Key Takeaways

- Companies that manage their working capital well stand to gain a competitive edge.

- UOB’s integrated suite of working capital solutions helps businesses to streamline their operations for enhanced business efficiency.

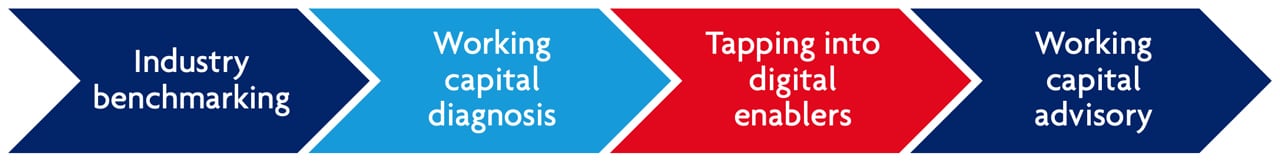

- Our four-step approach consists of industry benchmarking, working capital diagnosis, tapping into digital enablers and working capital advisory.

Companies that harness the benefits of technology to manage their supply chains with greater effectiveness and efficiency will gain a competitive edge in today’s digital economy.

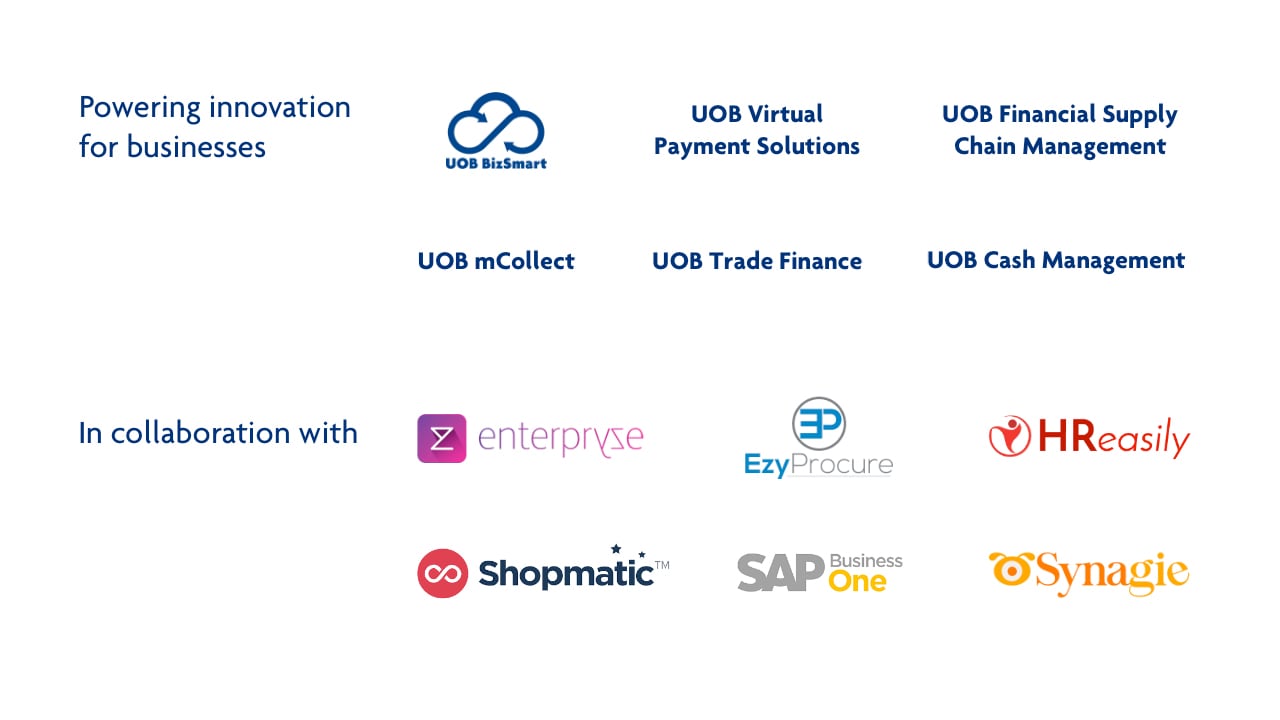

To this end, UOB offers SMEs and corporations a suite of market-ready and proprietary digital solutions to manage their supply chain processes across all stages. The digital solutions help businesses to achieve improved cash flow, better productivity and improved business performance.

