actors, Tookitaki takes a democratised detection approach with its industry-only AML ecosystem, which includes the network of experts.

The AML Ecosystem is a game changer since it helps remove the information vacuum created by siloed AML operations. It also lays the foundation for a democratised detection approach where AML behavioural models are shared across an ecosystem through a privacy-protected framework. Tookitaki's network of experts includes risk advisers, legal firms, AML specialists, consultancies and financial institutions from across the globe.

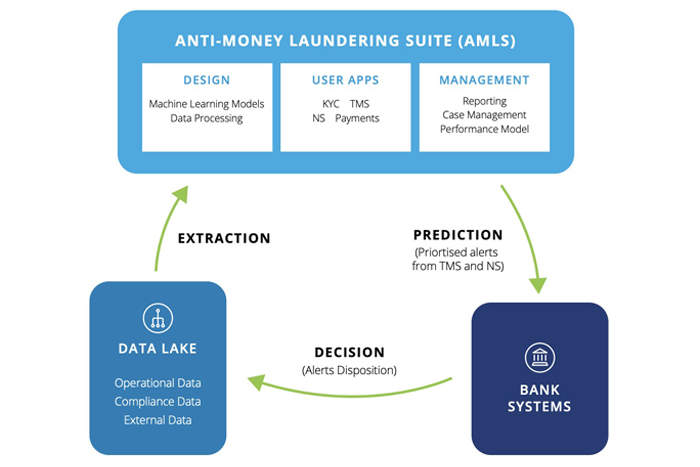

In addition to the AML ecosystem, which is a first-of-its-kind community-driven initiative, Tookitaki's Anti-Money Laundering Suite, or AMLS, is an operating system comprising of four modules, under one roof to address customers' compliance requirements. It provides holistic risk coverage, sharper detection, and significantly fewer false alerts. It can be deployed in multiple environments including the public cloud, private cloud, and data centre.

Tookitaki's AML Ecosystem and the AMLS work in tandem and help stakeholders widen their view of risk from an internal one to an industry-wide one across organizations and borders. Moreover they can do so without compromising privacy and security.

“Multiple AI solutions need to come together to build a sophisticated, integrated AI framework in the banking and financial services world,” says Abhishek, in a joint whitepaper by UOB and Deloitte. “Tookitaki's AMLS follows the same guiding principle and allows seamless integration with existing frameworks while being scalable and explainable.”

Machine learning models, too, benefit AML ecosystems. For one, it increases effectiveness in identifying suspicious activities due to its sharper focus on data anomalies rather than threshold triggering. Machine learning models also allow for easier customisation of data features to accurately target specific risks, as well as enable extended look-back periods to detect more complex scenarios.

Tookitaki designed an integrated machine learning platform to rapidly develop and deploy AML solutions. Photo: UOB Tech Startup Ecosystem.

Tookitaki's AMLS explained

Tookitaki's AMLS has four modules, namely: Transaction Monitoring, Smart Screening, Customer Risk Scoring, and Case Management, a centralised investigation solution. We delve into the first two modules here:

- Transaction Monitoring looks for suspicious transactions across different systems. It unlocks the power of Tookitaki's library of typologies to detect hidden suspicious patterns.

Tookitaki's AMLS generates fewer alerts of higher quality alerts and then segregates them into low-, medium-, or high-risk alerts so companies can prioritise their investigations. During pilot testing, Deloitte and UOB have validated that Tookitaki's AMLS reduces false positives by 40 per cent; in production, results improved to 50 per cent reduction.

False positives, or false alarms, happen when an AML software incorrectly flags or alerts the presence of a threat. Note that legacy AML software generates many false positives: around 90 per cent to 95 per cent of alerts raised daily are false positives.

Tookitaki's AMLS also updates regularly to include new money laundering patterns. In comparison, legacy AML software is not as updated and tends to miss activities related to more current and sophisticated money laundering schemes. - Smart Screening watches out for high-risk individuals and corporate customers. Tookitaki designed the name screening module to handle a wider range of complex name permutations. To reduce the number of undetermined hits, Tookitaki enriched the module with inference features and additional customer profile identifiers.