UOB’s financing, cash management and digital solutions for businesses

UOB’s approach to help businesses optimise supply chain processes

UOB adopts a four-step approach to help businesses manage their supply chain better.

1. Industry benchmarking

UOB performs industry benchmarking for businesses to see how they stand against competitors in the industry.

2. Working capital diagnosis

We help businesses find areas for improvement in their management of physical supply chain processes – opportunities to streamline and automate their processes. By analysing the client’s receivables, stock holdings and other financing requirements, we also help businesses to save costs by unlocking savings that will either benefit the business or its supply chain trading partners.

3. Tapping into digital enablers

Thereafter, UOB helps businesses overcome their challenges in supply chain management with the adoption of digital solutions to automate and digitalise operational processes. Our solution partners include:

- Enterpryze*: Lets businesses seamlessly manage multiple core processes such as sales, invoicing, payroll, accounting and more. Built on SAP Business One.

- HReasily*: A cloud-based system that allows SMEs to manage staff records, payroll, leave, claims and attendance with ease.

- SGeBiz: Products under SGeBiz include EzyProcure*, an e-procurement platform that facilitates and simplifies the purchasing process for buyers and sellers by automating the requisition-to-order process.

- Shopmatic*: An e-commerce platform that enables online sales, tracking of customer transactions, shipping and delivery costs on a single platform.

- Synagie: A cloud-based platform that enables businesses to integrate their sales and distribution in Singapore and Malaysia across multiple e-marketplaces as well as offline channels within a single dashboard.

*Available on UOB BizSmart

4. Working capital advisory

The Bank’s specialists will also recommend to businesses the relevant banking solutions to help them optimise their supply chain and working capital. Examples of these solutions include:

- Early Payment Discounting: The Bank assists the buyer to pay sellers before the original due date of the invoice, so that the buyer can potentially enjoy discounts from the seller for early payments.

- Account Receivables Financing: Sellers can obtain financing easily prior to invoice due date by selling their receivables to the Bank to reduce payment risks.

- UOB Virtual Payment Solutions suite: This solution enables businesses to pay their vendors and suppliers with a virtual corporate credit card account, even if these parties do not accept credit card payments.

- UOB mCollect: This solution helps companies to enhance their collection and reconciliation processes by digitalising invoices and collections.

Illustration: Digitalising operations in the F&B industry

As companies seek ways to optimise their supply chains, going digital brings about greater efficiencies.

As companies seek ways to optimise their supply chains, going digital brings about greater efficiencies.

A challenge commonly faced by clients in the F&B industry, particularly large restaurant chains, is the high volume of invoices from suppliers that need to be processed manually. Besides the substantial amount of time and resources spent on a low-value activity, discrepancies in the invoices can often result in late payments.

UOB can help such clients harness technology to manage their supply chains with greater efficiency.

For example, a restaurant chain could benefit from integrating EzyProcure to automate the procure-to-order process, with reconciliation services from order to payment; financing solutions which include early payment discounting and virtual payment solutions; and UOB’s Business Internet Banking Plus to make timely payments and gain better visibility of its cash flows through consolidated reports.

Benefits for the restaurant chain (buyer):

- Save time and effort by automating the procure-to-pay process, thus reducing paperwork and improving overall efficiency in the workflow

- Extension of ‘Days Payable Outstanding’ through financial solutions such as early payment discounting or virtual payment solutions to ease cash flow

- Enjoy potential discounts from suppliers by paying them early

- Improve the working relationship with suppliers due to timely payments

- Reduce potential errors by digitally reconciling purchase orders, invoices and payment records

Benefits to suppliers (seller):

- Easier reconciliation process through e-invoicing

- Improve visibility of cash flow

- Reduce discrepancies on invoices

- Shorten ‘Days Sale Outstanding’ to ease cash flow by enjoying early payment from the restaurant chain

To learn more about our integrated working capital solutions, get in touch with us.