As UOB and Deloitte have validated, Tookitaki's name screening module also reduces false positives, which happens when an AML software incorrectly flags a customer as high-risk. During pilot testing, there was a 60 per cent and 50 per cent reduction in false positive alerts for individual names and corporate names, respectively. In production, results improved to 70 per cent and 60 per cent reduction, respectively.

Co-creating a robust anti-money laundering platform

Tookitaki joined the FinTech acceleration programme organised by The FinLab powered by UOB, in 2017. Through the programme, Tookitaki received guidance to scale up the business.

Joining the programme enabled Tookitaki to learn more about the financial ecosystem and to navigate the industry efficiently, shares Abhishek. “There has been tremendous mentorship and support from The FinLab to ensure that Tookitaki evolves, which helped us understand what needs to be done to better cater to larger banks,” he adds.

With guidance from The FinLab, Tookitaki learned how to step into the buyer's shoes and understand key challenges that need to be addressed by its AML ecosystem. Additionally, Tookitaki became more mindful of the various compliance regulations and jurisdictions across different regions and countries. This helped Tookitaki stay ahead of financial threats and to be more proactive in its fight against financial crime.

Financial institutions (FIs) regularly collaborate with RegTech companies to co-create custom-built models and innovations for financial crime compliance (FCC). One such partnership is between UOB and Tookitaki.

After graduating from The FinLab programme, Tookitaki collaborated with UOB to co-create a machine learning solution that will enable the Bank's Group Compliance team to manage risks and conduct deeper and broader analyses as part of its anti-money laundering efforts.

“At the time, of course, things were still emerging. Tookitaki was willing to co-partner or co-create with good compliance on some of the use cases. There were not as many RegTech startups working on it, so there were several challenges,” recalls Eric Ang, Executive Director and Head of Compliance Analytics and Insights, Group Compliance, at UOB.

Tookitaki offers a robust artificial intelligence (AI) and machine learning platform that allows UOB Group Compliance to look into different use cases in a flexible and scalable manner. Eric shared that both Tookitaki and UOB contributed to the solutions in the co-creation partnership. The Bank, as an industry practitioner, supported with their industry knowledge.

Tookitaki aims to fight financial crime with machine learning-based regulatory compliance software. Photo: Tookitaki

Continuing the fight against financial crime

Today, Tookitaki continues to collaborate and co-create with UOB to help organisations fight financial crime. UOB appreciates that Tookitaki has remained open-minded, agile,and hungry despite its years in the AML ecosystem. “Their willingness to partner with UOB to solve industrial problems and to co-create the whole journey, I think, is very important,” shares Eric regarding Tookitaki's partnership with UOB.

Tookitaki continues to develop. In 2022, Singapore-based global payments startup Thunes acquired a majority stake in Tookitaki by investing over US$20 million in the company.

Recently, Tookitaki piloted a Customer Risk Scoring module with UOB, which calculates risk scores based on customer profile and transaction history. Aside from establishing customer identity, the module scores customers based on their activities, such as the number of failed log-in attempts and unverifiable sources of funds. UOB and Tookitaki will continue to work together to strengthen the AML ecosystem.

Tookitaki is just one example of how financial and innovation acceleration can propel game-changing startups to success. Visit our website to learn more about how UOB and The FinLab alumni are disrupting the digital landscape.

Tookitaki bagged the inaugural Singapore Business Review Technology Excellence Award 2019 in the 'AI - Banking' category. Photo: Tookitaki

This article is jointly written by The FinLab and UOB. This article shall not be copied or relied upon by any person for whatever purpose. This article is given on a general basis without obligation and is strictly for information only. The information contained in this article is based on certain assumptions, information and conditions available as at the date of the article and may be subject to change at any time without notice. You should consult your own professional advisers about the issues discussed in this article. Nothing in this article constitutes accounting, legal, regulatory, tax or other advice. This article is not intended as an offer, recommendation, solicitation, or advice to purchase or sell any investment product, securities or instruments. Although reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this article, UOB and The FinLab and their employees make no representation or warranty, whether express or implied, as to its accuracy, completeness and objectivity and accept no responsibility or liability for any error, inaccuracy, omission or any consequence or any loss or damage howsoever suffered by any person arising from any reliance on the views expressed and the information in this article.